Zheshang Development Group Bundle

What's Next for Zheshang Development Group?

Zheshang Development Group, a key player in China's modern service industry, is poised for significant growth. With a diverse portfolio spanning equity investment and financial services, the company's strategic focus on supporting economic growth positions it for future success. Its journey has involved significant transformation, including a strategic headquarters relocation and rebranding, setting the stage for its current market standing.

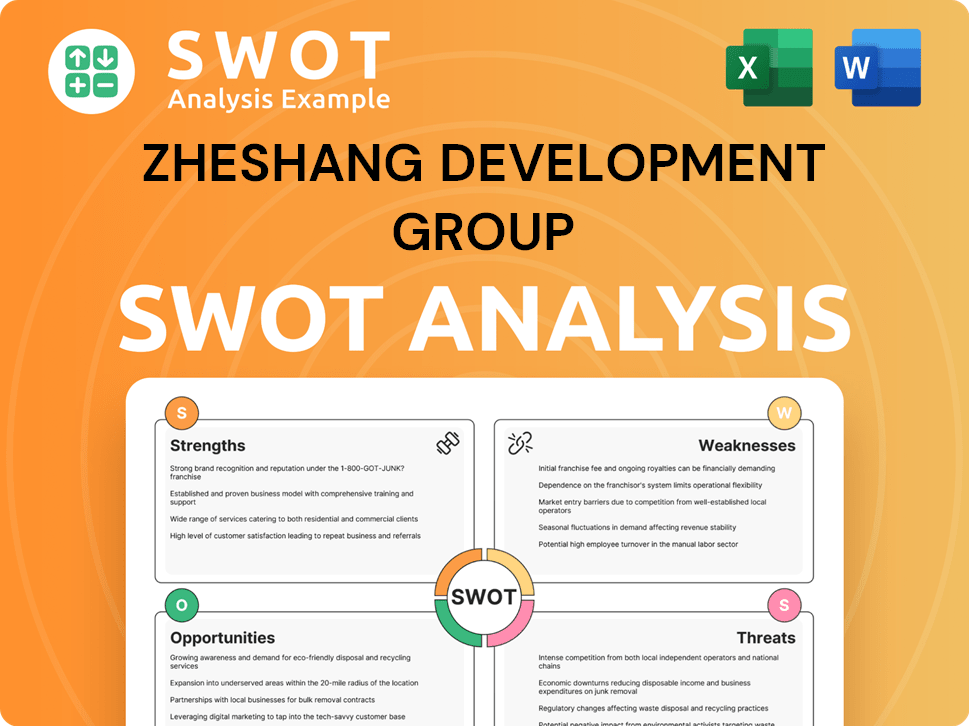

Delving deeper, Zheshang Development Group's Zheshang Development Group SWOT Analysis reveals critical insights into its strengths, weaknesses, opportunities, and threats, providing a comprehensive company analysis. The company's expansion plans and 'going global' strategy suggest a proactive approach to capitalizing on future development opportunities within the dynamic landscape of the Chinese market. Understanding the future prospects of Zheshang Development Group in China requires a close examination of its investment strategy and its ability to navigate the complexities of the real estate development sector and beyond, ensuring sustainable development strategy.

How Is Zheshang Development Group Expanding Its Reach?

Zheshang Development Group is actively pursuing several expansion initiatives to broaden its business scope and strengthen its market position. The company's growth strategy involves entering new markets and diversifying its service offerings. This strategic move is designed to enhance its market share and capitalize on emerging opportunities within the real estate development sector and beyond.

A key component of Zheshang Development Group's strategy is regional expansion within China. The establishment of a wholly-owned platform company in Zhoushan highlights this focus. Furthermore, the company is integrating into the new development pattern of domestic and international dual circulation, accelerating its 'going global' strategy to capture future opportunities, showcasing its commitment to long-term growth potential.

In terms of product and service diversification, the company is actively exploring opportunities to expand its industrial chain, aiming to promote trade and industry simultaneously. This includes a focus on supporting the development of new ship orders towards large-scale, high-end, and dual-fuel directions by 2025, with top shipyards leading in the construction of large ships with advanced technology. The company is also expanding industrial financial services, such as supply chain finance and logistics finance, through in-depth cooperation with financial institutions.

Zheshang Development Group is focused on entering new markets and diversifying its service offerings. This includes establishing a presence in Zhoushan and expanding into industrial financial services. The company aims to enhance its market position and capture future opportunities through strategic diversification.

The company is accelerating its 'going global' strategy to capture international opportunities. This aligns with the dual circulation strategy, aiming to balance domestic and international markets. This approach is crucial for sustainable development and long-term growth.

The company is expanding its industrial chain to promote trade and industry simultaneously. This includes supporting new ship orders and expanding industrial financial services. This diversification supports the company's growth strategy and enhances its investment portfolio.

An example of a new venture is the introduction of its household photovoltaic brand, ZSD Guangying, in March 2023. This initiative provides rooftop photovoltaic system solutions for rural users, aligning with 'carbon peaking and carbon neutrality' efforts. This demonstrates the company's commitment to sustainable development strategy.

Zheshang Development Group's expansion plans include regional growth within China and international market entry. The company focuses on diversifying its service offerings and industrial chain. These initiatives are supported by strategic partnerships and new ventures.

- Entering new markets and diversifying service offerings.

- Establishing a wholly-owned platform company in Zhoushan.

- Integrating into the dual circulation strategy for domestic and international markets.

- Expanding industrial financial services and supporting new ship orders.

Zheshang Development Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zheshang Development Group Invest in Innovation?

Zheshang Development Group (ZSDG) strategically integrates technology and innovation to drive sustainable growth, focusing on digital transformation. This approach is central to its growth strategy, leveraging cutting-edge technologies to enhance operational efficiency and market competitiveness. The company's commitment to technological advancement is evident in its investments in digital platforms and its focus on integrating technology research with business management.

The company's 'Digital ZSD' initiative, launched in June 2019, underscores its commitment to digital transformation. The launch of its digital supply chain operation platform in September 2022 marked a significant milestone. This platform represents a new digital management system and business model. It integrates nationwide offline networks with industrial internet platforms, optimizing resource collaboration across warehousing, transportation, and processing.

ZSDG's emphasis on digital and technological innovation investments aims to accelerate the transformation and export of innovative achievements. While specific R&D investment figures in areas like AI or IoT are not detailed in the provided information, the firm's dedication to industrial management software, customized information management software development, and various digital platforms demonstrates its forward-thinking approach. This includes platforms for supply chain management, CRM, power sales, financial leasing, and cross-border e-commerce.

The 'Digital ZSD' initiative, launched in June 2019, is a core aspect of ZSDG's strategy. This initiative aims to integrate digital technologies across all aspects of the business. The focus is on streamlining operations and improving overall efficiency.

The digital supply chain operation platform, launched in September 2022, is a critical component. It integrates offline networks and industrial internet platforms. This platform enhances resource management and collaboration.

ZSDG integrates technology research and development with business management. This approach aims to capitalize on digital and technological innovation. The goal is to accelerate the transformation and export of innovative achievements.

The company is committed to industrial management software and customized information management software. It develops various digital platforms for supply chain management, CRM, power sales, financial leasing, and cross-border e-commerce. This demonstrates a strong focus on technological advancement.

The broader industry trend emphasizes generative AI and cloud technology. These technologies enhance efficiency and improve data management security. This trend is likely influencing ZSDG's technological investments and strategies.

ZSDG invests in digital and technological innovation projects. This investment aims to accelerate the transformation and export of innovative achievements. The company's financial performance is closely tied to these strategic investments.

ZSDG's innovation and technology strategy focuses on digital transformation and the application of cutting-edge technologies. This strategy is crucial for its growth strategy and future prospects. The company's approach involves several key elements:

- Digital Transformation: Implementing digital solutions across all business operations.

- Supply Chain Optimization: Utilizing digital platforms to streamline supply chain processes.

- Investment in Innovation: Allocating resources to R&D and technology projects.

- Software Development: Developing and deploying customized software solutions.

- Platform Development: Creating digital platforms for various business functions.

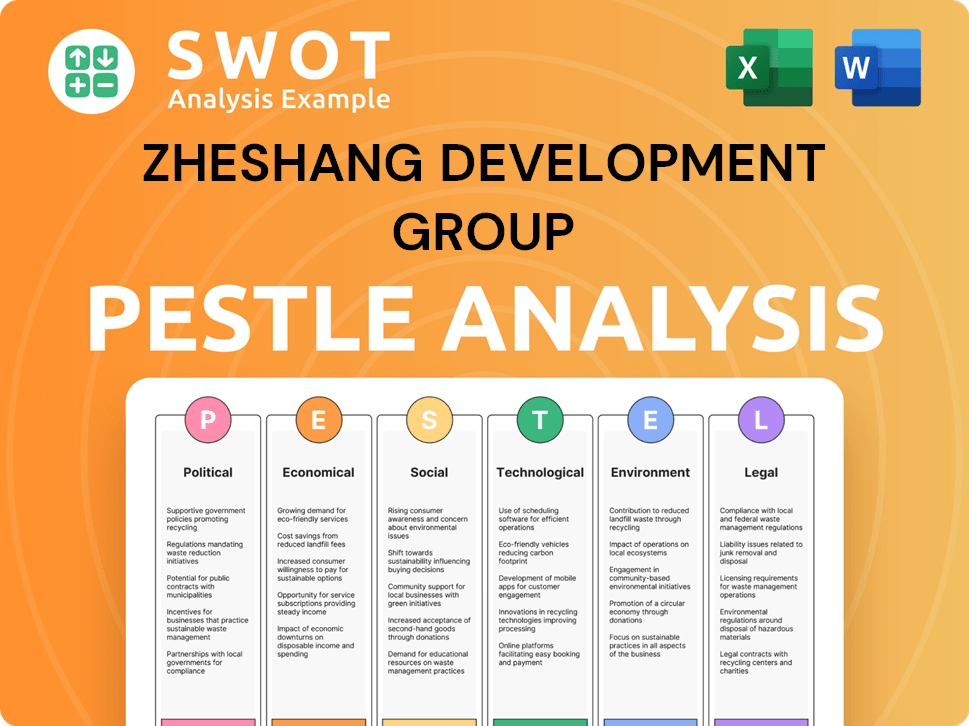

Zheshang Development Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Zheshang Development Group’s Growth Forecast?

The financial outlook for Zheshang Development Group reflects a complex landscape, with both challenges and strategic initiatives shaping its trajectory. The Zheshang Development Group financial performance for 2024 indicates a slight decrease in sales and a more significant decline in net income compared to the previous year. Despite these short-term fluctuations, the company is taking steps to ensure long-term stability and growth. This includes strategic moves by its controlling shareholder, which signals confidence in the Zheshang Development Group's long-term growth potential.

For the year ended December 31, 2024, the company reported sales of CNY 201,901 million, a slight dip from CNY 203,064.5 million in 2023. Net income decreased to CNY 368.86 million from CNY 682.91 million in 2023. Basic earnings per share also fell, from CNY 0.9 in 2023 to CNY 0.45 in 2024. The company’s trailing 12-month revenue was $28.9 billion as of March 31, 2025. These figures paint a picture of a company navigating a challenging market environment, yet still maintaining a significant revenue base.

Despite the drop in net income, the company's strategic moves and shareholder confidence suggest a positive outlook. The planned increase in shareholding by the controlling shareholder, Zhejiang Provincial Transportation Investment Group Co., Ltd., highlights a belief in the company's future. This move is a key indicator of the Zheshang Development Group's future prospects, showing commitment to its long-term investment value. The proposed cash dividend for 2024 is CNY 2.00 per 10 shares (tax included), with an equity registration date of June 4, 2025, and an ex-dividend date of June 5, 2025. The total liabilities of the Group decreased to Rmb 143,484.00 million as of December 31, 2024, from Rmb147,328.69 million in 2023. The company does not anticipate any liquidity and financial resource problems in the foreseeable future.

The Zheshang Development Group market share shows a slight decrease in sales for 2024, with CNY 201,901 million compared to CNY 203,064.5 million in 2023. This indicates a need for strategic adjustments to maintain and improve sales figures. The company's ability to adapt to market changes will be crucial.

Net income declined significantly, from CNY 682.91 million in 2023 to CNY 368.86 million in 2024. Basic earnings per share also fell, from CNY 0.9 in 2023 to CNY 0.45 in 2024. These figures highlight the importance of improving profitability.

The controlling shareholder's plan to increase its shareholding by 1%-2% is a positive signal, indicating confidence in the company's long-term value. This supports a favorable investment strategy. The Zheshang Development Group investment portfolio is likely to benefit from this strategic backing.

The proposed cash dividend of CNY 2.00 per 10 shares reflects the company's commitment to rewarding shareholders. The decrease in total liabilities to Rmb 143,484.00 million as of December 31, 2024, from Rmb147,328.69 million in 2023, strengthens the financial position. The company anticipates no liquidity issues.

The growth strategy for real estate companies will be crucial. Despite the challenges, the company has a solid foundation to build upon. The focus on strategic shareholder support and financial stability is key for the future. The company's ability to overcome challenges will be crucial.

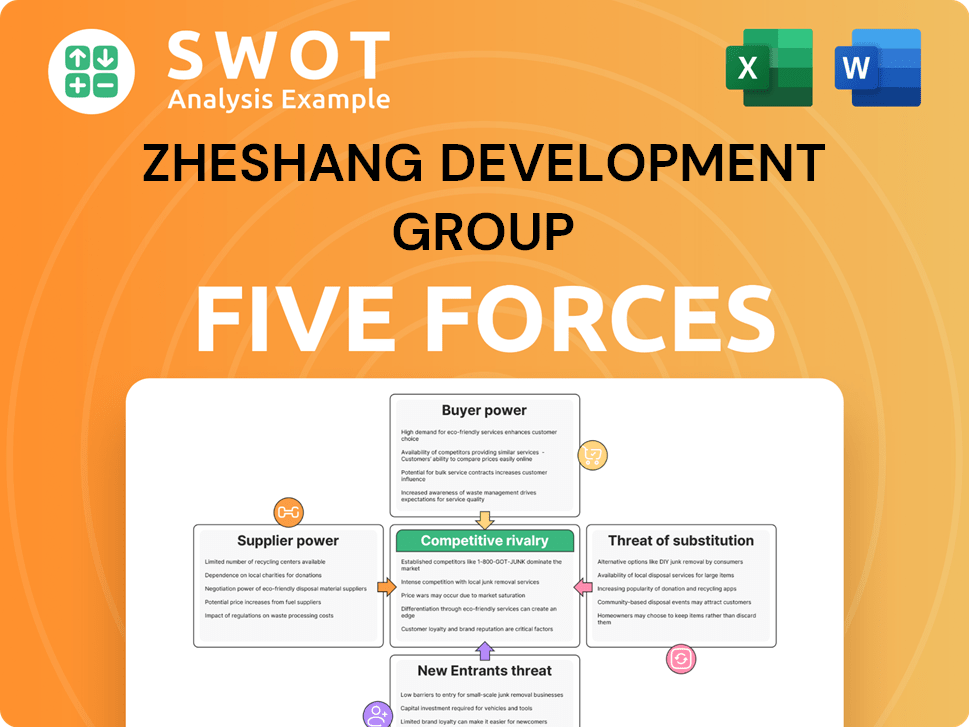

Understanding the competitive landscape is essential for Zheshang Development Group competitive analysis. For insights into the competitive environment, you can explore the Competitors Landscape of Zheshang Development Group.

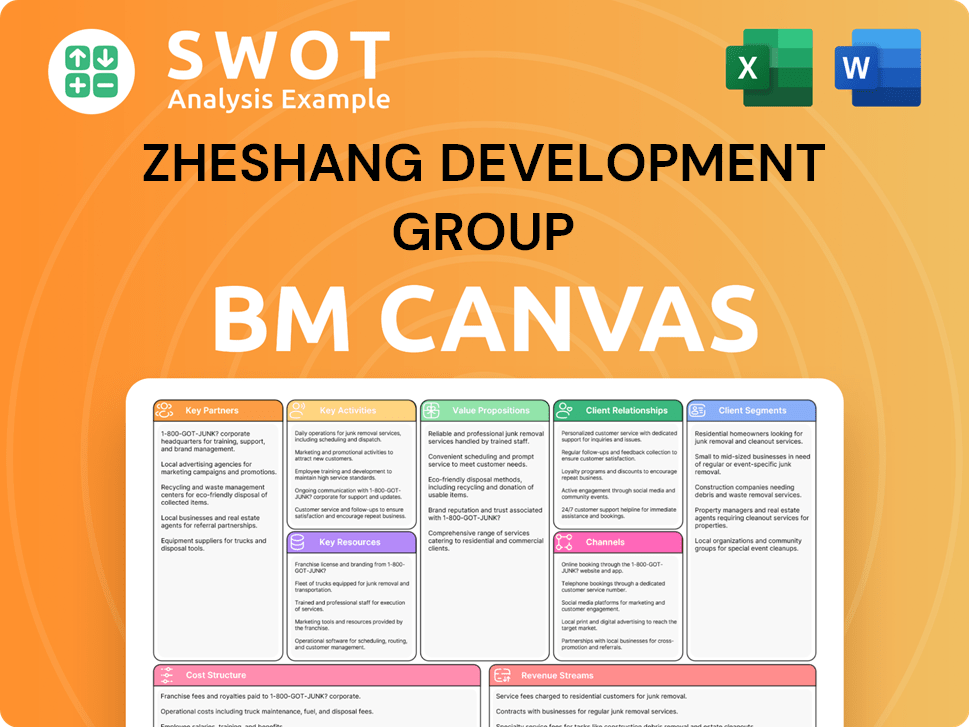

Zheshang Development Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Zheshang Development Group’s Growth?

Analyzing the potential risks and obstacles is crucial for understanding the Mission, Vision & Core Values of Zheshang Development Group and its future prospects. The company faces various challenges inherent in its diverse operations, spanning commodity supply chains, financial services, automotive, and logistics. These risks can impact its growth trajectory and require proactive management.

Market competition, particularly within the modern service industry, poses a continuous challenge. Regulatory changes in China's financial and industrial sectors also present significant hurdles, demanding constant adaptation and compliance. Additionally, supply chain vulnerabilities and technological disruption add to the complexity.

Internal resource constraints and the need for continuous investment in technology further complicate the landscape. Understanding these factors is vital for investors and stakeholders assessing the company's long-term viability and investment strategy.

The modern service industry is highly competitive, requiring continuous innovation and efficiency improvements. Competitors may have greater resources or specialized expertise, potentially affecting Zheshang Development Group's market share. Maintaining a competitive edge involves strategic investments and effective market positioning.

Changes in China's financial and industrial regulations can create uncertainty and require significant adjustments. Stricter capital market regulations, expected to become more explicit in 2024, could influence the company's financial strategies. Compliance costs and operational changes can also affect profitability.

The commodity trading and logistics segments are vulnerable to global economic shifts and geopolitical events. Disruptions in the supply chain can lead to increased costs, delays, and reduced profitability. Diversifying suppliers and building resilient logistics networks are essential to mitigate these risks.

Rapid advancements in AI and automation necessitate ongoing investment and adaptation. Failure to keep pace with technological changes can erode competitiveness. The company's strategy of integrating technology R&D with business management is crucial for staying ahead.

Talent acquisition and retention are vital for executing expansion and innovation strategies. Competition for skilled professionals can drive up costs and limit the company's ability to achieve its goals. Effective human resource management is essential.

Economic downturns can impact demand for the company's products and services. Diversification across business segments, including raw material trading, automobiles, logistics warehousing, and property leasing, can help to mitigate these effects. Proactive risk management is critical.

Zheshang Development Group focuses on strengthening its foundation, management, and characteristics to address these risks. Diversification across its business segments, including raw material trading and real estate development, helps build resilience. Management likely employs risk management frameworks and scenario planning.

The company's emphasis on integrating domestic and foreign markets and its 'going global' strategy may serve as a form of diversification against domestic market fluctuations. Expanding into international markets can provide new revenue streams and reduce reliance on any single region. This helps improve the company's investment portfolio.

Zheshang Development Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zheshang Development Group Company?

- What is Competitive Landscape of Zheshang Development Group Company?

- How Does Zheshang Development Group Company Work?

- What is Sales and Marketing Strategy of Zheshang Development Group Company?

- What is Brief History of Zheshang Development Group Company?

- Who Owns Zheshang Development Group Company?

- What is Customer Demographics and Target Market of Zheshang Development Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.