Vivonio Furniture Group Bundle

Unveiling the Inner Workings of Vivonio Furniture Group: How Does It Thrive?

Vivonio Furniture Group, a major player in the European furniture sector, shapes the industry through strategic acquisitions and a diverse product portfolio. Its influence extends across furniture manufacturing and sales, making it a key entity for investors and industry watchers. With the global furniture market exceeding $600 billion, understanding Vivonio's operations is more critical than ever.

This article explores the Vivonio Furniture Group SWOT Analysis, its business model, and its strategic moves within the competitive landscape. Delving into the Vivonio company's history, its approach to furniture manufacturing, and its European furniture market positioning, we'll uncover how Vivonio has become a significant force. Furthermore, we will examine the Vivonio business model, its furniture brands, and the factors driving its expansion strategy, providing insights into its financial performance and competitive advantages.

What Are the Key Operations Driving Vivonio Furniture Group’s Success?

The core operations of the Vivonio Furniture Group revolve around acquiring and managing a portfolio of furniture manufacturing and sales companies, primarily targeting the mass market. This Marketing Strategy of Vivonio Furniture Group focuses on a 'buy-and-build' platform, integrating niche players across various furniture segments under one holding company. This model fosters cross-brand synergies and cost savings, which are then passed on to consumers through competitive pricing and a diverse product portfolio.

The group's value proposition centers on offering furniture for different living areas, including side furniture, wardrobes, and office furniture. Subsidiaries like MAJA, Staud, and Leuwico specialize in ready-to-assemble furniture, bedroom solutions, and ergonomic office furniture, respectively. This diversified approach allows Vivonio to cater to a broad range of customer preferences and market segments, enhancing market resilience and operational efficiency.

Operational efficiency is a key strength for the Vivonio company. Production sites are strategically located in Germany, Austria, the Netherlands, and Denmark, enabling rigorous quality control and efficient European logistics. For instance, the MAJA production site in Wittichenau is a major supplier to IKEA, manufacturing items like Malm and Alex drawer units, and the Kallax shelving system. This demonstrates the company's capacity for high-volume production and efficient supply chains, which are essential in the mass market.

Localized production across Germany, Austria, the Netherlands, and Denmark ensures quality control and efficient logistics.

A diverse product portfolio addressing various market segments, enhancing market resilience and offering competitive pricing.

Economies of scale and expertise in high-volume manufacturing, leveraging established relationships with major furniture retailers.

The 'buy-and-build' platform strategy combines niche players, fostering cross-brand synergies and cost savings.

The 'buy-and-build' strategy of Vivonio Furniture Group provides several benefits, including a diversified product range, enhanced market resilience, and cost-effective production. The company's focus on the mass market allows it to benefit from economies of scale and established distribution networks.

- Diversified product portfolio catering to various customer preferences.

- Enhanced market resilience through a wide range of offerings.

- Competitive pricing due to efficient production and supply chain management.

- Strategic acquisitions to expand market share and product offerings.

Vivonio Furniture Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vivonio Furniture Group Make Money?

The core of Vivonio Furniture Group's revenue generation stems from the sale of furniture products. The company leverages its diverse portfolio of subsidiary brands to cater to various market segments. This approach allows for a broad market reach and mitigates risks associated with relying on a single product or customer base.

Vivonio's monetization strategy is heavily reliant on high-volume product sales, particularly within the mass market. The group's financial performance has been notable, with a past annual turnover of approximately €400 million. The company aims to maintain a strong market presence through strategic product offerings and efficient operations.

The company's revenue streams are diversified across various furniture categories, including home office systems, media furniture, storage furniture, bedroom furniture (particularly sliding door wardrobes), and high-quality office furniture. This diversification helps mitigate risks associated with reliance on a single product or customer group. For instance, the demand for modular and flat-pack furniture is projected to reach $16.69 billion in 2025, a market Vivonio is actively tapping into with new programs like its quick-ship flat-pack furniture program with a 72-hour delivery guarantee for European customers, unveiled in April 2025.

Vivonio employs several key strategies to generate revenue and maintain a competitive edge in the furniture manufacturing industry. These strategies are essential for sustaining growth and profitability in the dynamic European furniture market.

- High-Volume Sales: The company focuses on selling large quantities of furniture products, particularly in the mass market segment, to maximize revenue.

- Efficient Production: Vivonio emphasizes efficient production processes and economies of scale to maintain competitive pricing.

- E-commerce Expansion: The company is expanding its online presence to tap into the growing e-commerce market, which is projected to reach $78.7 billion in 2024, offering broader market penetration.

- Retail Partnerships: Leveraging established relationships with major furniture retailers for large-volume purchases.

- Product Diversification: Offering a wide range of furniture categories, including home office, media, storage, and bedroom furniture, to reduce reliance on a single product line.

Vivonio Furniture Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vivonio Furniture Group’s Business Model?

Founded in 2012, the Vivonio Furniture Group has established itself as a significant player in the European furniture market. The company's formation involved the merger of Maja Möbel and Möbelwerk Staud, backed by Equistone Partners Europe, which later became the majority shareholder. The strategic moves and acquisitions have been pivotal in shaping the company's growth and market position.

Equistone Fund IV sold its investment in Vivonio Furniture Group in March 2024, signaling a notable shift in ownership. The group has expanded its portfolio through key acquisitions, including Leuwico, Noteborn, fm Büromöbel, and KA Interiør. These acquisitions have allowed Vivonio to consolidate seven leading European furniture manufacturers, aiming for market leadership in a fragmented industry.

Despite facing challenges like the declining German furniture market and financial difficulties for some subsidiaries, Vivonio continues to adapt. Brands such as fm Büromöbel and KA Interiør are still operating independently. KA Interiør was acquired by a Danish family office in March 2025, demonstrating ongoing strategic adjustments within the group.

The merger of Maja Möbel and Möbelwerk Staud in 2012 laid the foundation for Vivonio. The acquisition of Leuwico in August 2016, Noteborn in March 2017, fm Büromöbel in October 2017, and KA Interiør in June 2018 expanded its portfolio. The sale of Equistone's investment in March 2024 marked a significant ownership change.

Vivonio's strategic moves include acquisitions to broaden its brand portfolio and market reach. The company focused on consolidating leading European furniture manufacturers. Adapting to market trends, such as the growing demand for eco-friendly furniture, is a key strategy. Vivonio launched a quick-ship flat-pack furniture program in April 2025.

A diversified brand portfolio reduces market risk. Established production sites in Germany, Austria, and Denmark provide a strong manufacturing base. The mass-market focus allows for economies of scale and efficient supply chains. Strong relationships with key furniture retailers are also a competitive advantage.

The declining German furniture market and financial difficulties for some subsidiaries present challenges. Insolvency proceedings for Staud and Leuwico highlight operational hurdles. The company is adapting to the growing demand for eco-friendly furniture, which saw a 5% shift in 2024.

The European furniture market is highly competitive, with a mix of established players and emerging brands. The online furniture sales are projected to reach $78.7 billion in 2024, indicating a significant shift towards e-commerce. Vivonio's ability to adapt to these trends, as seen with its quick-ship program, will be crucial for future success. Learn more about the Target Market of Vivonio Furniture Group.

- The company's diversified brand portfolio helps mitigate market risks.

- Established production sites in Europe support quality control and logistics.

- Focus on mass-market allows for economies of scale and efficient supply chains.

- Strong relationships with key retailers provide a competitive advantage.

Vivonio Furniture Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vivonio Furniture Group Positioning Itself for Continued Success?

The Vivonio Furniture Group holds a strong position as a leading player in the European furniture manufacturing market. With a diverse portfolio of brands, it caters to various segments, from mass-market to premium solutions. The company's established presence in key European markets and its relationships with major retailers highlight its market reach.

However, the Vivonio company faces several risks, including intense competition in the global furniture market and economic downturns. Supply chain disruptions and changing consumer preferences also pose challenges. Recent financial difficulties within some subsidiaries underscore the need for strategic adaptation and resilience.

The company is a significant player in the European furniture market, uniting several leading furniture manufacturers. Its diverse brand portfolio includes products for both living and office spaces, ranging from mass-market to premium solutions. Strategic partnerships, such as those with major retailers, enhance its market reach.

The global furniture market, valued at over $600 billion in 2024, presents intense competition. Economic downturns can reduce furniture sales. Supply chain disruptions, like increased shipping costs (up 15% in 2024), and changing consumer preferences demand continuous adaptation. The insolvency proceedings of subsidiaries highlight financial challenges.

The company aims for strong, sustainable growth. It focuses on market expansion, particularly in the flat-pack furniture market, which is predicted to reach $95.2 billion by 2030, and the green furniture market, forecast to hit $68.6 billion by 2025. Innovation and sustainability are key priorities.

The company is investing in its digital presence to capitalize on booming e-commerce furniture sales, projected to reach $78.7 billion in 2024. Recent initiatives include a quick-ship flat-pack furniture program, with a focus on sustainable materials. Strategic acquisitions and multifunctional furniture also play a role.

The Vivonio business model focuses on several key areas to ensure future success and sustainability. Growth Strategy of Vivonio Furniture Group highlights the importance of market expansion, especially in the flat-pack and green furniture sectors. The company is also focusing on product innovation and strengthening its digital presence to meet evolving consumer demands. These strategies aim to mitigate risks and capitalize on emerging opportunities in the dynamic furniture market.

The company is focusing on several key strategies to ensure future success and sustainability. These include market expansion, product innovation, and strengthening its digital presence.

- Expanding into the flat-pack furniture market, projected to reach $95.2 billion by 2030.

- Focusing on the green furniture market, forecast to hit $68.6 billion by 2025.

- Investing in its digital presence to capitalize on booming e-commerce furniture sales, projected to reach $78.7 billion in 2024.

- Developing and launching sustainable and innovative products.

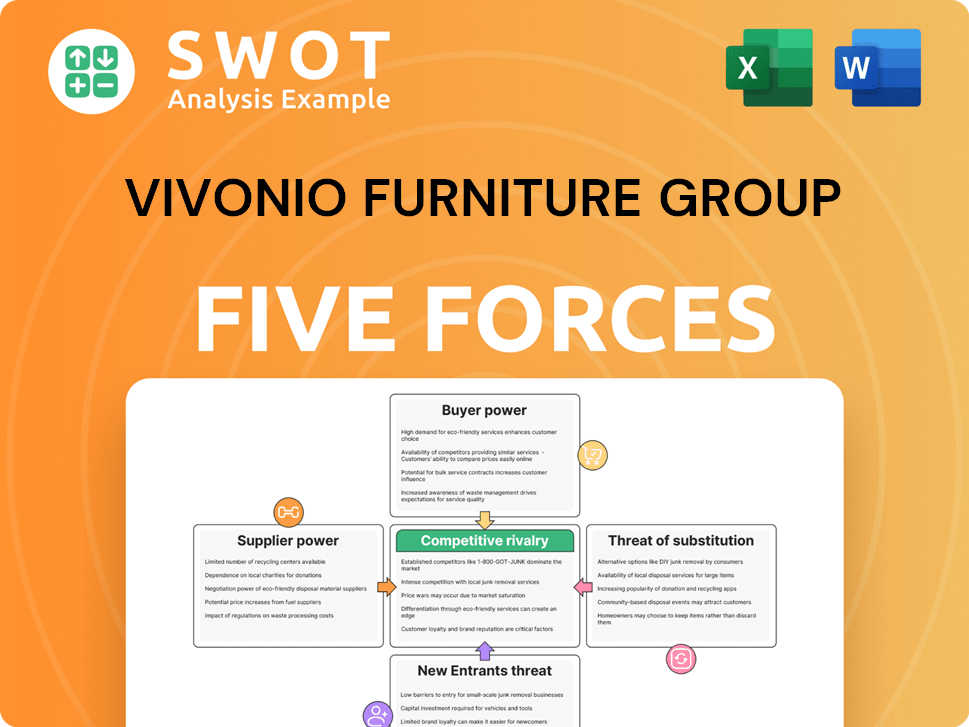

Vivonio Furniture Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vivonio Furniture Group Company?

- What is Competitive Landscape of Vivonio Furniture Group Company?

- What is Growth Strategy and Future Prospects of Vivonio Furniture Group Company?

- What is Sales and Marketing Strategy of Vivonio Furniture Group Company?

- What is Brief History of Vivonio Furniture Group Company?

- Who Owns Vivonio Furniture Group Company?

- What is Customer Demographics and Target Market of Vivonio Furniture Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.