Abercrombie & Fitch Bundle

Can Abercrombie & Fitch Continue Its Retail Comeback?

Abercrombie & Fitch (A&F), a once-struggling retail company, has staged an impressive turnaround, captivating the fashion industry with its revitalized brands. From navigating past challenges to achieving remarkable financial success, A&F's story is one of strategic adaptation and consumer understanding. In a market saturated with clothing brands, how has Abercrombie & Fitch managed to not only survive but thrive?

To truly understand A&F's success, we must delve into its core operations and Abercrombie & Fitch SWOT Analysis. The company's multi-brand strategy, including Abercrombie & Fitch and Hollister Co., allows it to target diverse demographics within the fashion industry. Examining its Abercrombie & Fitch business model, revenue streams, and market positioning offers valuable insights into its competitive advantages and future growth potential.

What Are the Key Operations Driving Abercrombie & Fitch’s Success?

The core of the Abercrombie & Fitch (A&F) business model revolves around creating and delivering value through its distinct brands: Abercrombie & Fitch, Abercrombie kids, and Hollister Co. These brands cater to different customer segments within the fashion industry, offering a range of apparel, personal care products, and accessories. The company's success is built on understanding its target audience and providing them with a unique shopping experience, both in-store and online.

The company's operational processes are designed to ensure a seamless customer experience across both physical and digital channels. This includes robust global sourcing and manufacturing networks to ensure the timely delivery of merchandise. A&F leverages a sophisticated supply chain management system to optimize inventory levels and respond quickly to fashion trends. Their distribution networks encompass a global footprint of retail stores and a strong e-commerce presence, allowing them to reach customers worldwide. For example, as of February 3, 2024, the company operated 743 stores across various regions, with 432 stores in the United States and 311 international locations.

A&F focuses on integrating its brand identity deeply into the customer experience. The company invests in creating distinctive store environments that reflect each brand's aesthetic, enhancing the shopping experience. Furthermore, A&F has significantly invested in its digital platforms, offering a cohesive omnichannel experience that allows customers to shop seamlessly across different touchpoints. This focus on brand experience and a strong omnichannel strategy, coupled with efficient supply chain management and a global retail footprint, translates into customer benefits such as access to desirable fashion, consistent brand quality, and convenient shopping options.

The company offers a wide array of clothing, including jeans, tops, outerwear, and dresses. These products are designed to align with the brand's aesthetic and target audience preferences. Accessories and personal care items are also part of the product range.

Abercrombie & Fitch targets young adults aged 18-24 with a focus on quality and a refined casual aesthetic. Hollister Co. appeals to teenagers with a more relaxed, accessible style. Understanding the target audience is key to the Abercrombie & Fitch business model.

A&F employs a sophisticated supply chain to manage inventory and respond to fashion trends. The company focuses on creating distinctive store environments and investing in digital platforms to provide a cohesive omnichannel shopping experience. The company's focus on brand experience and a strong omnichannel strategy is a key factor.

Customers benefit from access to desirable fashion, consistent brand quality, and convenient shopping options. The company's commitment to a strong brand image and a seamless shopping experience helps it retain customers. Check out the Growth Strategy of Abercrombie & Fitch.

The value proposition includes offering distinctive apparel and accessories, creating a strong brand image, and providing a seamless shopping experience. The company's focus on its target audience and its ability to adapt to changing fashion trends are also important.

- High-quality apparel and accessories.

- Distinctive brand identity and store environments.

- Convenient shopping options through physical stores and e-commerce.

- Strong supply chain management.

Abercrombie & Fitch SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Abercrombie & Fitch Make Money?

The Abercrombie & Fitch (A&F) company primarily generates revenue through the sale of apparel, personal care products, and accessories. As a retail company in the fashion industry, it operates under several brands, including Abercrombie & Fitch, Abercrombie kids, and Hollister Co. Product sales are the main driver of their financial performance.

In the first quarter of fiscal year 2024, A&F reported net sales of $1.02 billion, demonstrating its strong market position. The Abercrombie & Fitch business model focuses on driving full-price sales and a direct-to-consumer approach through retail stores and e-commerce. Digital sales have become an increasingly important component of their revenue.

For fiscal year 2023, A&F's total net sales reached $4.3 billion, with significant contributions from both its Abercrombie and Hollister brands. This highlights the importance of its diverse brand portfolio in monetizing different fashion preferences and age demographics. The company's strategy involves optimizing its store footprint and adapting to evolving market conditions.

The primary revenue stream for A&F is product sales across its brands. Other revenue sources include shipping fees from online orders and potential licensing agreements, though these are smaller contributors. A&F's focus on full-price sales and a strong online presence are key to its monetization strategy. Read more about the Growth Strategy of Abercrombie & Fitch.

- Product Sales: Apparel, accessories, and personal care products.

- Digital Sales: E-commerce platforms contributing significantly to overall revenue.

- Retail Sales: Sales from physical store locations.

- Other Revenue: Shipping fees and potential licensing deals.

Abercrombie & Fitch PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Abercrombie & Fitch’s Business Model?

The story of Abercrombie & Fitch Co. (A&F) is one of significant transformation, especially in recent years. A key aspect of this has been the successful rebranding of its core labels, notably Abercrombie & Fitch itself. This shift involved moving away from past controversial marketing tactics towards a more inclusive and mature image. This strategic change has resonated well with consumers and has led to strong financial results.

The company has navigated various operational challenges, including global supply chain disruptions that affected the retail sector. A&F has maintained product availability and managed costs by diversifying its sourcing and optimizing logistics. Another strategic move has been the investment in digital capabilities and the omnichannel experience, recognizing the growing importance of e-commerce. This has allowed for improved customer engagement and a smoother shopping experience across online and in-store channels.

A&F's competitive advantages stem from several factors. Its brand recognition, developed over decades, provides a significant edge. The company's ability to adapt its brand messaging and product offerings to align with contemporary consumer values, such as inclusivity and sustainability, further strengthens its appeal. Furthermore, its global retail footprint, combined with a robust e-commerce platform, offers extensive market reach. The company's focus on creating a distinctive brand experience, both in its physical stores and online, differentiates it from competitors. A&F continues to adapt to new trends, evidenced by its focus on customer-centricity and leveraging data analytics to inform product development and marketing strategies.

A&F has seen a resurgence by revitalizing its brands, particularly Abercrombie & Fitch. This involved a shift towards a more inclusive aesthetic, moving away from past controversies. The company reported record fiscal year 2023 net sales of $4.3 billion, demonstrating the success of these strategic adjustments.

The company has effectively managed operational challenges, including supply chain disruptions. Significant investments in digital capabilities and the omnichannel experience have enhanced customer engagement. These moves have improved the overall shopping experience across online and in-store channels.

A&F benefits from strong brand recognition and the ability to adapt to contemporary consumer values. Its global retail presence and robust e-commerce platform offer extensive market reach. A focus on a distinctive brand experience further differentiates the company from its rivals.

The company's financial performance reflects its strategic successes. Record fiscal year 2023 net sales reached $4.3 billion, and operating income was $336 million. These figures highlight the positive impact of the brand's transformation and operational improvements.

A&F's business model focuses on creating a distinctive brand experience and adapting to consumer preferences. This includes a strong emphasis on customer-centricity and leveraging data analytics. The company's ability to adapt to new trends is crucial for its continued success in the fashion industry.

- Strong Brand Recognition: Built over decades, providing a significant advantage.

- Adaptation to Consumer Values: Aligning with inclusivity and sustainability.

- Global Retail Footprint and E-commerce: Offering extensive market reach.

- Distinctive Brand Experience: Differentiating from competitors.

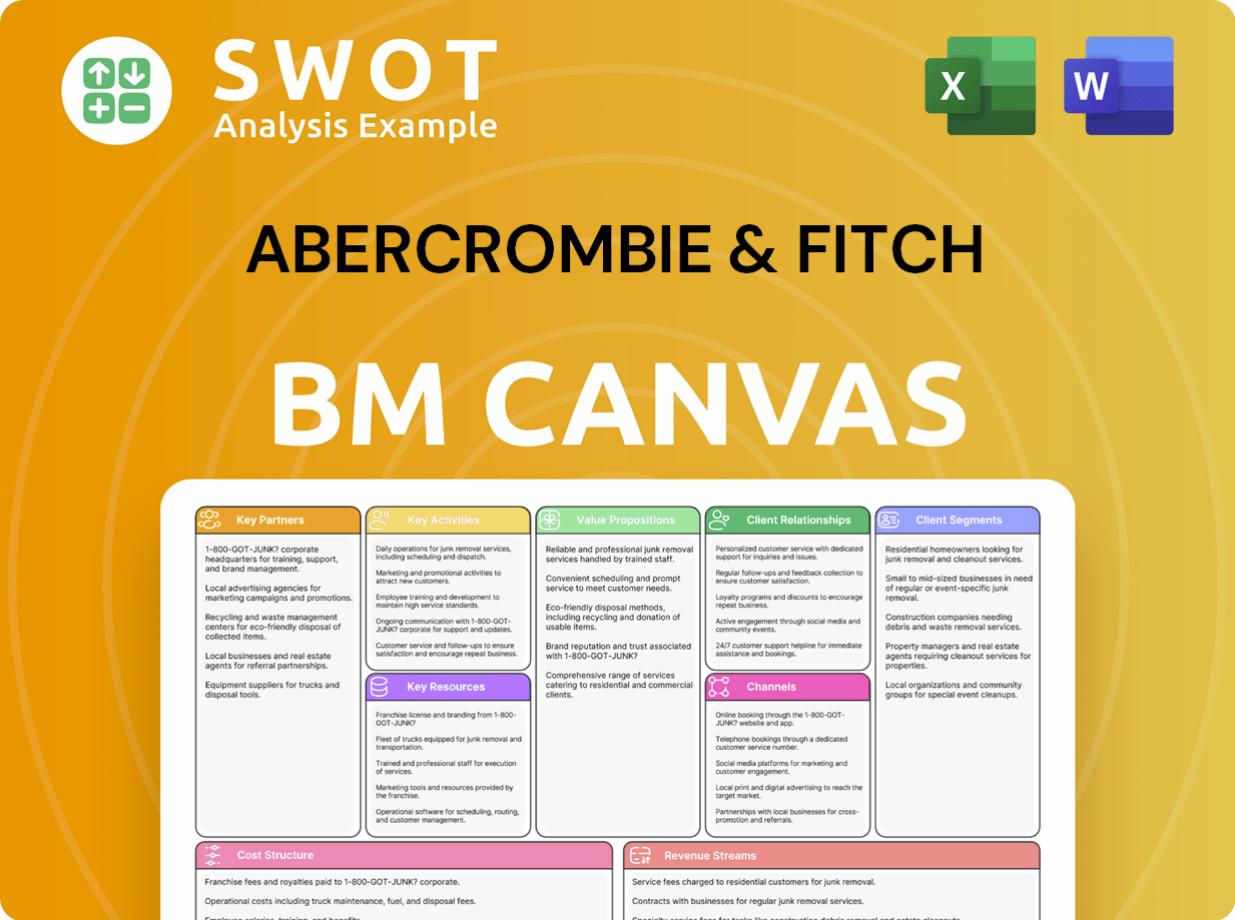

Abercrombie & Fitch Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Abercrombie & Fitch Positioning Itself for Continued Success?

The Abercrombie & Fitch Co. has significantly improved its standing in the specialty retail apparel sector. The company's recent financial performance demonstrates its strong market position. This positive trend is supported by the successful repositioning of the Abercrombie & Fitch brand and the consistent appeal of Hollister.

However, the company faces several risks, including changing consumer preferences and intense competition. Economic downturns and supply chain disruptions also pose challenges. Despite these risks, A&F is focused on strategic initiatives to sustain and expand revenue, including digital enhancements and store optimization.

As of February 3, 2024, Abercrombie & Fitch operated 743 stores worldwide, indicating a strong global presence. The company’s net sales increased by 22% in the first quarter of fiscal year 2024, reaching $1.02 billion, which exceeded market expectations. This growth reflects strong customer loyalty and successful brand repositioning within the clothing brand market.

Changing fashion trends and intense competition from fast-fashion retailers and online brands pose significant threats. Economic downturns and inflationary pressures could impact consumer spending. Supply chain disruptions and rising labor costs also present ongoing operational risks. These challenges require constant innovation and strategic adaptation within the fashion industry.

Abercrombie & Fitch is focusing on digital capabilities to enhance the omnichannel experience. The company is also optimizing its store footprint and exploring new product categories. Sustainable practices and corporate social responsibility are also key. The company aims to build on its recent momentum and deliver consistent profitability.

The Abercrombie & Fitch business model focuses on delivering a premium retail experience. This includes a strong brand image, a focus on customer service, and a curated product range. The company leverages both physical stores and online platforms for sales. The company is also focused on expanding its brand's reach.

The company's strategic initiatives include enhancing its digital presence and optimizing its store network. This involves investing in e-commerce and refining the store format. These strategies are designed to improve the online shopping experience and adapt to changing consumer behaviors.

- Enhancing digital capabilities to improve the online shopping experience.

- Optimizing store footprints with smaller, more efficient formats.

- Expanding into new product categories or markets.

- Focusing on sustainable practices.

Abercrombie & Fitch Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Abercrombie & Fitch Company?

- What is Competitive Landscape of Abercrombie & Fitch Company?

- What is Growth Strategy and Future Prospects of Abercrombie & Fitch Company?

- What is Sales and Marketing Strategy of Abercrombie & Fitch Company?

- What is Brief History of Abercrombie & Fitch Company?

- Who Owns Abercrombie & Fitch Company?

- What is Customer Demographics and Target Market of Abercrombie & Fitch Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.