Autodesk Bundle

How Does Autodesk Thrive in a Tech-Driven World?

Autodesk, a global powerhouse in 3D design and engineering software, has fundamentally reshaped industries from architecture to entertainment. Its pioneering software, including the iconic AutoCAD, set a new standard for computer-aided design. Today, Autodesk SWOT Analysis reveals the company's strategic positioning in a rapidly evolving market, with a focus on innovation and a subscription-based model.

Autodesk's transition to a subscription model and cloud-based services has been a game-changer, driving substantial revenue growth and creating a predictable financial model. Understanding the inner workings of the Autodesk company and how it generates revenue is crucial for anyone seeking to understand the dynamics of the SaaS landscape. This exploration will provide insights into how Autodesk works, its core strategies, and its potential for continued success in the face of technological advancements.

What Are the Key Operations Driving Autodesk’s Success?

The Autodesk company operates as a software-as-a-service (SaaS) provider, delivering a comprehensive suite of software solutions tailored for professionals across diverse industries. This includes architecture, engineering, construction (AEC), manufacturing (MFG), and media and entertainment (M&E). The company's core products, such as AutoCAD, Revit, Inventor, Maya, and 3ds Max, are industry benchmarks, enabling users to design, simulate, and fabricate their ideas, enhancing collaboration and efficiency throughout project lifecycles.

The company's value proposition centers on empowering its users with tools to design, simulate, and fabricate their ideas, fostering collaboration and efficiency throughout project lifecycles. By providing these tools, the Autodesk company aims to improve project outcomes, reduce errors, and enhance sustainability through data-driven design choices. This approach helps professionals across various sectors to streamline their workflows and achieve better results.

The Autodesk company focuses on continuous technology development, with a significant investment in research and development. This investment fuels the enhancement of existing products and the integration of cloud capabilities. The shift to cloud-based platforms, such as Autodesk Construction Cloud and Fusion 360, is a strategic move to create more integrated, end-to-end solutions and facilitate seamless data transfer from design to documentation.

Autodesk offers a range of software solutions, including AutoCAD for 2D and 3D CAD design, Revit for Building Information Modeling (BIM), and Inventor for 3D mechanical design. Maya and 3ds Max are used for 3D animation and rendering. These products are industry standards, used by professionals worldwide.

Autodesk is transitioning to cloud-based platforms like Autodesk Construction Cloud and Fusion 360. These platforms provide integrated, end-to-end solutions. They also facilitate seamless data transfer from design to documentation, improving workflows.

Autodesk uses a hybrid distribution model, combining direct sales with a global network of resellers and distributors. Approximately 63% of its revenue in fiscal year 2024 came from indirect channel sales. This approach ensures broad accessibility and support for its customers.

Autodesk focuses on structured and managed data through industry-specific cloud models, enabling AI-driven insights. This data strategy supports more adaptable workflows. It also helps in automating tasks and accelerating complex design creation.

Autodesk's operations are centered around continuous technology development, with a significant investment in research and development, approximately $1.6 billion in fiscal year 2024. This investment drives the enhancement of existing products and the integration of cloud capabilities. The company's approach to creating a unified platform that connects design-to-make processes is unique, leveraging data and AI to automate tasks and accelerate complex design creation.

- SaaS Business Model: Provides software solutions through subscriptions, ensuring recurring revenue.

- Hybrid Distribution: Uses direct sales and a global network of resellers for broad market reach.

- Data-Driven Approach: Leverages data and AI to improve design processes and customer outcomes.

- Focus on Innovation: Continuous investment in R&D to enhance products and integrate new technologies.

For further insights into the financial structure and ownership of the Autodesk company, you can refer to the article about Owners & Shareholders of Autodesk.

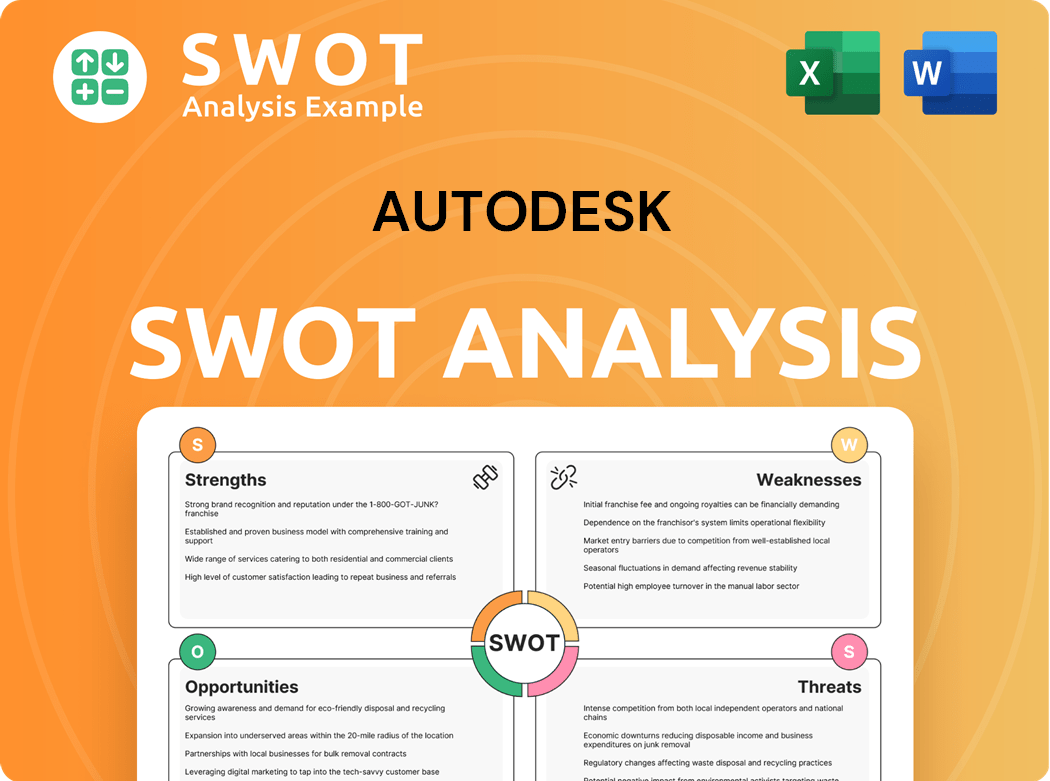

Autodesk SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Autodesk Make Money?

The Autodesk company primarily generates revenue through its subscription-based software and cloud services, a strategic shift that has become central to its financial model. This approach provides a predictable revenue stream and fosters customer loyalty. This model allows for continuous updates and support, enhancing the value proposition for users of Autodesk software.

In fiscal year 2025, recurring revenue, predominantly from subscriptions, accounted for a significant 97% of its total revenue. This highlights the success of its transition to a subscription-based model. The company offers flexible subscription plans—monthly, annual, or multi-year—catering to diverse customer needs and budgets, ensuring continuous access to updates and support services.

For the full fiscal year 2025, Autodesk reported total revenue of $6.13 billion, marking a 12% year-over-year increase. Design revenue, which encompasses offerings in Architecture, Engineering, Construction, AutoCAD, and Media and Entertainment, reached $5.10 billion, reflecting a 10% increase. Make revenue, including manufacturing solutions, was $654 million, showing a 25% increase. Subscription plan revenue reached $5.72 billion, growing 12% as reported.

Beyond subscriptions, Autodesk also generates revenue through licensing fees, enterprise business agreements, and professional services and consulting. The company's strategic initiatives include transitioning to direct sales to gain more customer data and pricing control, which is expected to lead to higher revenue by tailoring offerings and optimizing pricing. The company has successfully increased its adjusted operating margin by 300 basis points since fiscal 2023, achieving its target of between 38% and 40% ahead of schedule, excluding the effects of new sales models. For more insights into their market approach, explore the Marketing Strategy of Autodesk.

- Autodesk products are widely used across various industries.

- The subscription model ensures a steady revenue stream.

- The company focuses on expanding product adoption in manufacturing and construction.

- Strategic initiatives include transitioning to direct sales.

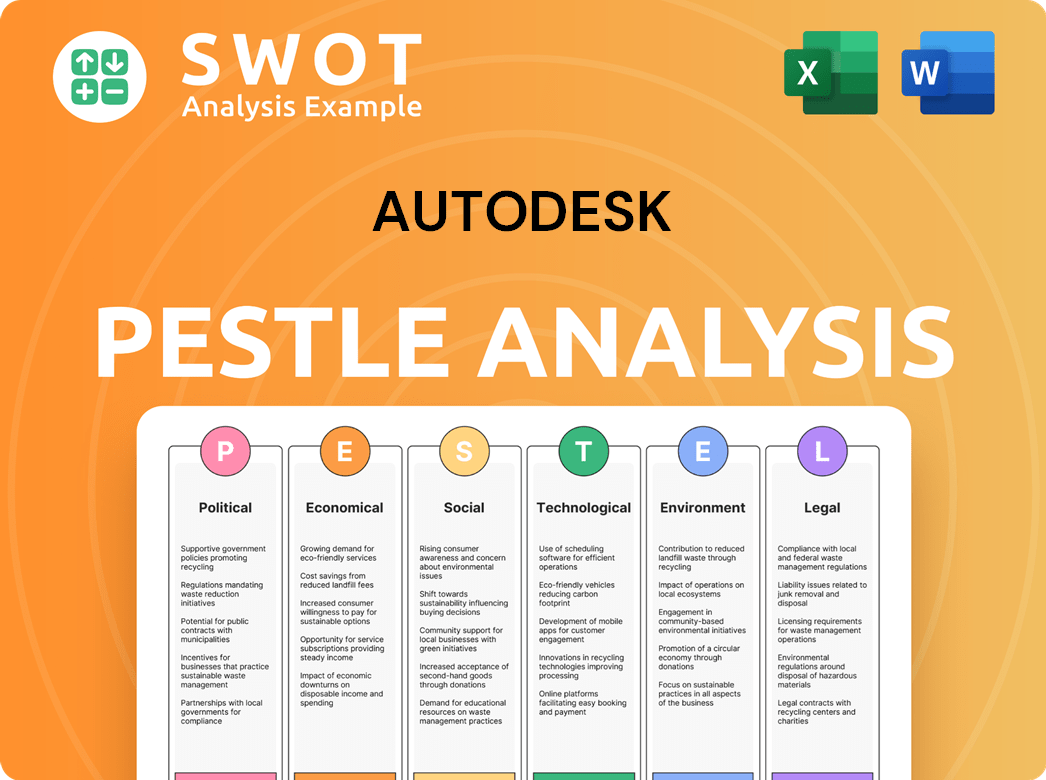

Autodesk PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Autodesk’s Business Model?

The evolution of the Autodesk company has been marked by significant shifts, most notably its transition to a subscription-based model. This strategic move, initiated in 2015, aimed to ensure more predictable revenue streams and facilitate continuous innovation. While this transition presented initial challenges, it has largely proven successful, with subscription revenue now forming the bulk of its total earnings. This change has reshaped the company's financial structure and its approach to product development and customer engagement.

A key strategic focus for Autodesk has been on cloud-based platforms and the integration of artificial intelligence (AI) across its product offerings. Initiatives such as the Autodesk Construction Cloud, Fusion 360, and Forma are central to this strategy, designed to unify design-to-make processes and enable more integrated workflows. The company is also actively researching generative AI for 3D content and developing multimodal foundation models to automate tasks and accelerate design generation.

Operationally, Autodesk has faced challenges, including an internal investigation in 2024 regarding its financial practices. While the investigation concluded without restatement of financial statements, it highlighted the company's efforts to meet financial targets through certain sales strategies. In response, Autodesk has focused on optimizing its go-to-market functions and reallocating resources to strategic priorities like cloud, platform, and AI, alongside a restructuring plan that included a reduction in force.

The shift to a subscription model, which began in 2015, was a major turning point, transforming its revenue model. The company's focus on cloud-based platforms and AI integration represents a strategic pivot towards more integrated workflows. These moves have been crucial in adapting to evolving market demands and technological advancements.

Investing heavily in cloud-based platforms, like Autodesk Construction Cloud, and integrating AI across its products are key strategies. The company is also working on generative AI for 3D content and developing multimodal foundation models. These moves aim to streamline processes and enhance user experience.

Autodesk benefits from strong brand recognition, with products like AutoCAD and Revit being industry standards. It has a large installed base, creating network effects and high switching costs. The company's comprehensive product portfolio and ongoing investments in AI and automation provide a competitive advantage. For more insights, you can explore the target market of Autodesk.

In fiscal year 2024, Autodesk reported total revenue of approximately $5.5 billion, with subscription revenue making up the majority. The company's focus on cloud-based solutions and AI integration continues to drive growth. The company's stock price and annual revenue reflect its market position and strategic direction.

Autodesk holds a strong competitive position due to its recognized brand and comprehensive product offerings. Its large user base and integrated product portfolio create significant advantages in the market. The company's ongoing investments in AI and automation are essential for future innovation.

- Strong brand recognition and industry-standard products.

- Large installed base and network effects.

- Comprehensive and integrated product portfolio.

- Ongoing investments in AI and automation.

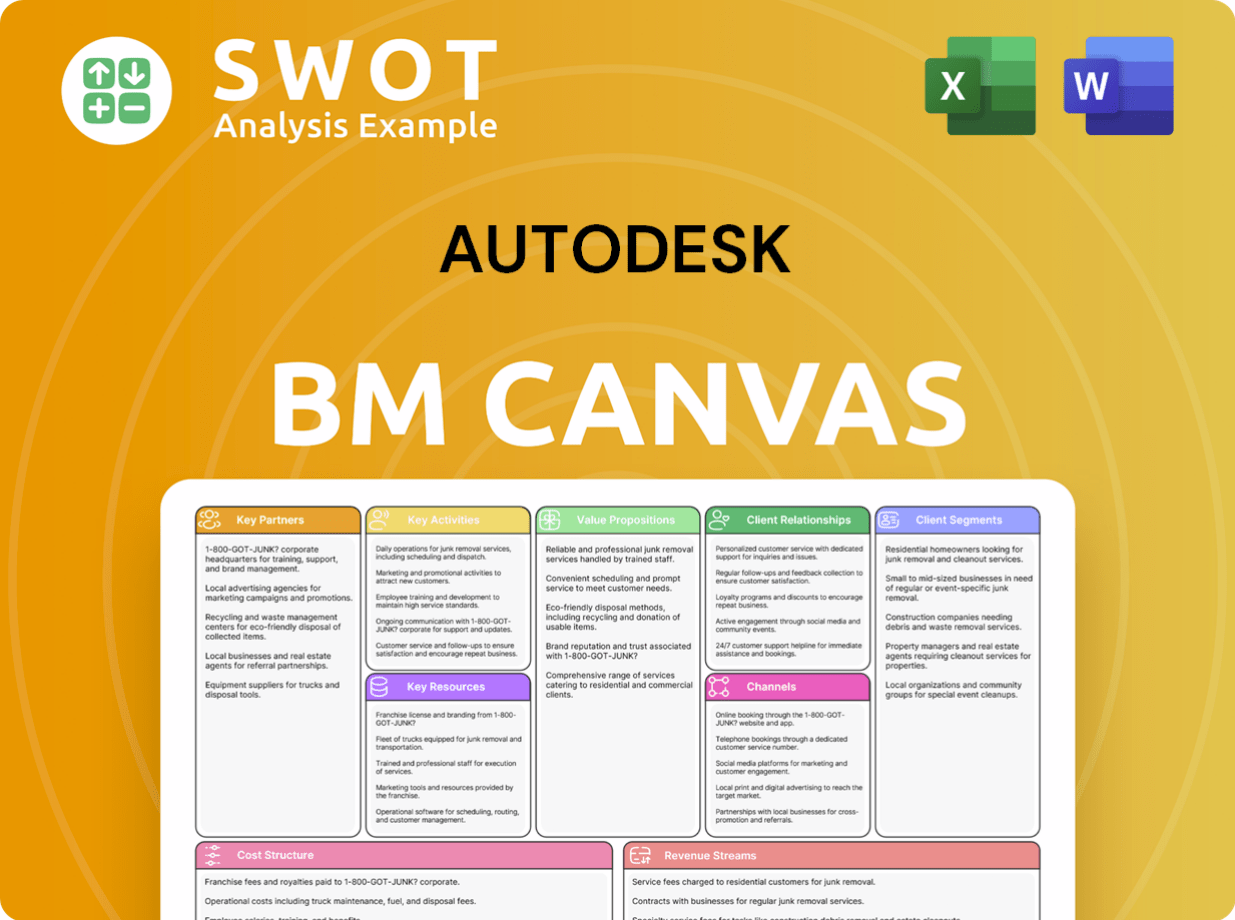

Autodesk Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Autodesk Positioning Itself for Continued Success?

The Autodesk company holds a significant position in the global design, engineering, and entertainment software market. Its strong presence is particularly notable in the Architecture, Engineering, and Construction (AEC) and Manufacturing sectors. The shift to cloud-based platforms and subscription models has further solidified its market standing. In fiscal year 2024, the Americas region was the most profitable for Autodesk, generating around $2.4 billion in revenue, followed by Europe, the Middle East, and Africa, which brought in approximately $2 billion.

Autodesk software faces several challenges despite its strong market position. These include competition, rapid technological advancements, and legal issues related to software piracy. A critical vulnerability in 2024 in AutoCAD highlighted a security risk. Additionally, scrutiny over sales strategies, such as multi-year billing practices, poses a risk. Economic downturns affecting customer spending in AEC and Manufacturing also present potential challenges.

Autodesk is a leader in the design and engineering software market, especially in AEC and Manufacturing. Its comprehensive product portfolio, including AutoCAD and Revit, supports its market share. The company's focus on cloud-based solutions and subscription models reinforces its competitive advantage and future growth.

Autodesk faces risks such as competition, technological changes, and potential legal issues. The company's sales strategies and economic downturns in key sectors also present challenges. A critical vulnerability in AutoCAD in 2024 highlighted security concerns.

Autodesk aims to expand its platform ecosystems and capitalize on digital transformation trends. Strategic initiatives include investments in AI and cloud-based solutions. The company is focused on sustainability and expects underlying revenue growth of more than 10% in fiscal year 2025.

Autodesk focuses on integrating data, AI, and collaboration to drive innovation. The company is committed to consistent growth, disciplined execution, and share repurchases. Its initiatives are designed to deliver sustainable shareholder value and maintain a competitive edge. Learn more about Autodesk in Brief History of Autodesk.

Autodesk is concentrating on several key areas to drive future growth and maintain its market position. These include expanding cloud-based solutions, investing in AI capabilities, and focusing on sustainable design practices. These efforts are designed to enhance customer value and foster long-term growth.

- Expansion of cloud-based platforms like Construction Cloud and Fusion 360.

- Further investments in artificial intelligence and machine learning.

- Integration of sustainability into product design and development.

- Focus on delivering consistent shareholder value through disciplined execution.

Autodesk Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autodesk Company?

- What is Competitive Landscape of Autodesk Company?

- What is Growth Strategy and Future Prospects of Autodesk Company?

- What is Sales and Marketing Strategy of Autodesk Company?

- What is Brief History of Autodesk Company?

- Who Owns Autodesk Company?

- What is Customer Demographics and Target Market of Autodesk Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.