CarMax Bundle

How Does CarMax Revolutionize Used Car Sales?

CarMax has fundamentally altered the used car market, becoming the nation's largest retailer with a customer-centric approach. Its innovative model, built on no-haggle pricing and transparency, has made it a dominant force. Understanding CarMax SWOT Analysis is crucial for anyone looking to navigate the evolving automotive retail landscape.

This exploration will dissect the CarMax process, revealing how it generates billions in revenue through used car sales and a seamless CarMax buying experience. Whether you're considering selling your car to CarMax, seeking insights into CarMax financing options, or simply curious about how CarMax works, this analysis provides a comprehensive overview. We'll also delve into the details of the CarMax car buying process step by step, offering valuable insights for both buyers and sellers.

What Are the Key Operations Driving CarMax’s Success?

The CarMax process is designed to offer a straightforward and transparent experience for both buying and selling used cars. Their core operations focus on providing a wide selection of vehicles, no-haggle pricing, and integrated services to create value for customers. This approach has made CarMax a prominent player in the used car market, serving a large customer base across the United States.

CarMax primarily caters to individual consumers looking to purchase used vehicles, as well as those seeking to sell their current cars. Their main offerings include used car sales, vehicle financing through CarMax Auto Finance (CAF), and various additional services like extended protection plans (EPPs) and vehicle reconditioning. The company's operational model is built around efficiency, transparency, and customer satisfaction, setting it apart from traditional dealerships.

The operational process at CarMax begins with sourcing vehicles from various channels, including direct consumer purchases, automotive auctions, and trade-ins. They emphasize rigorous reconditioning and inspection of vehicles, with most cars undergoing a comprehensive inspection to ensure quality and reliability. This commitment to quality assurance is a key differentiator in the used car market. The company also uses a sophisticated logistics network to transport vehicles to its numerous retail locations, ensuring a diverse inventory across its stores. Sales channels include physical dealerships and a robust online platform, allowing customers to browse inventory, get appraisals, and complete purchases remotely. Customer service is integrated throughout the entire process, from the initial inquiry to post-sale support.

Vehicles are sourced through direct consumer purchases, auctions, and trade-ins. Each vehicle undergoes a thorough inspection, often involving a 125+-point check. This process ensures vehicles meet quality standards before they are offered for sale.

CarMax provides sales through physical dealerships and an online platform. Customer service is a priority, with support available throughout the buying and selling process. This includes assistance with financing, warranties, and post-sale support.

CarMax offers vehicle financing through CarMax Auto Finance (CAF). They also provide extended protection plans (EPPs) and other services. These additional services contribute to a comprehensive customer experience.

CarMax manages a diverse inventory across its stores, supported by a sophisticated logistics network. This ensures customers have access to a wide selection of vehicles. The company focuses on efficient inventory turnover.

What sets the CarMax process apart is its vertically integrated model, which includes its own financing arm (CAF) and reconditioning centers. This integration allows CarMax to control more aspects of the customer experience, optimize costs, and capture additional revenue streams. The no-haggle pricing strategy eliminates a common pain point for car buyers, building trust and simplifying the transaction. This transparency, coupled with a wide selection and a customer-friendly return policy, translates into significant customer benefits and market differentiation. For instance, the company's 'Love Your Car Guarantee' offers a 30-day money-back guarantee, providing peace of mind to buyers. The efficient reconditioning process allows CarMax to maintain high-quality inventory and manage costs effectively, further enhancing its competitive edge. For more insights, you can explore the Growth Strategy of CarMax.

CarMax distinguishes itself through several key features that enhance the CarMax buying experience. These include no-haggle pricing, a wide selection of vehicles, and a customer-friendly return policy. These elements contribute to a streamlined and transparent process.

- No-Haggle Pricing: Eliminates negotiation, making the process simpler.

- Extensive Inventory: Offers a broad selection of vehicles to meet different needs.

- Customer-Friendly Policies: Includes a 30-day money-back guarantee for added assurance.

- Integrated Services: Provides financing, warranties, and other services.

CarMax SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CarMax Make Money?

Understanding how CarMax generates revenue is key to grasping its business model. The company primarily focuses on the used vehicle market, with multiple streams contributing to its financial performance. CarMax's approach includes a mix of direct sales, financing, and service offerings, all designed to maximize profitability and customer satisfaction.

In fiscal year 2024, CarMax reported total revenues of $27.1 billion. This figure reflects the company's strong position in the used car market and its ability to generate income from various sources. The following sections will delve into the specifics of these revenue streams and the strategies CarMax employs to monetize its operations.

The core of CarMax's revenue model is its used car sales. This segment accounted for $24.8 billion of the total revenue in fiscal year 2024, representing approximately 91.5% of the company's total revenue. This highlights the importance of used car sales as the primary driver of CarMax's financial success. The company's focus on providing a transparent and customer-friendly buying experience is crucial to driving sales volume.

Beyond direct vehicle sales, CarMax utilizes several other channels to generate revenue and enhance profitability. CarMax Auto Finance (CAF) is a significant contributor, providing financing to customers and generating interest income. The company also offers extended protection plans (EPPs) and generates revenue from wholesale vehicle sales and service and reconditioning activities.

- CarMax Auto Finance (CAF): Generates interest income from vehicle loans. While not always broken out as a direct percentage, it is a significant profit center.

- Extended Protection Plans (EPPs): Provides coverage for vehicle repairs, contributing to service-related revenue.

- Wholesale Vehicle Sales: Sales of vehicles that do not meet retail standards.

- Service and Reconditioning: Revenue from servicing and preparing vehicles for sale.

CarMax PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CarMax’s Business Model?

The journey of CarMax has been marked by significant milestones and strategic decisions that have solidified its position in the used car market. A pivotal move was the introduction of its no-haggle pricing model, which offered transparent, fixed prices, building consumer trust and setting it apart from traditional dealerships. This strategy, implemented from its inception in 1993, has been a cornerstone of its success, fundamentally changing the Growth Strategy of CarMax.

Another key strategic move has been the consistent expansion of its physical presence across the United States, allowing it to reach a wider customer base and increase inventory accessibility. Furthermore, the company has strategically invested in its digital capabilities, accelerating its omni-channel platform to meet evolving consumer preferences. This includes features like online appraisals, financing applications, and vehicle delivery options, proving crucial in recent years.

CarMax has faced operational challenges, including supply chain disruptions and inventory management complexities, particularly during periods of volatile vehicle availability. For example, during the fiscal year 2024, CarMax reported a decrease in total retail used units sold by 7.3% compared to the prior year, mainly due to vehicle affordability challenges and reduced inventory. In response, the company has focused on optimizing its inventory acquisition strategies and leveraging its extensive network to maintain a diverse selection of vehicles.

The introduction of the no-haggle pricing model in 1993 revolutionized the car-buying experience, building trust. Continuous expansion of physical stores across the U.S. has broadened its customer reach and inventory access. Strategic investment in digital capabilities, including online sales and financing, has adapted to changing consumer behaviors.

Focus on an omni-channel platform, allowing customers to buy and sell vehicles online or in-store seamlessly. Optimization of inventory acquisition strategies to maintain a diverse vehicle selection. Leveraging its extensive network to manage and adapt to market fluctuations and supply chain challenges.

Strong brand recognition built on trust and transparency, a significant asset in used car sales. Economies of scale achieved through a large network of stores and reconditioning centers, ensuring operational efficiency. Integrated CarMax Auto Finance segment provides competitive rates and streamlined processes, enhancing its value proposition.

CarMax continues to enhance its digital platform and refine its omni-channel approach. This adaptation is crucial for maintaining its competitive edge in the evolving market. The focus is on meeting the increasing demand for online car buying and providing customer convenience.

CarMax's competitive advantages are multifaceted, including strong brand recognition and operational efficiency. The company's integrated finance segment and commitment to customer service further enhance its value proposition. The 'Love Your Car Guarantee' also contributes to customer loyalty, setting it apart in the used car market.

- Strong brand recognition and trust.

- Economies of scale and efficient operations.

- Integrated CarMax Auto Finance.

- Customer service and guarantees.

CarMax Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CarMax Positioning Itself for Continued Success?

CarMax holds a leading position in the fragmented used vehicle retail industry within the United States. As the largest retailer of used cars nationwide, it has a substantial market share, despite the competitive nature of the used car market, which includes numerous independent dealerships, franchised new car dealerships, and online platforms. CarMax's brand loyalty is fostered by its transparent pricing, extensive inventory, and customer-focused sales approach.

Despite its strong market position, CarMax faces several key risks. Economic downturns and rising interest rates can significantly impact consumer spending on big-ticket items like cars, affecting both sales volume and the profitability of its financing arm. The emergence of new competitors, particularly online disruptors offering innovative purchasing models, poses a continuous threat. Technological disruption, such as the increasing adoption of electric vehicles, could require significant adjustments to its inventory mix, reconditioning processes, and sales strategies.

CarMax is the largest used car retailer in the U.S., with a significant market share. Its national presence and customer-centric approach set it apart. However, the used car market is highly competitive, including independent dealerships and online platforms. Learn more about the target market of CarMax.

Economic downturns and rising interest rates can affect sales and financing. Regulatory changes and the emergence of online competitors pose additional threats. Technological shifts, such as the rise of electric vehicles, also present challenges.

CarMax focuses on enhancing its omni-channel experience and optimizing inventory. Data analytics and customer-centric models are key. The company aims to sustain profitability by focusing on operational excellence and adapting to the evolving automotive retail landscape.

The CarMax process involves transparent pricing and a customer-focused sales approach. CarMax’s ability to adapt to changing consumer preferences and leverage data analytics will be critical. The company's emphasis on customer service and innovation is expected to drive future growth.

CarMax focuses on omni-channel experiences, inventory optimization, and data analytics. In fiscal year 2024, CarMax cited vehicle affordability challenges as a factor in decreased retail used units sold. The company is committed to adapting to the evolving automotive retail landscape.

- Enhancing digital platforms and customer service.

- Optimizing inventory management for a consistent supply of quality used cars.

- Leveraging data analytics to improve operational efficiency.

- Adapting to changing consumer preferences, including online transactions.

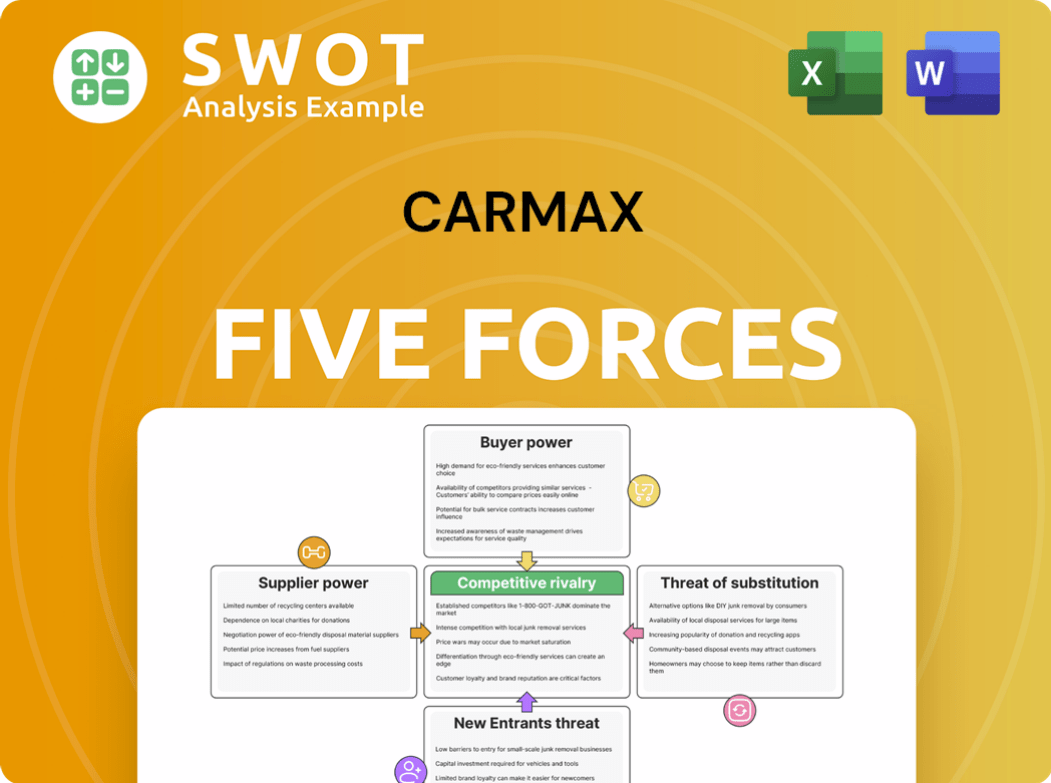

CarMax Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CarMax Company?

- What is Competitive Landscape of CarMax Company?

- What is Growth Strategy and Future Prospects of CarMax Company?

- What is Sales and Marketing Strategy of CarMax Company?

- What is Brief History of CarMax Company?

- Who Owns CarMax Company?

- What is Customer Demographics and Target Market of CarMax Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.