Capcom Bundle

How Does Capcom Thrive in the Gaming World?

Capcom, a titan in the video game industry since 1983, has captivated audiences worldwide with its legendary franchises like Resident Evil and Street Fighter. This Japanese game company has consistently delivered blockbuster hits, but how does Capcom company maintain its dominance and achieve record-breaking financial results year after year? With its recent fiscal achievements, understanding the inner workings of Capcom is more crucial than ever.

Capcom's success story is a testament to its effective game development process and strategic business decisions. Its impressive financial performance, including twelve consecutive years of operating income growth, highlights a robust Capcom SWOT Analysis. Exploring Capcom's history and evolution, from its game development studios to its marketing strategies, reveals the secrets behind this Japanese game company's enduring appeal and profitability. This analysis will delve into the core of the Capcom business model.

What Are the Key Operations Driving Capcom’s Success?

The core operations of the Capcom company revolve around creating, marketing, and distributing interactive entertainment software. This includes games for consoles, PCs, and mobile devices. Its main value proposition is delivering high-quality video games and gaming technology, appealing to both casual and hardcore gamers.

Capcom's commitment to excellence and innovation, supported by cutting-edge technology and established franchises, underpins its success. The company's focus on robust internal development capabilities, especially through its RE ENGINE, is a key operational aspect. This in-house technology reduces reliance on third parties and ensures control over the production pipeline, streamlining the game development process.

Capcom's business model is built on a foundation of creating and distributing video games. The company focuses on developing and releasing games for various platforms, including consoles, PCs, and mobile devices. Capcom also leverages its intellectual property (IP) across various media to create and deliver value beyond just game sales.

Capcom emphasizes internal development, utilizing its RE ENGINE to streamline the game development process. This proprietary engine enables lifelike visuals and improves efficiency. This approach allows for greater control over the production pipeline.

Capcom has a strong digital distribution strategy, with over 90% of game copies sold digitally. This digital-first approach allows for direct demand fulfillment. Digital sales also provide a steady revenue stream from a vast catalog of content.

Capcom maximizes profitability through its 'Single Content Multiple Usage' strategy. This involves adapting game content for various entertainment businesses. The company leverages its IP across movies, character merchandise, and esports.

Capcom's financial performance is driven by game sales and digital distribution. In the last fiscal year, 54.4% of digital sales were on PC alone. This highlights the importance of digital sales and the PC platform in Capcom's revenue streams.

Capcom's operational strategy includes robust internal development, digital distribution, and IP utilization.

- Internal Development: Utilizes the RE ENGINE for efficient game creation.

- Digital Distribution: Over 90% of game copies sold digitally.

- IP Expansion: Leverages game content across multiple entertainment sectors.

- Strategic Partnerships: Collaborates to expand market reach and content offerings.

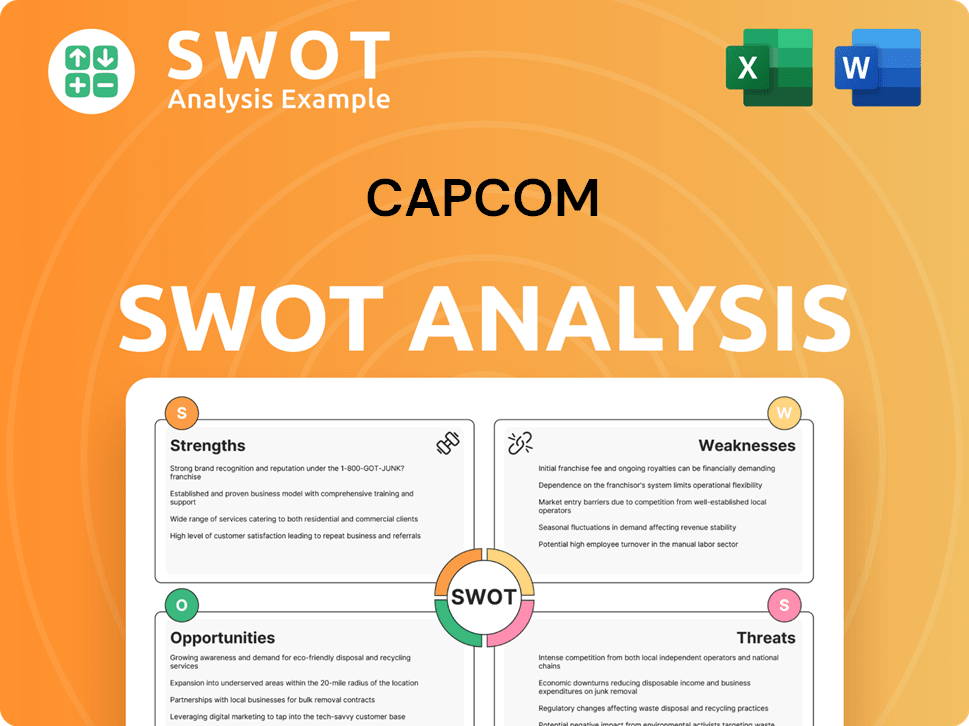

Capcom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Capcom Make Money?

The Capcom company, a prominent video game developer, employs a multifaceted approach to generate revenue. Its primary revenue stream is the Digital Contents business, which includes sales of both packaged and digital games across various platforms. This segment is crucial to Capcom's business success, driving the majority of its financial performance.

Capcom's monetization strategy extends beyond direct game sales, leveraging its intellectual property (IP) through a 'Single Content Multiple Usage' approach. This involves licensing its content for various entertainment ventures, including movies, merchandise, and esports. Additionally, the company operates arcades and amusement equipment businesses, further diversifying its revenue sources.

The company's financial health is significantly influenced by its digital content sales, particularly its catalog titles. These older games, with fully depreciated R&D costs, offer high profit margins. However, Capcom also explores additional revenue streams through partner programs and advertising on video-sharing platforms, while facing scrutiny over certain in-game monetization practices.

Capcom's revenue streams are diverse, with the Digital Contents business leading the way. The company strategically uses its IPs to maximize profits and maintain a strong market position. Understanding these strategies is key to analyzing Capcom's financial performance.

- Digital Contents: This segment includes sales of both packaged and digital games for consoles, PCs, and mobile devices. In the fiscal year ending March 31, 2025, Capcom reported net sales of ¥169.6 billion (approximately $1.15 billion USD).

- Catalog Sales: Older game titles contribute significantly to revenue due to high margins. In the fiscal year ending March 31, 2025, catalog sales reached 39.49 million units, up from 36.29 million units the previous year.

- 'Single Content Multiple Usage': Licensing IPs for movies, TV, merchandise, and esports. This strategy allows Capcom to monetize its content across multiple entertainment sectors.

- Arcade Operations and Amusement Equipments: The 'Plaza Capcom' arcades and the use of home video game content for pachi-slot machines contribute to revenue.

- Partner Programs and Advertising: Monetization through partnerships and advertising on video-sharing platforms like YouTube and Twitch. For more insights, consider exploring the Marketing Strategy of Capcom.

- In-Game Monetization: Practices like charging for character customization options in games such as Monster Hunter Wilds and Street Fighter 6.

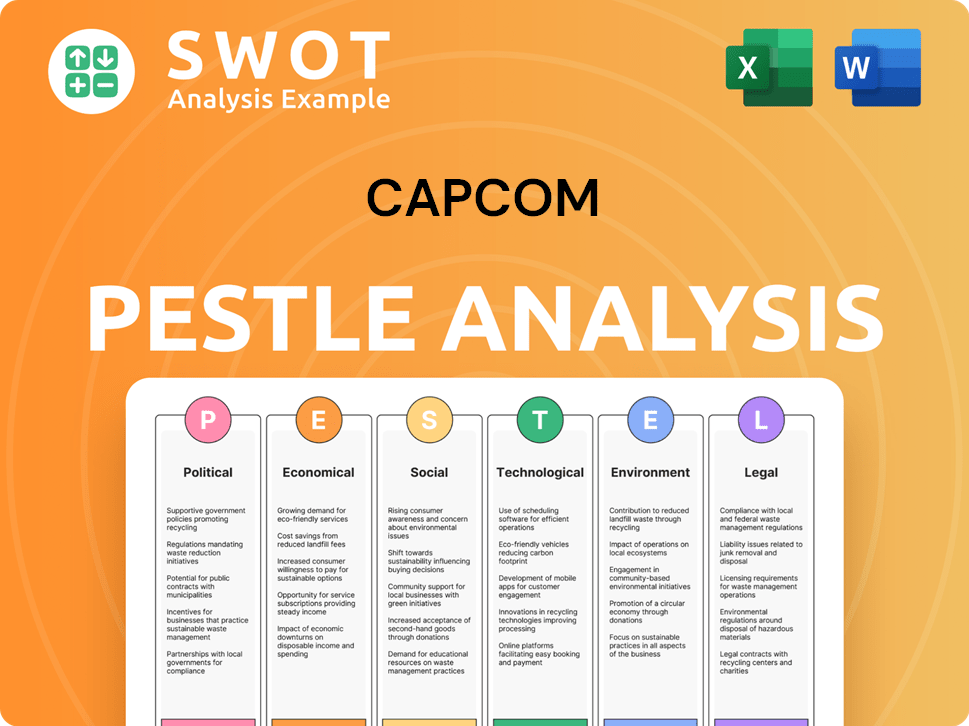

Capcom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Capcom’s Business Model?

The evolution of the Capcom company has been marked by significant strategic shifts and key milestones. A major transition in the 2010s involved a move from solely relying on new game releases to focusing on remakes and expanding global digital sales of older titles. This approach has been highly successful, contributing to stable sales growth and strong profitability over the past decade. The Capcom business has consistently demonstrated its ability to adapt and innovate within the dynamic video game industry.

This Japanese game company has achieved record-breaking financial results, including its eighth consecutive year of record-high net sales and profits in the fiscal year ending March 31, 2025, and twelve consecutive years of operating profit growth. The success is largely attributed to flagship franchises such as Resident Evil, Street Fighter, and Monster Hunter. The company's ability to transform niche franchises into global successes has been a key driver of its financial performance. This strategic focus has allowed Capcom to maintain a competitive edge in the market.

Capcom's competitive advantages include strong brand recognition, a diverse portfolio of enduring intellectual properties, and advanced in-house development capabilities, particularly with the RE ENGINE. The RE ENGINE allows for efficient and high-quality game development. The company's commitment to releasing remakes and leveraging its back catalog also helps control R&D spending and offsets higher costs. To understand more about their target audience, you can read about the Target Market of Capcom.

The company's transition to remakes and digital sales of older titles in the 2010s was a pivotal shift. This strategy enabled stable sales growth. The success of franchises like Resident Evil and Monster Hunter has been crucial.

Focus on remakes and digital distribution expanded the global reach. Staggering releases across platforms and regions has helped Monster Hunter become a global success. Investing in development capabilities, including the RE ENGINE, is a key strategy.

Strong brand recognition and a diverse portfolio of IPs provide a competitive advantage. Advanced in-house development capabilities, like the RE ENGINE, contribute to efficient game development. The company's commitment to remakes and leveraging its back catalog helps manage R&D costs.

Capcom achieved its eighth consecutive year of record-high net sales and profits in the fiscal year ending March 31, 2025. Twelve consecutive years of operating profit growth highlights sustained success. Monster Hunter Wilds sold over 10 million units in its first month.

Capcom is investing in its development capabilities and workforce to adapt to new trends. A new development hub near Osaka is planned for completion by 2027. The company aims to hire 100 new staff members annually, recognizing the importance of human talent.

- The company is working to improve working conditions, including reducing the gender wage gap.

- Encouraging male employees to take paid parental leave.

- These investments and operational efficiencies underscore Capcom's commitment to sustained growth.

- This approach ensures continued innovation in the gaming industry.

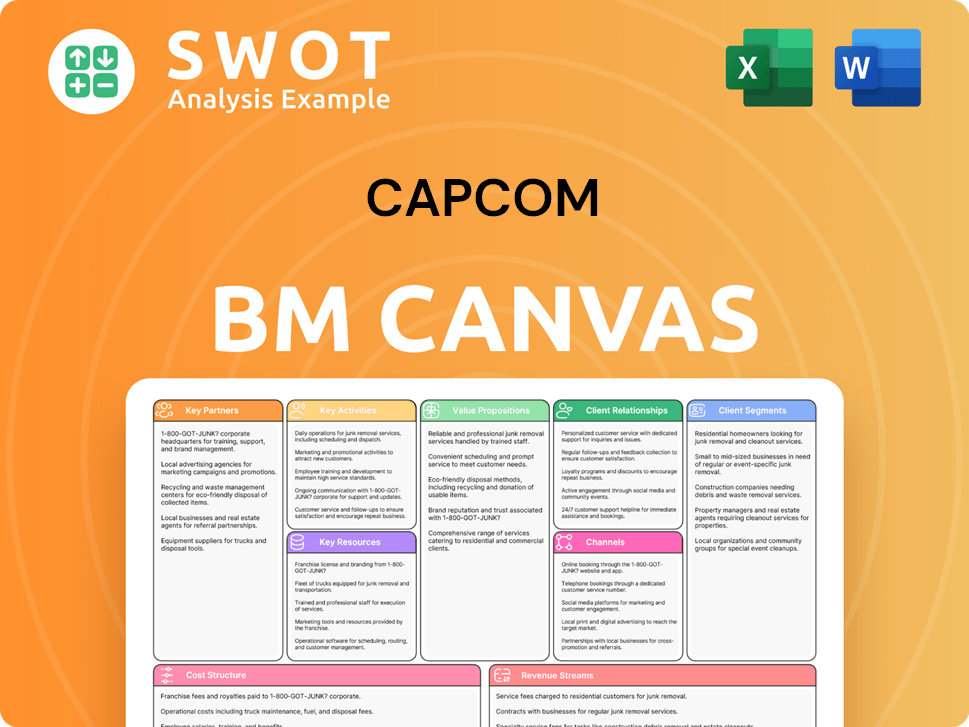

Capcom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Capcom Positioning Itself for Continued Success?

The Capcom company holds a strong position in the global video game industry, consistently achieving record profits. This success is driven by its established franchises and effective strategies. For the fiscal year ending March 31, 2025, the company's performance highlights its global reach and digital distribution success.

Despite its robust market position, Capcom faces risks like changing consumer preferences and potential development delays. It also needs to invest heavily in research and development to stay ahead of technological advancements and intense competition. Regulatory changes and new competitors also pose ongoing challenges.

Capcom is a leading video game developer with a global presence. Its enduring franchises and digital sales strategy contribute to its strong market share. The company's financial performance reflects its effective business model and ability to adapt to market changes.

Capcom faces risks including evolving consumer tastes and potential development delays. The company also needs to make significant R&D investments to stay competitive. Regulatory changes and new market entrants pose additional challenges to its operations.

Capcom plans to maintain and expand profitability through strategic initiatives. The company projects continued revenue and profit growth, driven by new game releases and catalog sales. Investments in development capacity and strong IP will support its future growth trajectory.

For the fiscal year ending March 31, 2026, Capcom anticipates net sales of ¥190 billion (approximately $1.28 billion USD) and operating income of ¥73 billion (approximately $493 million USD). This projects a ninth consecutive year of record-high profit and an eleventh consecutive year of over 10% operating income growth.

In the fiscal year ending March 31, 2025, Capcom's primary market was North America, accounting for 29.8% of game copies sold, followed by Asia (excluding Japan) with 21.6%, and Europe with 18.6%. Japan accounted for 16.2%. Over 80% of Capcom's sales are from overseas, and close to 90% are digital sales. To learn more about the company's origins, check out Brief History of Capcom.

Capcom is focused on releasing AAA titles regularly and increasing catalog sales. The company is also expanding its development capacity. These strategic moves are designed to maintain its growth and adapt to future market demands.

- Releasing AAA titles every one to two years.

- Increasing catalog title sales.

- Building a new facility in Osaka, set to be completed by 2027.

- Hiring 100 new employees annually.

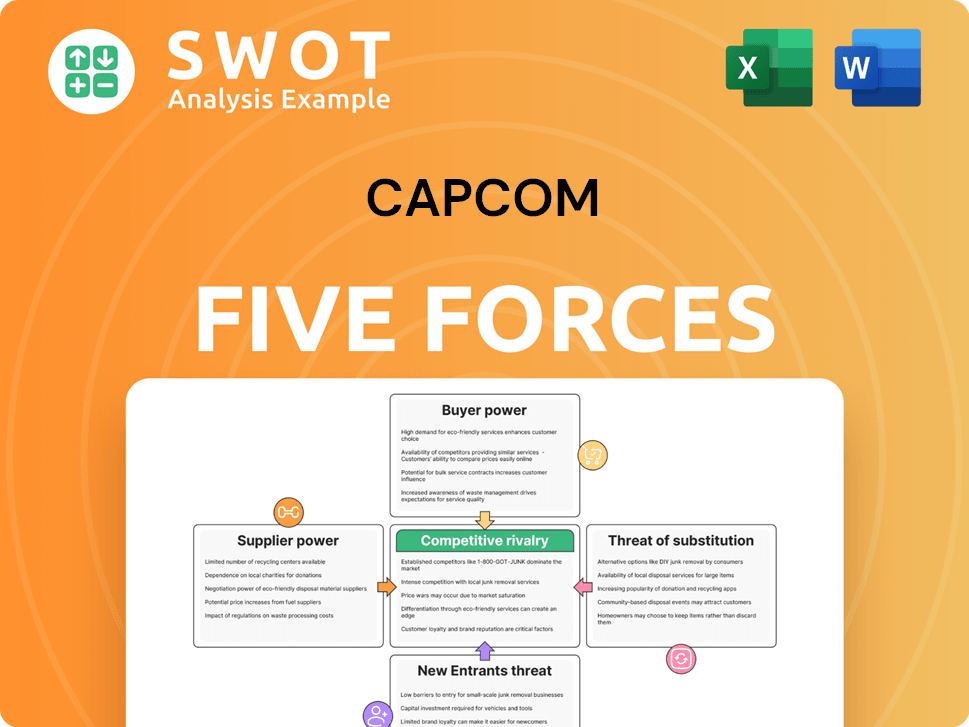

Capcom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Capcom Company?

- What is Competitive Landscape of Capcom Company?

- What is Growth Strategy and Future Prospects of Capcom Company?

- What is Sales and Marketing Strategy of Capcom Company?

- What is Brief History of Capcom Company?

- Who Owns Capcom Company?

- What is Customer Demographics and Target Market of Capcom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.