Amsted Industries Bundle

Unveiling Amsted Industries: How Does This Industrial Giant Operate?

Amsted Industries, a global manufacturing company, is a powerhouse in sectors like railway, vehicular, and construction. Its focus on engineered solutions has solidified its leadership across crucial markets worldwide. With a strategic push into e-mobility, including eAxle technology, Amsted demonstrates a forward-thinking approach.

This in-depth analysis explores the Amsted Industries SWOT Analysis, its core operations, and revenue strategies, providing a comprehensive view of the

What Are the Key Operations Driving Amsted Industries’s Success?

Amsted Industries, a prominent manufacturing company, focuses on producing highly engineered industrial components. Its core operations revolve around serving the railway, vehicular, construction, and building products markets. The company's value proposition lies in its ability to deliver specialized products that enhance efficiency and performance across various sectors.

The company's primary offerings include railcar components, bearings, springs, plastic products, and advanced components for electric and hybrid vehicles. Amsted Industries utilizes advanced manufacturing techniques such as metal-forming, powder metallurgy, and additive manufacturing. These processes enable the production of high-quality components for a diverse range of applications.

Amsted Industries operates through various business units, each contributing to its overall value. For instance, Amsted Rail focuses on improving railway safety and efficiency, while ConMet specializes in commercial vehicle components. Amsted Graphite Materials is a world leader in graphite material science, supplying various carbon and graphite materials for industrial applications across over 35 countries.

Amsted Industries employs advanced manufacturing processes. These include metal-forming, powder metallurgy, and additive manufacturing. Amsted Automotive uses powder metal technology for components like gears and sprockets, offering cost-effective solutions.

The company operates through various business units. Amsted Rail focuses on railway components, while ConMet specializes in commercial vehicle parts. Amsted Digital Solutions provides telematics for railcars. Amsted Graphite Materials is a world leader in graphite material science.

Amsted Industries has a significant global footprint. With over 75 locations in 13 countries, the company supports extensive distribution networks. This global presence ensures product availability and market reach.

The value proposition of Amsted Industries lies in its engineered solutions and high-performance components. This approach enables premium pricing and fosters long-term customer relationships. The company aims to be a global leader in its niches.

Amsted Industries leverages its engineering expertise and continuous innovation to achieve market leadership. The company’s focus on high-performance components supports premium pricing. This approach has allowed the company to maintain a strong position in the industrial products market.

- The company’s global presence includes over 75 locations across 13 countries, supporting extensive distribution networks.

- Amsted Automotive has 13 U.S.-based manufacturing facilities, producing over 100 million components annually.

- Amsted Graphite Materials supplies materials to over 35 countries.

- The company's approach combines century-long engineering expertise with continuous innovation.

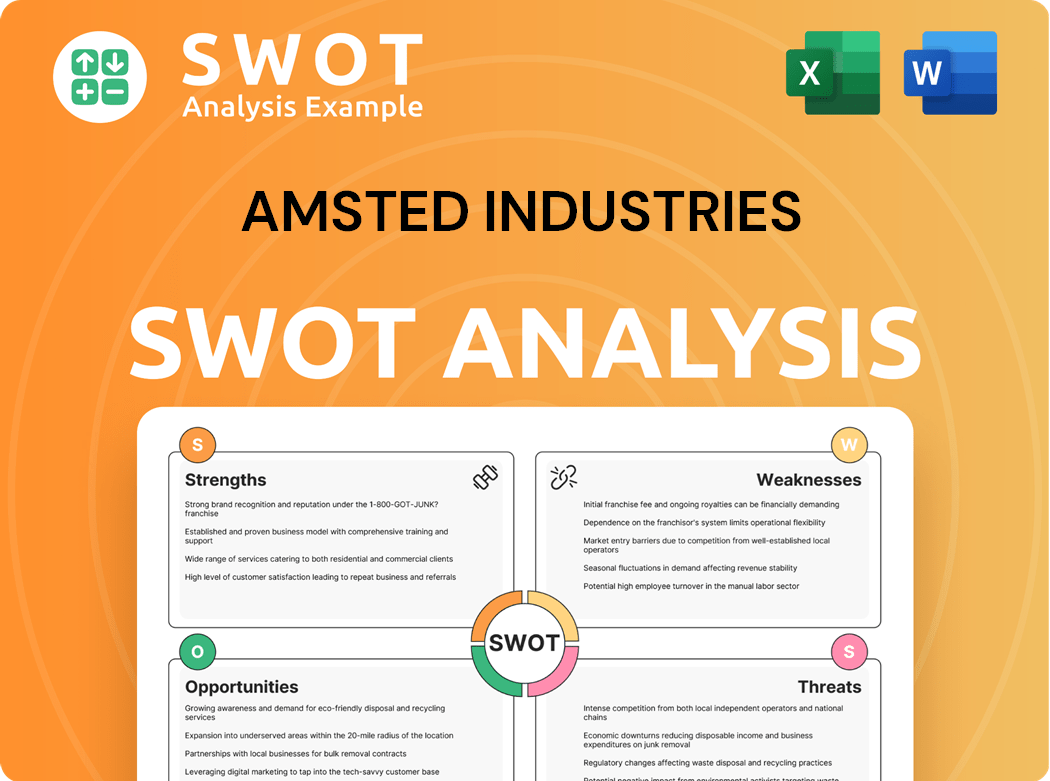

Amsted Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Amsted Industries Make Money?

The Amsted Industries generates revenue through the sale of highly engineered industrial components. These components serve diverse sectors, including railroad, vehicular, construction, and building products. This diversified market presence helps mitigate risks associated with economic fluctuations.

The Amsted company strategically diversifies its revenue streams across several key segments. This approach ensures a balanced financial performance, as seen in 2024. The company's focus on engineered solutions and performance allows for premium pricing and the development of digital solutions.

The Amsted business model incorporates various monetization strategies. These include premium pricing for engineered solutions and leveraging digital services, such as telematics for railcars. The company's investment in technological advancements also contributes to increased efficiency and profitability.

The company's revenue streams are diverse, ensuring stability and growth. Key segments include railroad products, commercial vehicle products, automotive and industrial products, and construction and building products. The company's ability to innovate and adapt to market changes is crucial for its financial success.

- Railroad Products: This segment offers railcar components like wheels and bearings. The global railway market was valued at approximately $200 billion in 2024.

- Commercial Vehicle Products: This segment includes wheel ends and brake drums for heavy-duty trucks. In 2024, this segment generated approximately $1.5 billion in revenue.

- Automotive and Industrial Products: This segment focuses on powertrain solutions and components for various vehicles. The e-mobility market is projected to reach $823.75 billion by 2030.

- Construction and Building Products: This segment contributes to the company's diversified revenue base. Amsted Global Solutions provides customized castings for industrial applications.

The Amsted Industries employs several monetization strategies. The company's emphasis on engineered solutions and performance allows for premium pricing. Digital solutions, like telematics for railcars, provide valuable services, potentially creating new revenue streams. The global telematics market was valued at $80 billion in 2024 and is expected to reach $160 billion by 2030, indicating significant potential for Amsted. For more information about the business's marketing strategies, you can read this article: Marketing Strategy of Amsted Industries. Additionally, the company's investment in technological advancements can lead to efficiency increases and reduced waste, indirectly impacting profitability. Amsted Industries' revenues grew to $4.40 billion in 2024.

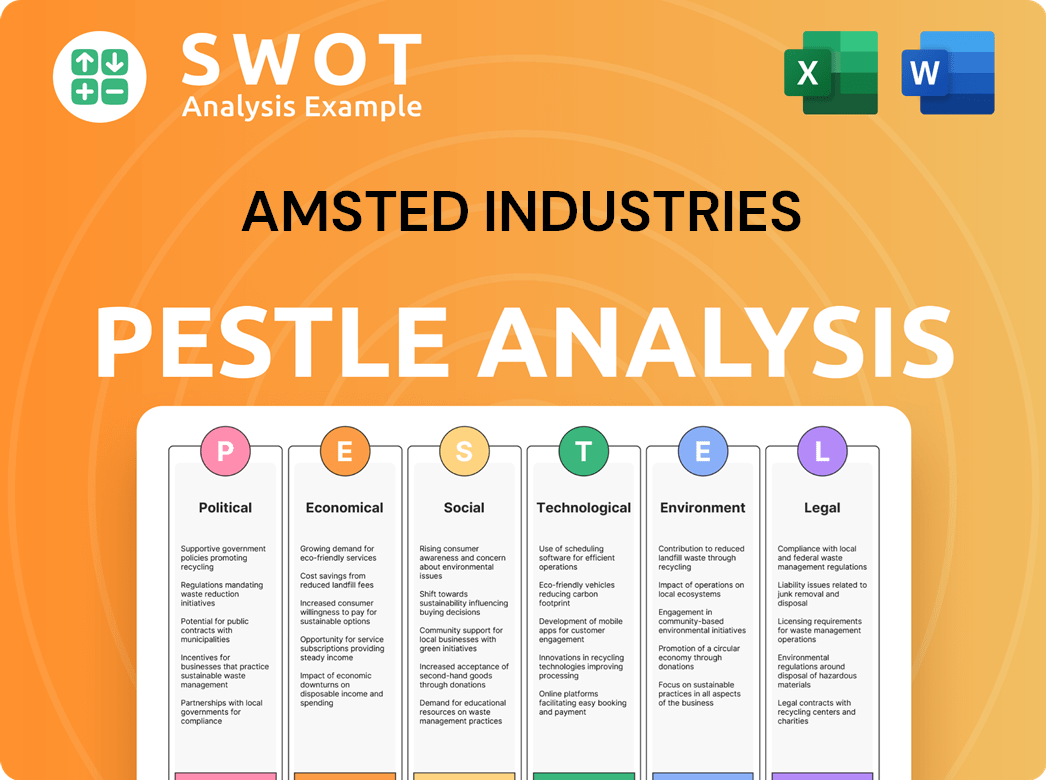

Amsted Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Amsted Industries’s Business Model?

Amsted Industries, a leading industrial manufacturing company, has strategically navigated its path through key milestones and strategic moves. The formation of the Amsted Automotive Group (AAG) in 2021 marked a significant shift towards electric vehicle (EV) technology and manufacturing, positioning the company for future growth in the e-mobility market. In early 2025, Amsted Industries further solidified its financial standing through crucial refinancing efforts.

These strategic maneuvers demonstrate Amsted Industries' proactive approach to adapting to market trends and enhancing its operational efficiency. The company's focus on innovation, including investments in research and development, underscores its commitment to maintaining a competitive edge. Amsted Industries continues to adapt to new trends and technological shifts. Its investments in research and development increased by 15% in 2024, demonstrating a commitment to innovation.

Amsted Industries' competitive edge is built on a foundation of diversified market presence and engineered solutions expertise. The company's strong market positions, global presence, and technological advancements further contribute to its ability to thrive in a dynamic industrial landscape. For a deeper dive into the company's background, check out the Brief History of Amsted Industries.

In 2021, Amsted Automotive Group (AAG) was formed to focus on EV technology. In March 2024, a new manufacturing facility opened in Nanjing, China, to produce components for electric, hybrid, and internal combustion vehicles for the Asian market.

Refinancing efforts in 2024 and early 2025 included a $500 million issuance of senior notes and the refinancing of a $1.4 billion credit facility. These moves aimed to optimize the company's capital structure and manage debt. The company also extended its $225 million AR securitization facility.

Amsted Industries benefits from a diversified market presence and engineered solutions expertise. The company has strong market positions and a global presence with distribution networks across over 75 locations in 13 countries. Technological advancements, like powder metal and additive manufacturing, boost its competitive edge.

The company's debt levels were approximately $2 billion in 2024. Investments in research and development increased by 15% in 2024. The sustainable investing market reached approximately $1.3 trillion in 2024.

Amsted Industries maintains a strong competitive position due to several key advantages. These advantages include a diversified market presence, engineered solutions expertise, and established market positions.

- Diversified Market Presence: Reduces dependency on any single market.

- Engineered Solutions Expertise: Allows premium pricing and fosters customer relationships.

- Established Market Positions: Strong brand recognition and significant market share in rail and construction components.

- Economies of Scale: Enable better supplier deals and lower production costs.

- Global Presence and Extensive Distribution Networks: Create barriers to entry.

- Technological Advancements: Boost competitive edge and improve efficiency.

- Employee Ownership Structure: Fosters a culture of ownership and dedication.

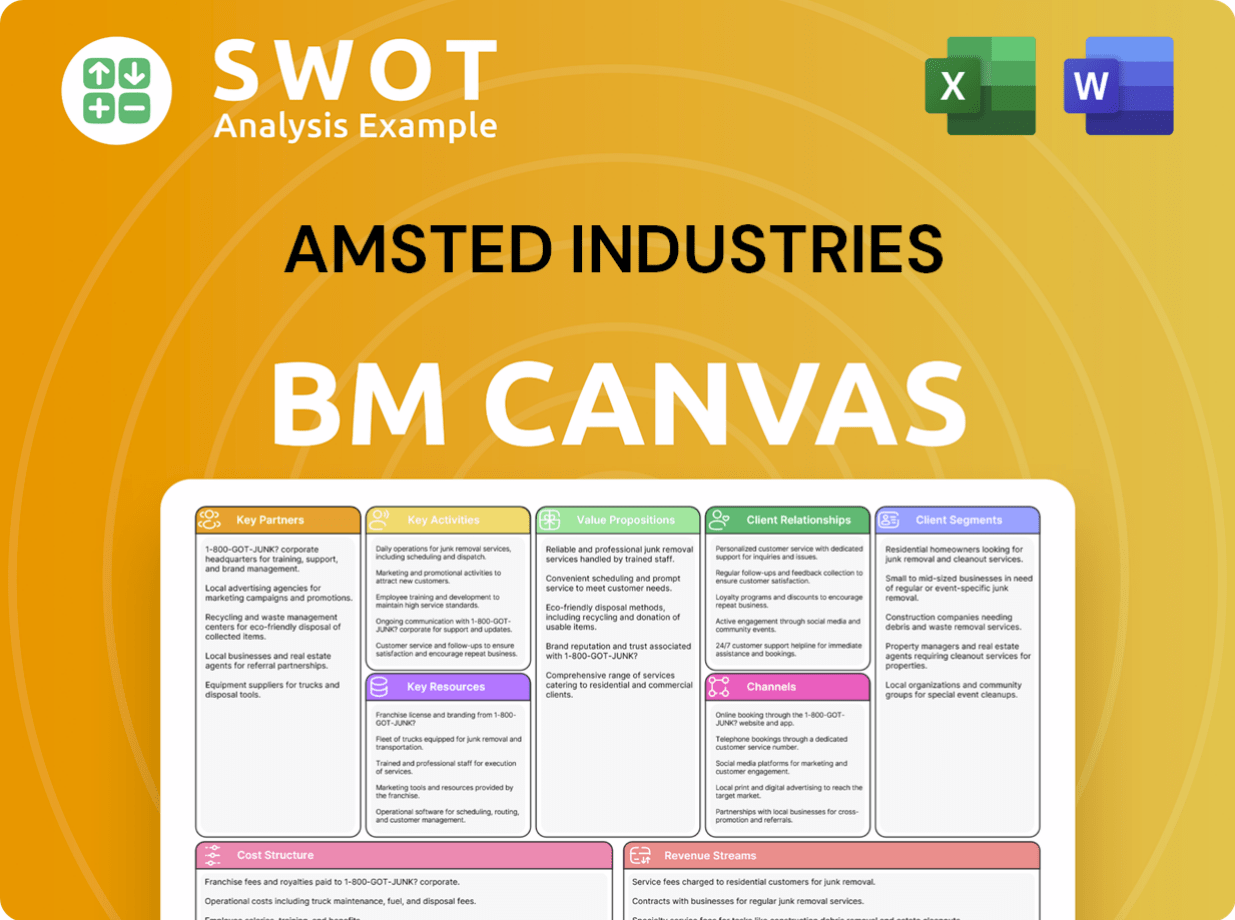

Amsted Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Amsted Industries Positioning Itself for Continued Success?

As a diversified global manufacturer, Amsted Industries holds a strong position in the industrial components market. The Amsted company has a significant presence across multiple sectors, including rail, automotive, construction, and building products. This diversification helps mitigate risks associated with economic fluctuations, with leading market positions in its four business segments.

Amsted's business model includes a global footprint and is particularly strong in the railway sector, with its subsidiary, Amsted Rail, being the world's largest supplier of freight rail wheels. The company's strategic positioning in the automotive sector, especially with its EV component offerings, is set for growth. The eAxle market is projected to reach $10 billion by 2026.

Amsted Industries is a key player in the industrial products market. It has leading market positions in its four business segments. Amsted Rail, a subsidiary, is the world's largest supplier of freight rail wheels and operates in over 50 countries. The company's diversified market presence across these sectors contributes to its stability.

Amsted Industries faces risks related to economic cycles, particularly in construction and rail. High debt levels, approximately $2 billion in 2024, and rising interest rates pose financial risks. Significant customer concentration in certain segments, like rail, increases revenue volatility. Reliance on global supply chains makes the firm susceptible to cost increases and disruptions.

Amsted Industries is focused on strategic initiatives to sustain and expand its business. The company is investing in e-mobility, developing components for electric and hybrid vehicles. Expansion in transit rail is another opportunity. Technological advancements like powder metal and additive manufacturing are also key.

Amsted Industries' financial performance is influenced by its diverse market presence. The company's performance is affected by economic cycles and market demand. The railway components sector is crucial for revenue generation. For a deeper dive into the company's growth strategies, check out this article: Growth Strategy of Amsted Industries.

Amsted Industries is actively pursuing several strategic initiatives to drive future growth and innovation. These include a strong focus on e-mobility, developing components for electric and hybrid vehicles to capitalize on the growing EV market. The company is also expanding its presence in transit rail, leveraging its expertise in freight rail to tap into the North American transit rail market, valued at $10.5 billion in 2024.

- Investing in technological advancements such as powder metal and additive manufacturing.

- Focusing on sustainability to expand eco-friendly product offerings.

- Exploring digital solutions and telematics for railcars to create new revenue streams.

- These initiatives are designed to enhance efficiency and create new revenue streams.

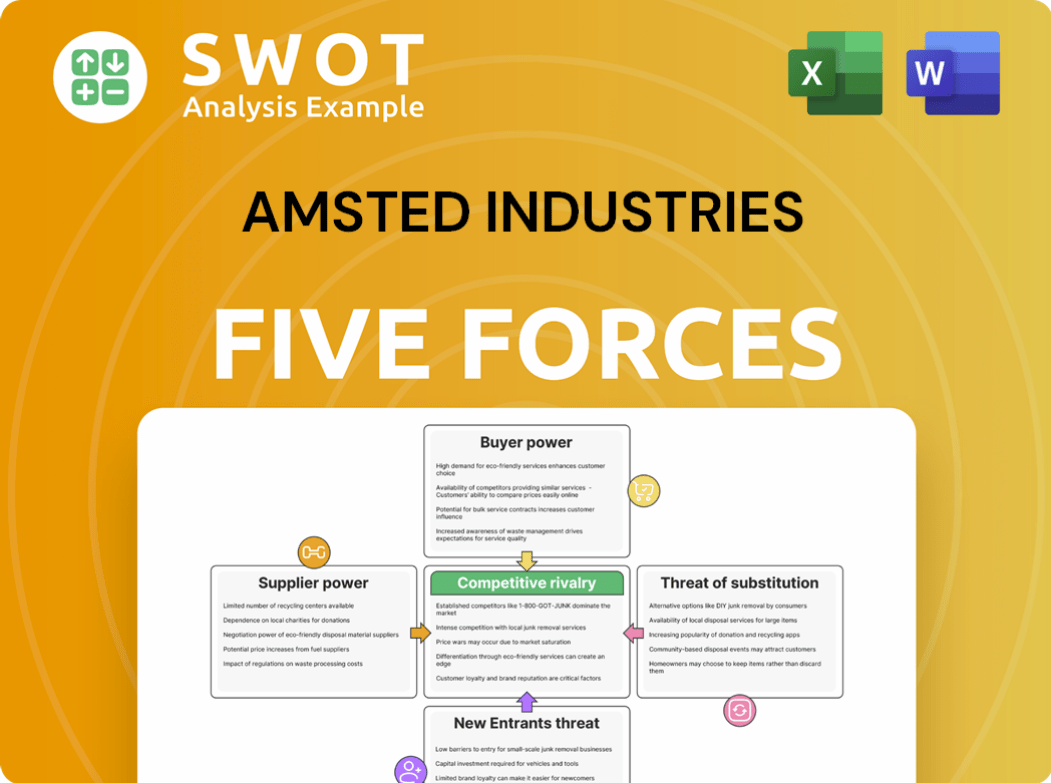

Amsted Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Amsted Industries Company?

- What is Competitive Landscape of Amsted Industries Company?

- What is Growth Strategy and Future Prospects of Amsted Industries Company?

- What is Sales and Marketing Strategy of Amsted Industries Company?

- What is Brief History of Amsted Industries Company?

- Who Owns Amsted Industries Company?

- What is Customer Demographics and Target Market of Amsted Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.