Zhongsheng Group Holdings Bundle

Unveiling Zhongsheng Group Holdings: How Does It Thrive in China's Car Market?

Zhongsheng Group Holdings, a major player in China's automotive sector, focuses on luxury and mid-to-high-end vehicles. As a leading auto dealership group, ZSH Group plays a vital role in distributing international automotive brands across China. Understanding its operations is crucial for anyone interested in the Zhongsheng Group Holdings SWOT Analysis, the Chinese car market, and the automotive industry in China.

This exploration of Zhongsheng Group delves into its core business model, including new vehicle sales and after-sales services. We'll examine how Zhongsheng Group generates revenue and navigates the competitive landscape of car dealerships in China. Analyzing ZSH Group's operational framework offers key insights into its financial performance, market share, and future outlook within the dynamic Chinese car market.

What Are the Key Operations Driving Zhongsheng Group Holdings’s Success?

Zhongsheng Group Holdings (ZSH Group) creates value primarily through its extensive network of car dealerships across China, focusing on the luxury and mid-to-high-end vehicle segments. Their core business centers around the sale of new vehicles from a diverse portfolio of international brands. In addition to new car sales, the company offers comprehensive after-sales services, which are crucial to their value proposition.

The company caters to a broad customer base, including affluent individuals and businesses seeking premium automotive solutions. Operational processes are meticulously managed, covering vehicle sourcing, inventory management, showroom sales, and high-quality after-sales support. Zhongsheng Group's partnerships with leading international automotive brands are crucial to their business model, enabling them to offer a wide selection of desirable vehicles.

Their distribution network is strategically located in key urban centers across China, optimizing market reach and customer accessibility. This specialization allows for higher profit margins per vehicle and a more affluent customer base that prioritizes quality after-sales service. This focus translates into customer benefits such as access to exclusive vehicle models, premium service experiences, and reliable support, differentiating them in a competitive market.

Zhongsheng Group's core operations involve the sale of new vehicles and after-sales services. They source vehicles directly from manufacturers and manage inventory efficiently. Showroom sales and high-quality after-sales support are also key components of their operations. Their strategic focus on luxury and high-end brands allows them to maintain higher profit margins.

The value proposition of Zhongsheng Group lies in offering premium automotive solutions. This includes access to exclusive vehicle models, premium service experiences, and reliable support. They differentiate themselves by focusing on luxury and high-end brands, catering to a customer base that values quality and service. Zhongsheng Group's comprehensive services create customer loyalty.

Zhongsheng Group's partnerships with leading international automotive brands are crucial. These partnerships enable them to offer a wide selection of desirable vehicles. The strategic alliances ensure a steady supply of vehicles and access to the latest models. These collaborations enhance their market position in the Chinese car market.

Zhongsheng Group primarily serves affluent individuals and businesses. These customers seek premium automotive solutions and value high-quality service. The company's focus on luxury and high-end brands attracts a customer base that prioritizes quality and exclusivity. This targeted approach allows for tailored services and customer loyalty.

Zhongsheng Group's strategic advantages include a focus on luxury brands and a strong after-sales service network. This specialization allows for higher profit margins and customer loyalty. Their strategically located dealerships and efficient supply chain contribute to their operational effectiveness.

- Focus on luxury and high-end brands.

- Comprehensive after-sales services.

- Strategic dealership locations.

- Efficient supply chain management.

Zhongsheng Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zhongsheng Group Holdings Make Money?

The revenue streams and monetization strategies of Zhongsheng Group Holdings (ZSH Group) are central to understanding its financial performance within the automotive industry in China. The company primarily generates revenue through two main channels: new vehicle sales and after-sales services. These strategies are crucial for Zhongsheng Group's profitability and market position.

Zhongsheng Group's business model relies heavily on these revenue streams. New vehicle sales are the most significant contributor to its overall revenue, especially considering the dynamics of the Chinese car market. After-sales services, which include repairs, maintenance, and the sale of parts, provide a stable, recurring income stream, often with higher profit margins.

Zhongsheng Group Holdings employs several monetization strategies to enhance its revenue. These include value-added services such as auto financing, insurance brokerage, and used car sales. The company also uses tiered pricing for certain services and cross-selling opportunities to encourage customers to use their after-sales services after purchasing a vehicle. For more details, you can read about the Owners & Shareholders of Zhongsheng Group Holdings.

Zhongsheng Group's financial success is driven by its strategic approach to revenue generation. The company focuses on maximizing revenue from its primary streams while leveraging additional services to boost profitability.

- New Vehicle Sales: This is the primary revenue source, benefiting from the strong demand in the Chinese car market.

- After-Sales Services: These services provide a steady income stream with higher profit margins, including repairs, maintenance, and parts sales.

- Value-Added Services: Includes auto financing, insurance brokerage, and used car sales, which complement core offerings.

- Tiered Pricing and Cross-Selling: Strategic pricing and promotions encourage customers to utilize after-sales services.

Zhongsheng Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Zhongsheng Group Holdings’s Business Model?

Zhongsheng Group Holdings (ZSH Group) has navigated the complexities of the automotive industry in China through strategic moves and key milestones. The company's journey has been marked by a consistent focus on expanding its dealership network, particularly for luxury brands, and forming strategic partnerships with global automotive manufacturers. This approach has enabled ZSH Group to capture a significant share of the high-end automotive market.

The company's adaptability in response to market challenges, such as supply chain disruptions and shifts in consumer demand, has been crucial. By optimizing inventory management and diversifying service offerings, Zhongsheng Group has demonstrated its resilience and ability to maintain a competitive edge. This proactive approach has positioned the company for sustained growth and profitability in the dynamic Chinese car market.

ZSH Group's success is also a reflection of its ability to integrate new energy vehicle (NEV) brands into its portfolio, adapting to the increasing adoption of electric vehicles. This strategic move ensures its continued relevance and competitiveness in the evolving automotive landscape. You can learn more about the Growth Strategy of Zhongsheng Group Holdings.

Zhongsheng Group's history includes several key milestones that have shaped its trajectory in the automotive industry. The expansion of its dealership network has been a consistent priority. Strategic partnerships with global automotive manufacturers have been pivotal in securing access to a diverse portfolio of vehicles.

Strategic moves have been central to Zhongsheng Group's success. The company has focused on expanding its presence in the luxury car segment. Adapting to market challenges, such as supply chain issues, has been another key strategic focus. Integrating NEV brands into its portfolio reflects a proactive approach to industry changes.

Zhongsheng Group's competitive advantages are multifaceted. The company benefits from a strong brand reputation and established relationships with luxury automotive brands. Its extensive dealership network allows for efficient operations and procurement. The focus on high-quality after-sales services fosters customer loyalty and generates recurring revenue.

In 2024, the Chinese automotive market saw significant shifts, with NEVs gaining substantial market share. Zhongsheng Group's strategic integration of NEV brands positions it well for this trend. The company's financial performance in the first half of 2024 showed continued growth, driven by strong sales in both traditional and new energy vehicles. The company's focus on premium and luxury brands has helped to maintain profitability despite market fluctuations.

Zhongsheng Group's competitive advantages are rooted in its strong brand reputation, extensive dealership network, and customer-focused service offerings. These elements collectively contribute to its sustained success in the Chinese car market.

- Strong Brand Reputation: Relationships with luxury automotive brands.

- Extensive Dealership Network: Economies of scale and efficient operations.

- High-Quality After-Sales Services: Fostering customer loyalty and recurring revenue.

- Strategic NEV Integration: Adapting to the growing electric vehicle market.

Zhongsheng Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Zhongsheng Group Holdings Positioning Itself for Continued Success?

Zhongsheng Group Holdings (ZSH Group) maintains a prominent position within China's automotive industry, especially in the luxury and high-end vehicle segments. Its vast network of dealerships and strong relationships with major car brands contribute to its significant market share and customer loyalty. The company's operations are primarily focused on the Chinese market, where it has established a strong presence.

However, ZSH Group faces several challenges. These include regulatory shifts, intense competition, technological disruptions like the rise of electric vehicles, and evolving consumer preferences. Strategic initiatives are crucial for ZSH Group to maintain its profitability and market leadership in the dynamic Chinese car market.

ZSH Group is a leading player in China's car dealership sector, particularly in luxury and premium vehicle sales. The company benefits from an extensive network of dealerships across the country. Strong brand partnerships and a focus on customer service enhance its market position.

Key risks include regulatory changes affecting vehicle sales, intense competition from other dealerships, and the growth of direct-to-consumer sales models. The shift towards electric vehicles and autonomous driving technologies also presents significant challenges. Adapting to changing consumer preferences is crucial for sustained success.

ZSH Group aims to expand its dealership network, especially for luxury and NEVs. Enhancing digital platforms for sales and after-sales services is a key priority. The company is focused on improving operational efficiency and capitalizing on the growing demand for premium vehicles in China. For more details, check out the Growth Strategy of Zhongsheng Group Holdings.

The Chinese car market continues to evolve, with increasing demand for electric vehicles and premium brands. ZSH Group must navigate these changes to maintain its competitive edge. Adapting to consumer preferences and technological advancements is essential for future success.

ZSH Group is focusing on several key areas to drive future growth and profitability. This includes expanding its dealership network, especially for luxury and new energy vehicles (NEVs). Enhancing digital platforms for sales and after-sales services is also a priority, along with improving operational efficiencies.

- Expansion of luxury and NEV dealerships.

- Development of digital sales and after-sales platforms.

- Optimization of operational efficiencies to improve profitability.

- Focus on enhancing customer experience to drive loyalty.

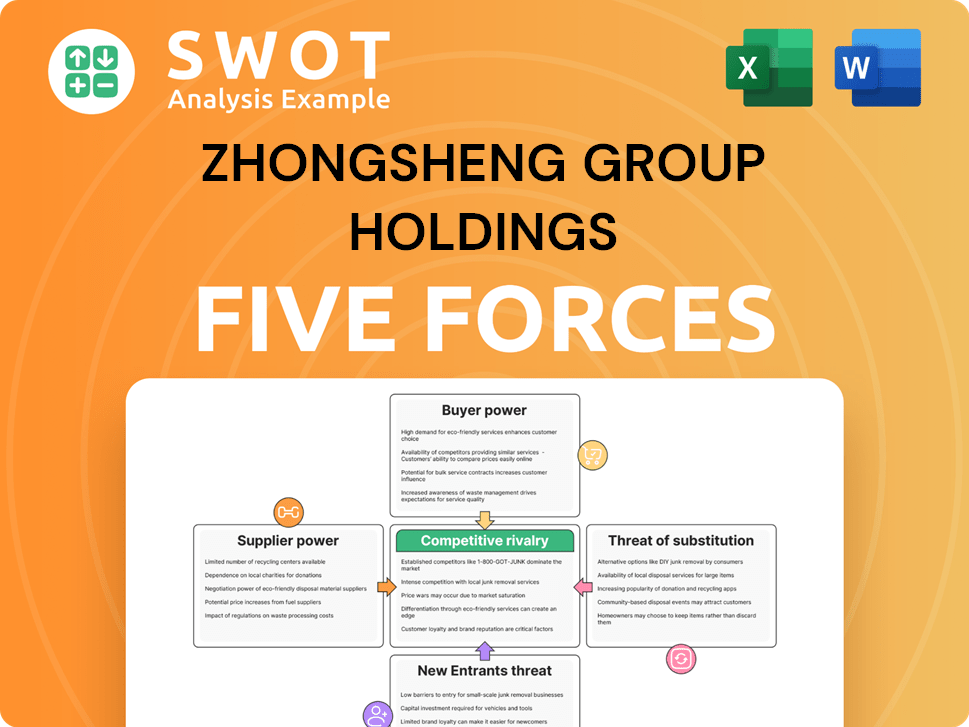

Zhongsheng Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zhongsheng Group Holdings Company?

- What is Competitive Landscape of Zhongsheng Group Holdings Company?

- What is Growth Strategy and Future Prospects of Zhongsheng Group Holdings Company?

- What is Sales and Marketing Strategy of Zhongsheng Group Holdings Company?

- What is Brief History of Zhongsheng Group Holdings Company?

- Who Owns Zhongsheng Group Holdings Company?

- What is Customer Demographics and Target Market of Zhongsheng Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.