Allianz Bundle

How Does Allianz Thrive in the Global Financial Arena?

Allianz SE, a titan in the financial services sector, consistently demonstrates its strength as a leading insurer and asset manager. In 2023, Allianz reported impressive figures, with revenues hitting €161.7 billion and an operating profit of €14.7 billion. This financial prowess highlights Allianz's significant impact on the insurance and asset management industries, solidifying its role in global financial stability.

With over 125 million customers across more than 70 countries, Allianz offers a comprehensive suite of Allianz SWOT Analysis, property-casualty insurance, life/health insurance, and asset management solutions. Its consistent ranking among the top global insurers underscores its importance. This exploration will provide a deep dive into Allianz's operations, revenue streams, strategic direction, and future prospects, offering valuable insights for investors, customers, and industry analysts alike. Understanding the Allianz company is crucial for anyone seeking to navigate the complexities of the financial world, from understanding Allianz financial products to assessing Allianz insurance coverage options.

What Are the Key Operations Driving Allianz’s Success?

Allianz's core operations are structured around two main segments: Insurance and Asset Management. These segments work in tandem to deliver value to a diverse customer base. The insurance segment provides a broad range of products, while the asset management division offers investment services.

The Insurance segment offers property-casualty and life/health insurance, catering to individuals, small businesses, and large corporations. Asset Management, primarily through PIMCO and Allianz Global Investors, manages investments for institutional and retail clients. These operations are supported by extensive networks and digital platforms, ensuring efficient service delivery.

Allianz's operational model is characterized by its global reach and local market expertise. This approach allows for tailored products and services, enhanced by digital transformation initiatives like AI-driven claims processing. This combination of global scale and local understanding is a key differentiator for the Growth Strategy of Allianz.

Allianz insurance operations include underwriting, claims management, and policy administration. They utilize a vast network of agents, brokers, and digital platforms. Advanced actuarial science and data analytics are employed to assess risks and price products competitively, ensuring profitability.

Asset management involves investment research, portfolio construction, risk management, and client servicing. Allianz Global Investors and PIMCO manage a wide array of assets, including fixed income, equities, and alternative investments. This segment focuses on active management strategies.

Allianz insurance offers financial protection against various risks, providing peace of mind to customers. They provide a wide range of Allianz products. Their competitive pricing and efficient claims processing enhance customer satisfaction. Allianz services are designed to meet diverse needs.

Allianz's asset management division offers investment management services to institutional and retail clients. Their active management strategies aim to generate strong returns. They provide access to global financial markets and sophisticated trading platforms.

Allianz distinguishes itself through its global reach and local expertise, tailoring products to specific regional needs. Digital transformation, including AI, enhances efficiency and customer experience. The company's focus on sustainability and responsible investing is also a key differentiator.

- Global reach with local market expertise

- Digital transformation and AI integration

- Focus on sustainability and responsible investing

- Comprehensive Allianz financial services

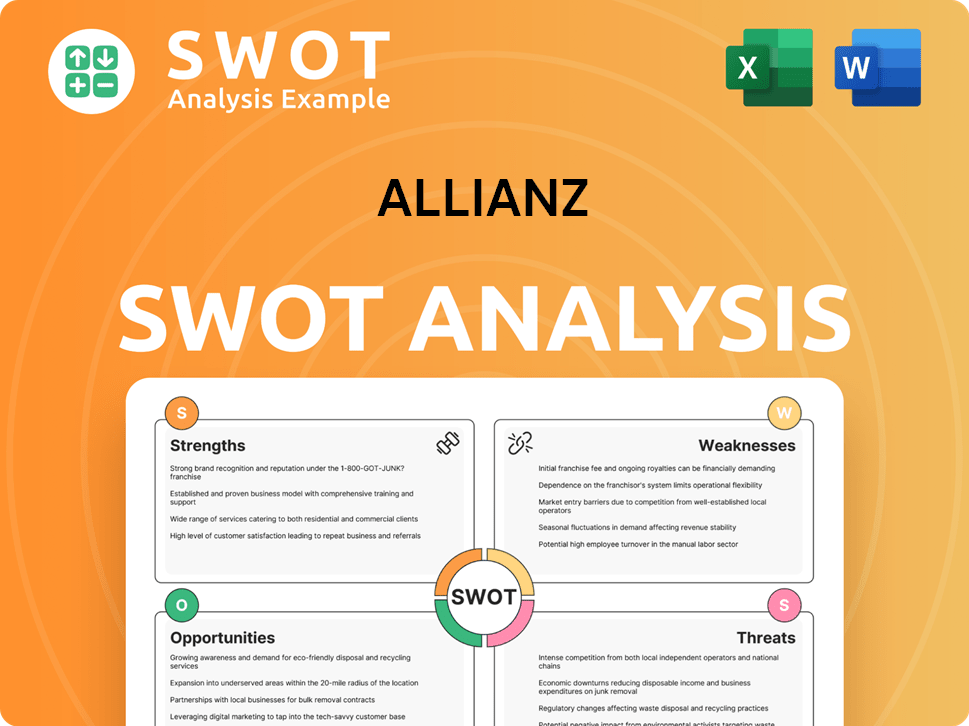

Allianz SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Allianz Make Money?

The financial success of the Allianz company is built upon a diversified revenue model. The company primarily generates income through its insurance operations and asset management services. In 2023, the company's total revenue reached a significant figure, demonstrating its strong market presence.

The insurance segment is a cornerstone of Allianz's financial performance, with revenue derived from premiums. Asset management contributes through fees generated from managing investments. This dual-pronged approach allows the company to capture value across different financial sectors.

In 2023, Allianz's total revenues were at €161.7 billion. The insurance segment's contribution was substantial, with property-casualty premiums at €76.5 billion and life/health premiums at €75.7 billion. The asset management division generated operating revenues of €8.2 billion during the same period.

Allianz employs a variety of strategies to monetize its services and products across its insurance and asset management businesses. These strategies are designed to maximize revenue and enhance customer value. For those interested in the company's customer base, you can learn more about the Target Market of Allianz.

- Insurance Premiums: Revenue is generated through the collection of premiums for various insurance policies. Premium pricing is often based on risk assessment and the level of coverage.

- Cross-Selling: Allianz focuses on cross-selling, offering multiple insurance products to existing customers to enhance their lifetime value.

- Asset Management Fees: Revenue in asset management primarily comes from management fees, which are a percentage of assets under management (AUM). These fees vary based on the asset class, investment strategy, and client type.

- Performance-Based Fees: Allianz utilizes performance-based fees for particular investment products.

- Bundled Services: The company offers bundled services that combine insurance and investment solutions for a comprehensive financial offering.

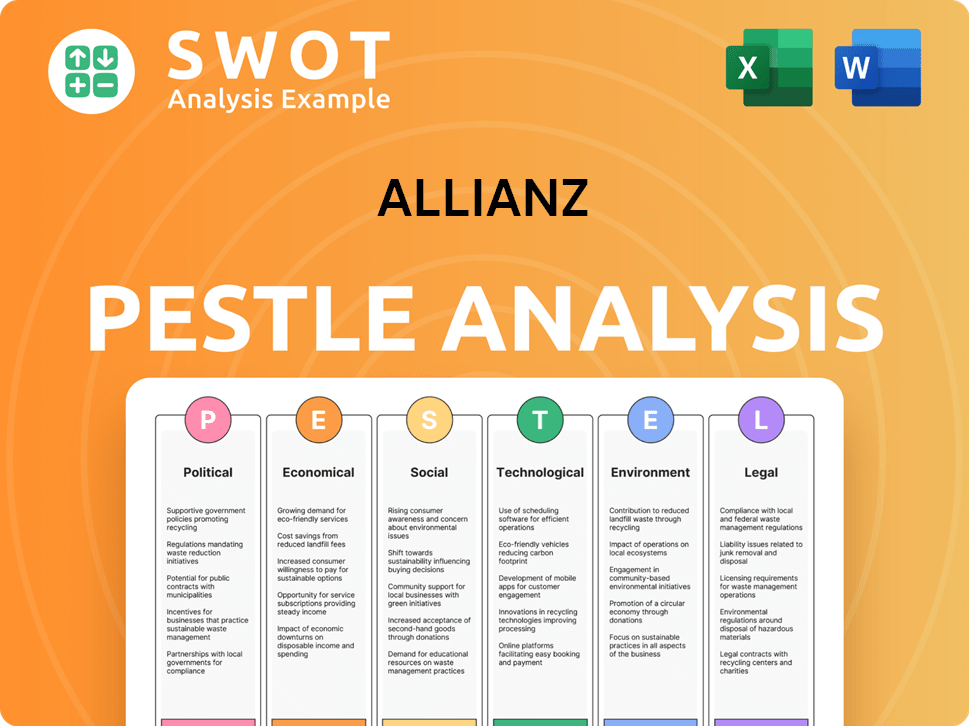

Allianz PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Allianz’s Business Model?

The history of Allianz is marked by significant milestones and strategic initiatives that have shaped its current standing in the financial services sector. A key strategic move in recent years has been its ongoing focus on digital transformation, aiming to enhance customer experiences, streamline operations, and reduce costs. For example, Allianz has invested in AI-driven solutions for claims processing and customer service, improving efficiency and responsiveness.

Allianz has also pursued strategic partnerships and acquisitions to expand its market reach and capabilities. Operational challenges include navigating volatile financial markets, adapting to stringent regulatory environments, and responding to increasing competition. The company has responded by strengthening its risk management frameworks and fostering an agile organizational culture. For instance, Allianz's strong brand recognition, built over decades, instills trust and loyalty among its vast customer base.

Allianz's competitive advantages are multifaceted, including its global scale, deep actuarial expertise, and robust investment management capability. The company continues to adapt to new trends, such as the growing demand for sustainable finance and personalized insurance products, by developing innovative solutions and leveraging advanced analytics to maintain its competitive edge. To understand its position better, you can explore the Competitors Landscape of Allianz.

Allianz has a long history, starting in 1890 in Berlin. Over the years, it has expanded globally through acquisitions and organic growth. Key milestones include entering new markets and adapting to changing financial landscapes. Allianz has consistently evolved its product offerings to meet customer needs.

Recent strategic moves include a strong emphasis on digital transformation. This involves investing in technology to improve customer service and operational efficiency. Allianz has also focused on strategic partnerships to expand its market presence. Furthermore, the company is actively managing its portfolio to optimize its global footprint.

Allianz benefits from a strong brand reputation and global scale. It has a diversified product portfolio, including Allianz insurance and Allianz financial services. The company's investment management capabilities, through PIMCO and Allianz Global Investors, provide a significant advantage. This allows for efficient operations and competitive pricing.

In 2024, Allianz reported a strong financial performance. For example, the company's operating profit was approximately €14.7 billion. Its total revenues reached around €161.7 billion. These figures reflect the company's robust financial health and strategic success. The company's solvency ratio remains strong, indicating financial stability.

Allianz faces challenges such as market volatility, regulatory changes, and competition from insurtech firms. The company addresses these challenges through robust risk management and agile organizational structures. Allianz has also invested in innovative technologies to improve efficiency and customer service.

- Strengthening risk management frameworks to navigate market volatility.

- Advocating for harmonized regulations to adapt to changing environments.

- Fostering an agile organizational culture to enhance responsiveness.

- Investing in AI and digital solutions for improved customer service and claims processing.

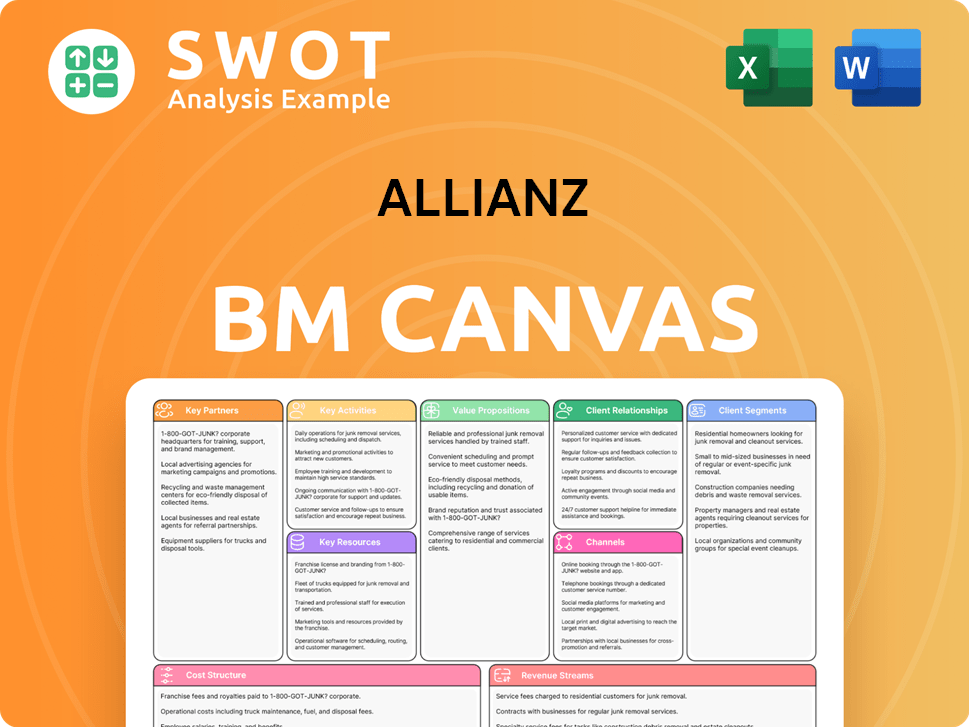

Allianz Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Allianz Positioning Itself for Continued Success?

Allianz, a leading global player in the insurance and asset management sectors, holds a strong market position. It consistently ranks among the top global insurers, marked by significant market share and strong brand loyalty across various regions. In 2023, the company served over 125 million customers worldwide, demonstrating its extensive reach and market penetration.

However, Allianz faces several risks, including regulatory changes, competition from insurtech startups, and technological disruptions. Adapting to changing consumer preferences and geopolitical uncertainties also poses challenges. These factors influence Allianz's strategic direction and operational decisions.

Allianz maintains a leading position in the global insurance market. It is recognized for its strong financial performance and extensive global presence, serving millions of customers. The company's market capitalization and premium income consistently place it among the top insurers worldwide.

Allianz faces several key risks, including evolving regulatory landscapes like Solvency II and data privacy laws. Competition from insurtechs and technological disruptions like AI and blockchain require continuous innovation. Geopolitical uncertainties and macroeconomic volatility also pose challenges.

Allianz is focused on digitalization and customer-centricity, with a commitment to its 'Refresh' program. Innovation roadmaps include leveraging AI and data analytics for predictive underwriting and fraud detection. The company aims to expand in high-growth emerging markets.

Allianz's strategic initiatives include integrating ESG factors into its investment and underwriting processes. The company plans to develop innovative product solutions and optimize operational efficiency through digital transformation. These efforts aim to sustain profitability and adapt to new technologies.

Allianz's future outlook is shaped by strategic initiatives aimed at sustaining and expanding its revenue generation capabilities. The company is committed to its 'Refresh' program, focusing on digitalization, operational efficiency, and customer centricity. Innovation roadmaps include further leveraging AI and data analytics. For more information on the strategic direction, consider reading about the Growth Strategy of Allianz.

Allianz aims to sustain its profitability by expanding in high-growth emerging markets and developing innovative product solutions. It focuses on optimizing operational efficiency through digital transformation. The company plans to adapt to new technologies and anticipate customer needs.

- Digital Transformation: Investing in technology to streamline operations and enhance customer experience.

- Product Innovation: Developing new insurance products to address evolving risks, such as cyber insurance.

- Geographic Expansion: Increasing its presence in high-growth markets.

- Sustainability: Integrating ESG factors into its investment and underwriting processes.

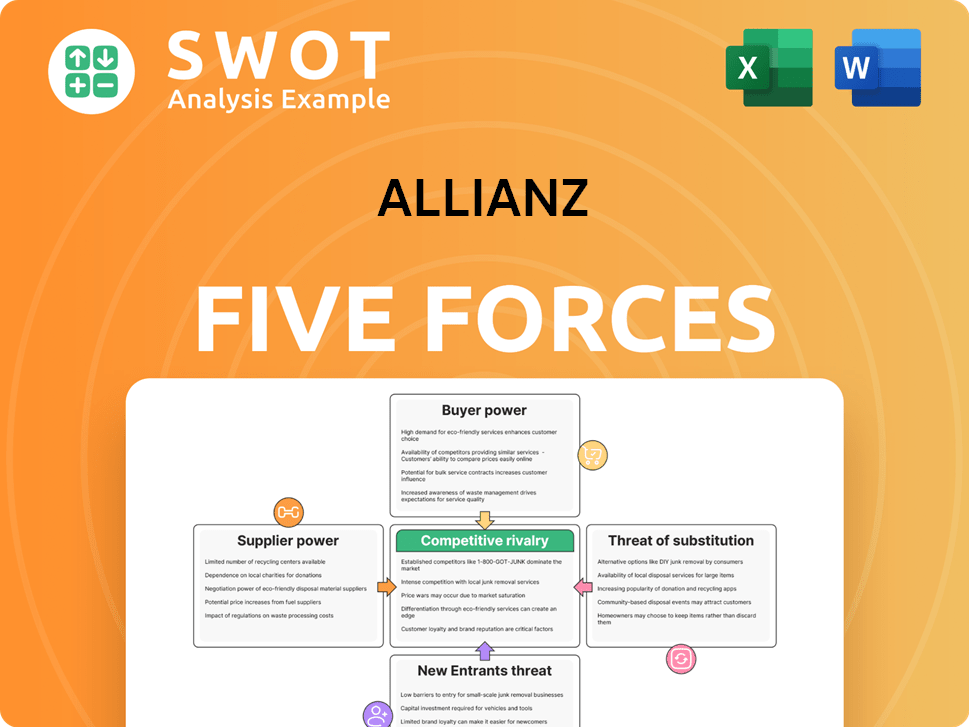

Allianz Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Allianz Company?

- What is Competitive Landscape of Allianz Company?

- What is Growth Strategy and Future Prospects of Allianz Company?

- What is Sales and Marketing Strategy of Allianz Company?

- What is Brief History of Allianz Company?

- Who Owns Allianz Company?

- What is Customer Demographics and Target Market of Allianz Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.