ZTO Express Bundle

Can ZTO Express Maintain Its Dominance in China's Delivery Market?

ZTO Express, a leading logistics company in China, has consistently demonstrated its strategic prowess, notably with its successful dual listing that fueled expansion. Founded in 2002, the company's journey from a partner-network model to a market leader is a testament to its effective growth strategy. This article explores the ZTO Express SWOT Analysis, its evolution, and the innovative approaches driving its future prospects in the dynamic e-commerce landscape.

From handling billions of parcels annually to maintaining the largest market share, ZTO Express's scale is impressive. Its commitment to technological advancements and strategic expansion initiatives positions it for sustained growth. We will analyze ZTO Express's financial performance review, expansion plans, and the challenges it faces, providing a comprehensive look at its future in the express delivery services sector and its impact on e-commerce growth.

How Is ZTO Express Expanding Its Reach?

ZTO Express, a leading logistics company, is actively pursuing several key expansion initiatives to fuel its future growth. The company's growth strategy focuses on strengthening its core express delivery business, diversifying into new logistics segments, and expanding its international presence. These initiatives are designed to capitalize on the booming e-commerce market and enhance its market share.

The company's expansion plans involve significant investments in infrastructure and technology to boost efficiency and capacity. ZTO Express aims to increase its parcel volume and strengthen its position in the highly competitive delivery services market. The company is also exploring strategic partnerships to accelerate its growth trajectory and leverage local expertise.

ZTO Express is committed to optimizing its network and enhancing last-mile delivery capabilities, especially in less developed regions within China. This involves continuous investment in infrastructure, such as new sorting centers and transportation fleets, to improve efficiency and capacity. The company's focus on operational excellence is a key driver of its growth strategy.

ZTO Express is investing in expanding its high-capacity automated sorting lines. The goal is to significantly increase daily sorting capacity by 2025. This investment is crucial for handling the increasing parcel volumes driven by e-commerce growth.

The company is actively developing its less-than-truckload (LTL) freight business. This expansion allows ZTO Express to capture a larger share of the broader logistics market. Leveraging its existing network infrastructure is key to offering comprehensive logistics solutions.

ZTO Express is exploring opportunities for international expansion, particularly in Southeast Asia and other emerging markets. This expansion will allow the company to capitalize on cross-border e-commerce growth. The company has a long-term vision for a more globalized logistics footprint.

Partnerships are crucial to ZTO Express's expansion plans, both domestically and internationally. These partnerships allow the company to leverage local expertise and existing infrastructure. This approach accelerates market entry and service diversification.

ZTO Express's growth strategy is multifaceted, focusing on domestic network optimization, LTL freight business development, and international expansion. These initiatives are designed to position the company for long-term success in the competitive logistics market. For more details on the company's core values, consider reading about Mission, Vision & Core Values of ZTO Express.

- Continued investment in automated sorting technology to improve efficiency.

- Strategic partnerships to facilitate international expansion and market entry.

- Focus on enhancing last-mile delivery capabilities in less developed regions.

- Development of LTL freight services to capture a larger market share.

ZTO Express SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ZTO Express Invest in Innovation?

ZTO Express, a leading logistics company, heavily invests in technology and innovation to fuel its growth strategy and maintain a competitive edge in the dynamic e-commerce and delivery services market. The company's commitment to research and development is a cornerstone of its approach, focusing on automation, digitalization, and data analytics to streamline operations and enhance service quality.

This strategic emphasis on technological advancements enables ZTO Express to optimize its processes, reduce costs, and improve customer satisfaction, which are crucial for its future prospects. By integrating cutting-edge technologies, ZTO Express aims to not only enhance its operational efficiency but also to offer innovative services that meet the evolving needs of its customers.

ZTO Express has significantly invested in automated sorting equipment, with advanced automated sorting lines capable of processing tens of thousands of parcels per hour. This investment has led to substantial improvements in sorting efficiency and accuracy. The company's automation efforts extend to its warehouses and transportation hubs, aiming to reduce manual labor and optimize operational flows.

ZTO Express is undergoing a digital transformation by developing sophisticated data analytics platforms and integrating AI and IoT. These technologies are key to enhancing operational efficiency and improving customer service. The company is leveraging data to make smarter decisions across its network.

AI is utilized for route optimization, predictive vehicle maintenance, and intelligent customer service. IoT devices are deployed for real-time tracking of parcels and vehicles. These advancements provide greater visibility and control over the logistics process.

ZTO Express is actively exploring environmentally friendly logistics solutions, such as adopting electric vehicles for last-mile delivery. They are also optimizing packaging materials to reduce its carbon footprint. These initiatives align with global sustainability goals.

Technological advancements enable ZTO Express to offer new and enhanced services, driving its growth objectives. These improvements help solidify its leadership in the smart logistics sector. The company aims to meet evolving customer demands.

The company's focus on technology contributes to operational efficiency and cost reduction. This is essential for maintaining a competitive edge in the market. Automation and digitalization are key to these improvements.

These efforts are designed to drive ZTO Express's growth objectives and solidify its leadership in the smart logistics sector. The company's investments in technology are a key part of its strategy. The goal is to stay ahead in the competitive landscape.

ZTO Express is continually enhancing its technological infrastructure to support its growth strategy. These advancements are critical for improving efficiency and customer satisfaction. The company's focus on innovation is a key factor in its success.

- Automated Sorting Systems: High-speed sorting lines that process tens of thousands of parcels per hour.

- AI-Powered Route Optimization: AI algorithms to determine the most efficient delivery routes.

- IoT-Based Tracking: Real-time tracking of parcels and vehicles using IoT devices.

- Electric Vehicles: Adoption of electric vehicles for last-mile delivery to reduce emissions.

ZTO Express PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ZTO Express’s Growth Forecast?

The financial outlook for ZTO Express is notably robust, supported by its strong position in the market and strategic growth initiatives. As a leading logistics company, ZTO Express has demonstrated consistent financial performance, reflecting its ability to capitalize on the expanding e-commerce sector in China. This performance is further enhanced by its investments in technology and infrastructure, which are crucial for maintaining a competitive edge in the delivery services market.

For the full year 2023, ZTO Express reported a total parcel volume of 30.2 billion, marking a significant increase of 32.1% year-over-year. Total revenues reached RMB38.4 billion (approximately US$5.3 billion), a 13.5% increase from the previous year. These figures highlight the company's capacity to scale operations and meet the growing demands of the market. The company projects continued strong growth in parcel volume for 2024, expecting to reach between 34.7 billion and 35.6 billion parcels, indicating a growth rate of 15% to 18% year-over-year.

ZTO Express has consistently maintained healthy profit margins, reflecting its effective cost control and operational leverage. The adjusted net income attributable to ZTO Express shareholders for 2023 was RMB8.8 billion (approximately US$1.2 billion), a 19.9% increase year-over-year. The company's financial strategy includes significant investments in infrastructure and technology, which are essential for supporting its growth and enhancing its service capabilities. These investments are funded by strong cash flow generation and a solid balance sheet, providing the financial flexibility needed for expansion and potential mergers and acquisitions.

The financial performance of ZTO Express underscores its successful growth strategy and promising future prospects. The company's ability to increase parcel volume and revenue while maintaining profitability is a testament to its operational efficiency and market adaptability. For a deeper dive into the company's strategic approach, consider exploring the Marketing Strategy of ZTO Express.

- Parcel Volume Growth: 32.1% year-over-year increase in 2023, reaching 30.2 billion parcels.

- Revenue Growth: 13.5% increase in total revenues, reaching RMB38.4 billion (approximately US$5.3 billion) in 2023.

- Net Income Growth: 19.9% increase in adjusted net income attributable to shareholders, reaching RMB8.8 billion (approximately US$1.2 billion) in 2023.

- Projected Parcel Volume Growth (2024): Anticipated growth of 15% to 18%, reaching between 34.7 billion and 35.6 billion parcels.

ZTO Express Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ZTO Express’s Growth?

The future prospects of ZTO Express, a leading logistics company, are subject to several potential risks and obstacles. These challenges could influence the company's growth strategy and its ability to maintain its strong position in the express delivery market. Understanding these risks is crucial for investors, stakeholders, and anyone evaluating the company's long-term viability.

Intense competition within China's e-commerce and delivery services sectors remains a significant hurdle. Regulatory changes, supply chain vulnerabilities, and technological disruptions also pose considerable threats. Internal operational challenges further complicate the landscape, requiring ZTO Express to navigate a complex web of factors to ensure continued success.

To understand ZTO Express's position better, consider the article Revenue Streams & Business Model of ZTO Express, which details the company's operations.

The express delivery market in China is highly competitive, with numerous players vying for market share. This competition can lead to price wars, affecting profit margins and necessitating continuous innovation. In 2024, the market saw intensified competition, impacting the profitability of several major players.

Changes in regulations related to data privacy, labor practices, and environmental standards pose a risk. Stricter rules can increase compliance costs and require significant operational adjustments. For instance, new regulations concerning gig economy workers could impact ZTO's extensive partner network model.

Supply chain disruptions, whether from global events or geopolitical tensions, can disrupt operations and increase costs. ZTO Express relies on a vast network, making it susceptible to disruptions in transportation and sorting facilities. The company must continuously monitor and adapt to global events.

Technological advancements, such as AI, automation, and drone technology, present both opportunities and risks. If competitors adopt more advanced solutions, ZTO Express must invest and adapt quickly to maintain its competitive edge. The rapid pace of technological change requires constant innovation.

Managing a vast partner network, ensuring consistent service quality, and attracting skilled talent are ongoing internal challenges. Maintaining operational efficiency across a large and complex organization requires constant attention and investment in human resources and technology. The company needs robust internal controls.

Fluctuations in fuel prices, currency exchange rates, and economic downturns can impact profitability. These external factors can increase operational costs and affect consumer demand. The company's financial performance review should include careful assessment of these risks.

ZTO Express employs a diversified strategy, investing heavily in risk management frameworks. The company conducts scenario planning to prepare for various contingencies, demonstrating its ability to respond to unforeseen challenges. Diversification helps buffer against specific market downturns.

The company has demonstrated resilience, as seen during the COVID-19 pandemic. ZTO adapted its network and enhanced safety protocols, showcasing its ability to navigate complex situations. This adaptability is key to its long-term success. The resilience is a part of the company's growth strategy.

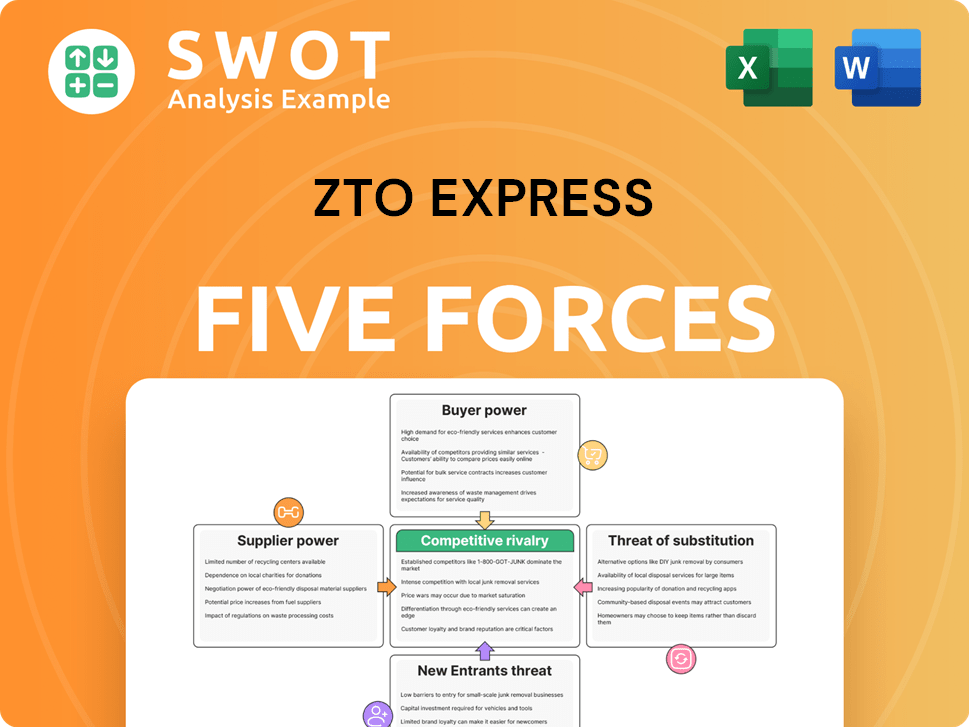

ZTO Express Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ZTO Express Company?

- What is Competitive Landscape of ZTO Express Company?

- How Does ZTO Express Company Work?

- What is Sales and Marketing Strategy of ZTO Express Company?

- What is Brief History of ZTO Express Company?

- Who Owns ZTO Express Company?

- What is Customer Demographics and Target Market of ZTO Express Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.