Belk Bundle

How Does the Belk Company Thrive in Today's Retail Market?

Belk, a cornerstone of Southern retail since 1888, continues to evolve within a dynamic industry. This iconic Belk SWOT Analysis provides a comprehensive look at the company's strengths, weaknesses, opportunities, and threats. With nearly 300

From its extensive selection of apparel, shoes, and home goods to its growing Belk online presence, the company's strategies are constantly adapting. This exploration will examine how Belk navigates challenges, such as the rise of e-commerce and evolving consumer preferences, to maintain its market position. Investors and customers alike will gain valuable insights into the inner workings of this established

What Are the Key Operations Driving Belk’s Success?

The core operations of the Belk company revolve around delivering a diverse range of merchandise to its customer base, primarily in the Southern United States. The company's value proposition centers on offering a curated selection of apparel, shoes, accessories, cosmetics, and home furnishings. This caters to a broad demographic seeking moderately priced designer and private brand items. The Belk department store focuses on providing a personalized shopping experience, which includes services like alterations and gift wrapping.

Belk's operational processes are multifaceted, encompassing sourcing, inventory management, logistics, and sales across its physical stores and e-commerce platform. The company's omnichannel strategy is a key component, seamlessly integrating physical stores with its online platform. This approach is designed to meet various consumer preferences, and has shown to increase customer lifetime value, with omnichannel retailers seeing a 15% increase in customer lifetime value in 2024.

Technology plays a crucial role in optimizing operations. Belk uses tools like SAS Analytics to refine inventory and allocation. This ensures the right sizes are available in the right stores, improving profitability. The supply chain and distribution networks are designed to ensure timely delivery of merchandise to its nearly 300 stores. Belk's strong regional focus in the Southeast, fostering community connections and strong brand recognition, sets it apart from larger chains.

Belk carefully manages its supply chain to ensure product availability and efficient distribution. They use data analytics to optimize inventory levels and allocation, ensuring popular items are stocked appropriately. Effective inventory management is crucial for minimizing costs and maximizing sales.

Belk's omnichannel approach integrates physical stores with its online platform. This allows customers to shop how they prefer, whether in-store, online, or a combination of both. The seamless experience improves customer satisfaction and drives sales, with omnichannel retailers seeing a 15% increase in customer lifetime value in 2024.

Belk emphasizes personalized shopping experiences, including services like alterations and gift wrapping. These services help build customer loyalty and differentiate Belk from competitors. Customer-focused strategies are essential for maintaining a strong brand reputation.

Belk's strong presence in the Southeast allows it to build community connections and brand recognition. This regional focus helps Belk understand and cater to local preferences. This approach is a key differentiator compared to larger national chains.

Belk distinguishes itself through its regional focus, personalized customer service, and omnichannel strategy. These elements enhance customer loyalty and drive sales. For more insights, explore the Growth Strategy of Belk.

- Strong regional presence in the Southeast.

- Personalized shopping experiences and customer service.

- Seamless integration of physical and online shopping.

- Effective use of data analytics for inventory management.

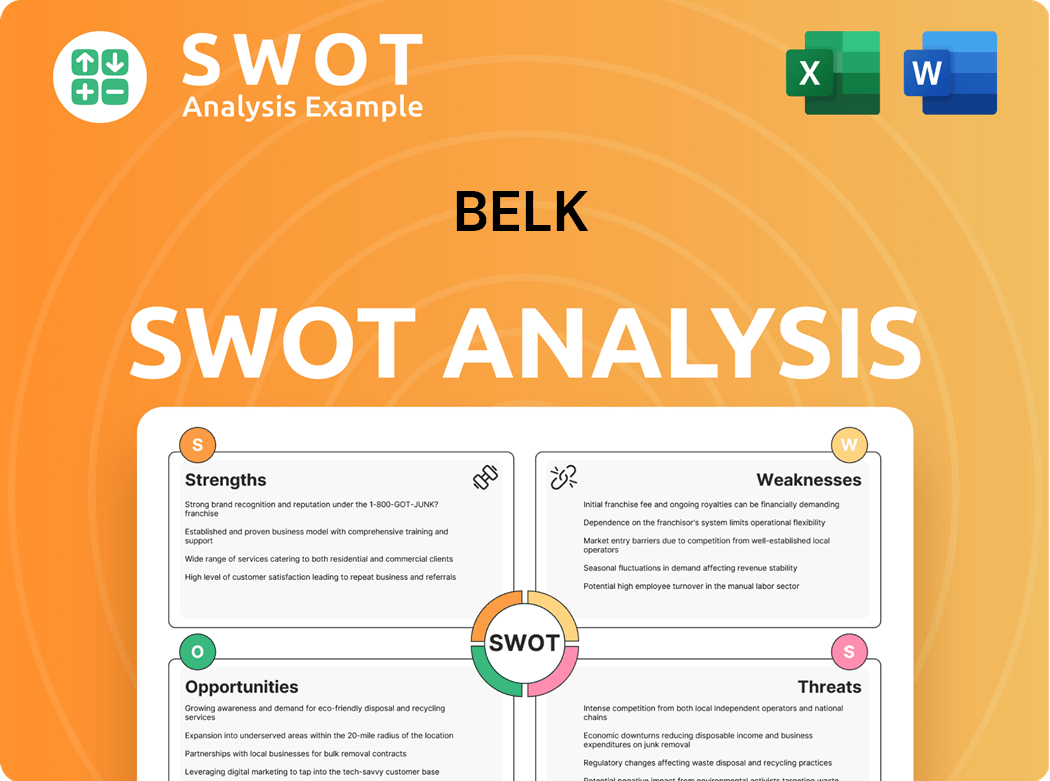

Belk SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Belk Make Money?

The Belk company, a prominent Belk department store, generates revenue primarily through the sale of merchandise across its physical Belk stores and online platform. This includes a wide array of products such as apparel, shoes, accessories, cosmetics, and home goods. While specific financial details for 2024-2025 are not publicly available due to its private ownership, understanding its revenue streams provides insight into its business model.

A key aspect of Belk's revenue strategy involves its private label brands, which contribute significantly to overall sales. These brands often offer higher profit margins compared to other brands sold. Furthermore, Belk has diversified its monetization strategies through initiatives like its retail media network, which allows for advertising on its digital platforms.

In 2024, Belk's annual revenue was $2.9 billion, following $3.1 billion in 2023 and $3.3 billion in 2022. This indicates the company's recent financial performance. The company's strategic moves, such as the launch of the Belk Media Network in October 2024, are aimed at enhancing revenue generation and customer engagement.

Private label brands like Crown & Ivy are a significant revenue source. In 2024, these brands accounted for approximately 25% of Belk's sales. They offer higher profit margins, typically 15-20% more than other brands.

Launched in October 2024, this network allows brands to advertise on Belk's digital properties. It uses sponsored products and onsite display advertising. Expansion into additional formats is planned for 2025.

The Belk Rewards+ program generates revenue through its securitization facility. In July 2024, it secured $210 million in new capital. This program also drives customer loyalty through discounts and rewards.

Revenue is generated through both Belk online sales and sales in physical stores. The company's strategy focuses on providing a seamless shopping experience across all channels. This approach aims to cater to diverse consumer preferences.

The Belk credit card program and other loyalty initiatives are designed to encourage repeat business. These programs offer incentives that increase customer retention. This helps stabilize revenue streams.

Collaborations with brands and agencies through the Belk Media Network are crucial. These partnerships expand reach and provide additional revenue streams. This is vital for growth.

The company's financial performance is driven by diverse strategies. These include private label brands, retail media, and customer loyalty programs. For more details on Belk and its financial performance, you can read this article about the company. These strategies are designed to maximize profitability and customer engagement.

- Sales of merchandise across physical stores and Belk online.

- Private label brands with higher profit margins.

- The Belk Media Network for advertising revenue.

- The Belk Rewards+ credit card program.

- Strategic partnerships to expand reach.

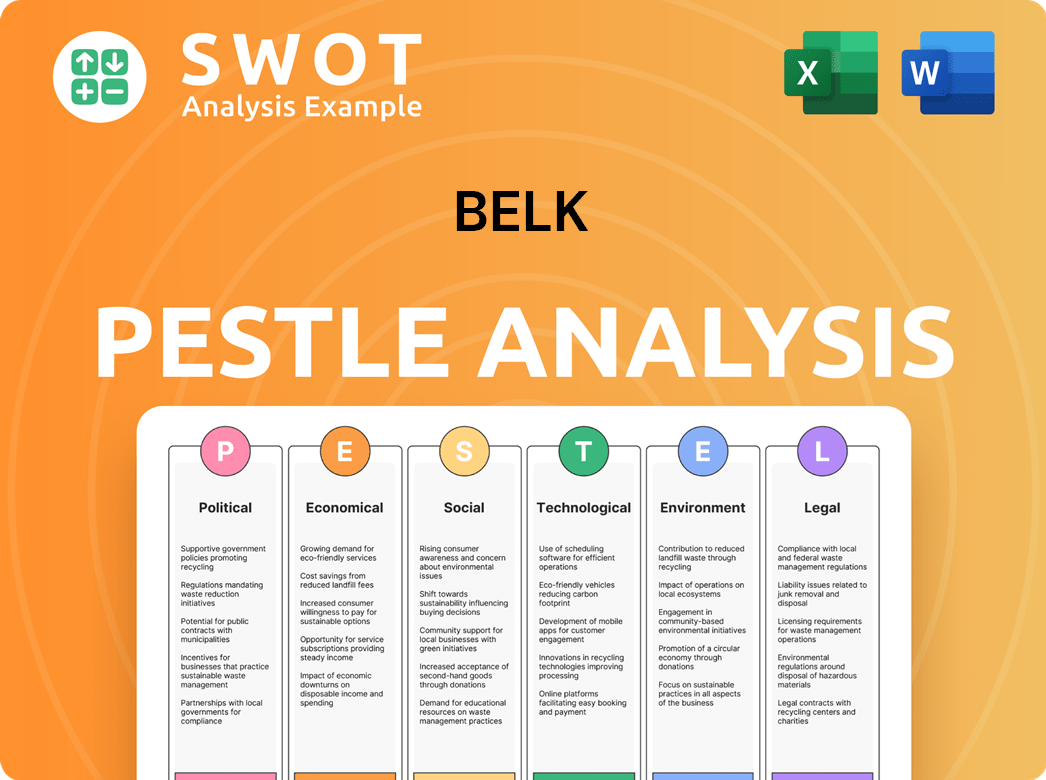

Belk PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Belk’s Business Model?

The Belk company has navigated the evolving retail landscape through strategic maneuvers and significant milestones. These actions have been crucial for maintaining its market position. The company has focused on strengthening its financial health and expanding its retail presence.

A key strategic move was the deleveraging transaction completed in July 2024. This financial restructuring reduced outstanding debt and secured new capital. Belk's focus on partnerships and its expansion of retail formats, such as the Belk Outlet stores, are also key components of its strategy.

Belk's competitive edge stems from its strong regional presence, brand heritage, and omnichannel strategy. The company continues to adapt to market trends. The company's loyalty program enhances the customer experience.

In July 2024, Belk completed a deleveraging transaction, reducing debt by over $950 million and securing approximately $485 million in new capital. This extended the maturity date of its asset-based credit facility to July 2029. A prior milestone was the one-day bankruptcy filing in 2021, which also involved debt reduction and loan extensions.

Belk has expanded its retail footprint with Belk Outlet stores, with two new stores opening in North Carolina in February 2025. Partnerships, such as the collaboration with Fanatics in August 2024 for licensed sports merchandise on Belk.com, have also been key. A multi-year partnership with the Carolina Panthers was announced in October 2024.

Belk benefits from a strong regional presence in the Southeastern U.S., fostering brand recognition and customer loyalty. Its omnichannel strategy integrates physical and digital shopping experiences. The Belk Rewards+ loyalty program can increase customer lifetime value by up to 25%.

Belk is investing in its retail media network and enhancing customer experience through technology. This includes AI-driven personalization, a trend in 2024. The company's focus on adapting to new trends and technology shifts is evident in its strategic initiatives. For more details, consider reading about the Growth Strategy of Belk.

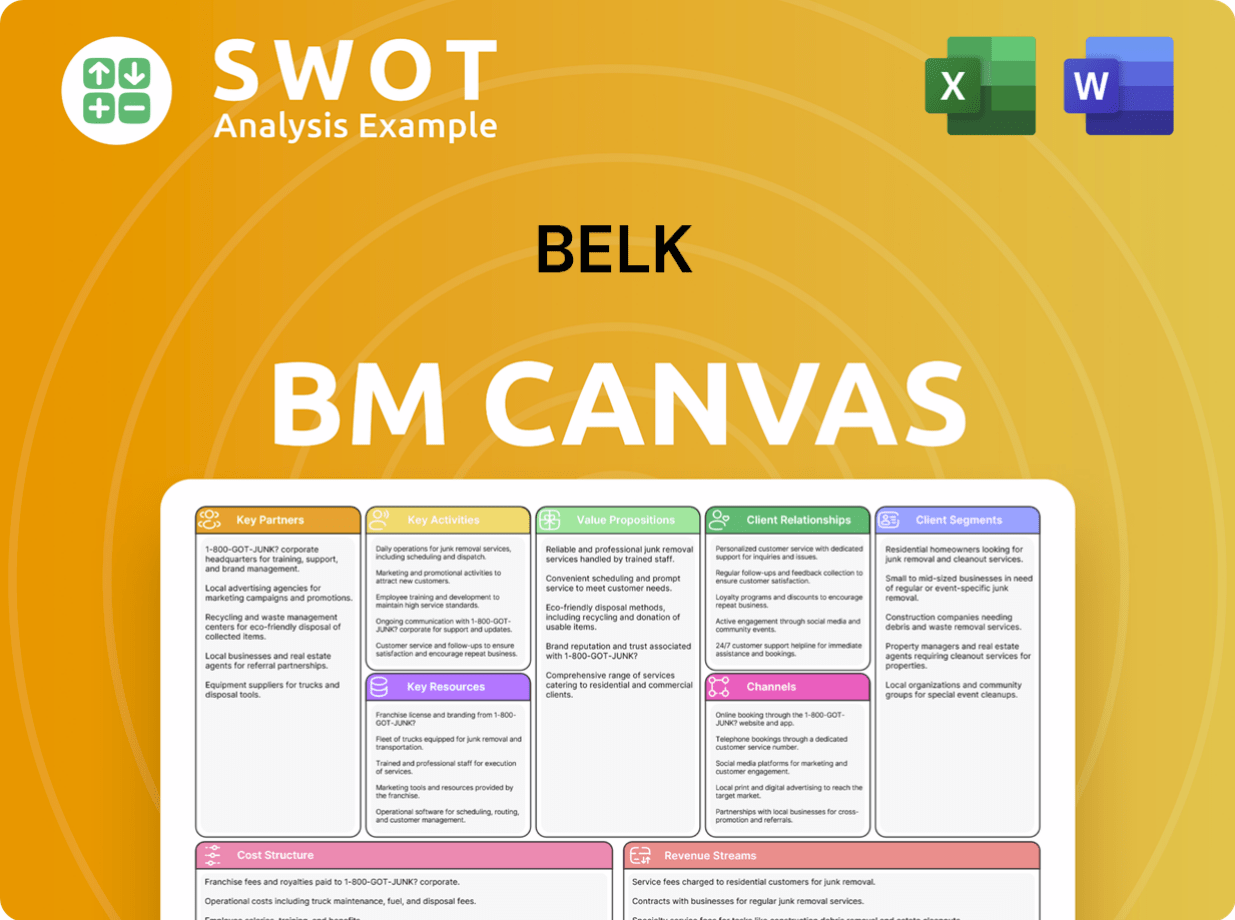

Belk Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Belk Positioning Itself for Continued Success?

The Belk company holds a significant position in the Southeastern United States, operating nearly 300 department stores across 16 states. This strong regional presence contributes to high brand recognition and customer loyalty. However, this geographic concentration poses a risk, as it makes the Belk department store vulnerable to regional economic fluctuations and limits its potential for expansion beyond its current footprint.

Belk faces intense competition from both online and traditional retailers. The accelerating shift to online shopping, with e-commerce accounting for roughly 16% of total retail sales in 2024, presents a challenge to its brick-and-mortar focus, as approximately 60% of its sales in 2024 were generated from physical Belk stores. Declining mall foot traffic, which decreased by 10% in 2024, further impacts its traditional model. In May 2025, a cyber incident disrupted its systems, though no sensitive customer data was impacted.

Belk has a strong regional presence in the Southeastern United States. This regional focus contributes to brand recognition and customer loyalty. However, this concentration also presents risks due to regional economic factors.

Belk faces intense competition from online and traditional retailers. The shift to online shopping and declining mall foot traffic pose challenges. Belk has also experienced past financial instability and a recent cyber incident.

The company is focused on boosting its e-commerce and digital presence. Strategic initiatives include expanding its outlet store concept and forming strategic partnerships. Belk is also enhancing customer experience through technology.

Belk is expanding its e-commerce and digital presence, with e-commerce growing 8% in Q1 2024. They are growing their outlet store concept, capitalizing on the rising demand for discounted goods, with off-price sales hitting $87 billion in 2024. Strategic partnerships are expected to diversify product lines and attract new customers.

Belk is focused on several strategic initiatives to sustain and expand its business. These include boosting its e-commerce and digital presence, expanding its outlet store concept, and forming strategic partnerships. They are also committed to enhancing customer experience through technology.

- Enhancing e-commerce and digital presence.

- Expanding the outlet store concept.

- Forming strategic partnerships.

- Improving customer experience through technology.

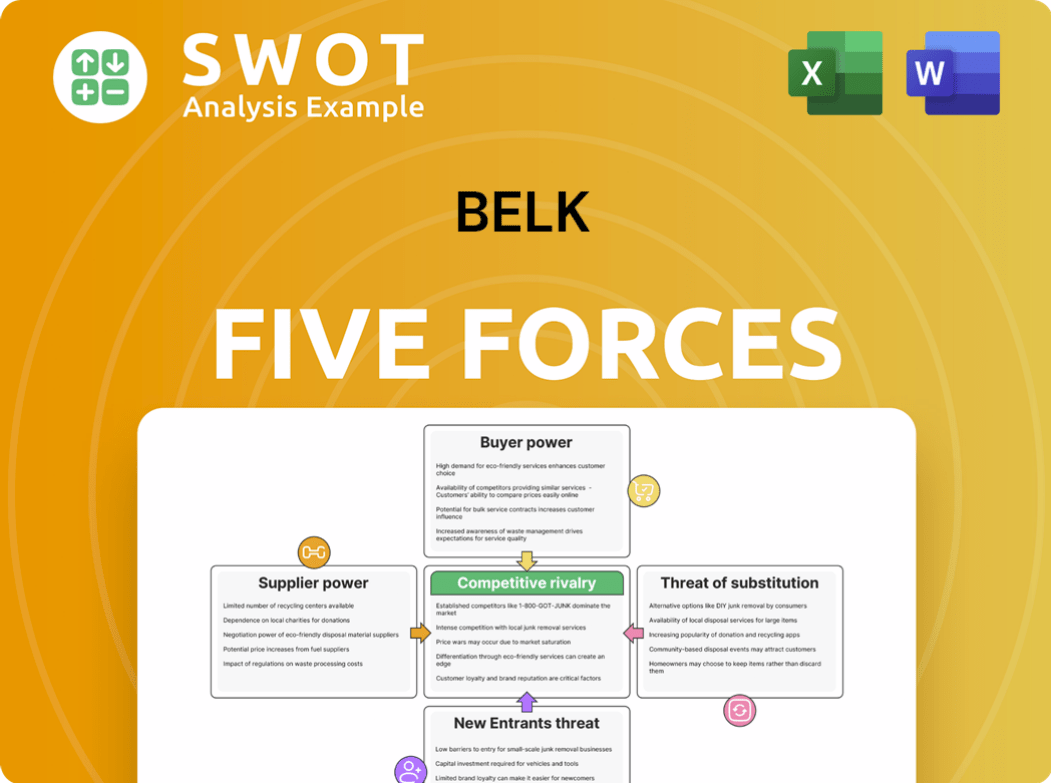

Belk Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Belk Company?

- What is Competitive Landscape of Belk Company?

- What is Growth Strategy and Future Prospects of Belk Company?

- What is Sales and Marketing Strategy of Belk Company?

- What is Brief History of Belk Company?

- Who Owns Belk Company?

- What is Customer Demographics and Target Market of Belk Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.