Belk Bundle

Who Really Owns Belk?

Understanding the ownership of a company is crucial for investors and strategists alike. A company's ownership structure dictates its strategic direction and financial performance. For Belk, a historic department store chain, the question of ownership is particularly compelling given its long and dynamic history.

Founded in 1888, Belk's journey from a small store to a major retail player offers valuable insights into the evolution of the retail landscape. This exploration into Belk SWOT Analysis will examine the Belk company's ownership, tracing its path from its founders to its current status. Discover the key players and events that have shaped the Belk department store and its Belk ownership structure, providing a comprehensive understanding of its past, present, and potential future.

Who Founded Belk?

The story of the Belk department store begins in 1888 with William Henry Belk. At just 26 years old, he launched his first store, 'New York Racket,' in Monroe, North Carolina. This marked the beginning of what would become a significant retail presence in the United States.

William Henry Belk started with modest resources: $750 of his own savings, a $500 loan, and approximately $3,000 worth of consigned goods. His early success was remarkable. Within seven months, Belk had not only repaid his debts but also generated a profit of $3,300, showcasing the effectiveness of his business model.

In 1891, William Henry Belk brought his brother, Dr. John M. Belk, into the business as a partner. The company was then renamed Belk Brothers Company, which fueled its expansion across the Carolinas. The brothers focused on keeping costs down and growing cautiously, which allowed them to buy up struggling competitors.

William Henry Belk implemented several innovative practices. He used clearly marked, non-negotiable prices, offered cash-only sales with full refunds, and extended store hours.

He emphasized 'bargain' items and was an early adopter of advertising. By 1897, he had established a cooperative buying network for his stores and others, which allowed for bulk purchases at lower prices.

The Monroe store served as the operational center until 1895 when the fourth and largest store opened in Charlotte, becoming the company's new base. Dr. John Belk managed the Monroe store until his death in 1928.

The Belk family maintained considerable Belk ownership, holding 70% of the Belk company by 2015. This made it the largest family-owned Belk department store chain in the U.S. at the time. For more details on its history, you can read about the [Belk history](0).

Understanding the Belk company ownership structure is key to grasping its evolution. Here are some important points:

- William Henry Belk founded the company in 1888, marking the beginning of the Belk's financial performance and ownership.

- Dr. John M. Belk joined as a partner in 1891, expanding the company.

- The Belk family retained significant ownership, making it a family-owned business for many years.

- The company has seen changes in ownership over time, including Belk private equity ownership and acquisitions.

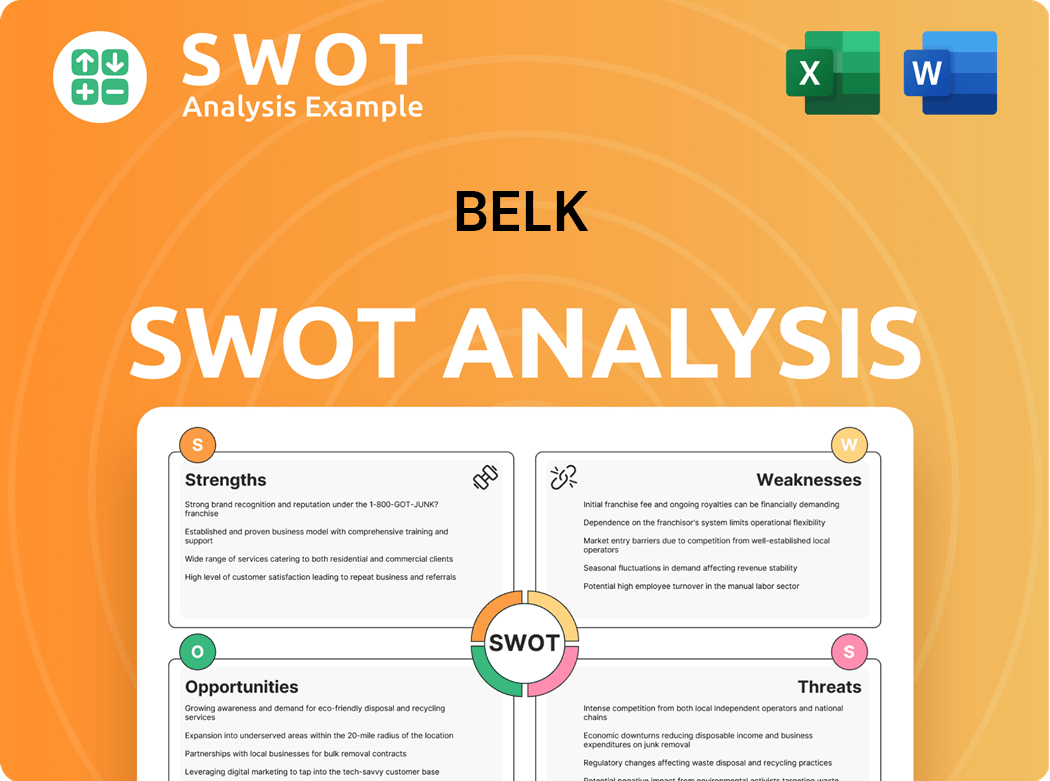

Belk SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Belk’s Ownership Changed Over Time?

The story of the Belk department store chain's ownership is a tale of family legacy, private equity involvement, and financial restructuring. For nearly 130 years, the [Belk company] operated as a family-owned business, growing to become the largest family-owned department store chain in the United States by 2015. This long-standing tradition shifted dramatically in August 2015 when Sycamore Partners, a private equity firm, acquired 100% of [Belk department store] in a deal valued at approximately $3 billion. This acquisition marked the end of the Belk family's direct control and leadership.

The acquisition by Sycamore Partners brought significant changes. The company faced a substantial debt burden, exceeding $2 billion, which was further complicated by a difficult retail environment and the COVID-19 pandemic. This led to [Belk stores] filing for Chapter 11 bankruptcy in February 2021. However, the company emerged from bankruptcy just one day later, thanks to a pre-packaged restructuring agreement. This agreement allowed Sycamore Partners to retain majority control. Other firms, including KKR and Blackstone Credit, also acquired minority stakes. As of July 2024, Belk reduced its debt by over $950 million and secured $485 million in new financing, with KKR and Hein Park gaining more controlling interests alongside Sycamore Partners. The company remains privately held.

| Event | Date | Impact on Ownership |

|---|---|---|

| Sycamore Partners Acquisition | August 2015 | Sycamore Partners acquired 100% of Belk |

| Chapter 11 Bankruptcy Filing | February 2021 | Restructuring agreement; Sycamore Partners retained majority control; KKR and Blackstone Credit acquired minority stakes. |

| Debt Reduction and New Financing | July 2024 | Debt reduced by over $950 million; KKR and Hein Park gained more controlling interests. |

The [Belk company] ownership structure has seen significant changes over time, evolving from a family-run business to one primarily controlled by private equity firms. The acquisition by Sycamore Partners in 2015 and the subsequent restructuring in 2021 highlight the dynamic nature of the retail industry and the impact of financial pressures. For more insights, you can explore the Competitors Landscape of Belk.

Belk's ownership has shifted from family control to private equity ownership.

- Sycamore Partners acquired Belk in 2015.

- The company underwent bankruptcy in 2021 but quickly restructured.

- KKR and Blackstone Credit hold minority stakes.

- Belk remains a privately-owned company.

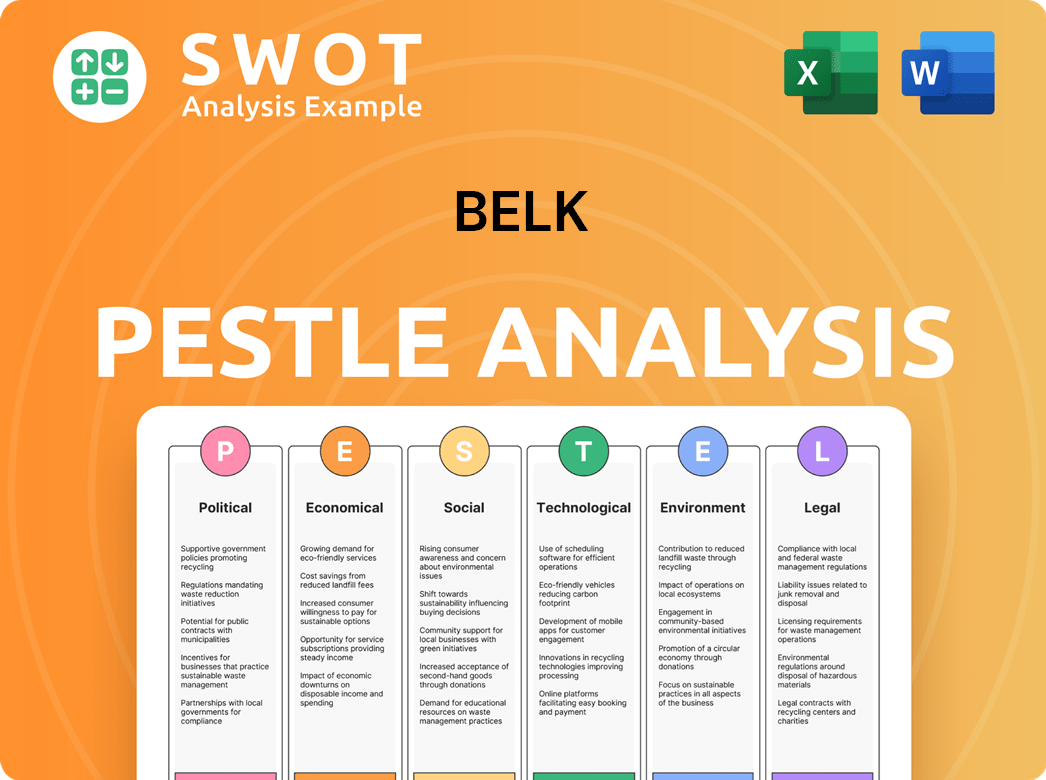

Belk PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Belk’s Board?

As a privately-owned entity, the board of directors significantly influences the strategic direction of the Belk company. In October 2024, the company announced a new Board of Directors, with Steve Sadove as Chairman. This restructuring followed a key financial move in July 2024, which was designed to bolster the company's financial health. This is crucial for understanding the Belk ownership structure and how decisions are made within the company.

The current board includes CEO Don Hendricks, along with Steve Sadove (Chairman), Joel Bines, Bob Hull, and Jon Zinman. Steve Sadove's experience includes previous roles as Chairman and CEO of Saks Incorporated. Joel Bines is a managing partner at Spruce Advisory. Bob Hull leads Integrity Strategic Solutions, and Jon Zinman heads JZ Advisors LLC. These board members bring extensive retail and operational expertise. Their collective experience is aimed at reinforcing Belk's brand partnerships, improving customer experience, and increasing engagement. Understanding the Belk department store leadership is vital for assessing its future strategies.

| Board Member | Title | Affiliation |

|---|---|---|

| Steve Sadove | Chairman | JW Levin Management Partners |

| Don Hendricks | CEO | Belk |

| Joel Bines | Managing Partner | Spruce Advisory |

| Bob Hull | Founder and CEO | Integrity Strategic Solutions |

| Jon Zinman | Managing Member | JZ Advisors LLC |

While specific voting structures aren't publicly disclosed for private companies, Sycamore Partners' majority ownership indicates significant control over decision-making. The 2021 bankruptcy restructuring allowed Sycamore Partners to maintain majority control, with KKR and Blackstone Credit gaining minority stakes. The July 2024 financial restructuring further solidified the controlling interests of some lenders, including KKR and Hein Park, along with Sycamore Partners. For more insights into the Belk history and its current position, consider exploring the Target Market of Belk.

The board of directors, led by Steve Sadove, is key to Belk's strategic decisions. Sycamore Partners holds significant control due to majority ownership. Recent financial restructurings have reinforced the influence of key lenders.

- Board restructuring occurred in October 2024.

- Sycamore Partners maintains majority ownership.

- Financial restructuring in July 2024 impacted lender influence.

- Board members bring extensive retail experience.

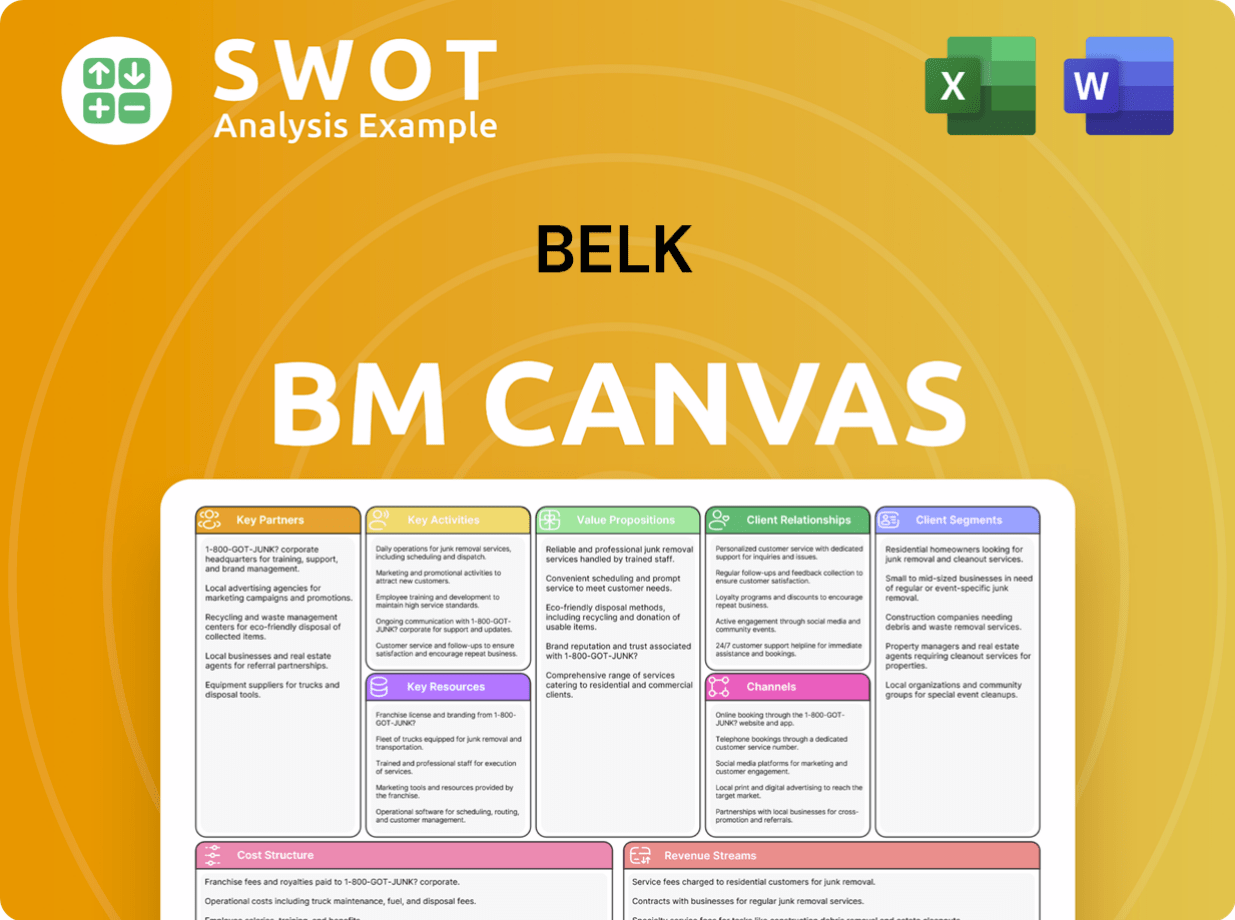

Belk Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Belk’s Ownership Landscape?

The Belk department store has seen significant shifts in its ownership and financial structure in recent years. A notable event was its Chapter 11 bankruptcy filing and subsequent emergence in February 2021. This restructuring, supported by its majority owner, Sycamore Partners, and lenders like KKR and Blackstone Credit, allowed the company to shed around $450 million in debt. Sycamore Partners retained majority control, while KKR and Blackstone gained minority stakes. This move aimed to enhance financial flexibility and support investments in omnichannel capabilities and product expansion. Therefore, the question of 'Who is the current owner of Belk' is primarily answered by Sycamore Partners, although other financial entities hold significant influence.

More recently, in July 2024, the company completed another substantial deleveraging transaction. This involved reducing its outstanding debt by over $950 million and securing $485 million in new financing. This transaction involved its first and second lien lenders, including private equity firms KKR and Hein Park, alongside its equity sponsor Sycamore Partners, with some lenders gaining more controlling interests. These financial maneuvers are designed to bolster the company's position for sustainable, long-term growth. Belk's current ownership status reflects a complex interplay of private equity and lending institutions.

| Ownership Trend | Details | Impact |

|---|---|---|

| Bankruptcy Filing & Emergence (2021) | Debt reduction of $450 million, new capital of $225 million. | Financial flexibility and investment in omnichannel and product expansion. |

| Deleveraging Transaction (July 2024) | Debt reduction of over $950 million, new financing of $485 million. | Strengthened financial position for long-term growth. |

| Key Stakeholders | Sycamore Partners (majority), KKR, Blackstone Credit, Hein Park. | Influence over strategic decisions and financial health. |

Operationally, Belk continues to focus on its brick-and-mortar presence, with nearly 300 stores across 16 states, and is actively expanding its outlet store concept. The company is also enhancing its national brand partnerships and improving the customer shopping experience. For example, the first Belk outlet store in North Carolina opened in September 2024. These initiatives, led by CEO Don Hendricks since 2022, reflect industry trends of adapting to changing consumer behaviors through strategic financial restructuring and a focus on omnichannel retail. The Belk company ownership structure is thus intertwined with its operational strategies.

Sycamore Partners maintains majority control. KKR, Blackstone Credit, and Hein Park hold significant minority stakes. These entities influence strategic and financial decisions.

Debt reduction and new financing have improved Belk's financial health. This supports investments in omnichannel retail and expansion. The company aims for sustainable growth.

Focus on brick-and-mortar stores, outlet expansion, and brand partnerships. Enhancements to the shopping experience are ongoing. The goal is to adapt to consumer trends.

Opening of outlet stores, like the one in Northlake Mall in Charlotte in September 2024. Launch of the Belk Media Network in partnership with Criteo in October 2024. These initiatives are key.

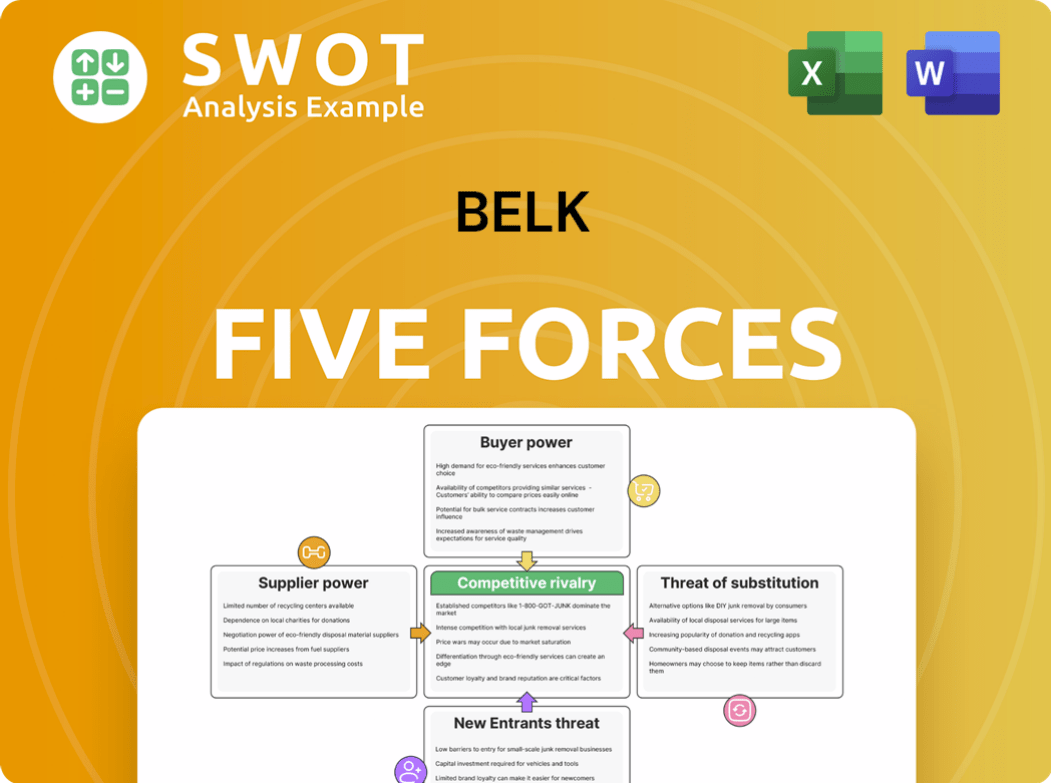

Belk Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Belk Company?

- What is Competitive Landscape of Belk Company?

- What is Growth Strategy and Future Prospects of Belk Company?

- How Does Belk Company Work?

- What is Sales and Marketing Strategy of Belk Company?

- What is Brief History of Belk Company?

- What is Customer Demographics and Target Market of Belk Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.