Autodesk Bundle

Who are Autodesk's Customers Today?

From revolutionizing design with AutoCAD in 1982 to its current position as an industry leader, Autodesk's journey has been marked by continuous evolution. Understanding the Autodesk SWOT Analysis is crucial to grasp its market dynamics. But who exactly are the architects, engineers, and designers who rely on Autodesk's diverse software suite today?

This exploration delves into the customer demographics and Autodesk target market, providing insights into the Autodesk customer profile. We'll analyze the Autodesk users and Autodesk audience, examining Autodesk clients across various industries, their needs, and how Autodesk adapts to their evolving demands. Understanding the customer base size, Autodesk customer segmentation analysis, and Autodesk ideal customer profile is key to grasping the company's strategic direction and future growth potential, including Autodesk customer buying behavior and Autodesk customer acquisition strategy.

Who Are Autodesk’s Main Customers?

Understanding the customer demographics and target market of Autodesk is crucial for grasping its business strategy. Autodesk primarily focuses on business-to-business (B2B) sales, targeting professionals across various industries. The company's core customer segments include architecture, engineering, construction (AEC), manufacturing, and media and entertainment (M&E).

Within the AEC sector, the Autodesk customer profile spans from individual architects and engineers to large construction firms. In manufacturing, the company serves product designers and mechanical engineers. The M&E segment includes animation studios and game developers. This diverse range reflects a broad spectrum of users, from entry-level designers to experienced project managers.

Specific demographic breakdowns like age or income are not publicly detailed. However, the nature of the software suggests a customer base with higher education, often holding degrees in engineering, architecture, design, or related fields. These professionals typically work within established businesses, ranging from small and medium-sized enterprises (SMEs) to large multinational corporations. The shift to a subscription model has broadened accessibility, while still maintaining strong ties with larger enterprise clients.

Autodesk's primary focus is on the AEC, manufacturing, and M&E sectors. These industries rely heavily on design and engineering software for their operations. The company's offerings are tailored to meet the specific needs of professionals in these fields. This targeted approach allows Autodesk to maintain a strong market presence.

Autodesk users include architects, engineers, designers, project managers, and executives. The software caters to a variety of roles within these industries. This diversity highlights the versatility of Autodesk's products. The software supports various stages of a project, from initial design to final execution.

Autodesk clients typically possess higher education, often with degrees in engineering, architecture, or design. This educational background is essential for effectively utilizing the software. The advanced nature of the tools requires a level of technical expertise. This ensures that users can leverage the full capabilities of Autodesk's products.

Autodesk serves a wide range of businesses, from SMEs to large multinational corporations. The subscription model has expanded accessibility to smaller firms. This allows Autodesk to cater to a diverse customer base. The company's solutions are scalable to meet the needs of various business sizes.

Autodesk's growth is significantly influenced by trends in the AEC industry, which often represents its largest revenue share. The company has expanded its offerings beyond traditional CAD to include BIM and cloud-based collaboration tools. This expansion reflects the increasing demand for integrated workflows and digital transformation, as discussed in the Marketing Strategy of Autodesk article.

- The AEC segment saw strong growth in fiscal year 2024, highlighting continued dominance.

- Autodesk is focusing on cloud-based solutions and data-driven insights for enterprise customers.

- The subscription model has enhanced accessibility for smaller firms and individual practitioners.

- The company's strategic moves reflect shifts in industry trends and digital transformation demands.

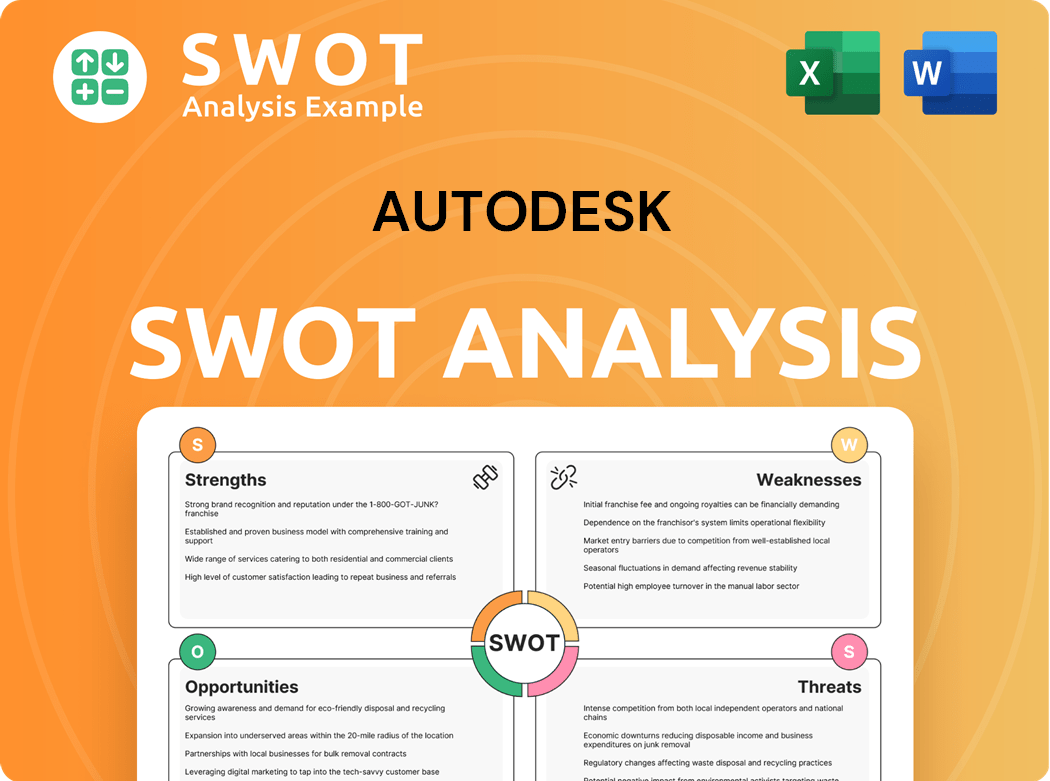

Autodesk SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Autodesk’s Customers Want?

Understanding the customer needs and preferences is crucial for [Company Name] to maintain its market position. The company's customers, often referred to as the Autodesk users, are driven by a fundamental need for efficient, accurate, and collaborative design and production tools. This need is especially pronounced in sectors like Architecture, Engineering, and Construction (AEC) and Manufacturing, where precision and collaboration are paramount.

Purchasing behaviors are heavily influenced by project requirements, industry standards, and the desire for seamless integration with existing workflows. For instance, in the AEC sector, the ability to create detailed building models, conduct clash detection, and collaborate in real-time are critical decision-making criteria. Customers prioritize software that offers robust features, reliability, and compatibility with industry-standard file formats, directly impacting the Autodesk customer profile.

The shift to subscription models also influences customer preferences, with a demand for flexible licensing and continuous software updates. This ensures access to the latest features and security enhancements. Autodesk's target market is diverse, encompassing various industries and professional roles, all seeking tools that enhance productivity and enable innovation.

Customers are driven by the aspiration to create cutting-edge designs, improve efficiency, and maintain a competitive edge. This includes the desire to solve complex design challenges and reduce errors.

Practical drivers revolve around solving complex design challenges, reducing errors, and accelerating project timelines. The need for tools that streamline workflows and enhance project efficiency is a key motivator.

Unmet needs often revolve around interoperability between different software platforms, the demand for more intuitive user interfaces, and the need for greater automation in repetitive tasks.

Autodesk addresses these pain points through continuous product development, incorporating customer feedback through beta programs, user forums, and direct engagement with industry professionals.

The ongoing development of cloud-based platforms like Autodesk Construction Cloud directly addresses the need for centralized data management and real-time collaboration across project teams.

Marketing efforts are tailored to specific segments, showcasing how Autodesk's tools can solve industry-specific challenges, such as reducing rework in construction or accelerating product development cycles in manufacturing.

Product features are continually refined to meet evolving industry demands, such as integrating artificial intelligence (AI) for generative design or enhancing virtual reality (VR) capabilities for design visualization. For example, the integration of AI in design tools can automate complex tasks, saving time and reducing errors. Furthermore, the continuous updates and enhancements in cloud-based platforms reflect the company's commitment to meeting the dynamic needs of its Autodesk clients. The company's focus on innovation and user-centric design ensures that it remains a leader in the design and engineering software market. For more insights, you can refer to an article about the company's overall strategy and market positioning.

Understanding the core needs and preferences of Autodesk's customer base is crucial for product development and market strategy.

- Efficiency and Productivity: Customers seek tools that streamline workflows and reduce project timelines.

- Collaboration: Real-time collaboration and data sharing are critical, especially in large-scale projects.

- Integration: Seamless integration with existing software and industry-standard file formats is essential.

- Innovation: The ability to leverage cutting-edge technologies, such as AI and VR, to create innovative designs.

- Flexibility: Flexible licensing options and continuous software updates are preferred.

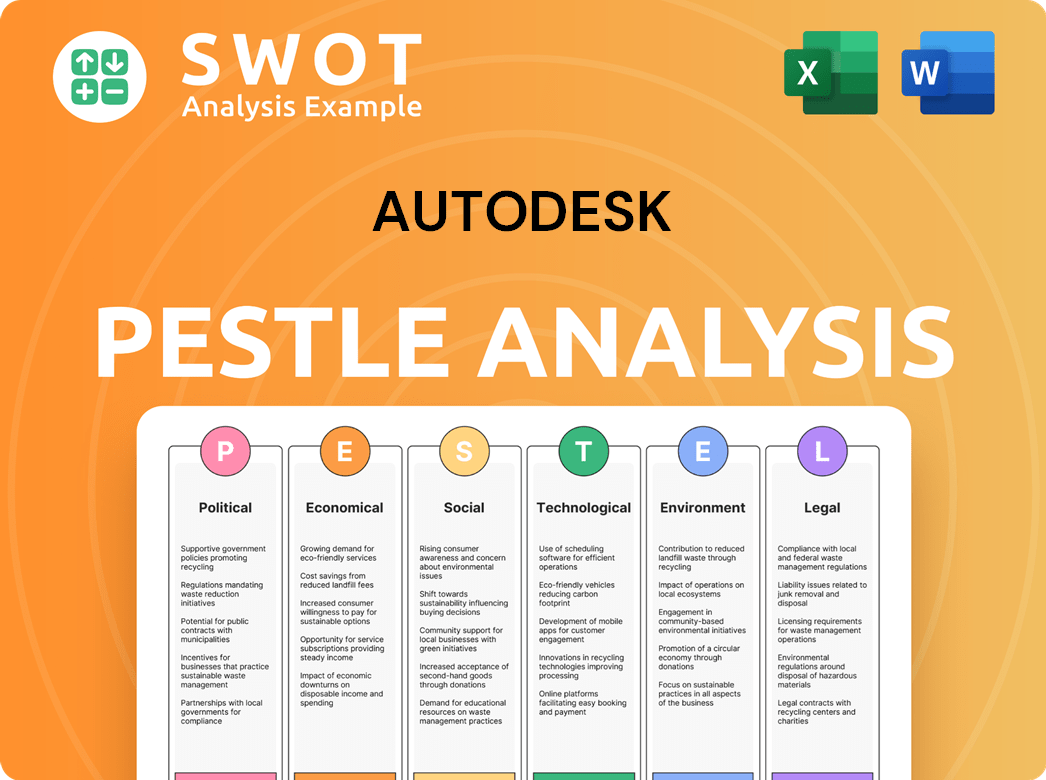

Autodesk PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Autodesk operate?

Autodesk maintains a substantial global presence, with major markets in North America, Europe, and the Asia-Pacific region. The United States and Canada are significant contributors to its revenue, fueled by strong Architectural, Engineering, and Construction (AEC) and manufacturing sectors. Europe, including countries like Germany, the UK, and France, is also a key market, benefiting from a well-established industrial base and the increasing adoption of digital design technologies. The Asia-Pacific region, especially China, Japan, and India, represents a crucial growth market for Autodesk, driven by rapid urbanization, infrastructure development, and expanding manufacturing capabilities.

This widespread geographical reach allows Autodesk to serve a diverse range of Autodesk clients. Autodesk's global strategy involves adapting to regional differences in customer demographics, preferences, and buying power. This approach ensures that Autodesk can cater to the specific needs of its Autodesk users in various locations. Furthermore, the company continuously assesses market opportunities and competitive dynamics to refine its market entry and expansion strategies, ensuring sustained growth and relevance in a dynamic global landscape.

Autodesk's strategy includes localizing its offerings through translated software interfaces, region-specific pricing, and partnerships with local resellers and distributors. Marketing campaigns are often adapted to cultural nuances and local industry trends. The geographic distribution of sales often reflects the global economic climate and regional investment in infrastructure and manufacturing, with strong growth observed in regions experiencing significant construction and industrial development. For more insights, you can explore the Owners & Shareholders of Autodesk.

The United States and Canada represent a significant portion of Autodesk's revenue. The AEC and manufacturing sectors are major drivers. Autodesk customer profile in this region includes established firms and innovative startups.

Countries like Germany, the UK, and France are key markets. There's a well-established industrial base and increasing adoption of digital design. Customer demographics here include a mix of experienced professionals and new entrants.

China, Japan, and India are key growth markets. Rapid urbanization, infrastructure development, and expanding manufacturing drive demand. Autodesk target market in this region is diverse, with significant growth potential.

Autodesk localizes its offerings with translated software, region-specific pricing, and partnerships. Marketing campaigns are adapted to cultural nuances. This approach helps to meet the Autodesk audience needs.

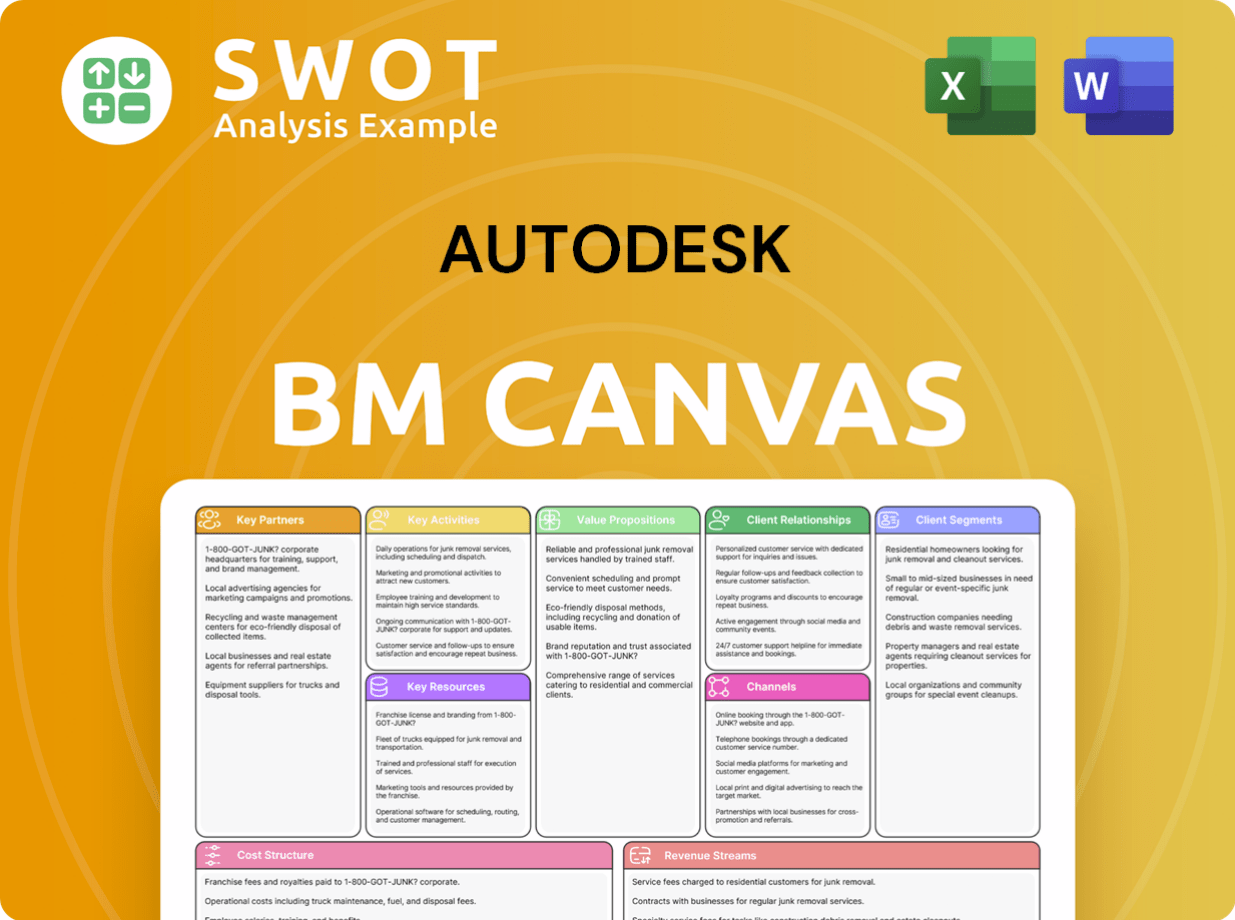

Autodesk Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Autodesk Win & Keep Customers?

Autodesk's approach to customer acquisition and retention is multifaceted, combining digital and traditional marketing with robust customer support. Their strategy leverages digital channels like search engine optimization (SEO) and pay-per-click (PPC) advertising to reach their target audiences. Traditional methods, such as industry trade shows and direct sales, also play a crucial role in engaging potential clients and securing new business.

The company's sales tactics often involve consultative selling, where sales teams work closely with clients to understand their specific needs and demonstrate how Autodesk's software solutions can provide value. Free trials and educational licenses are common tools for attracting new users. For retention, Autodesk emphasizes customer success, offering extensive online resources, technical support, and training programs to ensure customer satisfaction and continued use of their products.

A key element of Autodesk's strategy is its shift to a subscription model, which inherently strengthens retention by fostering ongoing relationships and providing continuous value through regular software updates and cloud services. Customer data and CRM systems are critical for targeting campaigns and personalizing experiences. The company analyzes usage patterns, customer feedback, and industry trends to refine its marketing messages and product development roadmap, ensuring that its offerings remain relevant and competitive.

Autodesk employs a robust digital marketing strategy, using SEO, PPC, content marketing (webinars, case studies, whitepapers), and social media campaigns. These efforts are designed to reach specific segments within their target market and drive traffic to their platforms. This approach helps in acquiring new customers and maintaining engagement with existing ones.

Consultative selling is a core sales tactic, with teams focusing on understanding client needs. Free trials and educational licenses are offered to allow potential users to experience the software. These strategies are important for attracting new customers. In 2024, the company reported a significant increase in new subscriptions, indicating the effectiveness of these tactics.

Customer success is a primary focus for retention, with extensive online resources, technical support, and training programs. The subscription model inherently promotes retention by offering continuous value through updates and cloud services. Loyalty programs, though not explicitly branded, are embedded in subscription tiers and enterprise agreements.

Autodesk uses customer data and CRM systems to target campaigns and personalize experiences. They analyze usage patterns and feedback to refine marketing messages and product development. This data-driven approach is crucial for understanding the needs of their Autodesk customer profile and improving customer lifetime value.

Autodesk's customer acquisition strategy is heavily influenced by its target market, which includes professionals in architecture, engineering, construction, manufacturing, and media and entertainment. The company focuses on attracting a diverse range of

Autodesk focuses its marketing efforts on specific industries and professional roles. This includes architects, engineers, designers, and manufacturers. By tailoring its messaging to these specific groups, Autodesk ensures its products meet the needs of its

The subscription model provides ongoing value through regular software updates and cloud services. This approach ensures customers remain engaged and benefit from the latest features and improvements. This model also allows for better customer lifetime value and manages churn rates effectively.

Autodesk provides extensive customer support, including online resources, technical support, and training programs. These resources help users maximize the value of their software and improve their skills. These training programs also increase customer satisfaction and retention.

Autodesk uses customer data to analyze usage patterns and gather feedback. This data helps refine marketing messages, product development, and customer experiences. By personalizing interactions, Autodesk enhances customer loyalty and satisfaction.

Autodesk partners with authorized resellers and training centers globally to expand its reach and provide localized support. These partners act as important touchpoints for customer acquisition and support. This network expands the company's ability to reach potential customers.

Autodesk's integrated cloud platforms enhance collaboration and workflow efficiency, making it challenging for customers to switch to competing solutions. This embedded value and network effects contribute to a strong customer lifetime value. This strategy helps maintain a competitive advantage.

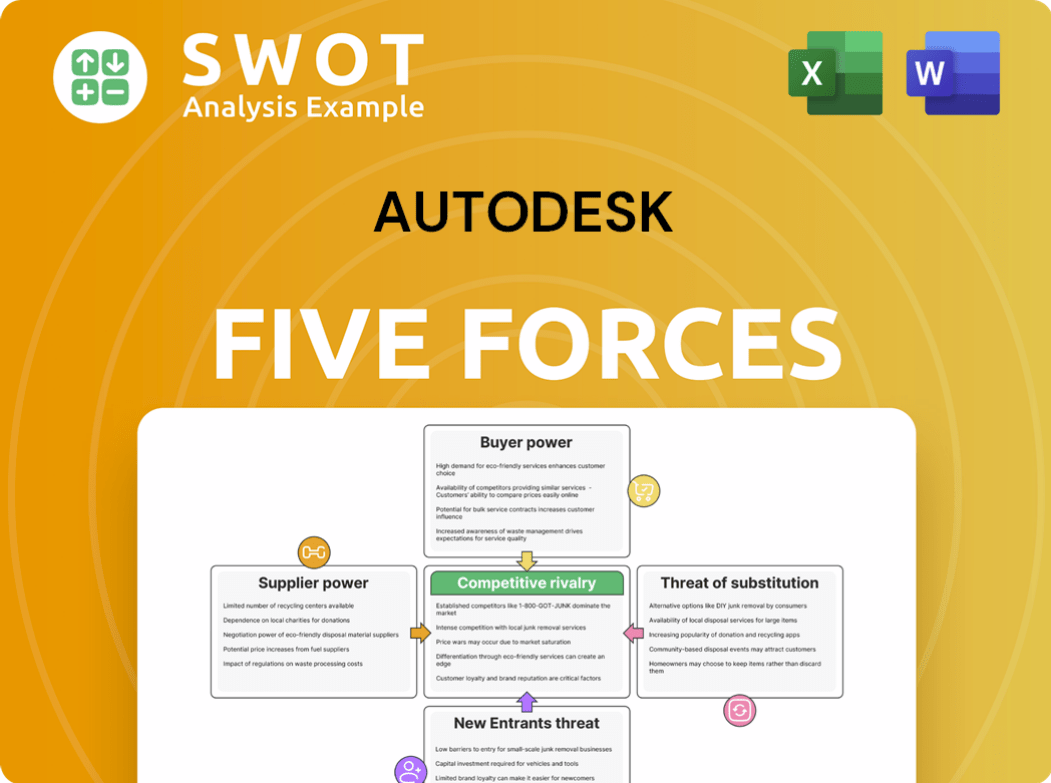

Autodesk Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autodesk Company?

- What is Competitive Landscape of Autodesk Company?

- What is Growth Strategy and Future Prospects of Autodesk Company?

- How Does Autodesk Company Work?

- What is Sales and Marketing Strategy of Autodesk Company?

- What is Brief History of Autodesk Company?

- Who Owns Autodesk Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.