Vp Bundle

Can VP Company Continue Its Bathroom Revolution?

Victoria Plum, a pioneer in the online bathroom retail space, transformed the UK's home improvement sector with its direct-to-consumer model. This strategic move challenged traditional retailers, offering stylish and affordable solutions online. Understanding the Vp SWOT Analysis is crucial to grasping the company's position and future trajectory.

From its inception in 2001, VP Company has demonstrated remarkable company growth. This analysis will explore the VP Company's growth strategy and delve into its future prospects, examining its expansion plans and strategic planning process. We'll also conduct a market analysis to uncover the challenges and opportunities that will shape its long-term goals and industry outlook.

How Is Vp Expanding Its Reach?

The Competitors Landscape of Vp reveals that the company's expansion strategy is primarily focused on solidifying its position within the UK market. This involves a multi-faceted approach aimed at enhancing customer experience and broadening product offerings. The core of the strategy centers on leveraging its established online presence to drive growth.

The company's growth strategy emphasizes deepening market penetration within the UK, while also exploring avenues for expansion. This includes continuous efforts to expand its product categories beyond traditional bathroom suites. The goal is to diversify revenue streams and increase average order values.

A key aspect of the expansion strategy is improving the customer journey. This includes investments in logistics and warehousing to ensure efficient and timely delivery across the UK. The company aims to reinforce its competitive advantage in a dynamic market.

The company is expanding its product range beyond core bathroom suites. This includes accessories, fittings, and potentially complementary home improvement items. Diversifying product offerings helps attract a wider customer base and increase revenue.

Investments in logistics and warehousing are crucial. Efficient delivery and after-sales support are key. The focus is on improving the customer journey from browsing to delivery.

The primary focus is on deepening market penetration within the UK. The company aims to reach a broader customer base. This involves leveraging its strong online presence.

The company is focused on enhancing operational efficiencies. This includes optimizing supply chains and streamlining processes. Efficient operations support sustainable growth.

The company's strategic initiatives are designed to achieve sustainable growth. These initiatives focus on improving customer experience and expanding product offerings. The goal is to reinforce its competitive advantage in the market.

- Expanding product categories to include accessories and home improvement items.

- Investing in logistics and warehousing for efficient delivery.

- Focusing on enhancing the customer journey from browsing to after-sales support.

- Leveraging its online presence to reach a broader customer base.

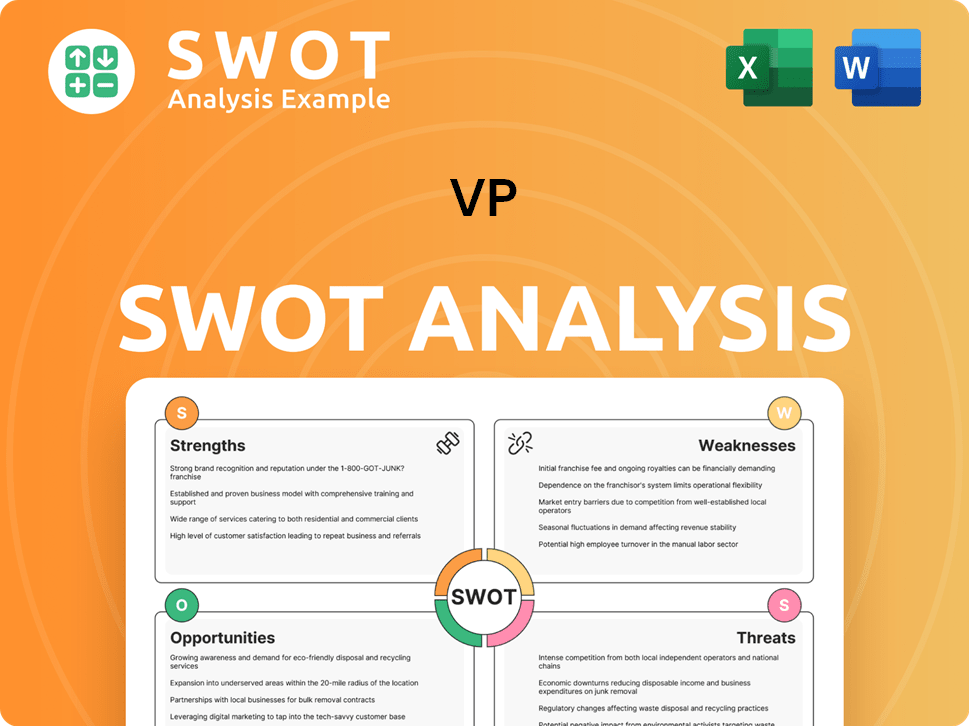

Vp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vp Invest in Innovation?

The company's growth strategy heavily relies on digital transformation and enhancing the online customer experience. This approach is crucial for maintaining a competitive edge in the evolving online retail market. By focusing on these areas, the company aims to improve customer satisfaction and drive higher conversion rates.

The company invests in research and development to refine its e-commerce platform. This includes improving website usability and using advanced analytics to understand customer preferences. This data-driven method allows for optimized product recommendations and personalized marketing efforts.

The company's future prospects are closely tied to its ability to integrate cutting-edge technologies. While specific details on AI or IoT applications for 2024-2025 are not extensively publicized, it is highly probable that the company is exploring these areas to enhance supply chain efficiency, automate customer service interactions, and potentially offer virtual design tools for bathrooms. Sustainability initiatives are also likely to be a focus, with the company potentially exploring eco-friendly product lines or more sustainable operational practices. These technological advancements and innovative approaches are crucial for maintaining the company's competitive edge and supporting its long-term growth objectives in the evolving online retail landscape.

The company focuses on improving its e-commerce platform. This involves optimizing website usability and implementing advanced analytics. The goal is to create a seamless and user-friendly online shopping experience.

The company uses data to personalize customer experiences. This includes tailored product recommendations and marketing efforts. This approach aims to increase customer engagement and sales.

The company is likely exploring AI and IoT applications. These technologies could enhance supply chain efficiency and automate customer service. The company is also exploring virtual design tools.

The company may focus on eco-friendly products and sustainable practices. This could involve exploring new product lines and operational methods. This demonstrates a commitment to environmental responsibility.

Technological advancements are vital for maintaining a competitive edge. Innovation supports long-term growth in the online retail landscape. This helps the company stay ahead of market trends.

The company's long-term goals are supported by technological innovation. These strategies are designed to ensure sustained success. This is crucial for adapting to the changing market.

The company's business strategy involves continuous innovation to meet customer needs and maintain a strong market position. The company's commitment to innovation is essential for achieving its company growth objectives. For more details, see the Brief History of Vp.

The company's market analysis suggests a strong emphasis on digital transformation and e-commerce optimization. This includes enhancing the online customer experience and leveraging data analytics.

- Enhancing E-commerce Platform: Improving website usability and performance.

- Data Analytics: Using customer data to personalize recommendations and marketing.

- AI and IoT: Exploring these technologies for supply chain efficiency and customer service automation.

- Sustainability: Investigating eco-friendly products and sustainable operational practices.

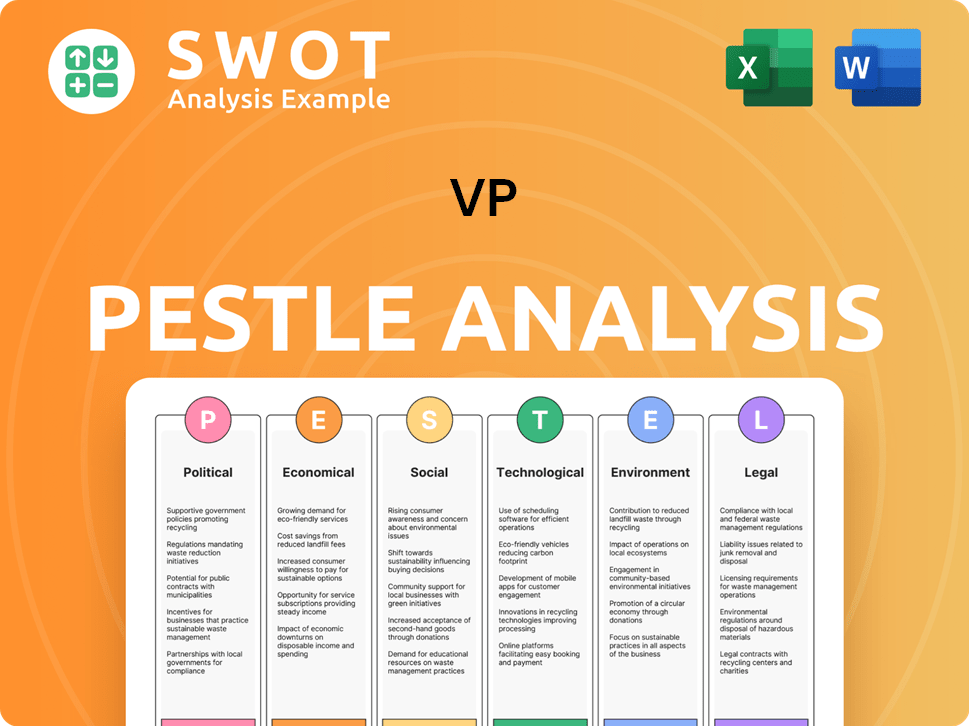

Vp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vp’s Growth Forecast?

The financial outlook for the company is centered on its online retail model and operational efficiency. As an online-only business, the company generally benefits from lower overhead costs compared to traditional retailers. This can lead to improved profit margins, which is a key factor in its Revenue Streams & Business Model of Vp.

The home improvement sector in the UK shows resilience, with continued consumer spending on home renovations and improvements. This positive trend supports the company's growth strategy. The company's financial goals likely include sustained revenue growth, driven by an expanding customer base and increased average transaction values. This focus on online sales and efficiency is crucial for the company's future prospects.

Key performance indicators, such as revenue growth and gross profit margins, are essential metrics for assessing the company's financial health. Given its online nature, the company will likely invest in technology, marketing, and logistics to support its growth. The overall financial narrative for the company is expected to be one of steady, profitable growth.

The company's revenue growth is expected to be driven by an expanding customer base and increased average transaction values. Market analysis indicates a steady increase in online retail spending in the UK home improvement sector. This growth is a key aspect of the company's business strategy.

The online-only model allows for lower overheads, which often translates to healthier profit margins. The company's focus on operational efficiency is expected to contribute to maintaining and improving these margins. Efficient logistics and supply chain management are crucial for profitability.

The company will likely prioritize investments in marketing to acquire new customers. Understanding customer acquisition costs is essential for sustainable growth. Effective digital marketing strategies are key to minimizing these costs and maximizing returns.

Investments in technology are vital for supporting the company's growth strategy. This includes e-commerce platforms, customer relationship management (CRM) systems, and data analytics tools. These investments enhance the customer experience and improve operational efficiency.

The company's financial performance is closely tied to key metrics. These metrics are essential for understanding the company's market analysis and overall financial health. The company's future prospects depend on these factors.

- Revenue Growth: Tracking the increase in sales over time.

- Gross Profit Margin: Measuring the profitability of sales after deducting the cost of goods sold.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Customer Lifetime Value (CLTV): The predicted revenue a customer will generate during their relationship with the company.

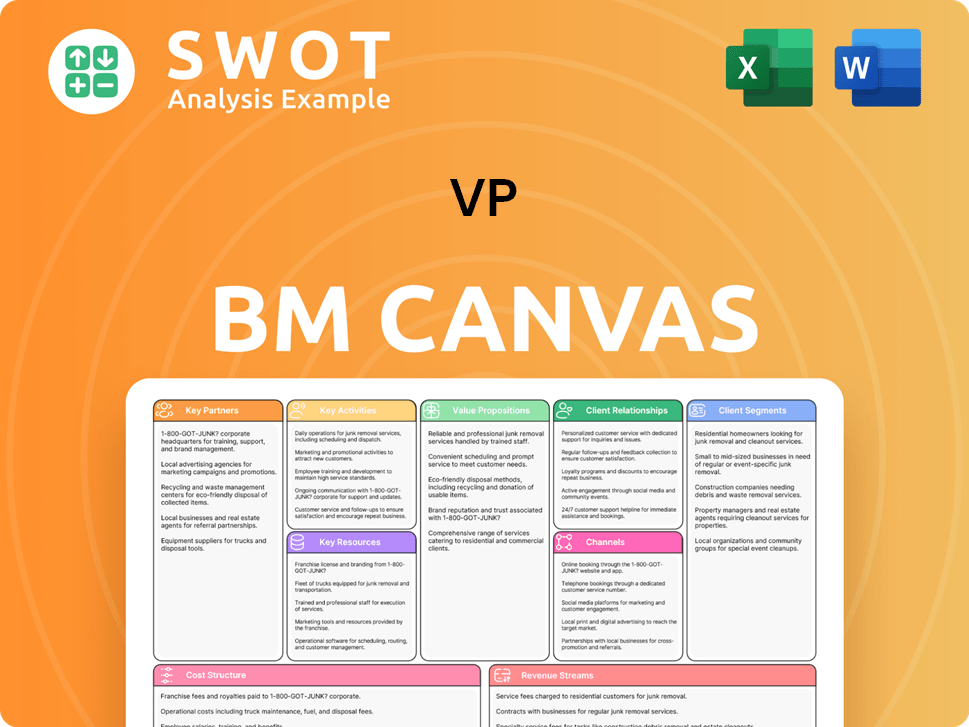

Vp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vp’s Growth?

The path to expansion for the company is not without its hurdles. The UK bathroom market, where the company operates, is competitive, with established players and online retailers vying for market share. This competitive landscape can lead to price wars and increased marketing costs, potentially impacting profitability. Furthermore, the company's growth strategy could face challenges from external factors, such as regulatory changes and supply chain disruptions.

Regulatory changes, including those concerning product standards or online trading, could necessitate operational adjustments. Supply chain vulnerabilities, especially for an online retailer reliant on timely deliveries, pose a significant risk. Disruptions due to global events, material shortages, or transportation issues could lead to delays and customer dissatisfaction, affecting the company's ability to meet its growth objectives. Internal resource constraints, such as attracting and retaining skilled talent, could also hinder the company's business strategy.

Technological disruption also presents a risk if the company fails to keep pace with advancements in e-commerce, digital marketing, or customer service technologies. The company likely mitigates these risks through a diversified supplier base, robust risk management, and continuous investment in technology and human capital. Addressing these potential risks is crucial for the company to achieve its future prospects and maintain its competitive position in the market. A thorough market analysis is essential to understanding these challenges.

The UK bathroom market is intensely competitive, with both traditional DIY chains and online retailers vying for market share. This competition can lead to reduced profit margins due to price wars and increased marketing expenses. Understanding the competitive landscape is vital for developing effective growth strategies.

Changes in regulations, particularly concerning product standards, consumer protection, and online trading, could pose compliance challenges. Adapting to these changes requires operational adjustments and can potentially increase costs. Staying informed about evolving regulations is crucial for long-term sustainability.

As an online retailer, the company depends on a robust and efficient supply chain for timely product delivery. Disruptions from global events, raw material shortages, or transportation issues can cause delays and customer dissatisfaction. Diversifying suppliers and having strong risk management is crucial.

Rapid advancements in e-commerce platforms, digital marketing, and customer service technologies present both opportunities and risks. Failing to keep pace with these advancements could lead to a loss of market share. Investing in technology and innovation is crucial for sustained company growth.

Attracting and retaining skilled talent in a competitive job market can be a challenge. Limited resources or an inability to secure the right talent can hinder company growth. Strategic workforce planning and employee development are vital for success.

Economic downturns can significantly impact consumer spending on non-essential items like bathroom products. A decline in demand can lead to reduced sales and lower profitability. Companies need to be prepared for economic fluctuations to maintain financial stability.

To mitigate these risks, the company likely employs several strategies. These include diversifying its supplier base to reduce supply chain vulnerabilities. Implementing robust risk management frameworks to anticipate and respond to potential disruptions is also important. Continuous investment in technological infrastructure and human capital can help the company stay competitive and adapt to market changes. For a deeper understanding of the company's operations, see the article on the company's business model.

The risks the company faces can have significant financial implications. Increased marketing expenses due to competition can reduce profit margins. Supply chain disruptions can lead to higher costs and lower revenue. Regulatory changes may require additional investment in compliance. Effective risk management is essential to protect profitability and ensure sustainable company growth. Understanding these financial implications is crucial for making informed investment decisions.

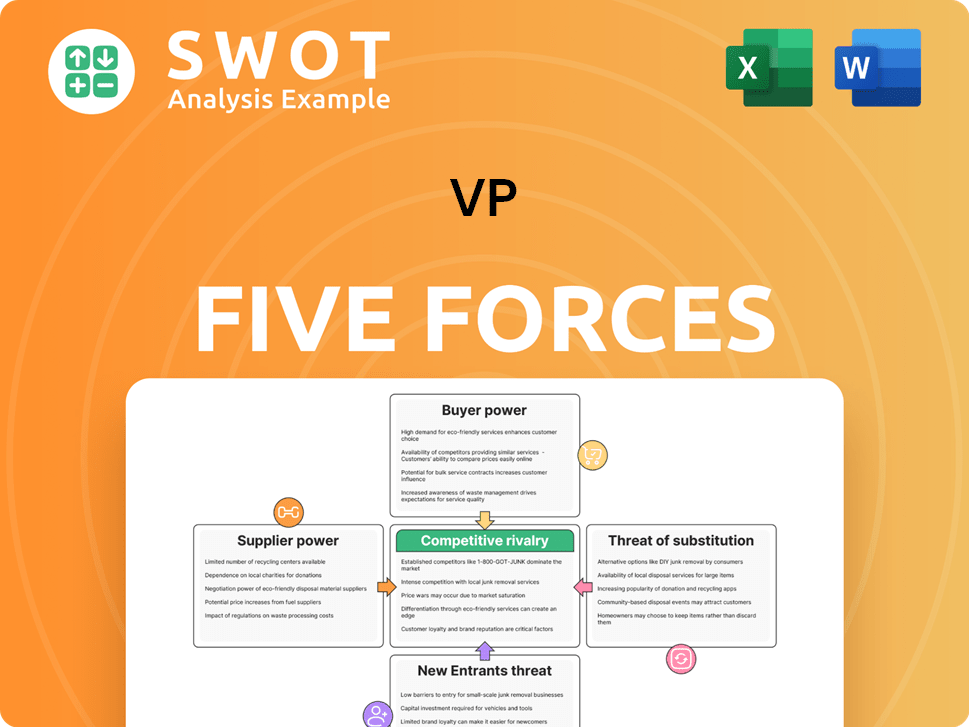

Vp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.