Vp Bundle

How Did Vp Company Operate Before Its Acquisition?

Victoria Plum, a prominent online retailer of bathroom products, once stood as a significant player in the home improvement market. Offering a wide range of bathroom suites and accessories, the Vp SWOT Analysis reveals the company's strategic positioning. Understanding its operational model is key to grasping the dynamics of online retail and market consolidation.

Before its acquisition, understanding How Vp company works is crucial to understanding its value. This analysis will explore Vp company operations, focusing on its revenue streams, strategic decisions, and overall market positioning. We'll delve into the Vp role and Vp responsibilities within the company's structure, providing a comprehensive overview of its business model and its ultimate fate within the industry. This provides insights into the Vp company decision-making process and Vp company leadership structure.

What Are the Key Operations Driving Vp’s Success?

The core operations of the Vp company centered on its direct-to-consumer online retail model. It provided a comprehensive range of bathroom products. The company offered a diverse selection of items, including full bathroom suites, individual showers, various types of furniture, and a wide array of accessories.

The value proposition of the Vp company focused on delivering stylish and affordable bathroom solutions. This catered to a broad customer base seeking convenience and competitive pricing for their home renovation needs. The operational processes involved managing an extensive online catalog, facilitating e-commerce transactions, and coordinating logistics for product delivery.

As an online retailer, the Vp company relied on efficient sourcing of products, warehousing, and a robust distribution network to deliver items directly to customers. The company's effectiveness stemmed from its online-only presence, which allowed for lower overheads compared to traditional brick-and-mortar retailers, enabling competitive pricing. This direct model translated into customer benefits such as convenience, a wider selection, and easy product and price comparison. For additional background, consider reading Brief History of Vp.

Vp company operations included managing an online catalog, processing e-commerce transactions, and coordinating product delivery. These processes were crucial for the company's direct-to-consumer model. Efficient supply chain management, warehousing, and distribution were also vital.

The Vp company offered stylish and affordable bathroom solutions, appealing to customers seeking convenience and competitive prices. The online-only model provided a wider product selection. Customers could easily compare products and prices, enhancing their shopping experience.

The Vp company's online-only presence allowed for lower overheads, leading to competitive pricing. This direct model provided convenience, a wider selection, and easy price comparisons for customers. The company differentiated itself in the bathroom retail market through these advantages.

- Competitive Pricing: Lower overheads enabled cost-effective offerings.

- Wider Selection: Online platforms offer more product choices than physical stores.

- Convenience: Direct-to-consumer model simplifies the buying process.

- Market Differentiation: Unique approach in the bathroom retail sector.

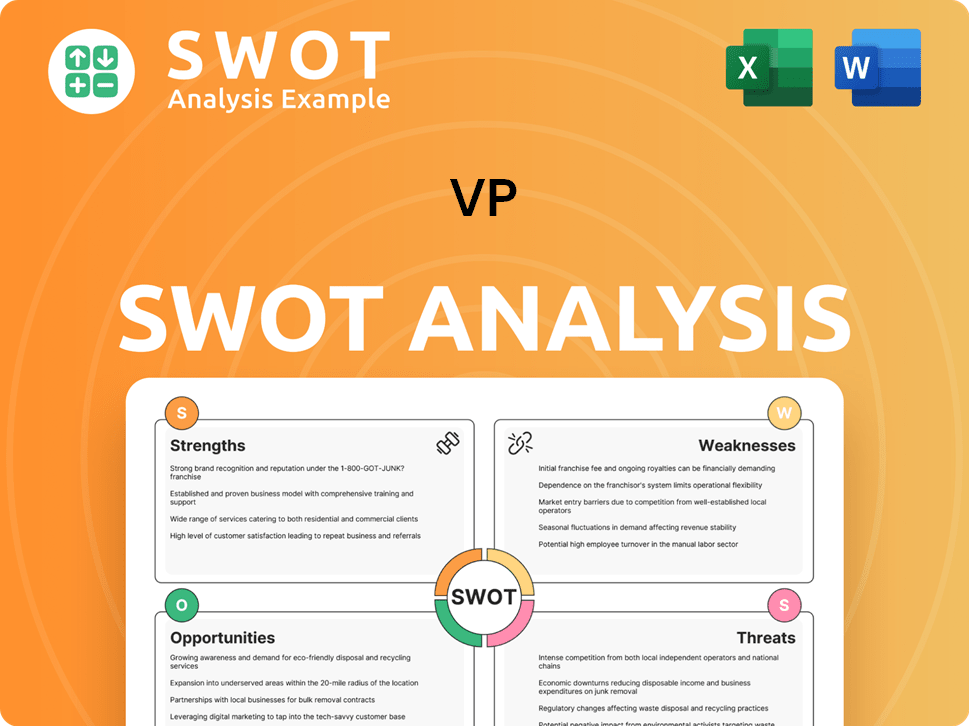

Vp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vp Make Money?

The primary revenue stream for the [Company Name] was generated through direct sales of bathroom products via its e-commerce platform. This included a wide range of items such as bathroom suites, showers, furniture, and accessories, all sold directly to consumers online. The business model focused on providing a convenient and accessible shopping experience for customers seeking bathroom solutions.

Before the acquisition, the [Company Name] had an estimated annual revenue of approximately £40 million. However, at its peak, the company had achieved sales of around £150 million. This demonstrates the company's potential for significant revenue generation within the online retail market for bathroom products. The acquisition by Victorian Plumbing in May 2024 marked a new phase in the company's financial performance.

Following the acquisition by Victorian Plumbing in May 2024, the [Company Name] contributed approximately £14.7 million in revenue to Victorian Plumbing's financial year ending September 2024. However, during this period, it also incurred an adjusted EBITDA loss of £2.2 million. This financial data highlights the initial impact of the acquisition on the company's financial performance, showing a contribution to revenue but also indicating operational challenges.

Online retailers like the [Company Name] typically employ various strategies to maximize revenue and improve profitability. These strategies often include tiered pricing for different product ranges, promotional bundles, and cross-selling related bathroom items to increase the average order value. The shift towards increasing sales of own-brand products, a strategy employed by Victorian Plumbing, also played a role in improving gross margins.

- Tiered Pricing: Offering different price points for various product lines to cater to a range of customer budgets.

- Promotional Bundles: Creating bundled deals to encourage customers to purchase multiple items at a discounted price.

- Cross-selling: Recommending complementary products to increase the overall value of each sale.

- Own-Brand Products: Focusing on increasing sales of in-house branded products to improve gross margins.

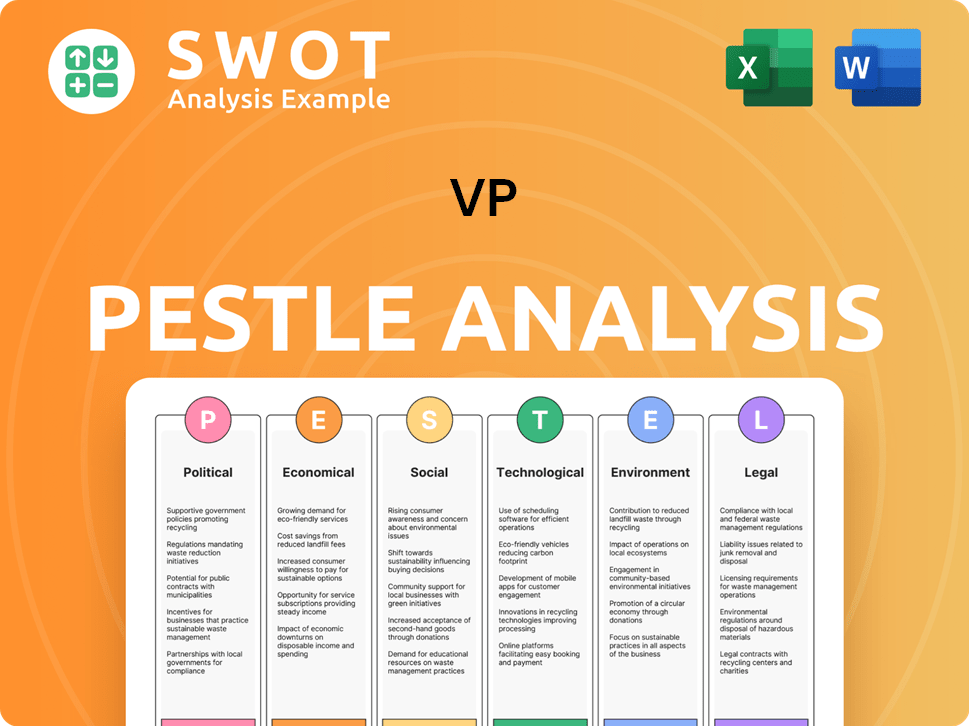

Vp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vp’s Business Model?

The story of the Vp company is marked by significant shifts and strategic realignments. Its trajectory includes a notable acquisition, operational adjustments, and a focus on leveraging core strengths to navigate the competitive online retail landscape. Understanding these key milestones, strategic moves, and competitive edges provides insights into the company's evolution and future direction.

A pivotal moment was the acquisition by Victorian Plumbing for £22.2 million on May 17, 2024. This move aimed to consolidate market presence. However, the subsequent closure of the Doncaster operations and website redirection to Victorian Plumbing's platform signaled a strategic consolidation to streamline operations and reduce brand marketing confusion. This approach was designed to accelerate growth for the combined entity.

Prior to the acquisition, the Vp company faced challenges, including administration in September 2023, due to factors such as higher shipping costs and a consumer spending slump. The company's operational challenges and strategic responses highlight the dynamic nature of the retail environment and the importance of adaptability.

The acquisition by Victorian Plumbing in May 2024 for £22.2 million was a key milestone. This was followed by the closure of the Doncaster operations and website redirection to Victorian Plumbing's platform by January 31, 2025, to streamline operations. The company had previously entered administration in September 2023.

The primary strategic move was the acquisition by Victorian Plumbing, aimed at consolidating market share. The closure of Vp company's Doncaster operations and the redirection of its website were strategic decisions to reduce brand marketing confusion. Further strategic moves involved focusing on own-brand products and expanding into new categories.

Victorian Plumbing's competitive advantages, which were leveraged through the acquisition, include brand strength, an extensive product range, and operational efficiencies. The new 544,000 sq ft semi-automated distribution center in Leyland, Lancashire, fully operational by December 2024, is expected to drive further efficiencies. The company continues to adapt by focusing on its own-brand products.

The focus on own-brand products, which accounted for 81% of half-year revenue in H1 2025, is a key operational adjustment. Expansion into new categories, such as tiles and décor, which saw a 36% increase in revenue to £7.6 million in H1 2025, also demonstrates operational adaptation. The planned launch into the UK homewares market under the re-invented MFI brand in H1 FY26 is another key move.

The Vp company is now part of a larger entity, Victorian Plumbing, which has a strong competitive edge due to its brand recognition and operational efficiencies. The company's strategic focus includes leveraging its e-commerce knowledge and supply chain logistics. The plan to launch into the UK homewares market in H1 FY26 under the re-invented MFI brand is part of the growth strategy, as discussed in Growth Strategy of Vp.

- Focus on own-brand products, accounting for 81% of H1 2025 revenue.

- Expansion into new categories like tiles and décor, with a 36% revenue increase to £7.6 million in H1 2025.

- Planned launch into the UK homewares market in H1 FY26 under the re-invented MFI brand.

- Operational efficiencies through a new 544,000 sq ft distribution center.

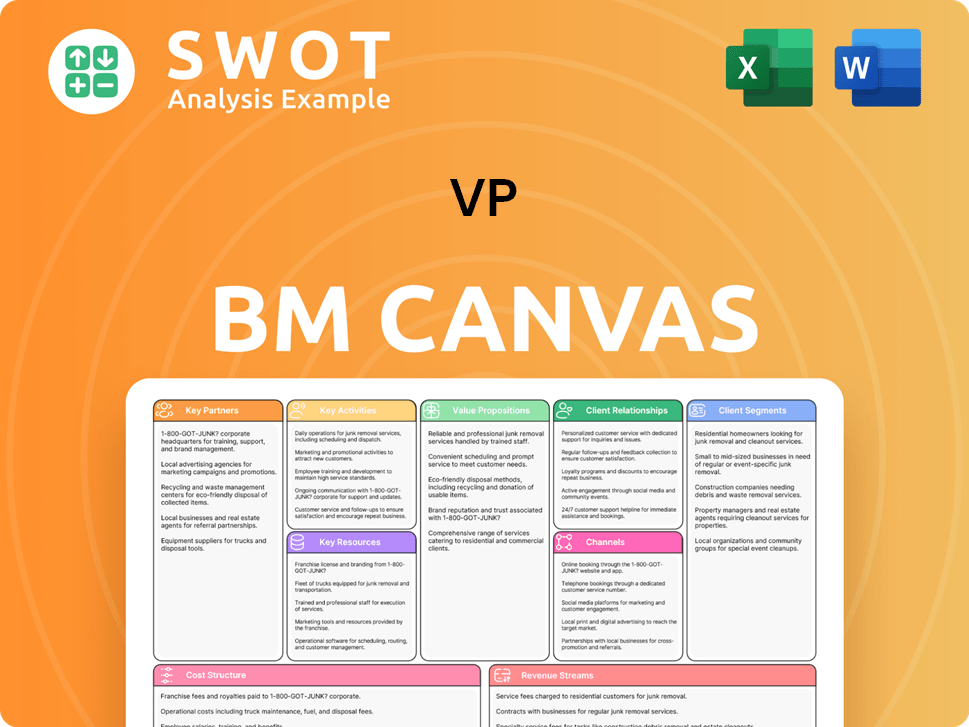

Vp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vp Positioning Itself for Continued Success?

The acquisition of the independent entity by Victorian Plumbing significantly reshaped the competitive landscape. Victorian Plumbing, now incorporating the former entity, has strengthened its position as a leading player in the UK bathroom retail market. This consolidation has allowed for strategic synergies and improved market penetration.

Victorian Plumbing's market share gains are evident in its financial performance. In H1 2025, total orders increased by 10% to 542,000. Trade revenue also grew, reaching £36.1 million, which represents 24% of the total revenue. This growth highlights the successful integration and expansion of the business operations.

The combined entity faces risks, including consumer uncertainty in the UK market, which can affect discretionary spending on home improvements. The e-commerce landscape is constantly evolving, requiring continuous innovation to address technological disruptions and competition. Understanding Target Market of Vp is crucial for navigating these challenges.

Victorian Plumbing is focused on initiatives to sustain and expand its revenue-generating capabilities. This includes investing in own-brand products and expanding into new categories like tiles and décor. The company also aims to further penetrate the B2B market.

Victorian Plumbing is planning to launch into the £20 billion UK homewares market in H1 FY26 under the MFI brand, utilizing its existing e-commerce platform and supply chain. The completion of its new semi-automated distribution center in December 2024 is expected to drive operational efficiencies.

- Continued investment in own-brand product ranges to improve gross margins.

- Expansion into new product categories, such as tiles and décor, which showed substantial growth in H1 2025.

- Further penetration of the B2B market, with trade revenue reaching £67.3 million in FY24.

- Launch into the UK homewares market in H1 FY26 under the MFI brand.

Vp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vp Company?

- What is Competitive Landscape of Vp Company?

- What is Growth Strategy and Future Prospects of Vp Company?

- What is Sales and Marketing Strategy of Vp Company?

- What is Brief History of Vp Company?

- Who Owns Vp Company?

- What is Customer Demographics and Target Market of Vp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.