Wisetech Global Bundle

How Does Wisetech Global Thrive in the Logistics World?

WiseTech Global has become a cornerstone in the global logistics arena, but how does this Wisetech Global SWOT Analysis company truly function? Its flagship product, CargoWise, is a comprehensive platform designed to streamline complex logistics processes. With a reported 27% revenue increase to US$500.2 million in the first half of 2024, understanding How Wisetech Global works is critical.

This deep dive into Wisetech Global services will explore its core operations and business model, revealing how it generates revenue and maintains its strategic position. We'll examine its technology solutions, from cloud-based solutions to logistics software features, and analyze its financial performance and market share. By understanding Wisetech Global's customer base and its approach to supply chain solutions, investors and industry observers can gain valuable insights into its long-term viability and growth potential, including its acquisitions and competitor analysis.

What Are the Key Operations Driving Wisetech Global’s Success?

At the heart of Wisetech Global's operations lies its integrated global logistics platform, CargoWise. This platform is designed to streamline and automate critical logistics processes. It serves a diverse customer base, including freight forwarders, customs brokers, warehousing providers, and shipping lines. CargoWise offers a comprehensive suite of modules covering freight forwarding, customs clearance, warehousing, transport, and financial management, all within a single, scalable system.

The company's value proposition centers on centralizing and simplifying complex logistics operations. This enables customers to boost efficiency, cut costs, enhance supply chain visibility, and ensure compliance with international trade regulations. Wisetech Global continuously invests in research and development to enhance CargoWise's capabilities, integrating new technologies like artificial intelligence and machine learning to adapt to industry changes and regulatory demands. The cloud-based delivery model ensures accessibility and scalability for its global customer base.

The distribution strategy of Wisetech Global includes direct sales and a robust partner program. This program involves implementation partners and service providers, which extends its reach. It also ensures effective deployment and support for its complex solutions. This approach helps drive market adoption and differentiates its offerings.

The core of Wisetech Global's business is the development and delivery of CargoWise. This platform offers a wide range of modules for managing and automating logistics processes. The platform supports freight forwarding, customs clearance, warehousing, transport, and financial management.

The value lies in streamlining complex logistics. Customers benefit from improved efficiency, reduced costs, and enhanced supply chain visibility. The platform helps ensure compliance with international trade regulations.

Wisetech Global invests heavily in R&D. This includes incorporating AI and machine learning. The cloud-based delivery model ensures accessibility for its global customer base.

The company uses direct sales and a partner program. This includes implementation partners and service providers. This approach ensures effective deployment and support.

Wisetech Global's operations are unique due to its deep industry specialization and the breadth of its integrated platform. Unlike competitors, CargoWise provides an end-to-end ecosystem. This eliminates data silos and automates workflows across logistics functions.

- Improved operational control

- Real-time data insights

- Reduced manual errors

- Enhanced collaboration across the supply chain

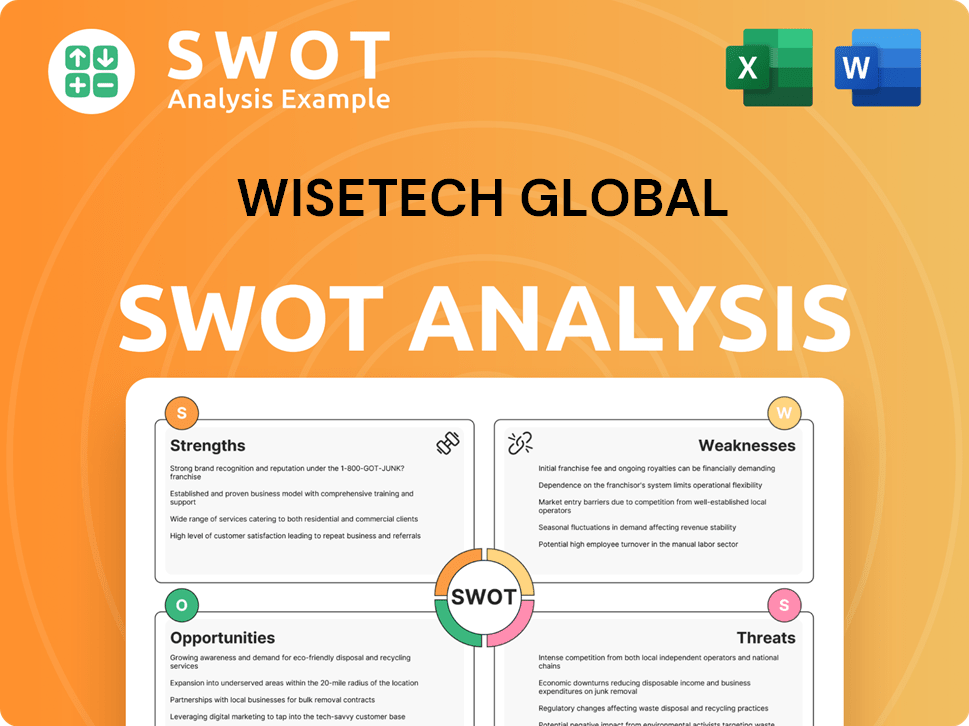

Wisetech Global SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wisetech Global Make Money?

The core of how Wisetech Global company operates revolves around its revenue streams and monetization strategies, primarily centered on its CargoWise platform. The company's financial success is largely driven by software subscriptions and usage-based fees, creating a recurring and transactional revenue model. This approach enables Wisetech Global to generate consistent income from its global customer base.

Wisetech Global's revenue model is designed to scale with customer needs, offering tiered pricing based on factors like the number of users, modules utilized, and transaction volumes. This structure encourages customers to expand their usage of the platform, leading to increased revenue as their operations grow. The company's focus on delivering value through operational improvements and cost savings justifies ongoing investments in the Wisetech Global platform.

In the first half of the 2024 financial year, Wisetech Global reported a total revenue of US$500.2 million, marking a significant 27% increase. CargoWise revenue specifically grew by 30% to US$476.9 million, highlighting its central role in the company's monetization strategy. This growth demonstrates the effectiveness of Wisetech Global's approach in the logistics software market.

The primary revenue source for Wisetech Global comes from software subscriptions and usage-based fees for its CargoWise platform. Customers pay for access to the software and are charged based on the volume of transactions processed.

Wisetech Global employs a tiered pricing model, often based on the number of users, the modules utilized, and transaction volumes. This model allows for scalability and customization to meet the needs of different customers.

Wisetech Global also generates revenue from professional services, including implementation, training, and consulting. These services support the deployment and optimization of CargoWise for its clients.

The company benefits from a recurring revenue model, with a significant portion of revenue derived from existing customers expanding their usage. This demonstrates the platform's value and its ability to grow with customer operations.

Wisetech Global acquires new customers, particularly larger global logistics providers, contributing to its revenue growth. This expansion of the customer base supports the company's overall financial performance.

The company's monetization strategies are aligned with the value it delivers, enabling customers to achieve operational improvements and cost savings. This approach ensures customer satisfaction and justifies ongoing investment in the platform.

Several factors contribute to Wisetech Global's revenue generation and sustained growth. These include the expansion of the global reach and the continuous enhancement of the platform's capabilities. Furthermore, the company's focus on customer success and the delivery of measurable value are critical.

- Customer Retention and Expansion: The ability to retain existing customers and encourage them to expand their usage of the CargoWise platform is crucial.

- New Customer Acquisition: Attracting new customers, especially major logistics providers, is essential for growth.

- Platform Enhancements: Continuous improvements and additions to the platform's features and functionalities drive customer satisfaction and usage.

- Professional Services: The provision of professional services, such as implementation and training, supports customer success and platform adoption.

- Market Dynamics: The overall growth and trends in the global logistics industry influence Wisetech Global's performance.

To understand more about the company's overall strategy, you can read about the Growth Strategy of Wisetech Global.

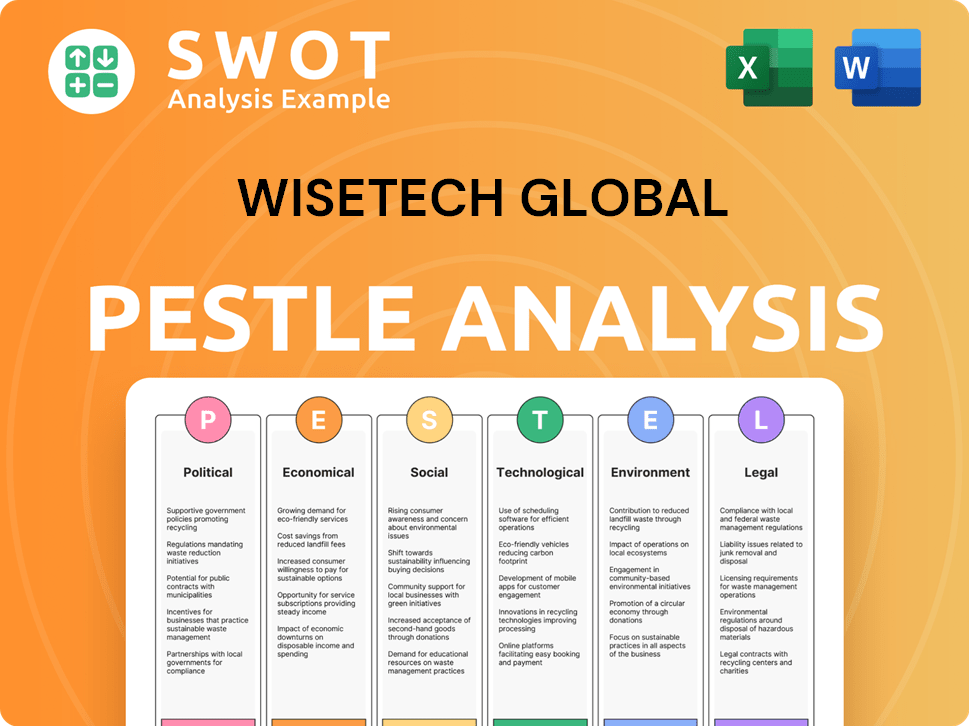

Wisetech Global PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Wisetech Global’s Business Model?

The journey of Wisetech Global has been marked by significant milestones and strategic moves, solidifying its position in the logistics software market. A key aspect of its growth strategy involves acquiring complementary businesses to broaden its global reach and enhance the functionalities of its CargoWise platform. These strategic acquisitions enable Wisetech Global to rapidly enter new markets, gain access to new customer segments, and integrate specialized technologies, thus accelerating its product development roadmap.

Operational challenges include integrating diverse acquired technologies and maintaining a unified platform architecture. The company addresses this by focusing on a 'single platform, global rollout' strategy, ensuring that acquired capabilities are seamlessly integrated into CargoWise, rather than operating as separate systems. This approach preserves the platform's core value proposition of an integrated, end-to-end solution. Wisetech Global continues to adapt to new trends and competitive threats by consistently investing in R&D and exploring emerging technologies.

Wisetech Global's competitive advantages are multifaceted. Its technology leadership, particularly with the comprehensive and deeply integrated CargoWise platform, provides a significant barrier to entry for competitors. The platform's extensive functionality, covering a wide range of logistics processes and geographies, offers a compelling value proposition that is difficult for rivals to replicate. The company benefits from strong network effects, as more logistics providers adopt CargoWise, it becomes a de facto standard, facilitating easier collaboration and data exchange across the supply chain. For a deeper understanding of their target audience, consider reading about the Target Market of Wisetech Global.

In the first half of the 2024 financial year, Wisetech Global completed the acquisition of SmartFreight. This acquisition is expected to strengthen its position in the global logistics landscape. Such acquisitions allow Wisetech Global to rapidly enter new markets and integrate specialized technologies.

The company focuses on a 'single platform, global rollout' strategy. This ensures acquired capabilities are seamlessly integrated into CargoWise. This approach maintains the platform's core value proposition of an integrated, end-to-end solution.

Wisetech Global's technology leadership, especially with its CargoWise platform, provides a significant barrier to entry. The platform's extensive functionality offers a compelling value proposition. The recurring revenue model and high customer retention rates also speak to the stickiness of its solutions.

Wisetech Global continues to adapt to new trends by consistently investing in R&D. The company is exploring emerging technologies like AI and blockchain for logistics. It strategically expands its global presence to capture new market opportunities.

CargoWise is a comprehensive platform designed to manage all aspects of the logistics process. It offers end-to-end solutions, integrating various functionalities to streamline operations. The platform's strength lies in its ability to handle complex logistics needs across different geographies.

- Comprehensive functionality covering freight forwarding, customs, and warehousing.

- Cloud-based solutions offering accessibility and scalability.

- Strong customer retention rates due to the platform's integral role in client operations.

- Continuous investment in R&D to integrate new technologies and address market demands.

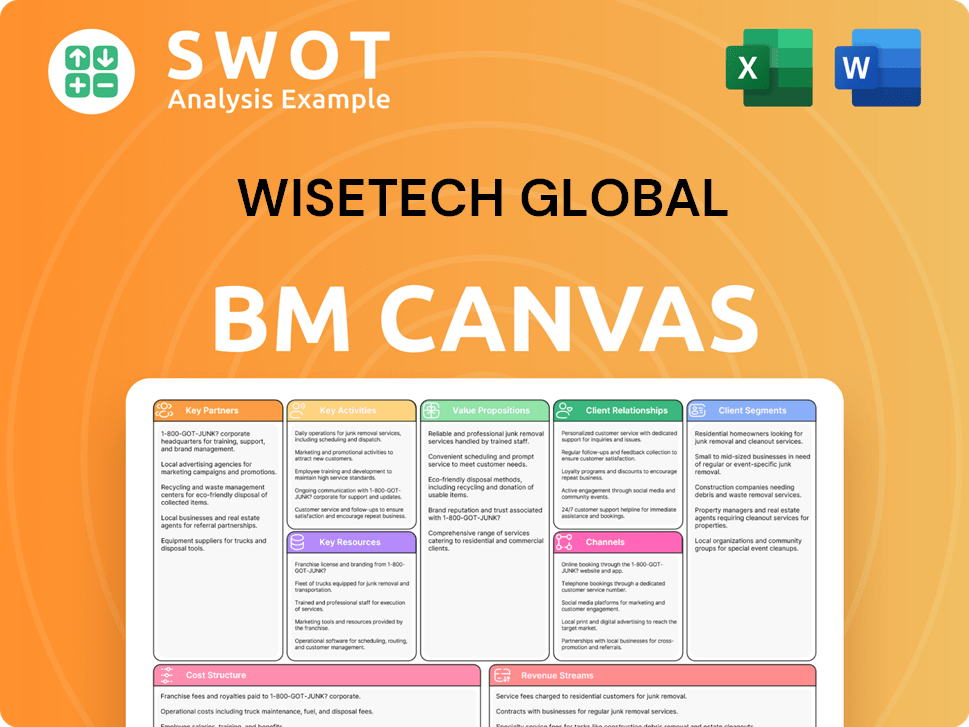

Wisetech Global Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Wisetech Global Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook for the company. WiseTech Global holds a prominent position in the global logistics software market, particularly with its comprehensive CargoWise platform. Its strong market share in freight forwarding and customs brokerage highlights its operational advantages. The company's global reach extends to over 165 countries, solidifying its industry standing.

Understanding the dynamics of how the Owners & Shareholders of Wisetech Global operate is crucial. Despite its strengths, the company faces various risks. These include regulatory changes, intense competition, technological disruptions like AI, and global economic downturns. These factors could impact its financial performance and market share.

WiseTech Global is a leader in the logistics software market. Its CargoWise platform is a key differentiator. The company has a significant market share within the freight forwarding and customs brokerage sectors, providing an integrated solution. Customer loyalty is high, with strong retention rates and increased adoption of additional modules.

Regulatory changes in international trade and customs pose a risk. Competition from enterprise software providers and niche players could pressure pricing. Technological disruptions, such as advancements in AI, could impact existing solutions. Global economic downturns or geopolitical instability could reduce trade volumes.

WiseTech Global aims to sustain growth through innovation and strategic expansion. Plans include enhancing the CargoWise platform with advanced technologies. Geographic footprint expansion and targeted acquisitions are also part of the strategy. The company focuses on deepening its presence in key logistics markets.

The company is committed to driving efficiency and visibility in the global logistics industry. It aims to capitalize on the ongoing digital transformation of supply chains. WiseTech Global seeks to sustain and expand revenue by delivering essential software solutions. These solutions enable logistics providers to navigate complex global trade environments.

In fiscal year 2024, WiseTech Global reported a revenue of $999.3 million, representing a 26% increase from the previous year. The company's EBITDA reached $347.8 million, a 33% increase. These figures demonstrate strong financial health and growth. The company continues to invest in research and development, allocating significant resources to enhance its platform.

- Revenue Growth: 26% increase in FY24.

- EBITDA Growth: 33% increase in FY24.

- Global Presence: Serving customers in over 165 countries.

- Strategic Focus: Continued investment in innovation and expansion.

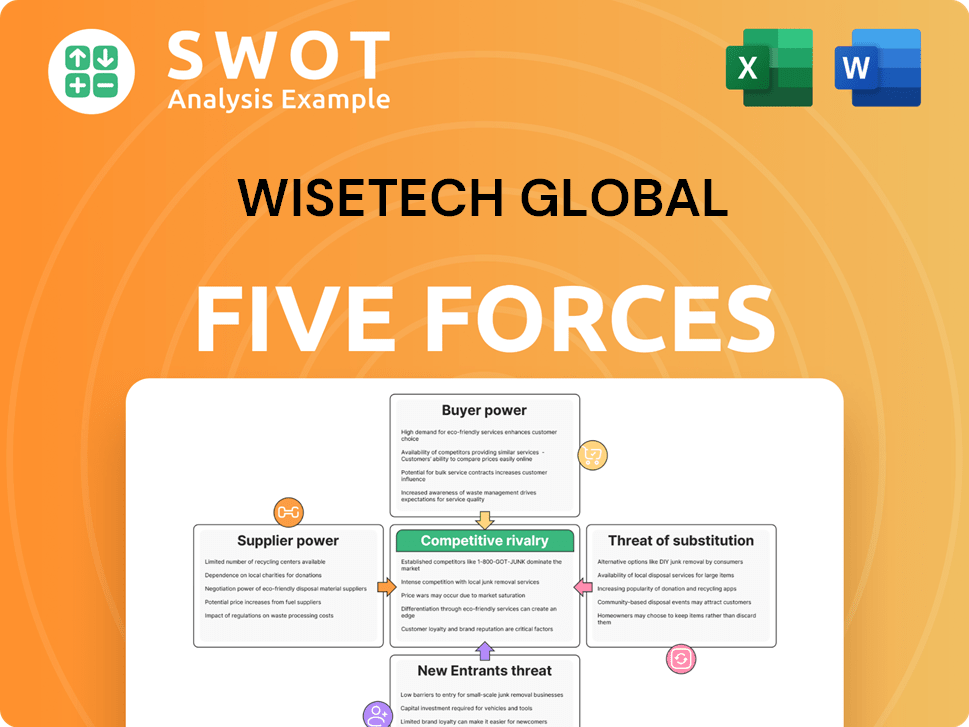

Wisetech Global Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wisetech Global Company?

- What is Competitive Landscape of Wisetech Global Company?

- What is Growth Strategy and Future Prospects of Wisetech Global Company?

- What is Sales and Marketing Strategy of Wisetech Global Company?

- What is Brief History of Wisetech Global Company?

- Who Owns Wisetech Global Company?

- What is Customer Demographics and Target Market of Wisetech Global Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.