Vivonio Furniture Group Bundle

Can Vivonio Furniture Group Continue Its Ascent in the Furniture Industry?

Established in 2012, Vivonio Furniture Group has rapidly become a key player in the European furniture market. Formed through strategic mergers and acquisitions, this holding company has united leading manufacturers under one roof, aiming for significant growth and international expansion. With a strong foundation and a focus on the mass market, Vivonio has positioned itself for future success.

This analysis delves into Vivonio Furniture Group's Vivonio Furniture Group SWOT Analysis, examining its growth strategy and future prospects within the dynamic furniture industry. We'll explore the company's market position, competitive landscape, and strategic initiatives, providing a comprehensive market analysis of its performance. Understanding Vivonio's expansion plans and long-term goals is crucial for assessing its investment potential and future outlook.

How Is Vivonio Furniture Group Expanding Its Reach?

The Vivonio Furniture Group has a clear focus on expanding its market presence and product offerings through strategic acquisitions and organic growth. Their expansion strategy is designed to capitalize on evolving consumer needs and market trends within the furniture industry. This approach aims to strengthen their position and drive company performance.

A key element of their growth strategy involves acquiring companies that complement their existing portfolio. This allows them to enter new market segments and broaden their customer base. The company's initiatives are also geared towards sustainability and adapting to the changing dynamics of the home and workplace environments.

Market analysis shows that the demand for adaptable and sustainable furniture is increasing. The company is responding to this demand by introducing innovative products and services. This includes offering quick-ship options and incorporating sustainable materials, demonstrating a commitment to meeting consumer expectations.

In 2018, the acquisition of KA Interiør enhanced the company's presence in the built-in and walk-in closet segment. This strategic move strengthened their position in the Benelux countries and Scandinavia. The launch of the Moltema brand in July 2024 expanded their offerings further.

The acquisition of Leuwico in 2016 allowed the company to tap into the growing market for ergonomic office furniture. This move was aimed at the "enormous growth potential" of height-adjustable desks. This demonstrates their focus on high-growth segments.

The company is responding to the increased importance of the home as a workplace. They are also adapting to increased workforce mobility, which is expected to drive further demand in the furniture market. This strategic focus positions them well for future growth.

In April 2025, the company launched a quick-ship flat pack furniture program for European customers. This program offers a 72-hour delivery guarantee. It also features a significant use of bio-based laminates and digital instructions.

The company's strategic initiatives are designed to drive Vivonio Furniture Group revenue and enhance its market share. Their expansion plans include both acquisitions and organic growth strategies. These initiatives are expected to positively impact their financial performance.

- The acquisition strategy allows for rapid expansion into new market segments.

- Focus on sustainable materials and digital solutions reflects evolving consumer preferences.

- The quick-ship program enhances customer satisfaction and operational efficiency.

- Continued investment in product innovation and international presence is key.

Vivonio Furniture Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vivonio Furniture Group Invest in Innovation?

The Vivonio Furniture Group actively employs innovation and technology to drive its growth strategy. This approach focuses on enhancing production, expanding product offerings, and improving customer experiences. The company's ability to adapt to changing consumer needs and the evolving furniture industry trends is key to its success.

The company has invested significantly in advanced manufacturing technologies, particularly in its production facilities. These investments have allowed for increased efficiency and the ability to meet the demands of major clients like IKEA. This strategic focus underscores the importance of innovation in maintaining a competitive edge and achieving long-term goals.

Vivonio Furniture Group's commitment to innovation is evident in its recent initiatives. The company is focused on adapting to the changing needs of customers. This includes a focus on sustainability and digital integration in its products.

Between 2012 and 2013, over 60 million euros were invested in a new lightweight furniture factory in Wittichenau. This investment more than doubled the production and warehouse area to over 85,000 square meters.

In April 2025, the company launched a quick-ship flat pack furniture program. This program offers a 72-hour delivery guarantee to European customers.

Approximately 25% of the new quick-ship line incorporates bio-based laminates and digital instructions. This highlights a commitment to sustainability.

Around 40% of newly launched furniture products in 2025 feature tool-free or minimal-tool assembly. Over 35% emphasize multi-functional utility.

The increasing use of augmented reality (AR) and virtual reality (VR) in furniture eCommerce is transforming online shopping experiences. This presents opportunities for digital transformation efforts.

The company is likely to embrace trends such as tool-free assembly and multi-functional furniture. This will help them to enhance their Revenue Streams & Business Model of Vivonio Furniture Group.

Vivonio Furniture Group is focused on several key strategies. These strategies aim to improve its company performance and maintain a strong market analysis.

- Advanced Manufacturing: Investing in automated facilities to increase production efficiency and capacity.

- Product Innovation: Adapting to consumer preferences by offering flat-pack furniture with quick delivery and incorporating sustainable materials.

- Digital Integration: Utilizing digital instructions and exploring augmented reality (AR) and virtual reality (VR) for online sales to enhance the customer experience.

- Sustainability: Using bio-based laminates in products to meet the growing demand for eco-friendly furniture.

- Market Adaptation: Aligning with industry trends, such as tool-free assembly and multi-functional designs, to stay competitive.

Vivonio Furniture Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vivonio Furniture Group’s Growth Forecast?

The financial outlook for the Vivonio Furniture Group is influenced by its strategic plans and the overall market environment. A key move was the successful refinancing completed in March 2022, which aimed to support future growth opportunities. This refinancing involved a consortium of international banks and credit funds, setting a sustainable financial foundation for the company.

The European furniture market is projected to grow, offering potential for Vivonio Furniture Group. Euromonitor forecasts an average annual growth of 3.1% in the European furniture market between 2021 and 2025. This growth is expected to bring the market to EUR 136.3 billion by 2025, driven by trends such as the rise in home working.

Historically, in 2019, the group reported a turnover of 400 million euros, with seven subsidiaries and around 1,800 employees. The company's strategy includes continuous expansion through acquisitions. This is intended to develop the group further and use synergy effects to drive growth. However, recent developments indicate a mixed financial situation.

The Furniture Industry is experiencing growth, with the European market expected to reach EUR 136.3 billion by 2025. This growth is driven by evolving consumer behaviors and market trends. The company's strategic initiatives are designed to capitalize on these opportunities.

While the group had a turnover of 400 million euros in 2019, recent challenges have emerged. Some subsidiaries have faced financial difficulties, including insolvency proceedings. The Company Performance is a mixed picture of strategic strength and operational challenges.

The Future Outlook for Vivonio Furniture Group depends on its ability to navigate current challenges. The company's expansion plans and strategic initiatives are key to its long-term success. The Growth Strategy is critical.

The Financial Performance of the group is impacted by both positive and negative factors. The 2022 refinancing provided a solid financial base. However, the difficulties faced by some subsidiaries highlight the need for careful management. Read more about the Marketing Strategy of Vivonio Furniture Group.

The Vivonio Furniture Group faces both challenges and opportunities in the current market. The growth in the furniture industry provides a favorable environment. However, the financial difficulties faced by some subsidiaries represent a significant challenge.

- Acquisition Strategy: The company’s acquisition strategy is designed to drive expansion and leverage synergies.

- Market Trends: Trends like increased home working are driving growth in the furniture market.

- Financial Stability: The 2022 refinancing aimed to ensure financial stability for future growth.

- Competitive Landscape: Navigating the competitive landscape requires strategic planning and effective execution.

Vivonio Furniture Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vivonio Furniture Group’s Growth?

The Owners & Shareholders of Vivonio Furniture Group face several significant risks and obstacles that could impact its growth strategy. These challenges range from financial distress within its subsidiaries to the competitive pressures of the furniture industry. Understanding these potential pitfalls is crucial for assessing the company's future outlook and investment potential.

One of the most immediate concerns is the financial vulnerability of key subsidiaries. The insolvency proceedings initiated by Staud and Leuwico in early February 2025, highlight operational risks related to declining sales and the complexities of their 'just-in-time production' model. These issues underscore the need for careful market analysis and strategic initiatives to ensure long-term company performance.

Market saturation and competition pose ongoing challenges. The German furniture market, where Vivonio has a strong presence, experiences low overall growth rates. This environment necessitates continuous innovation and brand positioning to maintain or increase market share. Regulatory changes and supply chain disruptions, influenced by global events, also present risks, potentially leading to increased costs and delays.

The financial difficulties of Staud and Leuwico, which sought investors in early February 2025 to avoid ceasing operations, underscore the immediate financial risks. These issues highlight the potential for further financial strain within the group and the need for effective restructuring or external investment. The company's financial performance could be significantly affected if these subsidiaries fail to recover.

The German furniture market's low growth rates and high competition necessitate a strong focus on product innovation and brand positioning. Vivonio's ability to differentiate itself and capture market share will be critical. The company's competitive landscape requires continuous adaptation to consumer preferences and emerging market trends.

Global events and regulatory changes can lead to supply chain disruptions, affecting raw material costs and transportation. These vulnerabilities could impact the company's ability to meet demand and maintain profitability. The company must proactively manage its supply chains and adapt to changing regulatory environments.

The rapid evolution of e-commerce, 3D configurators, and AR/VR in the furniture sector demands continuous investment. The company must adopt new technologies to remain competitive and meet evolving consumer expectations. The ability to integrate these technologies will be crucial for long-term growth and online sales strategy.

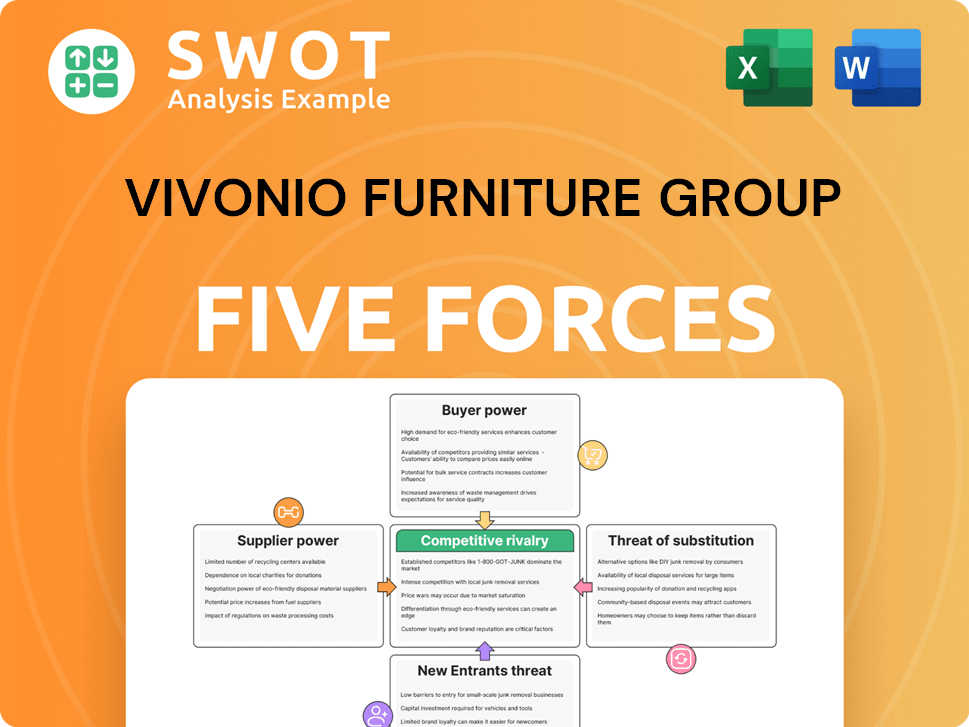

Vivonio Furniture Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vivonio Furniture Group Company?

- What is Competitive Landscape of Vivonio Furniture Group Company?

- How Does Vivonio Furniture Group Company Work?

- What is Sales and Marketing Strategy of Vivonio Furniture Group Company?

- What is Brief History of Vivonio Furniture Group Company?

- Who Owns Vivonio Furniture Group Company?

- What is Customer Demographics and Target Market of Vivonio Furniture Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.