Bangkok Bank Bundle

Unveiling Bangkok Bank: How Does It Thrive?

Bangkok Bank, a titan in Thailand's financial sector, plays a crucial role in the ASEAN banking landscape. As one of the largest commercial banks in Thailand, it provides a wide array of financial services, from deposit accounts to international banking. Understanding the inner workings of a Bangkok Bank SWOT Analysis is key to grasping its strengths and weaknesses.

This exploration of Bangkok Bank operations is essential for anyone seeking to understand the dynamics of a leading Thai bank. We'll examine its diverse Bangkok Bank services, revenue streams, and strategic initiatives. This analysis will provide valuable insights into its competitive position, potential risks, and future prospects, offering a comprehensive view of this prominent financial institution in Bangkok.

What Are the Key Operations Driving Bangkok Bank’s Success?

Bangkok Bank, a prominent Thai bank, delivers value through a broad spectrum of financial products and services. It caters to a diverse clientele, including individuals, small and medium-sized enterprises (SMEs), large corporations, and institutional clients. Its core operations are designed to meet the varied financial needs of these customer segments, ensuring accessibility and tailored solutions.

The bank's value proposition centers on providing comprehensive financial services. This includes traditional offerings like deposit accounts and loans, investment products, and robust international banking services. The bank's extensive network and digital platforms enhance customer convenience, making financial transactions seamless. Its focus on customer relationships and understanding the local market further differentiates it in a competitive landscape.

Bangkok Bank services include a wide range of deposit accounts, such as savings, current, and fixed deposits. Loan products are also a key offering, encompassing personal loans, housing loans, and business loans. Credit cards are another essential service provided to customers.

The bank offers investment options, including mutual funds and bancassurance products. These services allow customers to diversify their financial portfolios. This helps customers in financial planning and wealth management.

Bangkok Bank operations extend to international banking services, facilitating trade finance, foreign exchange, and cross-border transactions. This supports businesses engaged in international trade. The bank's international presence is particularly strong in ASEAN countries.

The bank utilizes a vast network of branches and ATMs across Thailand and internationally. It also offers digital platforms like mobile and internet banking. These channels ensure accessibility and convenience for customers.

The bank's operational effectiveness is enhanced by its long-standing relationships with large corporate clients and its deep understanding of the Thai market. Its strong regional presence, especially in ASEAN countries, provides a competitive advantage in facilitating cross-border business. The bank continuously adapts its services to meet evolving customer needs, as seen in the growth of its digital banking platforms. For a broader perspective on the competitive environment, consider exploring the Competitors Landscape of Bangkok Bank.

In 2024, Bangkok Bank reported total assets of approximately $110 billion USD. The bank's net profit for 2024 was around $1.05 billion USD, reflecting its strong financial performance. The bank's digital banking users continue to grow, with over 7 million active users as of late 2024.

- Extensive Branch Network: Over 1,200 branches and service points globally.

- Digital Transformation: Significant investment in mobile and internet banking.

- Customer Base: Serving millions of customers across various segments.

- International Presence: Operations in key financial hubs worldwide.

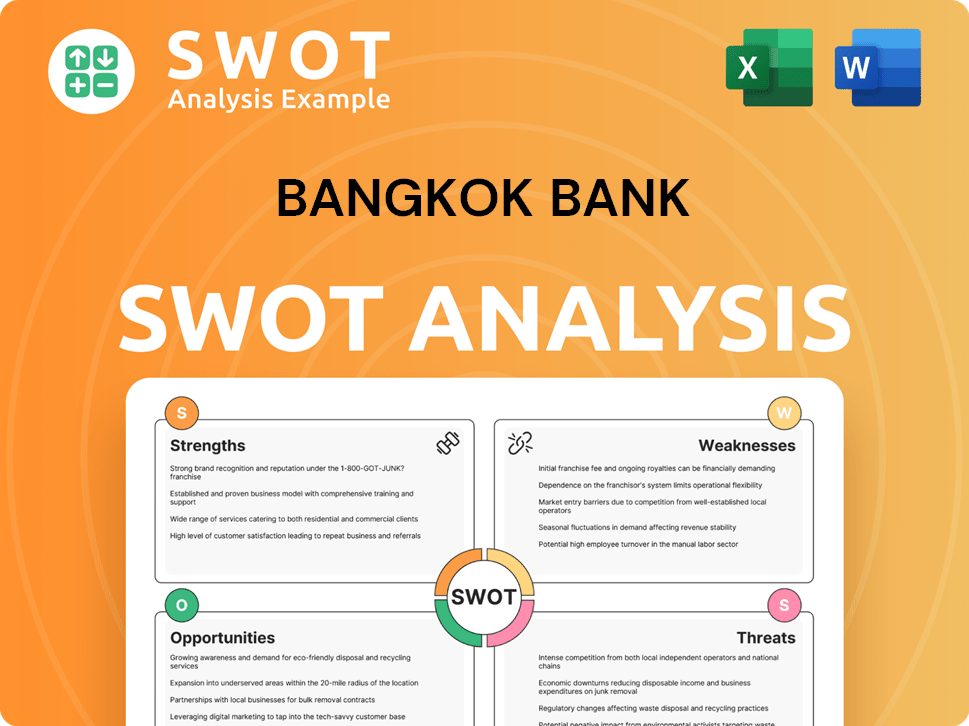

Bangkok Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bangkok Bank Make Money?

Bangkok Bank, a prominent financial institution, generates revenue through a diverse range of services. Its revenue streams are designed to capture value from various banking activities. Understanding these streams is crucial for assessing the bank's financial health and strategic direction.

The primary revenue sources for Bangkok Bank include net interest income, fee and service income, and gains from financial instruments. These streams reflect the bank's core operations and its ability to generate income from lending, transactions, and trading activities. The bank's monetization strategies involve tiered pricing, cross-selling, and digital transformation initiatives.

As of the end of 2024, net interest income is expected to be the largest contributor to the bank's total revenue, driven by loan growth and interest rate differentials. Fee and service income represents another significant stream, encompassing fees from credit cards, ATM transactions, fund transfers, bancassurance, wealth management services, and international banking services.

Bangkok Bank's revenue streams are multifaceted, contributing to its financial performance. The bank's operations are supported by several key income sources.

- Net Interest Income: This is the difference between interest earned on loans and investments and interest paid on deposits. It is a significant revenue driver, influenced by loan growth and interest rate spreads.

- Fee and Service Income: This includes fees from credit cards, ATM transactions, fund transfers, bancassurance, wealth management services, and international banking services. This stream is increasingly important as the bank expands its service offerings.

- Gains on Financial Instruments and Foreign Exchange: Revenue from trading activities and international operations contributes to this stream. It reflects the bank's ability to manage its investment portfolio and engage in foreign exchange transactions effectively.

The bank's monetization strategies are designed to maximize revenue from its services. The bank employs tiered pricing for various services, offering different benefits based on customer segments or transaction volumes. Cross-selling is a key strategy, where the bank leverages its existing customer base to offer additional products like insurance or investment funds. The bank has also been focusing on digital transformation, which is expected to enhance efficiency and potentially introduce new digital-centric revenue streams or optimize existing ones through lower operational costs. For more information about the bank's target customers, you can read about the Target Market of Bangkok Bank.

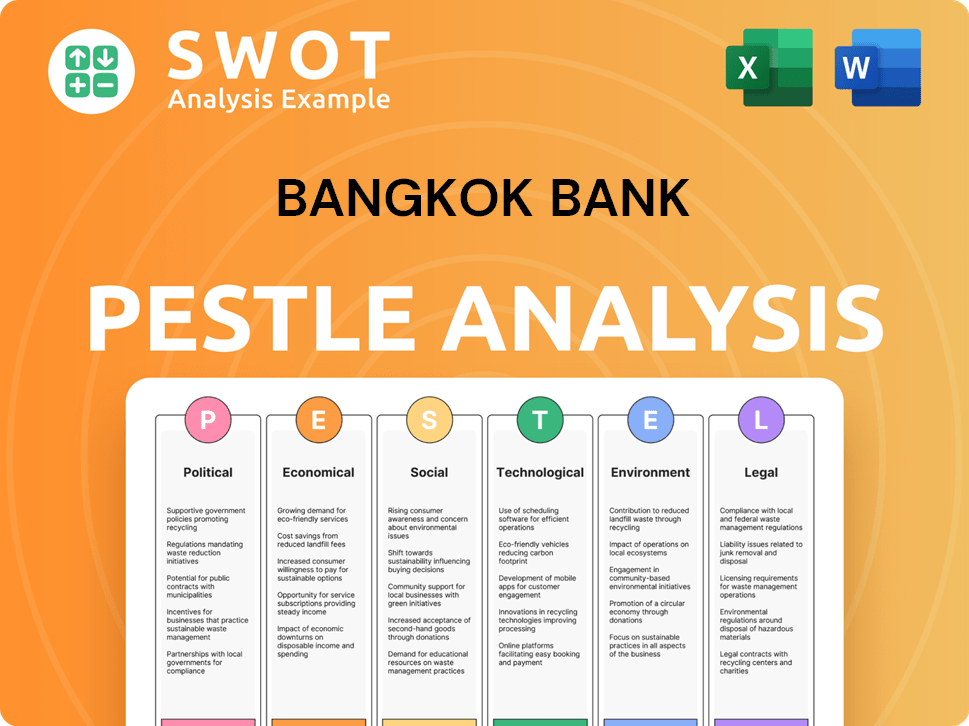

Bangkok Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bangkok Bank’s Business Model?

Bangkok Bank, a prominent Thai bank, has achieved significant milestones that have shaped its operations and financial performance. Key strategic moves, such as expanding its international network, particularly within ASEAN, have positioned it as a leading regional bank. The acquisition of PermataBank in Indonesia in 2020 was a pivotal moment, significantly bolstering its presence in Southeast Asia and diversifying its revenue base. This strategic move demonstrated the bank's commitment to regional integration and expansion.

Bangkok Bank operations have been characterized by continuous investment in digital transformation. The bank has launched enhanced mobile banking applications and online platforms to improve customer experience and operational efficiency. This adaptation to evolving technological trends and customer preferences has been crucial. The bank has also focused on prudent risk management and strategic adjustments to its lending portfolios, especially during economic uncertainties. For instance, it has focused on asset quality and maintaining strong capital adequacy ratios.

The bank's competitive advantages include strong brand recognition and deep-rooted customer loyalty, particularly among large Thai corporations and SMEs. Its extensive branch network and international footprint provide a significant distribution advantage. Furthermore, its long-standing expertise in corporate banking and trade finance offers a distinct competitive edge. The bank continues to adapt to new trends by investing in fintech, exploring opportunities in sustainable finance, and enhancing its data analytics capabilities to better understand customer needs.

Bangkok Bank's history includes several pivotal moments. The expansion of its international network, especially within ASEAN, has been a key strategy. The acquisition of PermataBank in 2020 was a significant step in expanding its Southeast Asian presence. This move was part of a broader strategy to diversify its revenue streams and strengthen its regional footprint.

The bank has consistently focused on expanding its international presence, particularly within the ASEAN region. Investment in digital transformation, including enhanced mobile banking and online platforms, has been a priority. Prudent risk management and strategic adjustments to lending portfolios, especially during economic downturns, have also been crucial. The bank has adapted to new trends by investing in fintech and exploring sustainable finance opportunities.

Bangkok Bank benefits from strong brand recognition and customer loyalty, particularly among large Thai corporations and SMEs. Its extensive branch network and international footprint provide a significant distribution advantage. The bank's expertise in corporate banking and trade finance offers a distinct competitive edge. The bank continues to enhance its data analytics capabilities to better understand customer needs.

As of 2024, Bangkok Bank's total assets were approximately $114.9 billion. The bank's net profit for 2023 was reported at $1.1 billion, reflecting a strong financial performance. The bank's capital adequacy ratio remains robust, demonstrating its financial stability. The bank's focus on digital transformation has led to increased online banking transactions, with over 70% of transactions conducted digitally.

Bangkok Bank is actively investing in fintech and exploring sustainable finance opportunities to stay relevant in a dynamic financial landscape. Enhancing data analytics capabilities is a key focus to better understand customer needs and drive personalized offerings. The bank's commitment to innovation ensures its continued relevance and competitiveness. For more insights, check out the Marketing Strategy of Bangkok Bank.

- Investment in fintech and sustainable finance.

- Enhancement of data analytics capabilities.

- Focus on personalized customer offerings.

- Continuous innovation to maintain competitiveness.

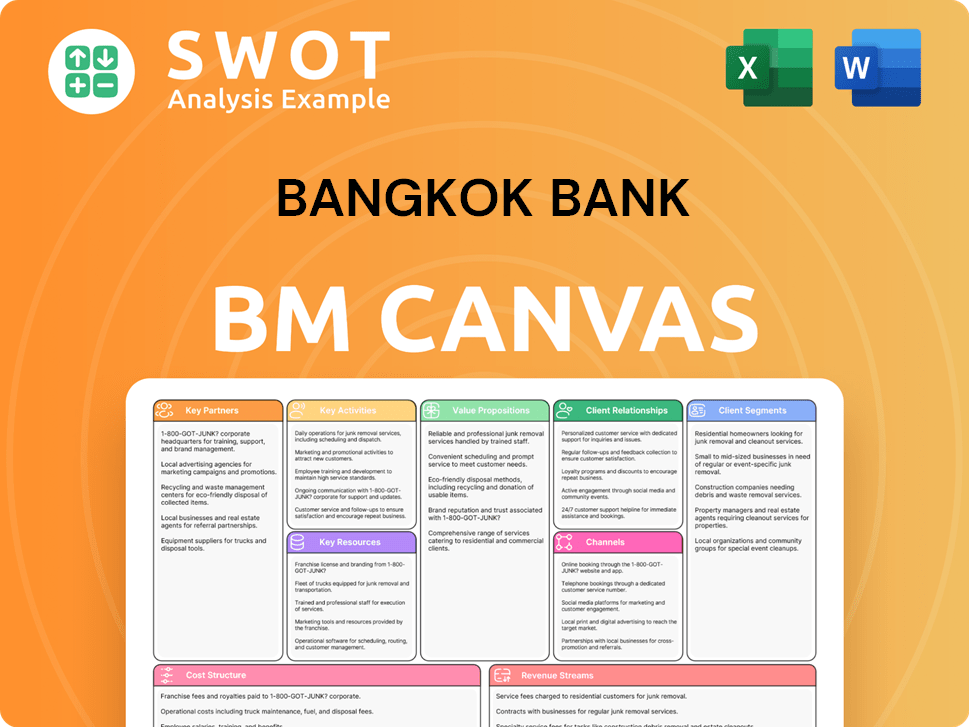

Bangkok Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bangkok Bank Positioning Itself for Continued Success?

Bangkok Bank, a prominent player in the Thai banking sector, consistently ranks among the top commercial banks by assets and market capitalization. Its strong market share in corporate and international banking, coupled with robust customer loyalty, especially among established businesses, gives it a competitive edge. The bank's extensive domestic network and significant international presence, particularly in Southeast Asia, further solidify its position.

However, Bangkok Bank faces several key risks, including regulatory changes and increased competition from both traditional banks and fintech companies. Economic downturns and technological disruptions also pose challenges. The bank’s future hinges on its ability to adapt and innovate to maintain its competitive edge in a rapidly evolving financial landscape.

Bangkok Bank is a leading Thai bank, holding a significant market share in Thailand's banking sector. It excels in corporate and international banking, supported by a vast network and strong customer relationships. Its strategic international presence, especially in ASEAN, is a key differentiator.

Bangkok Bank faces risks from regulatory changes, increased competition, and economic downturns. Technological advancements and the rise of fintech companies also present challenges. Maintaining profitability requires constant adaptation to these evolving market dynamics.

The bank is focused on digital transformation, international network integration, and sustainable finance. Leadership emphasizes innovation, customer-centricity, and prudent risk management. The goal is to strengthen its position as a regional leader, capitalizing on ASEAN's growth.

Bangkok Bank is prioritizing digital transformation to enhance customer experience and operational efficiency. It aims to leverage its international network further and is increasing its emphasis on sustainable finance and ESG principles in its lending and investment activities. These initiatives are designed to ensure the bank's continued success.

Bangkok Bank's strategic initiatives include digital transformation, international network expansion, and a focus on sustainable finance. The bank is adapting to the changing financial landscape through strategic investments and a diversified business model. This approach aims to solidify its position as a regional banking leader.

- Digital Transformation: Enhancing online banking features and the mobile app.

- International Network: Expanding its footprint in ASEAN and beyond.

- Sustainable Finance: Integrating ESG principles into its operations.

- Customer-Centricity: Improving customer service and experience.

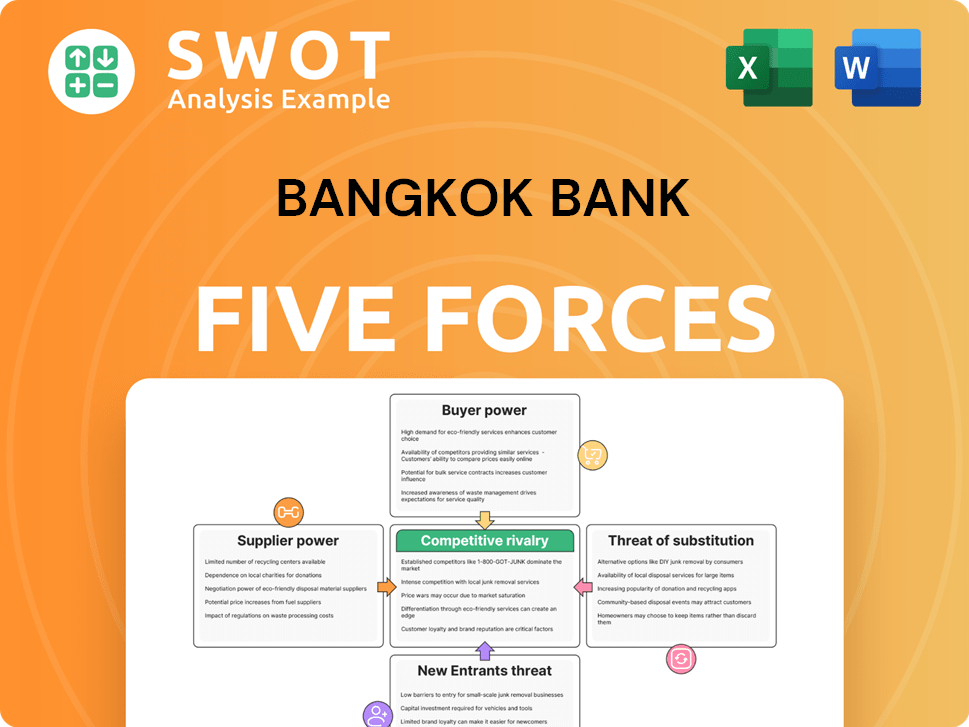

Bangkok Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bangkok Bank Company?

- What is Competitive Landscape of Bangkok Bank Company?

- What is Growth Strategy and Future Prospects of Bangkok Bank Company?

- What is Sales and Marketing Strategy of Bangkok Bank Company?

- What is Brief History of Bangkok Bank Company?

- Who Owns Bangkok Bank Company?

- What is Customer Demographics and Target Market of Bangkok Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.