Wix.com Bundle

Who Really Owns Wix.com?

Understanding the ownership structure of a company is crucial for investors and anyone interested in its strategic direction. For a tech giant like Wix.com, the story of its ownership is a dynamic tale of founders, public offerings, and institutional influence. Uncover the key players and how their stakes have shaped the evolution of this leading web development platform.

Founded in 2006, Wix.com SWOT Analysis offers a robust platform for creating websites. The company, based in Tel Aviv, went public in 2013, marking a significant shift in its ownership landscape. Exploring "Who owns Wix" and the "Wix ownership" details reveals insights into the company's governance, financial performance, and future prospects. The "Wix.com company" continues to be a prominent player in the website builder market, making understanding its ownership structure essential for stakeholders.

Who Founded Wix.com?

The story of Wix.com began in 2006, thanks to the vision of Avishai Abrahami, Nadav Abrahami, and Giora Kaplan. These three individuals laid the foundation for what would become a significant player in the website development industry. Their combined efforts were crucial in the early stages of the company, shaping its direction and laying the groundwork for its future success.

Avishai Abrahami currently holds the position of CEO and continues to guide the company. Nir Zohar joined in 2007, taking on the roles of President and COO. He has played a vital role in overseeing the company's operations and strategic planning. The early years were marked by a focus on making web development accessible to everyone, a core principle that drove the company's growth.

While the exact initial equity distribution among the founders isn't publicly available, Avishai Abrahami's current ownership as of April 2025 is approximately 1.68% of all outstanding shares. Early investors also played a role, acquiring stakes during the initial funding rounds that preceded the company's IPO. These early financial backers helped fuel the company's expansion and its mission of democratizing web development.

Understanding the ownership structure of a company like is important for investors and anyone interested in the company's direction. The founders' initial vision and the subsequent involvement of key figures like Nir Zohar have been instrumental in shaping the company's trajectory. The early investment rounds and the eventual IPO also played a significant role in the company's financial structure.

- Avishai Abrahami, Nadav Abrahami, and Giora Kaplan founded the company in 2006.

- Avishai Abrahami is currently the CEO and co-founder.

- Nir Zohar serves as President and COO, joining in 2007.

- As of April 2025, Avishai Abrahami owns approximately 1.68% of the outstanding shares.

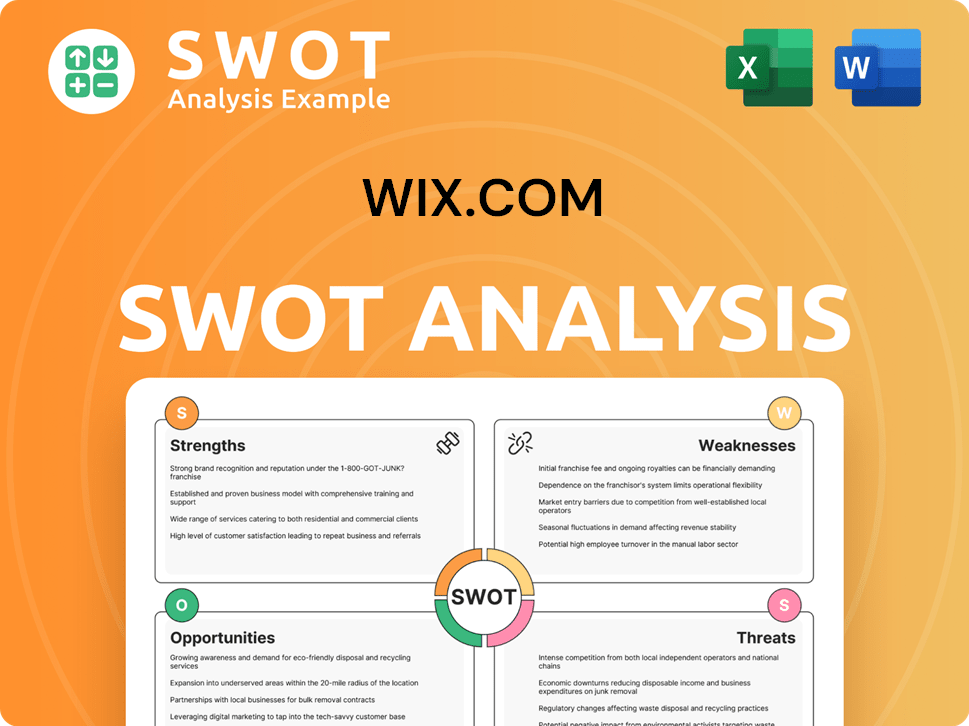

Wix.com SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Wix.com’s Ownership Changed Over Time?

The ownership structure of the Wix.com company underwent a major shift with its initial public offering (IPO) on November 5, 2013. The company began trading on the NASDAQ Global Market under the symbol WIX. The IPO priced common shares at $16.50 each. At the midpoint of its proposed IPO range, Wix.com had a fully diluted market value of $719 million. This event marked a significant transition, opening up ownership to public investors and institutional entities.

The founders, Avishai Abrahami, Nadav Abrahami, and Giora Kaplan, initially held significant stakes, but the IPO diluted their direct control as shares became available to the public. Over time, the ownership has evolved, with institutional investors now holding a large percentage of the outstanding shares. This shift reflects the growth and maturation of Wix.com as a publicly traded company.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | November 5, 2013 | Transitioned from private to public ownership; diluted founder control; opened shares to public and institutional investors. |

| Ongoing Market Trading | 2013-Present | Ownership fluctuates based on stock trading; institutional investors increase their holdings; further dilution of founder ownership. |

| Institutional Investment | Ongoing | Institutional investors hold a significant portion of shares, influencing company strategy and governance. |

As of May 2025, institutional investors collectively hold a substantial portion of Wix.com's shares. There are 774 institutional owners and shareholders, holding a total of 55,622,645 shares. Key institutional holders as of March 31, 2025, include Fmr Llc with 3,819,412 shares, Baillie Gifford & Co. with 3,227,099 shares, and BlackRock, Inc. with 3,000,174 shares. Other significant institutional investors include Vanguard International Growth Fund Investor Shares, Acadian Asset Management Llc, Senvest Management, LLC, Dorsal Capital Management, LLC, Lazard Asset Management Llc, Susquehanna International Group, Llp, and Citadel Advisors Llc. These institutional holdings represent a significant portion of the company's ownership, with institutional shares (long) totaling 55,592,870, or 99.45% (excluding 13D/G filings) as of recent data. This concentration of ownership among these large financial entities can influence company strategy and governance through their significant voting power. For more information on the company's operations, you can explore the Revenue Streams & Business Model of Wix.com.

Understanding the ownership structure of Wix.com is crucial for investors and stakeholders.

- The IPO in 2013 was a pivotal moment, transforming the company's ownership.

- Institutional investors now hold a significant majority of the shares.

- Key institutional holders have considerable influence over the company's direction.

- The founders' initial control has been diluted over time.

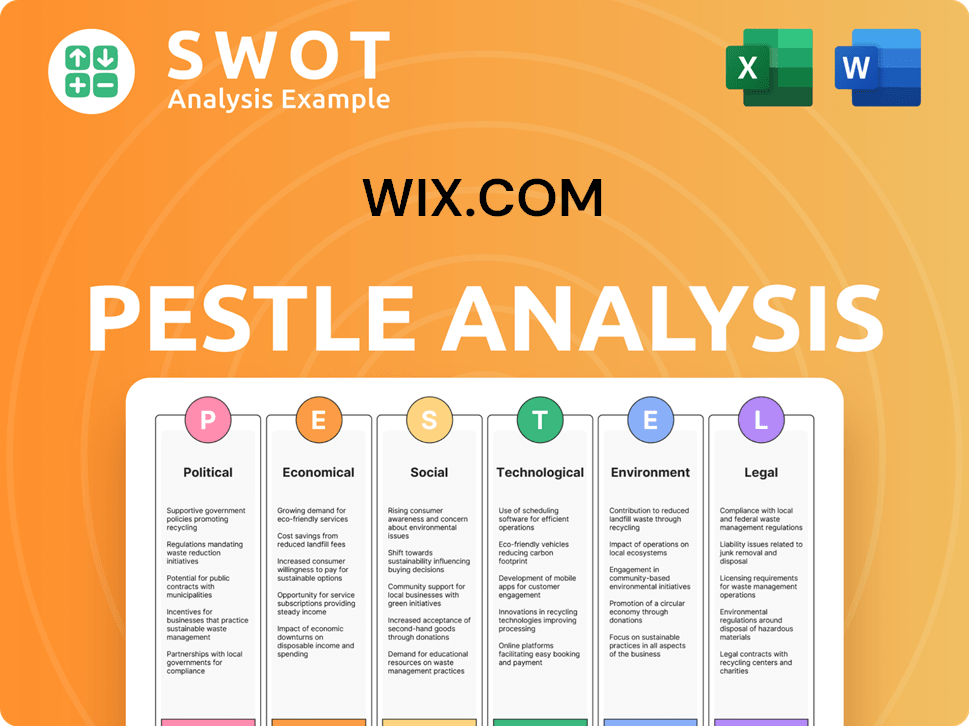

Wix.com PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Wix.com’s Board?

The Board of Directors at Wix.com oversees the company's strategic direction and governance. As of October 21, 2024, the board includes nine members. Mark Tluszcz chairs the board, and other members include Deirdre Bigley, Allon Bloch, Diane Greene, Ron Gutler, Francesco de Mojana, Gavin Patterson, and Ferran Soriano. Avishai Abrahami, Co-founder and CEO, also serves on the board. This composition reflects a blend of expertise and experience designed to guide the company's growth and operational efficiency.

Several board members bring significant industry experience or represent major shareholders. Gavin Patterson and Francesco de Mojana, appointed in March 2023, enhance the board's capabilities. Francesco de Mojana serves on the Audit Committee, and Gavin Patterson is on the Compensation Committee. This structure supports a strong, independent board focused on strategic oversight and operational excellence. Understanding the Growth Strategy of Wix.com can provide additional context on the company's direction.

| Board Member | Role | Date Joined (Approximate) |

|---|---|---|

| Mark Tluszcz | Chair of the Board | N/A |

| Avishai Abrahami | Co-founder and CEO | N/A |

| Deirdre Bigley | Director | N/A |

| Allon Bloch | Director | N/A |

| Diane Greene | Director | N/A |

| Ron Gutler | Director | N/A |

| Francesco de Mojana | Director | March 2023 |

| Gavin Patterson | Director | March 2023 |

| Ferran Soriano | Director | N/A |

Wix.com operates with a one-share-one-vote structure for its ordinary shares. A quorum for shareholder meetings requires at least two shareholders holding at least 25% of the voting power. If the quorum isn't met, the meeting can proceed with one or more shareholders present, regardless of their voting power. There is no public information suggesting dual-class shares or arrangements that would give specific individuals or entities disproportionate control beyond their proportional shareholding. This structure ensures that voting rights are generally aligned with share ownership, promoting a fair and transparent governance process.

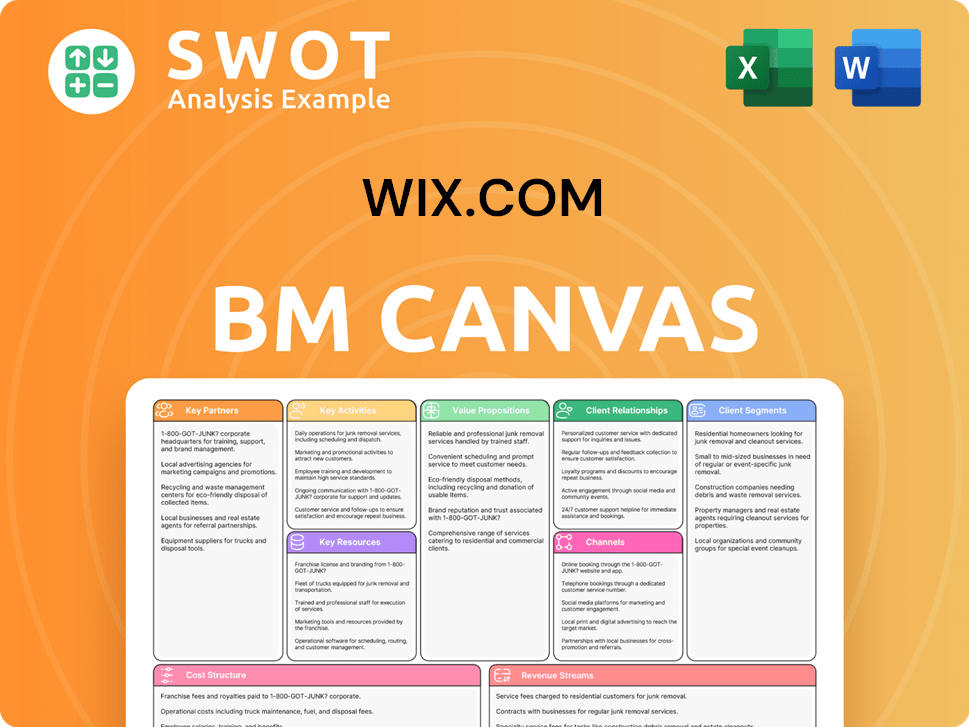

Wix.com Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Wix.com’s Ownership Landscape?

Over the past few years, Wix.com has actively managed its capital structure, demonstrating confidence in its valuation. A significant aspect of this has been the implementation of share buyback programs. In January 2025, the company completed a $200 million share repurchase program, buying back 868,026 ordinary shares at an average price of $230.41 per share, which represented around 1.5% of the total shares outstanding. This program followed a larger authorization by the Board of Directors in July 2024. In Q1 2025, the company further expanded its share repurchase program, adding an extra $200 million, bringing the total authorization to $400 million.

From a leadership viewpoint, Avishai Abrahami remains the CEO, with Nir Zohar as President and COO. The company has also focused on product innovation, especially in AI capabilities. The global launch of its AI Website Builder in early 2024 and the introduction of Wixel, a new standalone AI-powered visual design platform in Q1 2025, highlight this focus. These developments have been crucial in shaping the company's product offerings and market positioning.

| Metric | Value | Year |

|---|---|---|

| Total Revenue | $1.761 billion | 2024 |

| Share Repurchase Program (Completed) | $200 million | January 2025 |

| Share Repurchase Program (Expanded) | $400 million (total authorization) | Q1 2025 |

| GAAP Operating Income | Positive | 2024 |

Industry trends show an increase in institutional ownership within the tech sector, and Wix is part of this trend. As of March 31, 2025, major institutional investors such as Fmr Llc, Baillie Gifford & Co., and BlackRock, Inc. continue to hold substantial stakes. While some investors have adjusted their positions, the general trend indicates continued confidence in Wix's long-term growth. The company achieved its first year of positive GAAP operating income in 2024. Wix anticipates continued profitability growth in 2025, aiming to achieve the 'Rule of 45.'

Wix is a publicly traded company, meaning its ownership is distributed among various shareholders, including institutional investors and the public. Understanding the major shareholders is key to analyzing the company's direction.

Avishai Abrahami serves as the CEO, and Nir Zohar as President and COO. Knowing who leads the company is important for understanding its strategic vision and operational execution.

Wix reported $1.761 billion in total revenue for 2024, marking a 13% increase from the previous year. The company's positive GAAP operating income in 2024 is a key financial milestone.

Wix has actively repurchased its shares, demonstrating confidence in its valuation and commitment to returning value to shareholders. A $200 million share repurchase program was completed in January 2025.

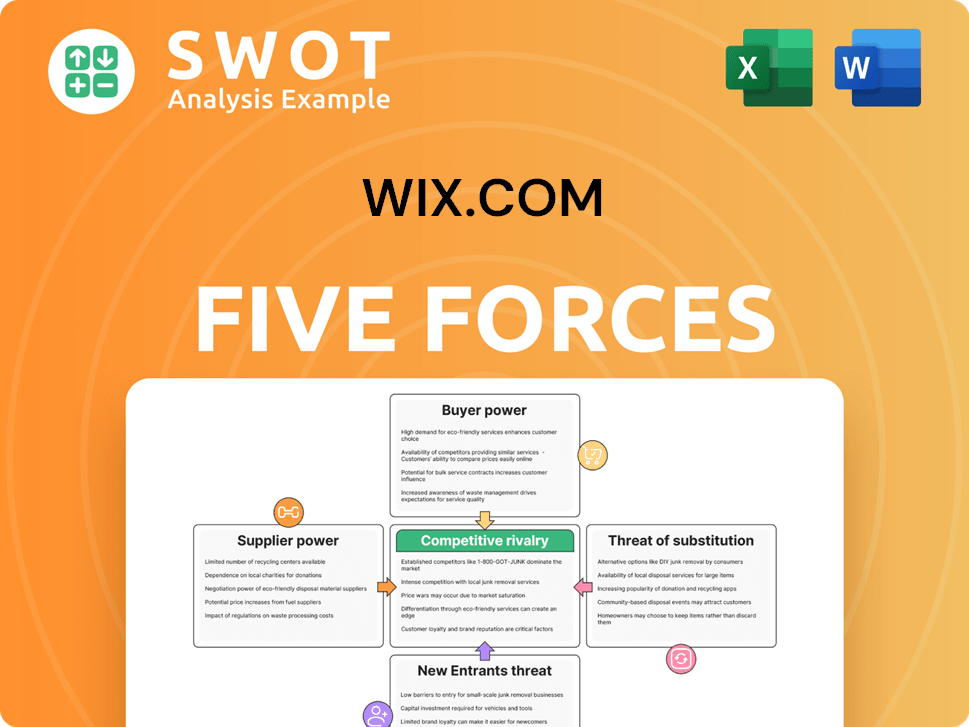

Wix.com Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wix.com Company?

- What is Competitive Landscape of Wix.com Company?

- What is Growth Strategy and Future Prospects of Wix.com Company?

- How Does Wix.com Company Work?

- What is Sales and Marketing Strategy of Wix.com Company?

- What is Brief History of Wix.com Company?

- What is Customer Demographics and Target Market of Wix.com Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.