Wix.com Bundle

Can Wix.com Continue Its Dominance in the Website Builder Market?

Wix.com, a pioneer in the cloud-based web development arena, has revolutionized how individuals and businesses establish their Wix.com SWOT Analysis online presence. Founded in 2006, the company's commitment to user-friendly design and comprehensive tools has fueled its remarkable expansion. This exploration delves into the core of Wix's Wix growth strategy and examines its ambitious plans for the future.

From its intuitive drag-and-drop interface to its vast array of website templates, Wix has consistently adapted to the evolving needs of the website builder market. Understanding the Wix future prospects requires a deep dive into its strategic initiatives, including its approach to digital marketing and expansion into new markets. This analysis will provide actionable insights for investors, business strategists, and anyone interested in the Wix.com company’s trajectory.

How Is Wix.com Expanding Its Reach?

The Owners & Shareholders of Wix.com are focused on expansion initiatives to drive growth. The company is actively pursuing a multi-faceted approach, including entering new markets, launching innovative products, and forming strategic partnerships. This strategy aims to broaden its customer base and solidify its position in the competitive website builder market.

A key element of the Wix growth strategy involves expanding its global footprint. The company is targeting emerging markets to capture new customer segments and diversify its revenue streams. Additionally, product development and enhancement of existing services are crucial components of its expansion plan. These initiatives are designed to meet the evolving needs of its diverse user base and stay ahead of industry trends.

Wix is also focusing on enhancing its offerings for enterprises and larger businesses, moving beyond its traditional SMB customer base. This includes enhancing its enterprise-grade solutions and providing more robust tools for scaling operations. The company is investing in vertical-specific solutions, tailoring its platform to cater to niche industries such as restaurant businesses, providing specialized features like online ordering and reservation systems.

Wix is actively exploring opportunities in emerging markets to capture new customer segments. This strategic move helps diversify its revenue streams and increase its global footprint. The company's expansion into new markets is a key part of its overall growth strategy.

The company is continually refining and introducing new features and services to its platform. This includes advancements in its e-commerce capabilities and the development of vertical-specific solutions. These innovations are designed to meet the evolving demands of its diverse user base.

Wix is exploring strategic partnerships to integrate third-party applications and services. This approach enriches its ecosystem and provides users with a more comprehensive suite of tools. These partnerships help Wix stay ahead of industry changes.

The company is enhancing its enterprise-grade solutions to cater to larger businesses. This includes providing more robust tools for scaling operations and meeting the complex needs of enterprise clients. This shift is part of the Wix.com company's strategy to expand its customer base.

Wix is focused on several key areas for expansion, including geographic expansion, product innovation, and strategic partnerships. These initiatives are designed to drive user growth and increase market share in the website builder market.

- Entering new markets to reach a broader customer base.

- Developing and launching new products and features to enhance the platform.

- Forming strategic partnerships to integrate third-party services and applications.

- Enhancing enterprise solutions to cater to larger businesses' needs.

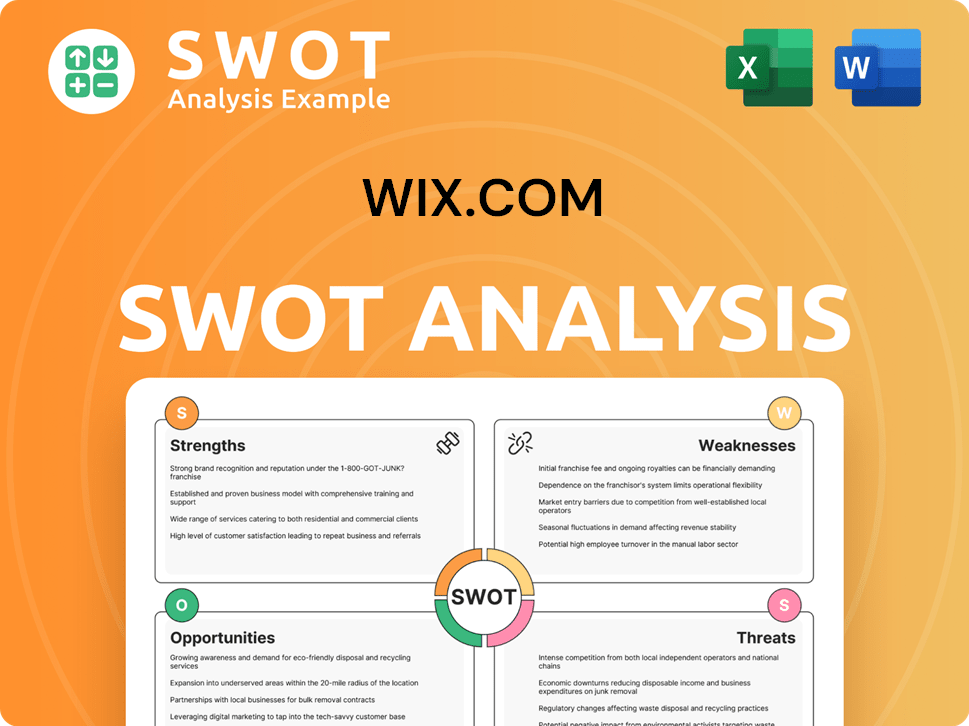

Wix.com SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wix.com Invest in Innovation?

The Wix.com company heavily invests in technology and innovation to drive its Wix growth strategy. This approach focuses on in-house development and strategic collaborations to enhance its platform's capabilities and user experience. A major area of focus is digital transformation and automation, streamlining the website creation process and empowering users with more intuitive design tools.

Wix.com company is at the forefront of integrating cutting-edge technologies like artificial intelligence (AI) to personalize user experiences, offer smart design suggestions, and automate routine tasks, making web development even more accessible. For instance, AI-powered tools assist users in generating content, optimizing SEO, and designing visually appealing layouts. These advancements are key to the Wix future prospects.

Wix.com company's commitment to innovation is also evident in its continuous development of new products and platforms. This includes expanding its editor capabilities, introducing advanced developer tools, and enhancing its mobile-first design functionalities. These technological advancements contribute directly to its growth objectives by attracting new users, improving customer retention, and expanding its addressable market. You can learn more about the company's origins in this Brief History of Wix.com.

Wix.com company focuses on digital transformation and automation. This includes streamlining the website creation process and empowering users with more intuitive design tools. The goal is to make web development more accessible and efficient for all users.

Wix.com company integrates AI to personalize user experiences and automate tasks. AI-powered tools help with content generation, SEO optimization, and design. This enhances the user experience and simplifies web development.

Wix.com company consistently develops new products and platforms. This includes expanding editor capabilities, introducing advanced developer tools, and enhancing mobile-first design functionalities. These efforts drive user growth and market expansion.

Wix.com company's technological advancements directly impact its growth objectives. These innovations attract new users, improve customer retention, and expand the addressable market. The company's agility and responsiveness to market trends are key to its success.

- Attracting New Users: Innovative features and ease of use draw in a wider audience.

- Improving Customer Retention: Continuous updates and new features keep users engaged.

- Expanding Addressable Market: By offering more tools and capabilities, Wix.com company caters to a broader range of users.

- Market Leadership: Consistently delivering innovative solutions solidifies Wix.com company's leadership in the website builder market.

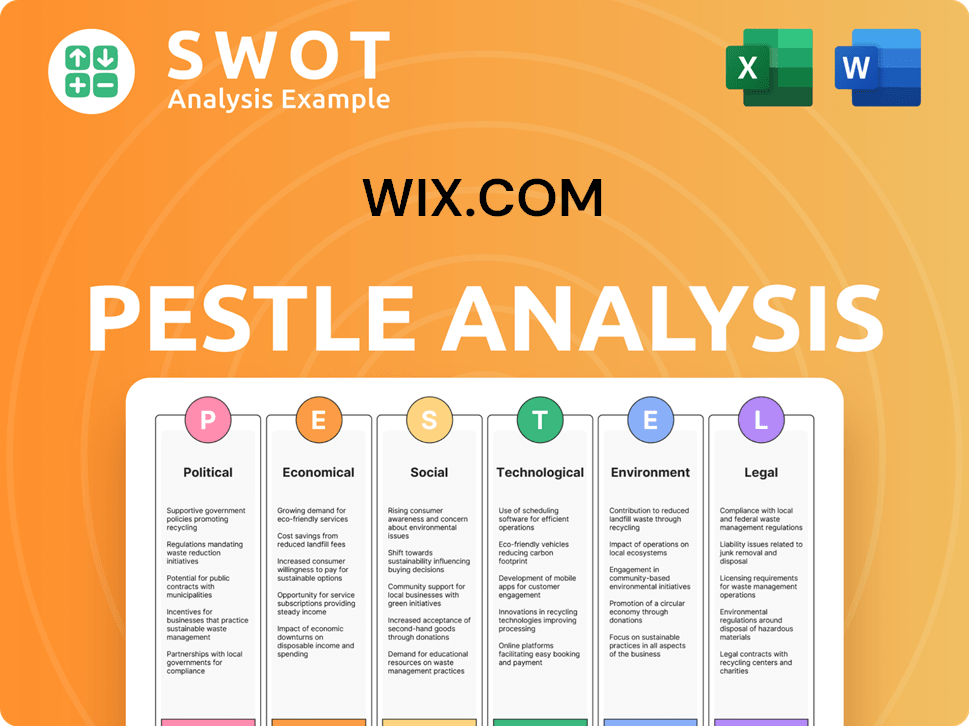

Wix.com PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Wix.com’s Growth Forecast?

The financial outlook for the company reflects a strategic focus on sustainable growth and profitability, which is key to its Wix growth strategy. The company has shown consistent revenue growth, driven by its expanding user base and the increasing adoption of its premium services. This focus is crucial in the competitive website builder market.

For the full year 2024, the company anticipates revenue in the range of $1.734 billion to $1.754 billion, representing year-over-year growth of 12% to 13%. This projection aligns with the company's long-term financial goals of achieving profitable growth. The company's ability to maintain and improve its financial performance is essential for its Wix future prospects.

The company is also focusing on improving its operational efficiency and expanding its free cash flow margin, which is expected to be between 16% and 17% in 2024. This financial discipline is crucial for funding expansion initiatives and technological advancements. This financial strategy underpins the company's strategic plans, demonstrating its commitment to delivering value to shareholders while continuing to innovate and expand its global reach.

The company projects revenue between $1.734 billion and $1.754 billion for 2024, indicating a growth rate of 12% to 13% year-over-year. This growth is driven by the increasing demand for its services and the expanding user base. This growth is essential for its Wix.com company to maintain its position in the market.

The company anticipates a free cash flow margin between 16% and 17% in 2024. This improvement in operational efficiency allows for greater investment in product development and marketing. A strong free cash flow margin is critical for sustainable growth and investment in future initiatives.

The company's financial strategy includes continued investment in product development to fuel future growth. This investment is crucial for staying competitive and meeting the evolving needs of its users. The company is dedicated to enhancing its platform with new features and capabilities.

The company is focused on effective marketing strategies to acquire new customers and enhance its online presence. This includes targeted campaigns and initiatives to reach a wider audience. Efficient customer acquisition is essential for driving revenue growth and expanding market share.

Analyst forecasts generally align with the company's positive trajectory, highlighting its strong market position and its ability to monetize its platform effectively. The company's robust balance sheet and consistent cash flow generation provide a solid foundation for funding its expansion initiatives and technological advancements. For more detailed insights into the company's performance, you can refer to this article about the company's business model. This financial narrative underpins the company's strategic plans, demonstrating its commitment to delivering value to shareholders while continuing to innovate and expand its global reach. The company's approach to digital marketing and product development will be critical for its long-term success.

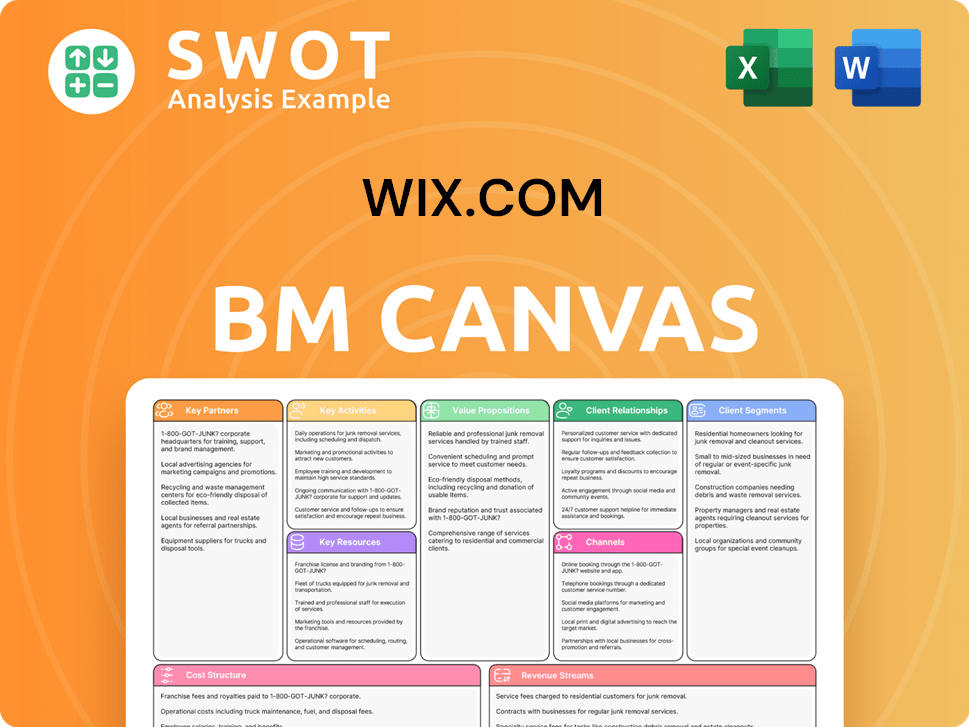

Wix.com Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Wix.com’s Growth?

The growth trajectory of Wix.com is subject to several potential risks and obstacles. These challenges span market competition, regulatory changes, and technological disruptions, all of which could impact the company's strategic and operational performance. Understanding these risks is crucial for evaluating the long-term sustainability and success of Wix's business model and its future prospects.

Market dynamics, including the intense competition within the website builder market, pose a significant challenge. The company must continuously innovate and adapt to maintain its market share and attract new users. Furthermore, staying compliant with evolving data privacy regulations and navigating technological advancements requires ongoing investment and strategic agility. These factors contribute to the complex landscape Wix.com navigates.

Internal resource constraints also present potential obstacles. The ability to attract and retain skilled talent in a competitive tech environment is essential for driving innovation and expansion. Addressing these risks proactively is key to ensuring that Wix can capitalize on its growth strategy and achieve its long-term goals. For more insights, explore the Competitors Landscape of Wix.com.

The website builder market is highly competitive, with numerous players vying for market share. Competitors include direct rivals like Squarespace and Weebly, as well as platforms offering specialized e-commerce solutions. This competition can lead to price wars and increased customer acquisition costs, impacting Wix's profitability.

Evolving data privacy laws, such as GDPR and CCPA, require Wix to continuously adapt its platform to ensure compliance. Changes in regulations concerning online commerce and digital marketing can also affect Wix's operations. Staying compliant necessitates ongoing investment in legal and technical resources.

The rapid pace of technological innovation poses a constant threat. Advancements in AI, new development frameworks, and changing user preferences require continuous investment in research and development (R&D). Failure to keep pace with these shifts could lead to a loss of market share and relevance.

Attracting and retaining top talent in the competitive tech market can be challenging. Resource constraints, including limitations in attracting skilled developers, designers, and marketers, could hinder Wix's ability to innovate and expand. This may affect product development and market penetration efforts.

Economic downturns could impact the demand for website building and e-commerce solutions. Reduced spending by small businesses and individuals could lead to slower user growth and lower revenue. Economic uncertainty can also affect Wix's advertising revenue and overall financial performance.

Cybersecurity threats pose a risk to Wix's platform and user data. Data breaches or security incidents could damage Wix's reputation and lead to financial losses. Protecting user data and maintaining platform security requires ongoing investment in cybersecurity measures and incident response capabilities.

Wix mitigates these risks through a diversified product offering, robust risk management frameworks, and proactive scenario planning. The company consistently monitors market trends and regulatory landscapes to anticipate and mitigate potential obstacles. They also invest in R&D to stay ahead of technological advancements, aiming to maintain its leadership position.

Wix's financial performance, including revenue growth and user acquisition costs, is closely monitored to assess its ability to navigate these risks. Analyzing metrics like customer lifetime value (CLTV) and churn rates helps evaluate the effectiveness of its strategies. The company's ability to maintain profitability while investing in growth is key.

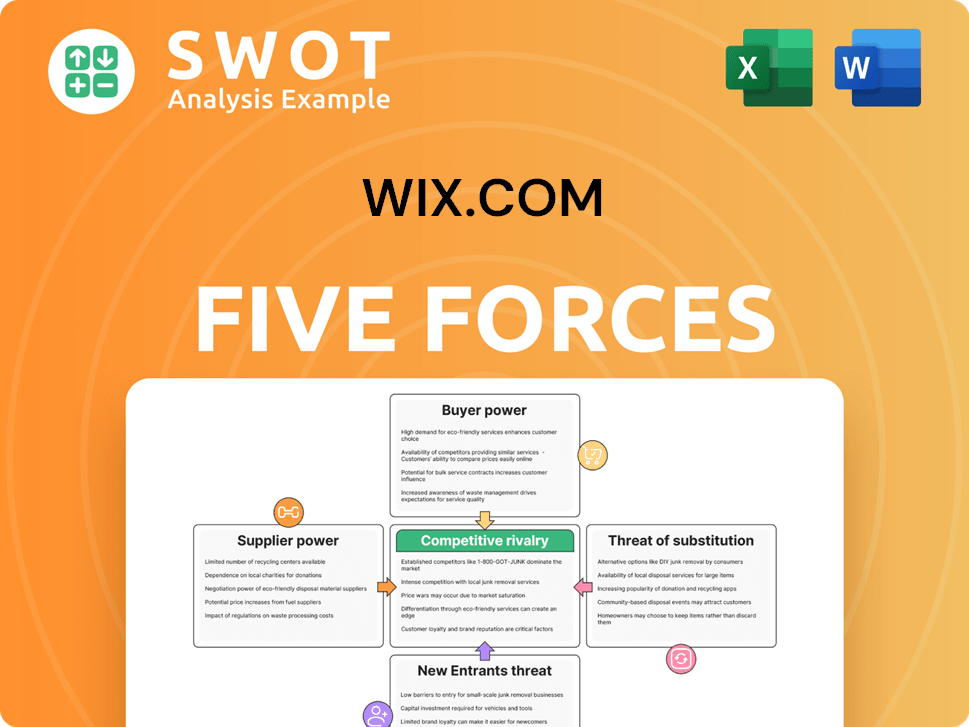

Wix.com Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wix.com Company?

- What is Competitive Landscape of Wix.com Company?

- How Does Wix.com Company Work?

- What is Sales and Marketing Strategy of Wix.com Company?

- What is Brief History of Wix.com Company?

- Who Owns Wix.com Company?

- What is Customer Demographics and Target Market of Wix.com Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.