Wisetech Global Bundle

Can WiseTech Global Continue its Ascent in the Logistics Software Arena?

WiseTech Global, a leader in logistics technology, has consistently demonstrated a powerful growth strategy, transforming the global supply chain. Their strategic acquisition of CargoSphere in 2017 was a game-changer, expanding their reach and capabilities in ocean freight management. Founded in 1994, the company has evolved from an Australian startup into a global powerhouse, serving over 18,000 logistics organizations worldwide.

This Wisetech Global SWOT Analysis explores the company's future prospects, focusing on its expansion plans and continuous innovation in the dynamic logistics technology sector. WiseTech Global's commitment to strategic planning is key to solidifying its market leadership and driving sustained success. We'll delve into their cloud-based solutions and SaaS offerings, examining how they navigate challenges and seize opportunities within the freight forwarding industry, and their impact on the supply chain solutions.

How Is Wisetech Global Expanding Its Reach?

The expansion initiatives of WiseTech Global are designed to boost its Growth Strategy and broaden its global reach. These initiatives encompass geographic expansion, strategic acquisitions, and enhancements to its core product offerings. The company is focused on growing its presence in both established and emerging markets, leveraging its technology platform to capture a larger share of the global logistics market.

A key element of WiseTech Global's strategy involves strategic acquisitions to integrate new technologies and expand its customer base. This includes acquisitions to access new customer segments, diversify revenue streams, and stay ahead of evolving industry demands. These moves are crucial for maintaining a competitive edge in the rapidly changing Logistics Technology landscape.

WiseTech Global is also focused on enhancing its product and service offerings within the CargoWise platform. This involves developing new modules and functionalities that address emerging needs in areas such as sustainability, real-time visibility, and advanced analytics. The company aims to onboard more of the world's largest logistics providers onto its CargoWise platform, leveraging its comprehensive capabilities to replace legacy systems.

WiseTech Global continues to expand its global footprint, particularly in emerging markets with growing logistics needs. This includes strategic investments and partnerships to enhance its presence in key regions. The company aims to diversify its revenue streams and increase its market share through targeted geographic growth initiatives.

M&A is a core component of WiseTech Global's expansion strategy. Recent acquisitions, such as Avalair in late 2023 and Envase Technologies in early 2024, demonstrate its commitment to adding new technologies and customer bases. These acquisitions are designed to enhance product offerings and expand market reach.

WiseTech Global is continually developing new modules and functionalities for its CargoWise platform. These enhancements focus on emerging needs like sustainability and advanced analytics. The goal is to provide comprehensive Supply Chain Solutions that meet the evolving demands of the logistics industry.

WiseTech Global emphasizes building a robust partner ecosystem to extend its reach and provide specialized solutions. Strategic alliances help ensure its technology remains adaptable and accessible across diverse operational landscapes. These partnerships are crucial for accelerating growth and market penetration.

WiseTech Global's '3 by 3' strategy, aiming to have the top 25 global freight forwarders on CargoWise across at least three regions by 2025, underscores its aggressive growth targets. The company is also focused on expanding its product offerings within the CargoWise platform, including new modules for sustainability and advanced analytics. These initiatives are supported by significant investments in research and development.

- Geographic expansion into emerging markets.

- Strategic acquisitions to integrate complementary technologies.

- Enhancements to the CargoWise platform with new modules.

- Building a robust partner ecosystem.

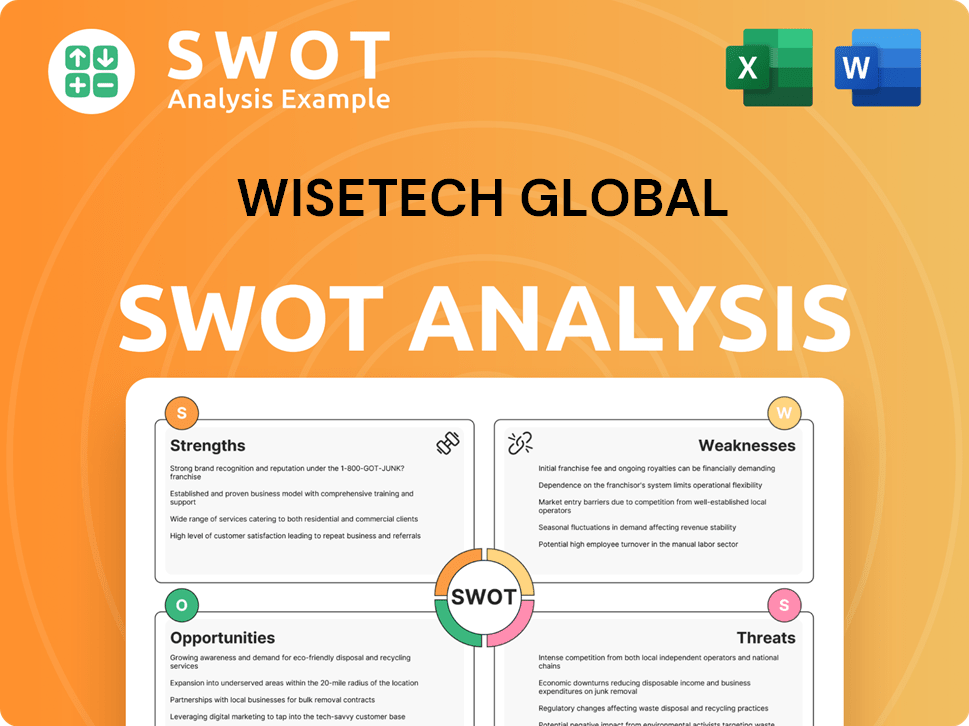

Wisetech Global SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wisetech Global Invest in Innovation?

WiseTech Global's Growth Strategy is heavily reliant on its dedication to innovation and technological advancement. The company consistently invests in research and development (R&D) to enhance its core product, CargoWise, and explore new technological opportunities. This commitment is evident in the continuous release of new features and modules aimed at improving efficiency and automation within the global supply chain.

The company's approach to digital transformation revolves around providing a single, integrated platform. This platform eliminates data silos and streamlines complex logistics processes. This strategic focus on a unified platform is a key element of their Future Prospects.

By leveraging cutting-edge technologies, the company aims to develop intelligent automation solutions and predictive analytics capabilities. This includes integrating artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into its platform. The goal is to offer greater efficiency and accuracy to users, optimizing routing, predicting delays, and enhancing customs compliance.

WiseTech Global allocates a significant portion of its resources to research and development. This investment is crucial for maintaining its competitive edge and driving future growth. The company's commitment to R&D is a core element of its Growth Strategy.

The integration of AI, ML, and IoT technologies is central to WiseTech Global's innovation strategy. These technologies are used to create intelligent automation solutions and predictive analytics. This helps to improve efficiency and accuracy across the supply chain.

WiseTech Global is developing tools to help logistics providers track and reduce their carbon footprint. This focus on sustainability is becoming increasingly important in the industry. This is part of the company's broader Growth Strategy.

The ongoing development of new products and platforms directly contributes to WiseTech Global's growth objectives. By increasing the value proposition of CargoWise, the company attracts new customers. This is a key driver of the company's Future Prospects.

Enhancements to the CargoWise platform are a constant focus. These enhancements include new features and modules designed to improve efficiency and automation. This helps to maintain the platform's competitiveness.

The primary goal of WiseTech Global's technology strategy is to enhance the value proposition for its customers. This is achieved by providing a comprehensive and integrated platform. The company's focus on customer value drives its Future Prospects.

WiseTech Global's focus on innovation is evident in its adoption of advanced technologies. These technologies are integrated into its core platform to improve efficiency and provide better services.

- AI and ML: Used for optimizing routing, predicting delays, and improving customs compliance.

- IoT: Integrated to enhance visibility and data collection across the supply chain.

- Cloud-Based Solutions: Offering scalable and accessible solutions for logistics providers.

- Sustainability Tools: Developing tools to help customers track and reduce their carbon footprint.

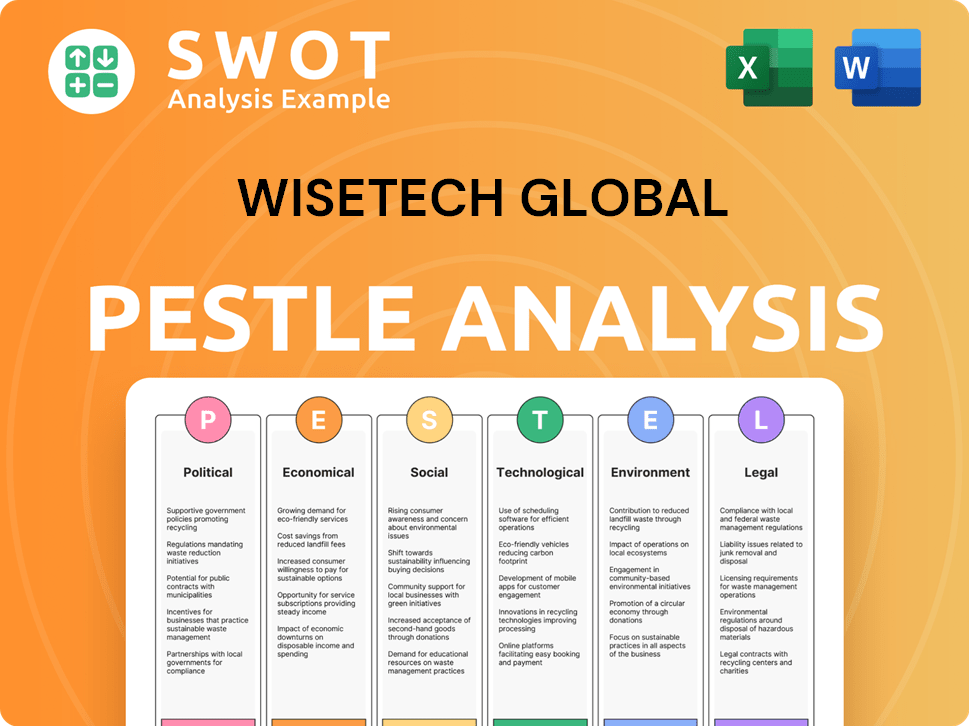

Wisetech Global PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Wisetech Global’s Growth Forecast?

The financial outlook for Wisetech Global is robust, supported by its effective growth strategy and increasing market penetration within the Logistics Technology sector. The company's performance in the first half of the 2024 financial year (1H FY24) demonstrates strong financial health and a clear path for future expansion. This positive trajectory is a key indicator of the company's potential for sustained success.

In 1H FY24, Wisetech Global reported a significant 32% increase in total revenue, reaching US$398.2 million. This impressive growth was primarily driven by a 38% rise in CargoWise revenue, which hit US$350.7 million. These figures highlight the effectiveness of its Supply Chain Solutions and the increasing adoption of its platform. The company's 27% increase in Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) to US$177.0 million further underscores its financial strength and operational efficiency.

Looking at the future, Wisetech Global has provided optimistic guidance for the full 2024 financial year. The company anticipates total revenue to be between US$880 million and US$910 million, representing a growth of 27% to 31%. The EBITDA guidance for FY24 is set between US$455 million and US$490 million, indicating a growth of 26% to 36%. These projections reflect the company's confidence in its ability to continue expanding its global footprint and leveraging the network effects of its CargoWise platform. To learn more about the company, you can read the Brief History of Wisetech Global.

The company's 1H FY24 results showcase strong financial performance. Revenue increased by 32% to US$398.2 million, and CargoWise revenue grew by 38% to US$350.7 million. EBITDA rose by 27%, reaching US$177.0 million, demonstrating efficient operations and strong financial management.

For the full FY24, Wisetech Global projects total revenue between US$880 million and US$910 million, reflecting a growth of 27% to 31%. This optimistic forecast indicates continued expansion and market penetration. These projections are based on the company's current performance and strategic initiatives.

EBITDA for FY24 is expected to be in the range of US$455 million to US$490 million, showing a growth of 26% to 36%. This guidance highlights the company's ability to maintain profitability and manage its costs effectively. This growth is a testament to their strategic investments.

Wisetech Global's financial strategy focuses on reinvesting operating cash flows into product development and strategic acquisitions. This approach supports future growth and innovation. The company's strong balance sheet enables further M&A activities.

The company's consistent performance and ambitious targets underscore its commitment to delivering long-term shareholder value. This is driven by the increasing adoption of its cloud-based solutions and software as a service (SaaS) offerings. The company's global presence and reach also contribute to its success.

Wisetech Global continues to invest in research and development to enhance its technology platform. The company's expansion plans and key acquisitions are vital for its growth strategy for the next 5 years. This approach is crucial for maintaining its competitive edge.

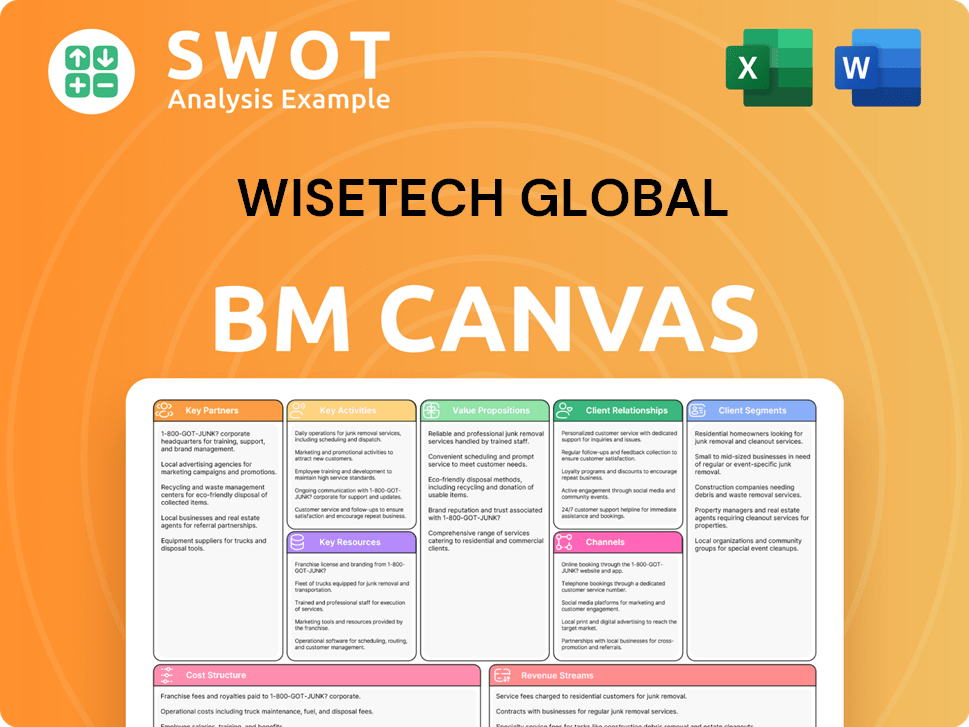

Wisetech Global Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Wisetech Global’s Growth?

While the future looks bright for the Owners & Shareholders of Wisetech Global, several potential risks and obstacles could impact its growth. The company operates in a dynamic market, and it's essential to understand the challenges that could affect its performance. These challenges range from competitive pressures to shifts in the global economic environment.

Understanding these risks is vital for evaluating the long-term viability of the company's Growth Strategy. External factors, such as regulatory changes and the global economy, can significantly influence the company's operations and success. Continuous adaptation and strategic planning are essential to navigate these potential hurdles effectively.

The logistics technology sector is highly competitive, with numerous companies vying for market share. Established players and emerging startups alike continually innovate, putting pressure on companies to maintain their competitive edge. This requires ongoing investment in research and development and a proactive approach to market trends.

The logistics software market is crowded, with many competitors vying for market share. This intense competition necessitates constant innovation and strategic adaptation to maintain a competitive edge. Companies must differentiate themselves through technology, service, and pricing.

Rapid technological advancements, particularly in areas like AI and blockchain, require continuous and substantial R&D investments. Staying ahead of the curve in Logistics Technology is crucial, as new technologies can quickly reshape the industry. Failure to adapt could result in a loss of market share.

Changes in international trade regulations, customs requirements, and data privacy laws can impact software functionality and compliance. Companies must adapt their solutions to meet evolving regulatory landscapes, which can be costly and time-consuming. Staying compliant is essential for global operations.

Disruptions in the Supply Chain Solutions can indirectly affect customers' ability to invest in new software. Economic downturns or global events can lead to decreased demand for logistics services, impacting sales cycles. Diversification of customer base can help mitigate this risk.

Limited availability of skilled software developers and implementation specialists can hinder product roadmap execution and global expansion. Attracting and retaining top talent is crucial for innovation and growth. Effective workforce planning is essential to address these constraints.

Economic recessions can lead to reduced spending on software and services within the logistics sector. Companies must be prepared for potential declines in revenue during economic downturns. Diversifying offerings and customer base can provide stability.

Wisetech Global employs several strategies to mitigate these risks. A diversified customer base reduces reliance on any single market or customer. Strong intellectual property protection safeguards innovations. A robust risk management framework, including scenario planning, helps the company adapt to market shifts.

Strategic acquisitions are a key part of the company's strategy, helping to diversify offerings and expand its market presence. Acquisitions can provide access to new technologies, customer bases, and geographic markets. This approach reduces reliance on any single product or market.

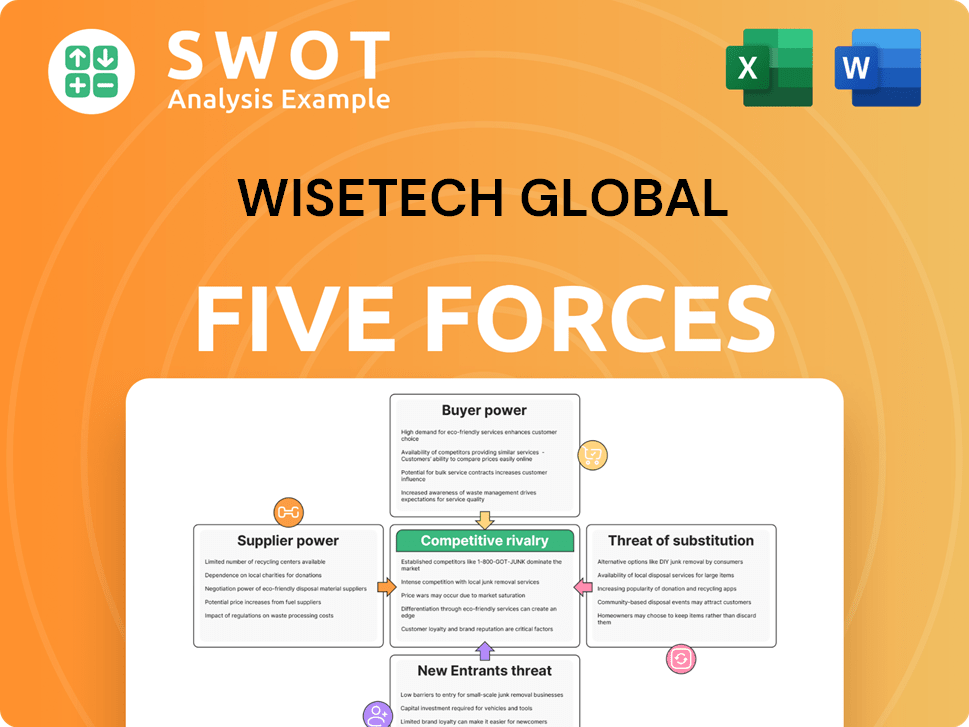

Wisetech Global Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wisetech Global Company?

- What is Competitive Landscape of Wisetech Global Company?

- How Does Wisetech Global Company Work?

- What is Sales and Marketing Strategy of Wisetech Global Company?

- What is Brief History of Wisetech Global Company?

- Who Owns Wisetech Global Company?

- What is Customer Demographics and Target Market of Wisetech Global Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.