Zhongsheng Group Holdings Bundle

Can Zhongsheng Group Holdings Continue Its Ascent in China's Auto Market?

Zhongsheng Group Holdings, a key player in China's dynamic automotive industry, has built a strong foundation by focusing on luxury and mid-to-high-end vehicle sales and services. Incorporated in 2008, the company's strategic approach has allowed it to navigate the competitive landscape effectively. This analysis delves into the Zhongsheng Group Holdings SWOT Analysis to understand its strengths and weaknesses.

This exploration of Zhongsheng Group Holdings' growth strategy will examine its competitive advantages and future prospects within the Chinese automotive retail sector. We'll conduct a thorough market analysis, evaluating its financial performance and expansion plans. Understanding the company's strategic initiatives is crucial for assessing its long-term investment potential and predicting its revenue growth forecast within the evolving market trends in China, including its electric vehicle strategy.

How Is Zhongsheng Group Holdings Expanding Its Reach?

Zhongsheng Group Holdings is actively pursuing several expansion initiatives to drive its future Growth Strategy, focusing on both market penetration and diversification of revenue streams. The company's strategic moves are particularly noteworthy in the context of the dynamic Automotive Industry. This includes a strong emphasis on expanding its dealership network, especially for new energy vehicles (NEVs).

A key aspect of Zhongsheng Group's expansion involves strategic partnerships and investments. These initiatives are designed to capitalize on emerging opportunities within the automotive market. The company's focus on after-sales services and pre-owned vehicles further demonstrates its commitment to a comprehensive and sustainable growth model. A detailed Competitors Landscape of Zhongsheng Group Holdings can provide additional context for these strategic moves.

The company's approach to expansion is multifaceted, encompassing both organic growth and strategic alliances. This strategy aims to strengthen its market position and enhance its financial performance. These initiatives are crucial for sustaining long-term growth and maintaining a competitive edge in the automotive sector.

Zhongsheng Group is significantly expanding its dealership network, with a strong focus on NEVs. In March 2025, the company signed a strategic cooperation agreement with FAW Audi Sales Co., Ltd. to establish at least 10 new sales outlets in 2025. This partnership supports the development of FAW Audi's dealership network and explores new business models in NEV development.

The after-sales services business is a key area of expansion, offering stable and higher-margin revenue. After-sales services revenue reached RMB 22.00 billion in 2024, marking a 9.6% year-over-year increase. The company is growing its collision service centers, with 20 Zhongsheng-branded centers operational across 15 cities as of March 2024.

The pre-owned automobile business is another significant growth area for Zhongsheng Group. In 2024, the company saw a 37.9% year-over-year increase in units delivered, reaching 226 thousand units. This segment contributed RMB 1.29 billion to the group's aggregate profit in 2024, representing an 8.7% share. The company aims for a monthly transaction volume of 20,000 pre-owned units.

Zhongsheng Group's expansion strategy prioritizes key areas to drive future market share and financial performance. These include expanding the dealership network, particularly for NEVs, and growing after-sales services. The pre-owned automobile business also plays a crucial role in the company's overall growth strategy.

Zhongsheng Group's expansion initiatives are designed to capitalize on market trends and enhance its competitive position. These initiatives are crucial for the company's long-term investment prospects and sustainable growth.

- Expanding the dealership network, with a focus on NEVs.

- Growing the after-sales services business to increase revenue and margins.

- Expanding the pre-owned automobile business to capture additional market share.

- Strategic partnerships to support growth and explore new business models.

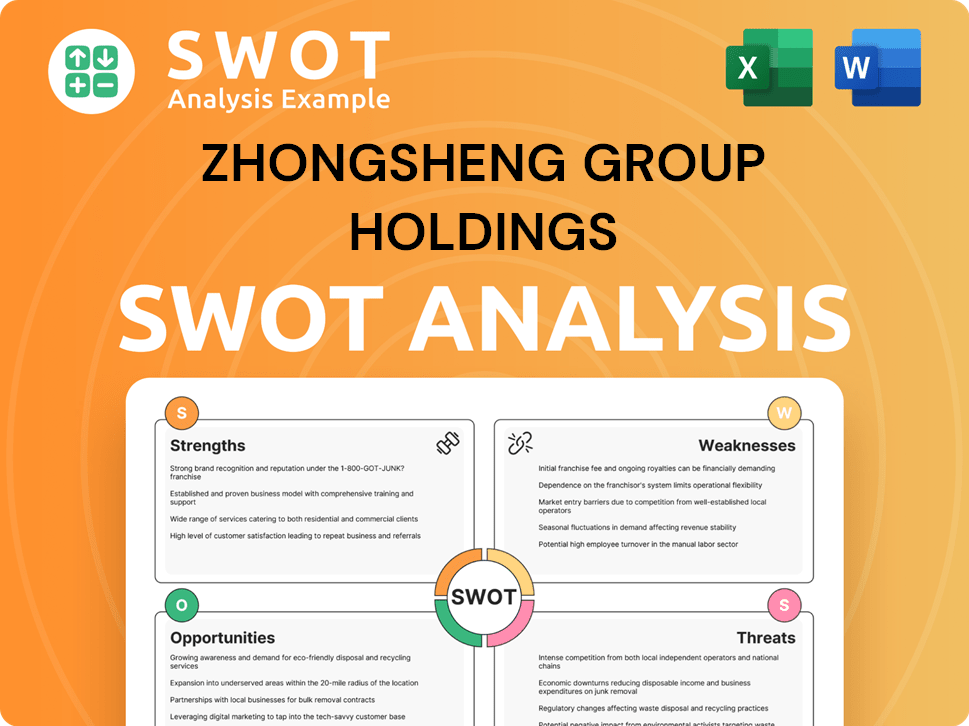

Zhongsheng Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zhongsheng Group Holdings Invest in Innovation?

The Zhongsheng Group Holdings is actively leveraging innovation and technology to drive its growth strategy, especially in the dynamic automotive industry of China. This approach is crucial for adapting to the changing market, particularly the shift towards new energy vehicles (NEVs) and the adoption of digital solutions.

The company's strategic focus includes significant investments in electric vehicles (EVs) and digital transformation to maintain its competitive edge. By expanding its EV business and integrating digital strategies, the company aims to enhance customer experience and operational efficiency.

Zhongsheng Group Holdings is adapting to the evolving automotive landscape in China through a robust innovation and technology strategy. This includes a strong emphasis on new energy vehicles (NEVs) and digital transformation, reflecting the broader market trends. The company's strategic initiatives are designed to maintain its competitive edge and capitalize on emerging opportunities within the sector.

With NEV sales accounting for over 50% of the new car market in China, Zhongsheng is expanding its EV business. This strategic shift is crucial to offset the decline in internal combustion engine (ICE) car sales and align with market demands.

Strategic alliances, such as the one with FAW Audi, are key to exploring new business models in NEV development. These collaborations aim to enhance the user experience and drive innovation in the EV sector.

The company's focus on digital engagement and customer relationship management is evident in the continuous expansion of its active customer base. This growth highlights the importance of digital platforms in the automotive retail strategy.

The active customer base grew to 4.19 million in 2024, marking a 10.7% year-over-year increase. This growth indicates a strong focus on digital engagement and customer relationship management, crucial for long-term financial performance review.

The centralized Zhongsheng-branded pre-owned automobile strategy integrates operations and aims to improve efficiency. This approach leverages technological solutions to manage the complexities of the business.

The introduction of advanced intelligent driving assistance systems in new models, co-developed with partners like Huawei, highlights a commitment to cutting-edge technologies. This demonstrates a focus on market trends China and innovation.

Zhongsheng Group Holdings is implementing several key technological initiatives to enhance its operations and customer experience. These initiatives are designed to support its expansion plans and improve its competitive position within the market.

- EV Business Expansion: Actively growing its electric vehicle segment to meet increasing consumer demand and new car sales outlook.

- Digital Transformation: Focusing on digital solutions to improve customer engagement and streamline operations.

- Strategic Partnerships: Collaborating with technology leaders to integrate advanced features like intelligent driving systems.

- Customer Relationship Management: Leveraging data analytics to enhance customer service and personalize the buying experience.

For more insights into the company's history, consider reading the Brief History of Zhongsheng Group Holdings.

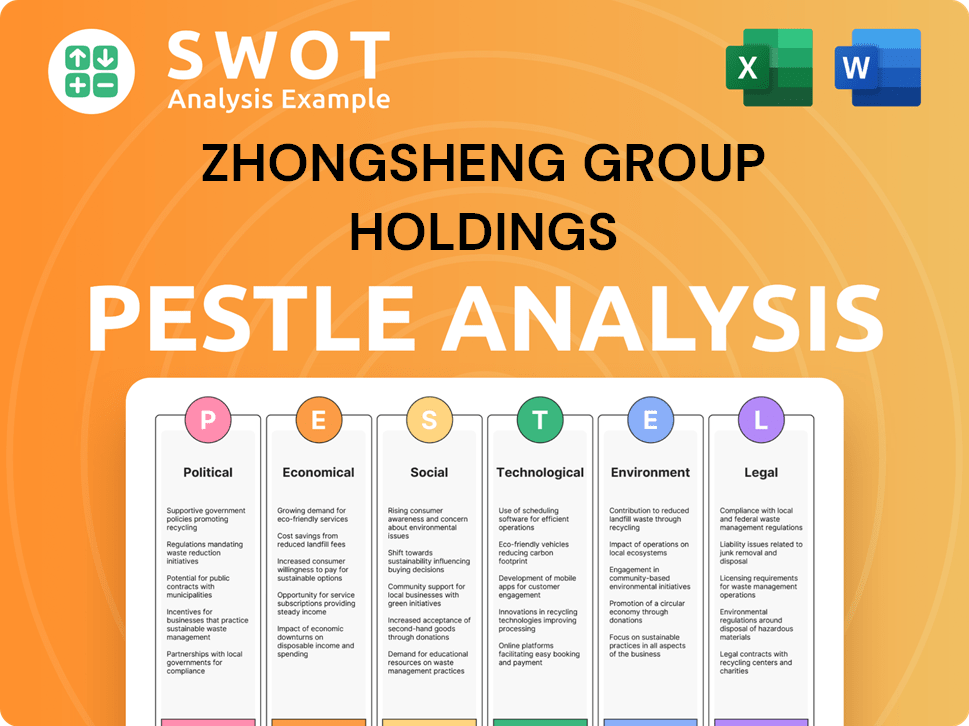

Zhongsheng Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Zhongsheng Group Holdings’s Growth Forecast?

The financial landscape for Zhongsheng Group Holdings reflects a period of adjustment within the automotive industry. A comprehensive Mission, Vision & Core Values of Zhongsheng Group Holdings provides further context to the company's strategic direction. The company's performance in 2024 reveals both challenges and opportunities, particularly within the context of the broader market.

The company's total revenue decreased by 6.2%, and profit attributable to owners of the parent decreased by 36.0% to RMB 3,212.2 million. The operating profit margin for 2024 was 3.4%, down from 4.7% in 2023. These figures underscore the need for strategic adaptation in the face of evolving market dynamics. The decline in total revenue and profit highlights the pressures faced by the company.

Despite the revenue and profit decreases, the after-sales services segment showed resilience. The after-sales services segment recorded a revenue of RMB 22.00 billion in 2024, a 9.6% year-over-year increase, and accounted for 16.3% of the total revenue. Pre-owned automobile sales also showed strong growth, increasing by 37.9% year-over-year in 2024, contributing 9.2% to total revenue and RMB 1.29 billion to segment profit. These segments are expected to be key support to earnings and cash flow in 2025-2026.

In 2024, Zhongsheng Group Holdings experienced a decrease in total revenue and profit. Total revenue dropped by 6.2%. Profit attributable to owners decreased by 36.0%. The operating profit margin was 3.4%, down from 4.7% in 2023.

The after-sales services segment grew by 9.6% year-over-year, contributing 16.3% to total revenue. Pre-owned automobile sales increased by 37.9% year-over-year, representing 9.2% of total revenue. These segments show strong growth.

Analysts predict that the company's total revenue will remain flat over the next two years. New car sales margins might remain negative at 1%-2%. Adjusted EBITDA is projected to recover to RMB 10.9 billion in 2025 from RMB 9.1 billion in 2024.

The company proposed a final dividend of HK$0.678 per share for the year ended December 31, 2024. As of December 31, 2024, Zhongsheng Group had a trailing 12-month revenue of $23.4 billion.

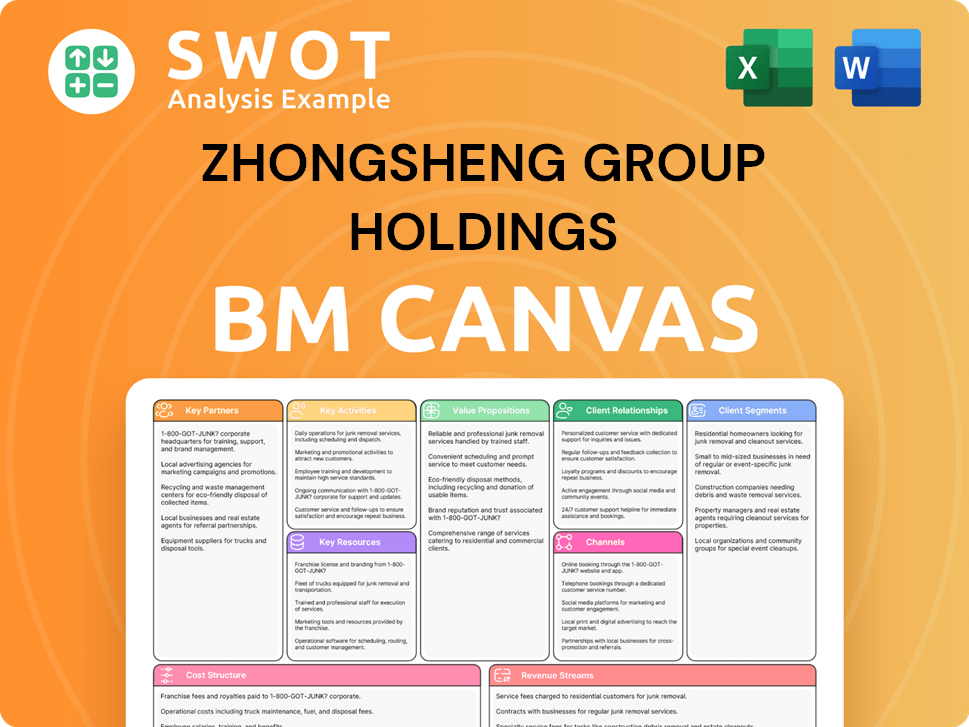

Zhongsheng Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Zhongsheng Group Holdings’s Growth?

Several risks and obstacles could challenge the growth ambitions of Zhongsheng Group Holdings within the dynamic Chinese automotive industry. The company faces intense market competition and pricing pressures, particularly in the new car market, which significantly impacts dealer margins. Moreover, the shift towards electric vehicles (EVs) presents a notable strategic challenge, potentially affecting the company's after-sales business tied to internal combustion engine (ICE) vehicles.

The automotive industry in China is undergoing rapid changes, creating uncertainties for Zhongsheng Group. Factors like supply chain vulnerabilities, especially concerning imported vehicles and parts, also pose risks. Furthermore, broader macroeconomic conditions in China, including fluctuations in GDP, consumer demand, and inflation, could significantly influence the company's performance and market dynamics. Zhongsheng Group Holdings' target market is pivotal to its success.

To mitigate these risks, Zhongsheng Group is diversifying its business towards higher-margin after-sales services and pre-owned car sales, aiming for more stable revenue streams. The company is also focusing on integrating operations at a group level to improve efficiency and dismantle barriers between brands and stores. These strategic moves are crucial for navigating the evolving automotive landscape and ensuring sustainable growth.

The Chinese automotive market is highly competitive, with numerous players vying for market share. Intense competition often leads to price wars and squeezed margins, especially in the new car segment. This pressure could directly impact Zhongsheng Group's financial performance and profitability.

The rapid shift to EVs poses a significant challenge, as Zhongsheng's after-sales business relies heavily on ICE vehicles. A slower-than-expected EV adoption rate could lead to financial shortfalls. The company must expand its EV-related services to offset declining ICE car sales.

Supply chain disruptions, especially those affecting imported vehicles and parts, can impact operations. Tariff impacts and logistical challenges may increase costs and reduce profitability. Diversifying supply chains and building strong supplier relationships are essential.

Government policies, such as those promoting NEVs, can shift market dynamics. While current policies may be beneficial, changes in incentives or regulations could affect demand. Zhongsheng must remain adaptable to changes in the regulatory environment.

Economic conditions in China, including GDP growth, inflation, and consumer spending, significantly impact demand. Concerns about debt levels and deflationary pressures could also affect consumer behavior. Monitoring these factors is crucial for strategic planning.

Zhongsheng Group is focusing on higher-margin after-sales services and pre-owned car sales to stabilize revenue. Expansion in these areas is crucial to offset the volatility in the new car market. These segments offer more stable and profitable opportunities.

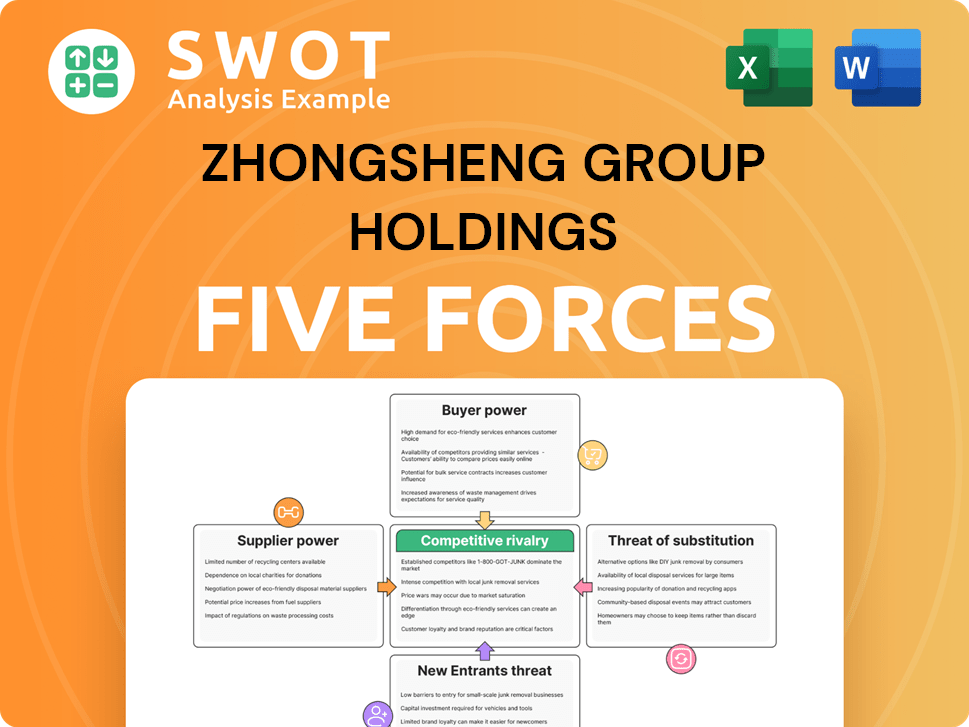

Zhongsheng Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zhongsheng Group Holdings Company?

- What is Competitive Landscape of Zhongsheng Group Holdings Company?

- How Does Zhongsheng Group Holdings Company Work?

- What is Sales and Marketing Strategy of Zhongsheng Group Holdings Company?

- What is Brief History of Zhongsheng Group Holdings Company?

- Who Owns Zhongsheng Group Holdings Company?

- What is Customer Demographics and Target Market of Zhongsheng Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.