Canon Bundle

Unveiling Canon: How Does This Tech Giant Thrive?

Canon, a titan in the imaging and optical world, has captivated consumers and businesses alike for decades. From its humble beginnings, Canon has transformed into a global powerhouse, continuously innovating across a diverse product range. Understanding the Canon SWOT Analysis is key to grasping its strategic positioning in the market.

This exploration into the Canon company delves into its intricate Canon business model, revealing how it generates revenue and maintains a competitive edge. We'll dissect Canon operations, examining its commitment to Canon technology and its ability to adapt to evolving market demands. This analysis is crucial for anyone seeking to understand the inner workings of a leading global enterprise, including its Canon products, Canon history, and future trajectory.

What Are the Key Operations Driving Canon’s Success?

The core operations of the Canon company are centered around creating and delivering value through its imaging and optical products and services. This involves a vertically integrated approach, from research and development to manufacturing and distribution. Canon's business model focuses on serving diverse customer segments, including consumers, businesses, and industrial clients, with a wide range of products and solutions.

Canon's value proposition lies in providing high-quality, reliable, and innovative products that meet the evolving needs of its customers. This is achieved through significant investments in technology, particularly in optics, sensor technology, and image processing. The company's operational efficiency and global reach enable it to maintain a competitive edge in the market.

Canon's operations are structured to ensure superior image quality and integrated solutions for various imaging needs. This comprehensive approach allows the company to differentiate itself from competitors and maintain a strong market position. Canon's focus on innovation and customer satisfaction drives its core operations and value proposition.

Canon's product range includes digital cameras (DSLRs, mirrorless, compact), camcorders, and inkjet printers for consumers. For businesses, it offers multifunction printers (MFPs), production print systems, and document management solutions. Industrial clients benefit from semiconductor lithography equipment and medical imaging systems.

Canon's operations are highly integrated, including R&D, manufacturing, supply chain, and global distribution. Advanced manufacturing facilities worldwide emphasize precision engineering and quality control. The supply chain is optimized for efficiency and global reach. Canon's investment in technology development supports its competitive advantage.

Canon's sales channels are diverse, including direct sales, retail partnerships, and e-commerce. Customer service is provided through online support and service centers. Canon's global presence is managed to ensure efficient operations and market penetration. Canon's organizational structure supports its global operations.

Canon offers reliable performance, superior image quality, and integrated solutions. It differentiates itself through vertical integration in key technologies. The company's focus on customer satisfaction and innovation drives its core operations. Canon's competitive advantage is supported by its technological investments.

Canon's operations are characterized by a strong emphasis on research and development, with significant investments in optical and imaging technologies. The company's global supply chain ensures efficient distribution and timely delivery of products. Canon's commitment to customer service and support enhances its value proposition.

- Research and Development: Canon invests heavily in R&D to drive innovation in imaging and optical technologies.

- Manufacturing: Canon operates advanced manufacturing facilities worldwide, focusing on precision and quality.

- Supply Chain: The company's supply chain is optimized for efficiency and global reach.

- Customer Service: Canon provides comprehensive customer service through various channels.

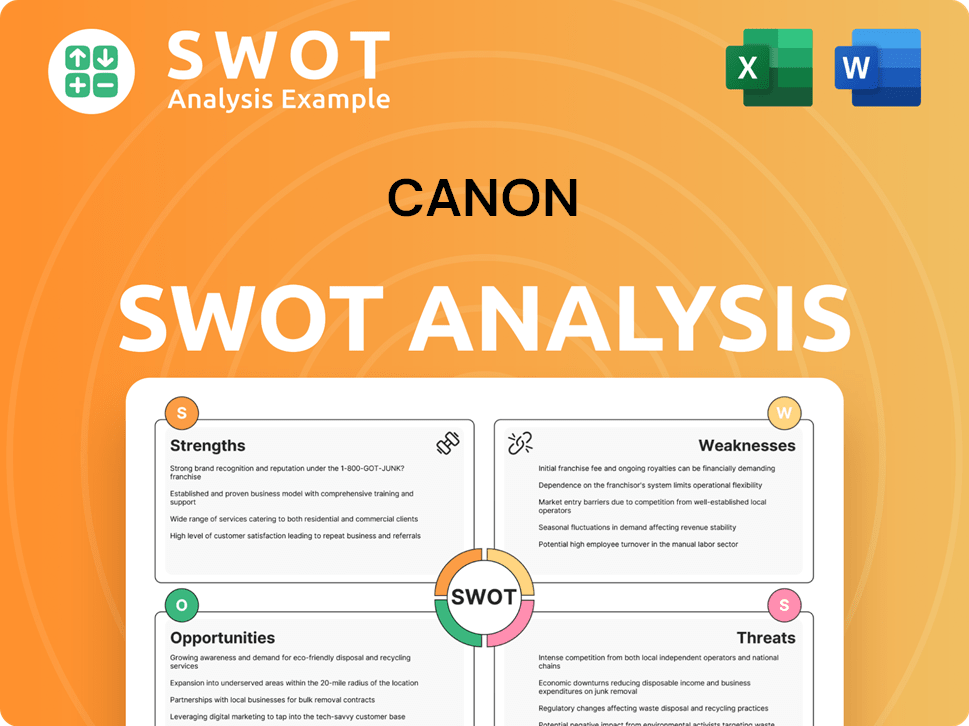

Canon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Canon Make Money?

The revenue streams and monetization strategies of the Canon company are multifaceted, reflecting its diverse product portfolio and global market presence. Canon's approach is designed to generate income through a combination of product sales, recurring services, and strategic partnerships. This diversified strategy helps the company maintain financial stability and adaptability in a competitive market.

Canon's revenue is primarily driven by sales from its various business segments. These include the Printing Business Group, the Imaging Business Group, the Medical Business Group, and the Industrial and Others Business Group. This structure allows Canon to tap into different markets and customer needs, enhancing its overall revenue generation capabilities. For the fiscal year ending December 31, 2023, the company reported net sales of approximately $27.3 billion USD.

Canon employs several monetization strategies to maximize revenue. Beyond the initial sale of its products, the company generates substantial recurring revenue from consumables like ink cartridges and toner. Service contracts and solutions for business clients, particularly in printing and document management, provide a stable income stream. Canon also leverages its extensive patent portfolio through licensing, contributing to its revenue. The company's strategy often involves bundling services with hardware sales, including software solutions, maintenance contracts, and technical support.

Canon's financial success is built on a solid foundation of diverse revenue streams and effective monetization strategies. The company's ability to innovate and adapt has allowed it to maintain a strong position in the market. Understanding these elements provides insight into the Competitors Landscape of Canon and its overall business strategy.

- Product Sales: Revenue from cameras, printers, and medical equipment forms a significant portion of Canon's income. The Imaging Business Group and Printing Business Group are key contributors.

- Consumables: Recurring revenue from ink cartridges, toner, and other consumables is a crucial part of the business model.

- Service and Solutions: Service contracts, software solutions, and technical support for business clients provide stable and recurring income.

- Licensing: Revenue from licensing its extensive patent portfolio.

- Bundled Services: Offering hardware sales with software solutions, maintenance contracts, and technical support.

- Tiered Pricing: Utilizing tiered pricing models to cater to different customer segments and their specific needs.

- Cross-selling: Leveraging its established customer base to introduce new products and services.

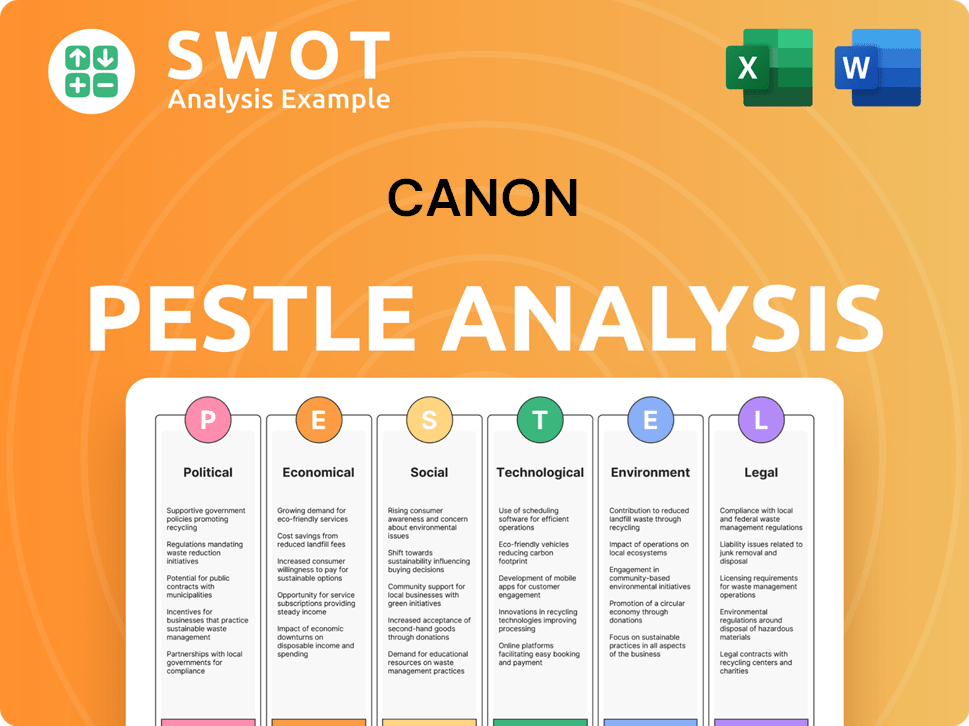

Canon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Canon’s Business Model?

The evolution of the Canon company has been marked by significant milestones and strategic maneuvers. From its early days in 1936 with the launch of its first camera to its diversification into business equipment in 1964, and the revolutionary bubble jet printing technology in the 1980s, Canon has consistently adapted and innovated. These moves have been critical in shaping its current Canon business model and overall market position.

Canon's strategic acquisitions, such as the 2016 purchase of Toshiba Medical Systems Corporation, have been instrumental in expanding its reach and revenue streams. These actions demonstrate Canon's commitment to not only staying relevant but also growing within diverse sectors. This proactive approach has helped Canon navigate the challenges of a competitive market landscape.

Canon's operational strategies and competitive advantages are multifaceted. The company faces challenges, including competition in the digital camera market and supply chain disruptions. Canon's response involves focusing on high-value segments and optimizing manufacturing processes. Its strong brand recognition, technological leadership, and efficient production are key factors in its success.

Canon's history is marked by significant achievements. The introduction of its first 35mm focal-plane-shutter camera in 1936 laid the foundation for its imaging business. The development of bubble jet printing technology in the 1980s revolutionized the printer market, showcasing Canon's innovation. The acquisition of Toshiba Medical Systems Corporation in 2016 expanded its presence in the medical equipment sector.

Strategic moves have been crucial for Canon's growth. Diversification into business equipment with the introduction of its first electronic calculator in 1964 was a key step. Canon's focus on high-value segments, such as professional imaging equipment and industrial solutions, has been a strategic response to market challenges. Continuous investment in R&D and refining product offerings is essential.

Canon maintains a competitive edge through several factors. Its strong brand recognition, built over decades of innovation, fosters customer loyalty. Technological leadership in optics and precision manufacturing provides a barrier to entry. Economies of scale in production and global distribution networks allow for cost efficiencies. Canon's extensive patent portfolio is a significant advantage.

Canon's operations are designed to maintain its competitive position. The company focuses on high-value-added segments, optimizing manufacturing, and adapting to market trends. Canon's global presence and distribution networks support its operations. The company's investments in R&D and customer service are key to its success.

Canon's competitive advantages are multifaceted, including strong brand recognition and technological leadership. The company benefits from economies of scale and global distribution networks. Canon's extensive patent portfolio and continuous R&D investments are also crucial.

- Strong brand recognition and customer loyalty.

- Technological leadership in optics and sensor technology.

- Economies of scale in production and distribution.

- Extensive patent portfolio and continuous innovation.

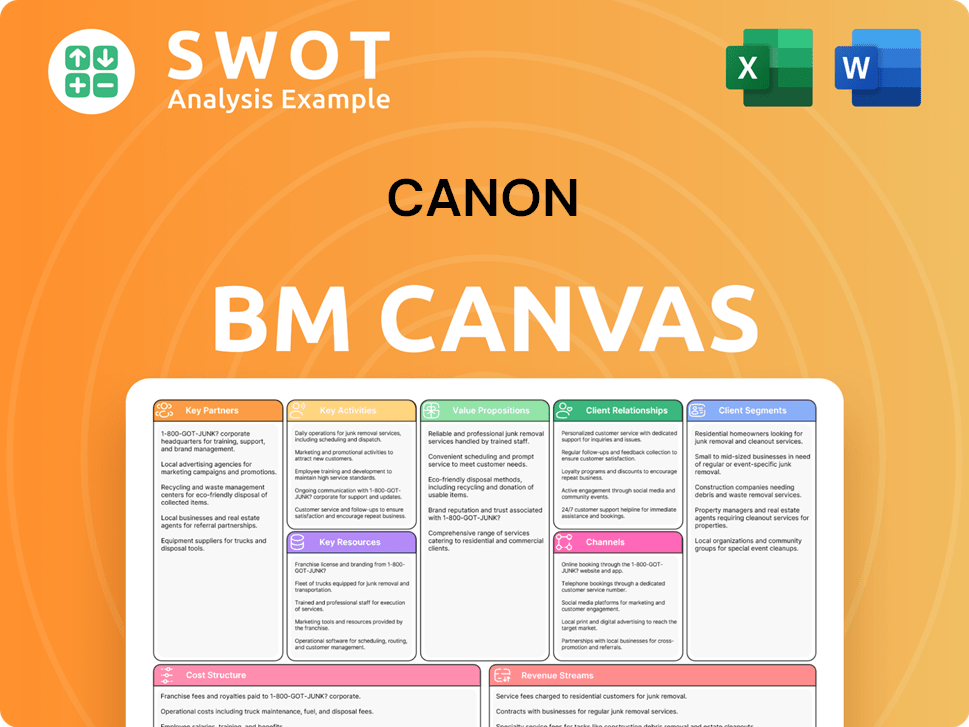

Canon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Canon Positioning Itself for Continued Success?

The Canon company maintains a strong industry position, particularly in imaging and printing solutions. Its global presence and diverse product portfolio contribute to its market leadership. However, the company faces risks from technological shifts, intense competition, and economic uncertainties. Canon's future strategy focuses on expanding its B2B businesses and investing in innovation to sustain profitability.

The Canon business model relies on a mix of hardware sales, services, and solutions. The company's operations span various segments, including digital cameras, office equipment, and medical devices. Canon's ability to adapt to changing market dynamics and leverage its technological expertise will be crucial for its long-term success, as highlighted in Growth Strategy of Canon.

Canon consistently ranks among the top players in the interchangeable-lens digital camera market globally. It holds a significant market share alongside competitors like Sony and Nikon. Canon's position in office and production printing markets is also robust, with a wide array of multifunction devices and commercial printing solutions.

Technological disruption, particularly from advancements in AI and software-defined imaging, could impact its traditional hardware-centric businesses. Intense competition across all its segments puts pressure on pricing and market share. Geopolitical tensions and economic downturns can affect global demand and supply chains.

Canon is focused on strengthening its B2B businesses, particularly in industrial and medical equipment, which offer higher growth potential and recurring revenue streams. Innovation roadmaps include continued investment in AI and IoT technologies to enhance its imaging and printing solutions, as well as further development in areas like network cameras and industrial automation.

Canon aims to expand its services and solutions offerings, moving beyond hardware sales to create more comprehensive, value-added propositions for its customers. This includes leveraging its core optical technologies for new applications and focusing on sustainability. The company’s goal is to maintain its market leadership in the evolving technological landscape.

Canon's ability to manage its global presence and navigate market changes will be critical. The company is investing in research and development to stay ahead of the competition, focusing on innovation. Canon aims to offer robust customer service and support to maintain customer loyalty.

- Canon faces challenges from smartphone photography, impacting camera sales.

- The company is exploring new technologies to diversify its portfolio.

- Canon's focus on sustainability and corporate social responsibility is increasing.

- The company's organizational structure will adapt to market needs.

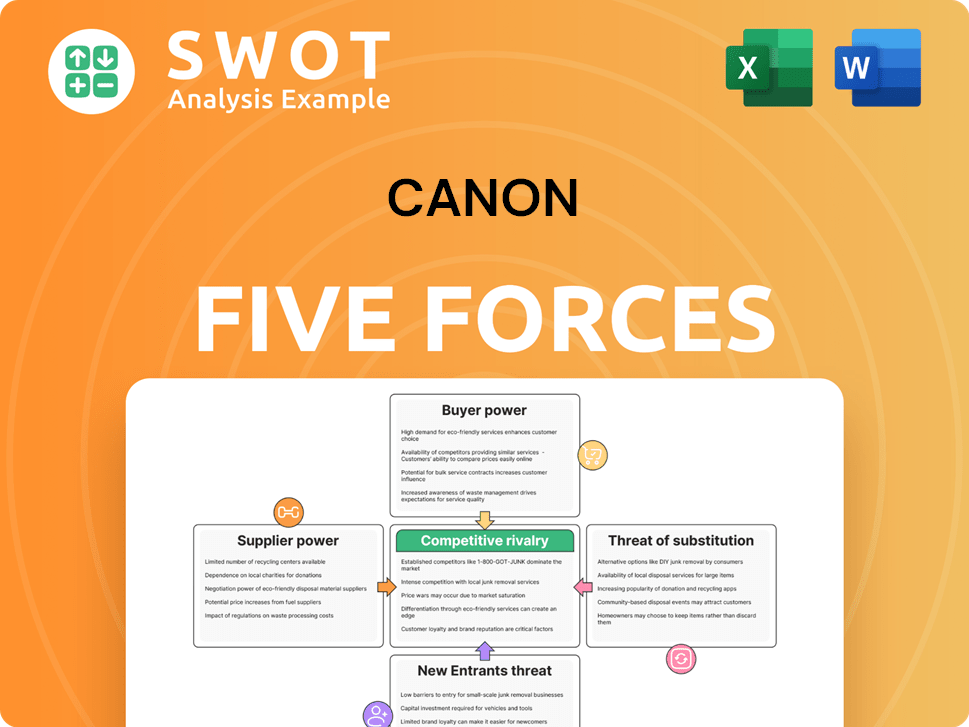

Canon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Canon Company?

- What is Competitive Landscape of Canon Company?

- What is Growth Strategy and Future Prospects of Canon Company?

- What is Sales and Marketing Strategy of Canon Company?

- What is Brief History of Canon Company?

- Who Owns Canon Company?

- What is Customer Demographics and Target Market of Canon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.