Bangkok Bank Bundle

Who are Bangkok Bank's Customers?

In today's dynamic financial world, understanding the customer demographics and target market is crucial for any bank's success. Bangkok Bank, a cornerstone of Thailand's financial sector, has adapted and evolved to meet changing customer needs. This analysis dives into the heart of Bangkok Bank's customer base, revealing key insights into their profile and preferences.

From its origins supporting post-war economic recovery to its current status as a comprehensive financial services provider, Bangkok Bank's Bangkok Bank SWOT Analysis offers a detailed look at its strategic evolution. This exploration will uncover the bank's customer profile, including age range, income levels, and location data, while also examining their preferred banking products and behaviors. Analyzing the bank's market segmentation and target market strategy provides valuable insights for investors and financial professionals alike, offering a deeper understanding of Bangkok Bank's customer acquisition cost and retention rate.

Who Are Bangkok Bank’s Main Customers?

Understanding the customer demographics and target market of Bangkok Bank is crucial for grasping its strategic positioning within the financial services sector. The bank's approach involves serving a diverse range of customers, both individual consumers (B2C) and businesses (B2B). This broad customer base allows Bangkok Bank to maintain a strong presence in the market and adapt to changing economic conditions.

The bank's customer base includes a wide spectrum of ages, with a growing emphasis on younger, digitally-savvy individuals alongside its traditional customer base. While specific demographic breakdowns are proprietary, the bank's extensive branch network across Thailand suggests a significant presence among middle to upper-income households. This wide reach enables Bangkok Bank to offer a variety of financial products and services tailored to different needs.

Bangkok Bank's target market strategy focuses on both retail and business customers, adapting to market trends and customer needs. This includes expanding digital services and specialized offerings for SMEs, reflecting its responsiveness to market research and external economic trends. This approach allows the bank to capture growth opportunities in emerging segments and maintain a competitive edge in the financial services industry.

Bangkok Bank caters to a diverse customer base, including individuals and businesses. Individual customers span a wide age range, with a growing focus on younger, digitally-savvy individuals. The bank's presence is significant among middle to upper-income households, reflecting its broad market reach.

The bank segments its market into B2C and B2B categories. For B2B, it serves SMEs and large corporations across various industries. The bank's strategy involves expanding its SME and retail customer base, driven by digital economy growth and diversification efforts.

Bangkok Bank has historically focused on large corporate clients but is now expanding its SME and retail customer base. This shift is driven by increasing competition and the growth of the digital economy. The bank is actively promoting digital lending solutions and specialized services for SMEs.

The bank's strategies reflect market research and external economic trends. They aim to capture growth opportunities in emerging segments. This includes digital lending solutions and specialized services for SMEs, recognizing their potential for rapid growth.

Bangkok Bank's primary customer segments include a diverse range of individuals and businesses. The bank strategically targets both retail and business clients, adapting to market trends and customer needs. This approach is supported by initiatives to expand digital services and specialized offerings for SMEs.

- Individual Customers: Wide age range, with a growing focus on younger, digitally-savvy individuals.

- Business Customers: SMEs and large corporations across various industries.

- Strategic Initiatives: Expanding digital lending solutions and specialized services for SMEs.

- Market Adaptation: Responding to market research and external economic trends.

For a deeper understanding of the bank's origins and evolution, consider reading about its history in Brief History of Bangkok Bank.

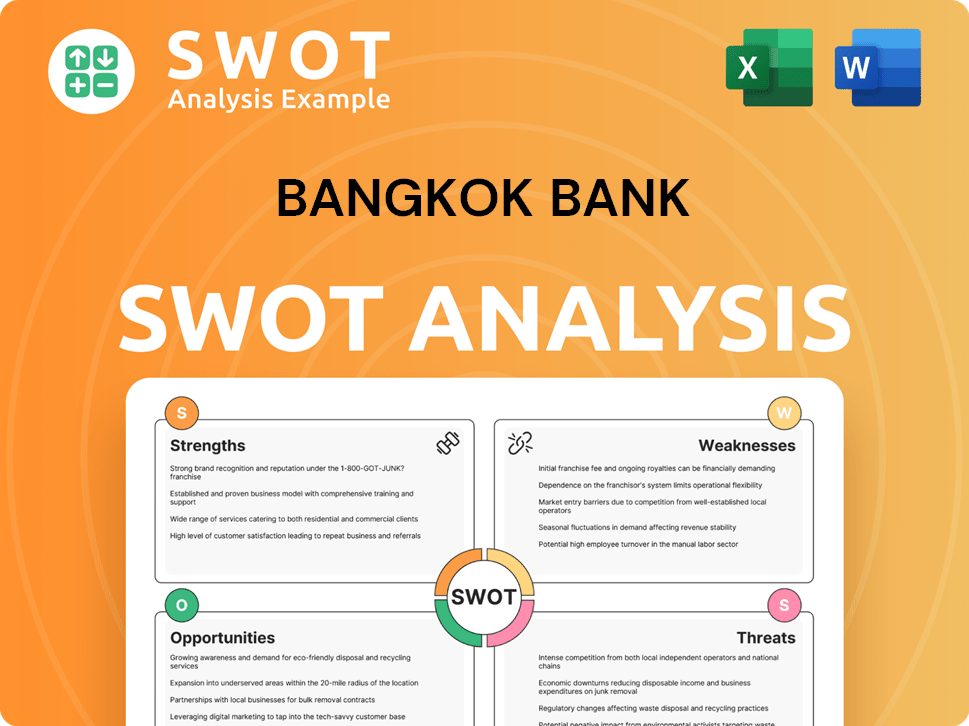

Bangkok Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bangkok Bank’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial institution. For Bangkok Bank, this involves catering to a diverse clientele with varying financial goals and expectations. This analysis delves into the key drivers behind customer decisions and how the bank adapts to meet these needs effectively.

The bank's approach is multifaceted, focusing on both individual and business clients. By analyzing the specific needs of each segment, Bangkok Bank can tailor its services and marketing strategies to enhance customer satisfaction and loyalty. This customer-centric approach is essential for maintaining a competitive edge in the financial services industry.

Bangkok Bank's customer base is segmented to better understand and serve their needs. This includes individual customers seeking convenience and security, and business clients requiring specialized financial solutions. The bank's strategies are designed to address the unique demands of each segment, ensuring a high level of customer satisfaction.

Individual customers prioritize convenience, security, and accessibility. They increasingly use digital banking for daily transactions and bill payments. The ease of use of mobile apps and online services heavily influences their purchasing behaviors.

Key factors include competitive interest rates, the breadth of product offerings, and reliable customer service. Psychological drivers include financial stability and growth, while practical drivers focus on efficient money management.

Bangkok Bank enhances its digital platforms and expands its ATM network to reduce wait times at branches. This ensures customers can access services quickly and efficiently. Continuous improvement is a priority.

Business clients require efficient cash management, access to capital, international trade finance, and risk management services. Tailored financial solutions and competitive financing options are essential for their success.

The bank offers specialized corporate banking services, trade finance solutions, and dedicated relationship managers. These services are designed to meet the specific needs of business clients, fostering strong relationships.

Feedback from surveys and direct interactions influences product development. This leads to features like enhanced mobile banking, streamlined loan applications, and specialized investment products. Customer input is highly valued.

To effectively target its customer demographics, Bangkok Bank leverages various marketing strategies. For retail customers, the bank emphasizes the benefits of its digital services, highlighting convenience and ease of use. For business clients, the focus is on the bank's expertise in corporate finance and tailored financial solutions. This targeted approach helps Bangkok Bank to maintain and grow its target market share. For further insights into the financial structure and ownership, you can explore the details in the article about Owners & Shareholders of Bangkok Bank.

Bangkok Bank's approach to customer needs is data-driven and customer-centric. The bank continually monitors customer behavior and preferences to refine its offerings and services. Here are some key strategies and data points that inform their approach:

- Digital Banking Adoption: In 2024, approximately 70% of Bangkok Bank customers actively used digital banking platforms for their transactions, reflecting a significant shift towards online and mobile banking.

- Customer Satisfaction: The bank consistently scores above 80% in customer satisfaction surveys, indicating a high level of trust and satisfaction with the services provided.

- Loan Application Process: The bank has streamlined its loan application process, reducing processing times by 30% in 2024. This improvement has led to increased customer satisfaction and faster access to funds.

- Market Share: Bangkok Bank holds a significant market share in Thailand's banking sector, with approximately 20% of the total banking assets.

- Investment in Technology: The bank has invested over $200 million in technology upgrades in the past year to enhance its digital infrastructure and improve customer experience.

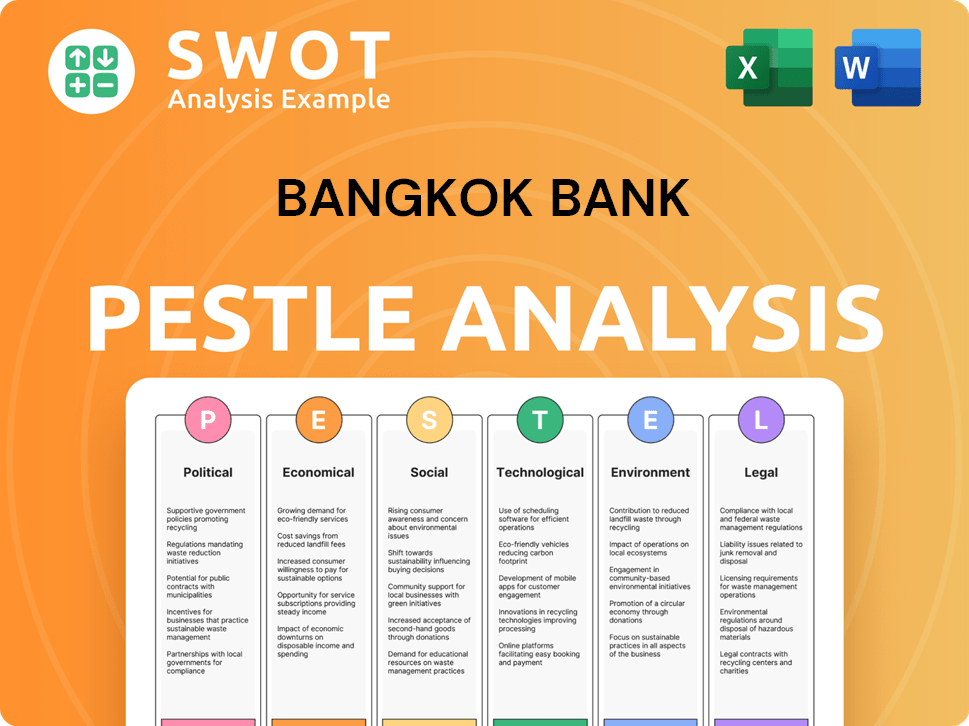

Bangkok Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bangkok Bank operate?

Bangkok Bank's geographical market presence is primarily centered in Thailand, where it holds a significant market share and strong brand recognition. The bank's extensive network of branches and ATMs covers the entire country, ensuring accessibility for a diverse Customer demographics in major cities like Bangkok, Chiang Mai, and Phuket, as well as in more rural areas. This wide reach is a key factor in its ability to serve a broad range of Bank customers.

Beyond its domestic operations, Bangkok Bank has a notable international presence. It operates branches in key financial hubs and economic centers across Asia and beyond. These locations include China, Hong Kong, Japan, Singapore, Malaysia, Vietnam, Laos, Cambodia, the Philippines, Indonesia, and the United Kingdom. This international footprint allows the bank to cater to both Thai businesses operating abroad and local businesses engaged in trade with Thailand.

The bank tailors its services to meet the specific needs of each market. For instance, branches in China often facilitate cross-border transactions and investments between Thailand and China. Recent expansions and strategic adjustments are typically driven by economic opportunities and geopolitical considerations. This approach helps the bank maintain a competitive edge and serve its diverse customer base effectively. For more insights, you can explore the Marketing Strategy of Bangkok Bank.

Bangkok Bank maintains a strong presence in Thailand. Its network of branches and ATMs ensures accessibility for a diverse customer base. The bank's operations cover major cities and rural areas, reflecting a comprehensive approach to market penetration.

Bangkok Bank strategically expands its international presence. It focuses on key financial hubs and economic centers. This expansion includes locations in Asia and other regions. The bank's international strategy supports its growth objectives.

The bank customizes services to meet specific market needs. In China, it facilitates cross-border transactions. This targeted approach helps the bank remain competitive. It ensures that services are relevant to each market.

Bangkok Bank focuses on providing services in relevant languages. It adheres to local regulations. The bank tailors products to meet the specific needs of each market. This approach enhances customer satisfaction.

Recent data indicates Bangkok Bank's consistent growth. The bank's domestic market share remains strong. International operations contribute significantly to its overall revenue. The bank's strategic expansions are driven by economic opportunities.

- Market Share: Bangkok Bank holds a significant market share in Thailand, estimated at around 19% in 2024.

- International Presence: The bank operates in over a dozen countries, with a growing focus on the ASEAN region.

- Revenue Growth: Bangkok Bank has shown consistent revenue growth, with international operations contributing approximately 20% of the total revenue in 2024.

- Customer Base: The bank serves a diverse customer base, including individuals, SMEs, and large corporations.

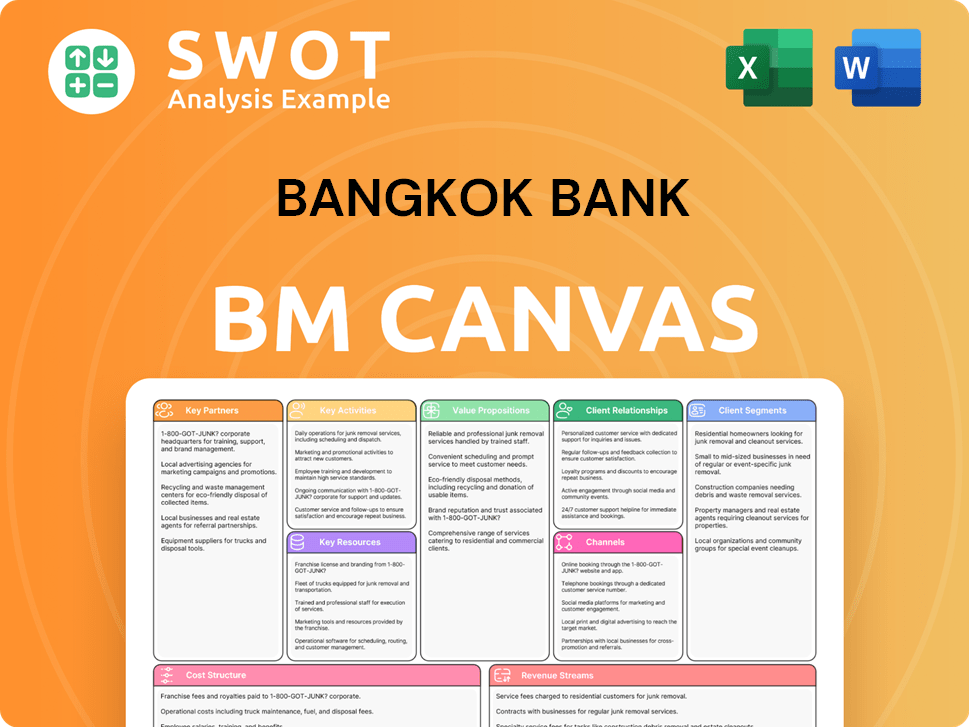

Bangkok Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bangkok Bank Win & Keep Customers?

The strategy of acquiring and retaining customers at Bangkok Bank is a blend of traditional and modern marketing approaches. The bank focuses on a broad customer base through various channels. They use both established methods and digital platforms to reach different segments of the population. Understanding the customer demographics is crucial for tailoring these strategies effectively.

For customer acquisition, Bangkok Bank utilizes a mix of traditional advertising and digital marketing. Traditional advertising includes television, radio, and print media, which help them reach a wide audience. Digital marketing efforts involve social media campaigns on platforms like Facebook and LINE, search engine marketing, and online content to attract younger, tech-savvy customers. Sales tactics are supported by a strong branch network with relationship managers who provide personalized service, particularly for corporate and high-net-worth clients. The bank also runs targeted promotions and partnerships to draw in new customers.

Customer retention is another key focus, emphasizing loyalty and increasing customer lifetime value. This is achieved by offering loyalty programs, such as reward points for credit card use and preferential rates for long-term deposits. They also use data analytics to personalize customer experiences, provide tailored product recommendations, and offer proactive customer support. Customer data and CRM systems are essential for segmenting customers for targeted campaigns and improving service delivery. After-sales service, including dedicated customer service hotlines and in-branch support, is a key differentiator. Recent successful acquisition campaigns have featured digital product launches, such as new mobile banking features and online loan applications. Innovative retention initiatives include gamified savings programs within their mobile app and exclusive events for premium customers. These strategies are continually refined based on customer feedback and market trends, aiming to reduce churn and build lasting relationships.

Bangkok Bank uses television, radio, and print media. These channels are essential for reaching a wide audience, particularly within Thailand. This approach ensures broad visibility and brand recognition across different demographic groups.

Digital marketing involves social media, search engine marketing, and online content. Platforms like Facebook and LINE are used to engage with younger, digitally-native customers. This strategy helps in reaching a more specific target market.

Relationship managers provide personalized service, especially for corporate and high-net-worth clients. This approach ensures tailored solutions and builds strong customer relationships. Such personalized interactions are crucial for customer retention.

Loyalty programs include reward points for credit card usage and preferential rates for long-term depositors. These programs incentivize continued engagement and build customer loyalty. Such initiatives are key to enhancing customer lifetime value.

Bangkok Bank's approach to customer acquisition and retention is comprehensive, utilizing both traditional and digital strategies to cater to a diverse customer base. The bank's focus on personalized service, loyalty programs, and data analytics underscores its commitment to building long-term customer relationships. For more insights into the bank's strategic direction, consider exploring the Growth Strategy of Bangkok Bank.

Market segmentation allows the bank to target specific customer groups with tailored products and services. This ensures that marketing efforts are more effective and resonate with the intended audience. Segmentation helps in understanding the different needs of various bank customers.

Data analytics is used to personalize customer experiences and offer tailored product recommendations. By analyzing customer data, the bank can anticipate customer needs and provide proactive support. This helps in improving customer satisfaction and retention.

Recent acquisition campaigns have focused on digital product launches, such as new mobile banking features and online loan applications. These initiatives attract tech-savvy customers and enhance the bank's digital presence. This helps in reaching a wider audience.

Innovative retention initiatives include gamified savings programs within the mobile app. These programs encourage regular savings and enhance customer engagement. This approach makes banking more interactive and appealing.

Exclusive events are organized for premium customers to enhance loyalty and provide added value. These events create a sense of exclusivity and strengthen customer relationships. This strategy helps in retaining high-value customers.

Dedicated customer service hotlines and in-branch support are key differentiators. Excellent after-sales service ensures customer satisfaction and builds long-term loyalty. This helps in reducing customer churn.

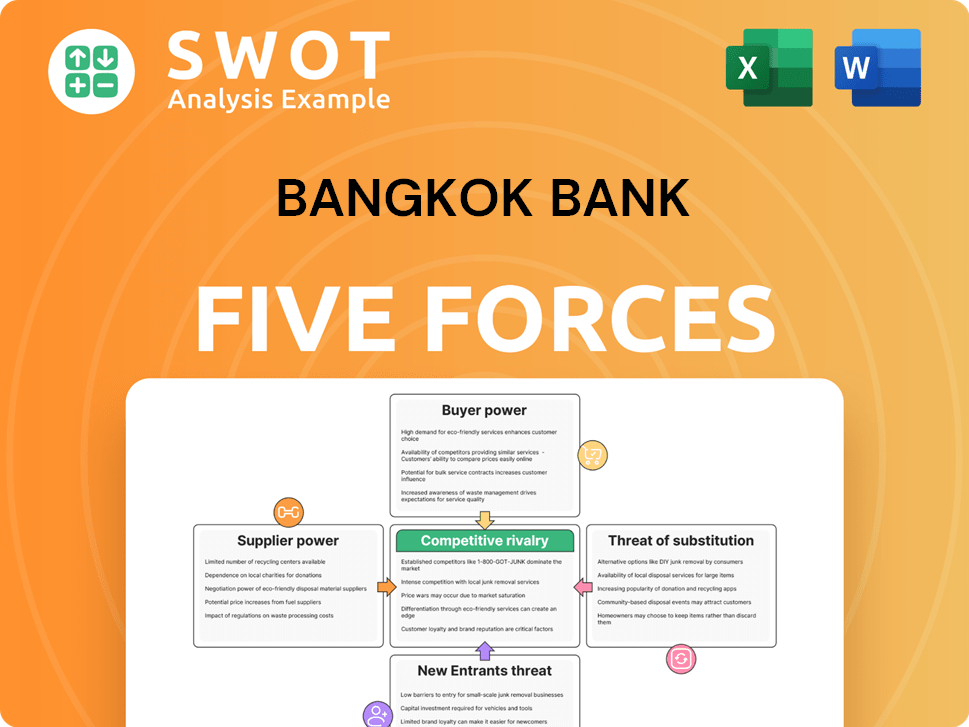

Bangkok Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bangkok Bank Company?

- What is Competitive Landscape of Bangkok Bank Company?

- What is Growth Strategy and Future Prospects of Bangkok Bank Company?

- How Does Bangkok Bank Company Work?

- What is Sales and Marketing Strategy of Bangkok Bank Company?

- What is Brief History of Bangkok Bank Company?

- Who Owns Bangkok Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.