Carter’s Bundle

How Does Carter's Thrive in the Children's Apparel Market?

Carter's, Inc. is a giant in the children's apparel industry, known for its popular Carter's brand and a wide range of products designed for infants and young children. With a strong presence in retail and online, and partnerships with major retailers, Carter's has established itself as a go-to brand for parents. In 2024, the company demonstrated its market strength with impressive sales figures.

To truly understand Carter's, it's essential to explore its operational strategies. This analysis will examine Carter's history, business model, and financial performance, providing insights for investors, customers, and industry watchers alike. Discover the inner workings of Carter’s SWOT Analysis to better understand its strengths and weaknesses. From its supply chain to its marketing strategy, we'll uncover how Carter's clothing continues to resonate with consumers and maintain its competitive edge.

What Are the Key Operations Driving Carter’s’s Success?

The core operations of the Carter's company revolve around designing, sourcing, and marketing children's apparel and related products. They focus on a wide range of items, from baby clothes to accessories, primarily under the Carter's brand and OshKosh B'gosh brands. This strategy allows them to cater to a broad customer base seeking comfortable, stylish, and trusted clothing options for children from newborn to ten years old.

Their value proposition is centered on providing high-quality, accessible clothing for children. This is achieved through a multi-channel global business model. Carter's clothing is available through various channels, including company-operated stores, e-commerce platforms, and partnerships with major retailers.

The operational processes encompass design, sourcing, and marketing. The company's extensive distribution network and strategic partnerships are key to its reach and effectiveness. The Carter's company has a vertically integrated model, which includes owning brands and leveraging partnerships, helping it stand out against competitors.

The primary focus is on baby and children's apparel, sleepwear, playwear, and accessories. The Carter's brand and OshKosh B'gosh are the most recognizable brands. They also include Little Planet, a brand focused on organic fabrics and sustainable materials, and Skip Hop, a global lifestyle brand for families with young children.

They operate through over 1,000 company-operated stores in the United States, Canada, and Mexico. E-commerce websites (carters.com, oshkosh.com, cartersoshkosh.ca, and carters.com.mx) are also a key part of their distribution strategy. Furthermore, Carter's sales are boosted by supplying to major North American retailers, including Walmart, Target, and Amazon.com.

The company's vertically integrated model, which includes owning brands and leveraging partnerships, helps it stand out against competitors. This approach allows for greater control over quality, design, and distribution. Strategic partnerships are key to its reach and effectiveness.

Their target customer includes parents and caregivers seeking comfortable, stylish, and trusted clothing for children. The product range covers newborns up to ten-year-olds. For more information, you can read about the Target Market of Carter’s.

The company's success is driven by its strong brand recognition, extensive distribution network, and focus on quality and value. The company's strategic partnerships with major retailers and its e-commerce presence contribute significantly to its overall performance. The company's vertically integrated model provides a competitive edge.

- Design and Product Development: Focus on creating appealing and functional clothing.

- Sourcing and Manufacturing: Ensuring high-quality materials and efficient production processes.

- Marketing and Sales: Utilizing a multi-channel approach to reach a wide customer base.

- Distribution: Operating through company-owned stores, e-commerce, and wholesale partnerships.

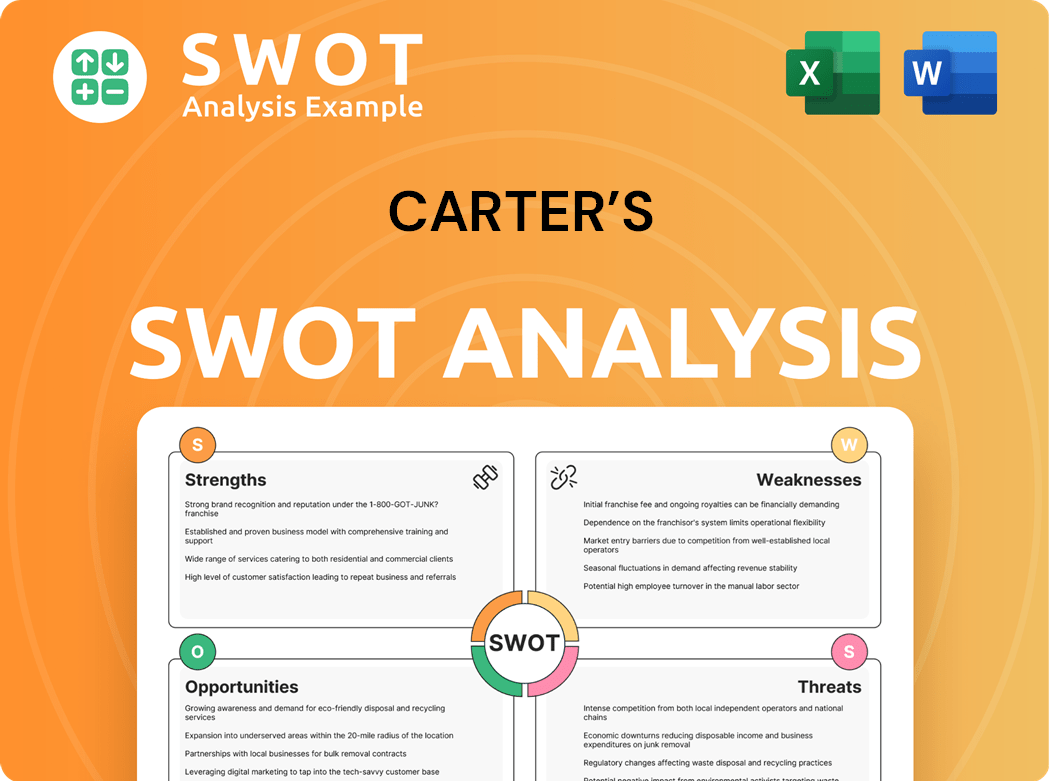

Carter’s SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Carter’s Make Money?

The revenue streams and monetization strategies of Carter's company are primarily driven by product sales across multiple distribution channels. The company's business model focuses on selling Carter's clothing through various segments, including retail, wholesale, and international markets. This approach allows Carter's brand to reach a broad customer base and generate substantial revenue.

Carter's products are sold through three main segments: U.S. Retail, U.S. Wholesale, and International. Each segment contributes to the overall revenue generation, with specific strategies tailored to the respective markets. The company also employs various monetization strategies, such as tiered pricing and cross-selling, to boost sales and customer acquisition.

In fiscal year 2024, Carter's company reported net sales of $2.844 billion. For the first quarter of fiscal year 2025, consolidated net sales were $629.8 million, representing a 4.8% decrease year-over-year. This decline highlights the dynamic nature of the market and the importance of adapting to changing consumer behavior. E-commerce continues to be a high-margin business for the company.

This segment includes sales through company-operated retail stores and e-commerce websites. In Q1 2025, net sales declined by 4.3%.

This segment involves sales to wholesale partners. In Q1 2025, net sales decreased by 5.3%.

This segment covers sales outside the United States, including retail stores and e-commerce in Canada and Mexico, and sales to international wholesale customers and licensees. The International segment saw a 4.9% decrease in net sales in Q1 2025.

E-commerce continues to be one of the company's highest-margin businesses. This channel is crucial for reaching a wider audience.

Carter's company uses several strategies to maximize revenue and customer engagement. These strategies include:

- Tiered pricing to offer different price points for various products.

- Cross-selling to encourage customers to purchase additional items.

- Investment in more competitive pricing and brand marketing to boost sales and customer acquisition.

For a deeper dive into Carter's history and its strategic initiatives, consider reading the Growth Strategy of Carter’s.

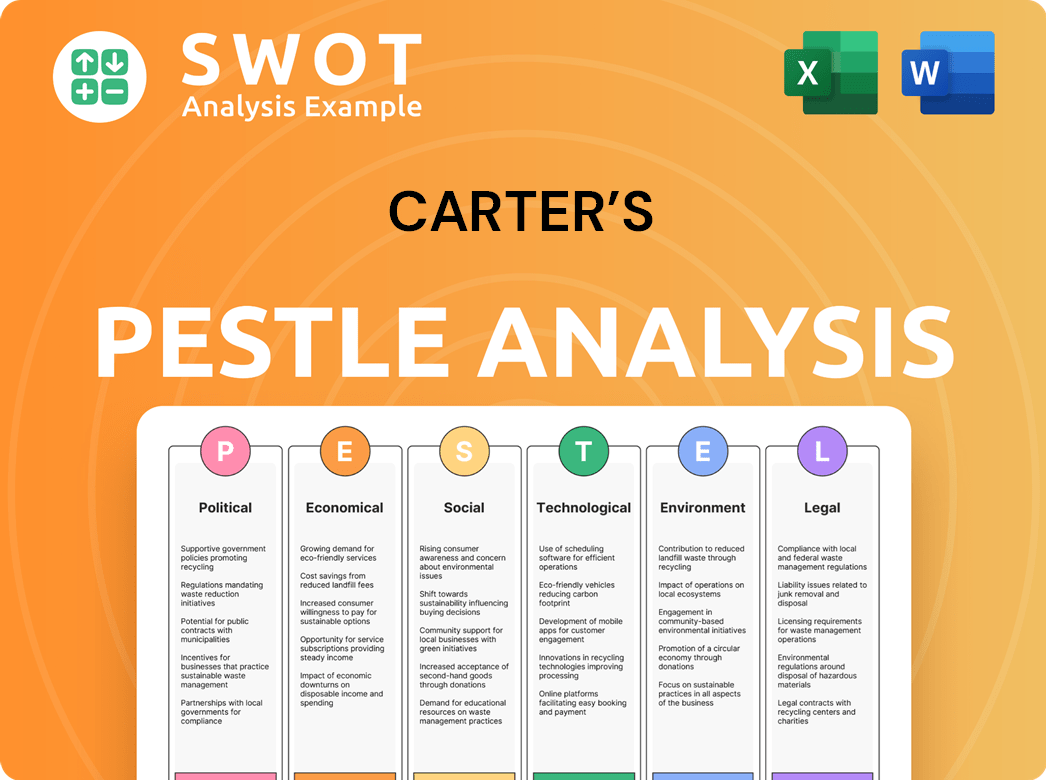

Carter’s PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Carter’s’s Business Model?

Understanding how Carter's company operates involves examining its key milestones, strategic moves, and competitive advantages. The company has consistently adapted to market dynamics, making significant investments and adjustments to maintain its position. This approach is crucial for navigating the competitive landscape of the children's apparel market.

A key aspect of Carter's history involves its strategic responses to market challenges and opportunities. These responses include investments in pricing, marketing, and retail experiences. Such moves are designed to improve customer acquisition and retention, which are vital for sustained growth. The company's ability to adapt is a key factor in its ongoing success.

The company's strategic focus includes optimizing its retail store fleet, enhancing the in-store shopping experience, and leveraging its multi-channel presence. These initiatives aim to improve sales and customer satisfaction. Furthermore, the company has demonstrated resilience and financial strength, which is essential for long-term stability.

In the second half of fiscal year 2024, Carter's company invested approximately $65 million in its U.S. Retail business, with a focus on pricing and brand marketing. This investment helped stabilize unit volumes and improve customer metrics. The company also focused on enhancing its retail store fleet.

Strategic moves include investments in pricing competitiveness and brand marketing. The company is also focused on optimizing its retail store fleet. Furthermore, Carter's brand has been expanding its presence in key markets like Mexico and Canada.

The company's strong brand assets, including Carter's and OshKosh B'gosh, provide a significant competitive advantage. Its multi-channel market presence, encompassing retail stores, e-commerce, and wholesale distribution, is also a key differentiator. The company's ability to generate strong operating cash flow is a significant advantage.

In fiscal year 2024, Carter's company generated nearly $300 million in operating cash flow. This financial strength supports its ability to invest in future growth. The company continues to adapt its product offerings and marketing strategies to meet consumer demands.

Despite macroeconomic challenges like inflation and elevated interest rates, Carter's clothing saw improvements in traffic, conversion, and comparable sales in its U.S. Retail businesses in Q4 2024. Strong demand for exclusive brands in the wholesale channel and momentum in international retail markets also contributed to its performance. The company is focused on enhancing its product offerings and marketing capabilities.

- Adaptation to market changes through strategic investments.

- Focus on improving customer acquisition and retention rates.

- Leveraging multi-channel presence for broader market reach.

- Maintaining strong operating cash flow for financial stability.

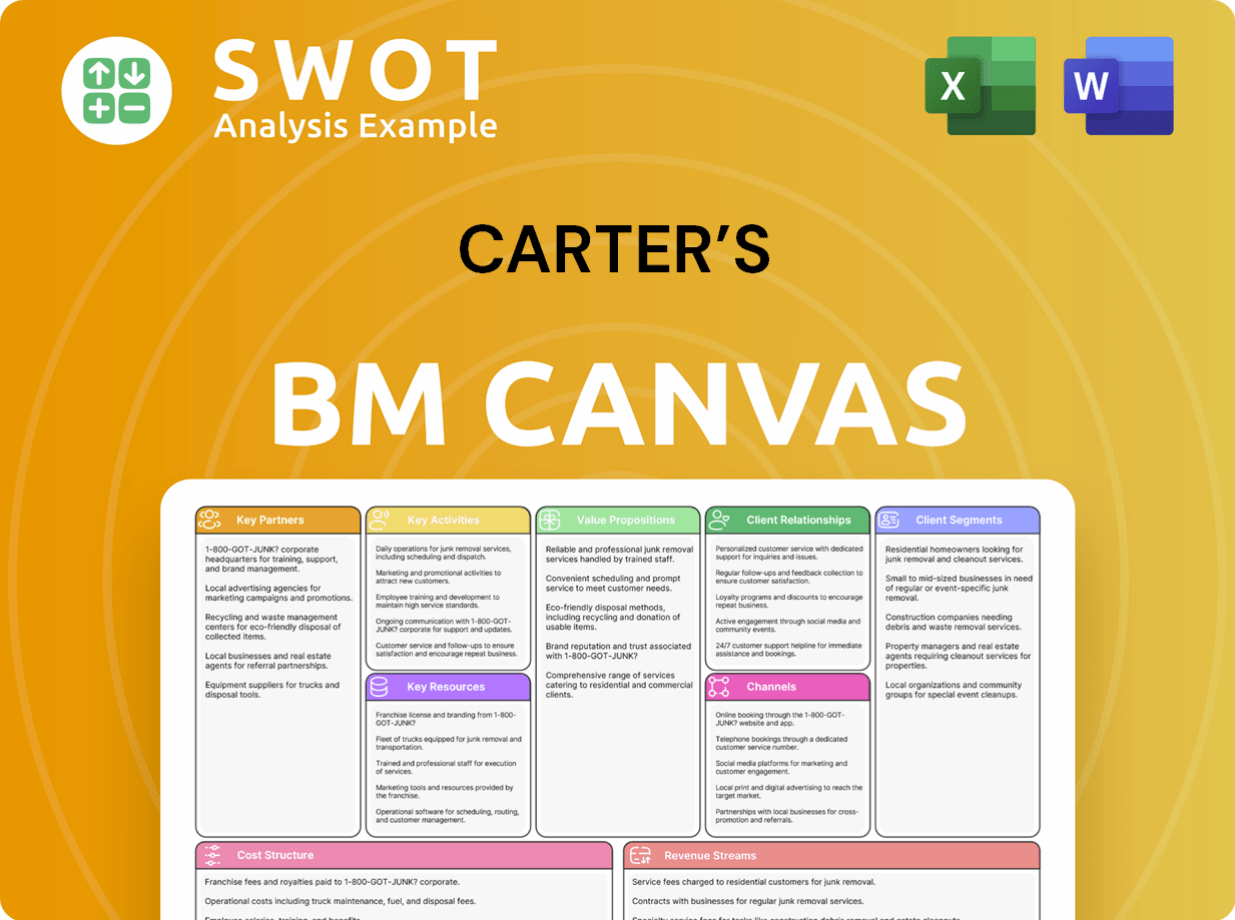

Carter’s Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Carter’s Positioning Itself for Continued Success?

The Carter's company holds a prominent position in the North American children's apparel market. With a significant market share, the Carter's brand caters to children from newborn to age 10. However, the company faces various challenges in the current economic climate.

The future outlook for Carter's clothing is influenced by macroeconomic pressures and competitive dynamics. While the company is implementing strategic initiatives to foster growth, it must navigate uncertainties in consumer spending and potential regulatory changes.

In Q1 2025, the Carter's company held an approximate market share of 2.29%. Despite this, its revenue experienced a decrease of 3.89%. The company benefits from strong customer loyalty and a wide global reach through its retail and wholesale channels.

Key risks include macroeconomic pressures like inflation and elevated interest rates, affecting consumer spending. Carter's faces intense competition from both branded and private label manufacturers. Regulatory changes and potential new tariffs introduce further uncertainties, leading the company to suspend its forward-looking guidance in April 2025.

For fiscal year 2025, Carter's projects net sales between $2.780 billion and $2.855 billion. Adjusted operating income is expected to range from $180 million to $210 million. The company anticipates U.S. retail sales to decline by mid-single digits, while wholesale sales are expected to remain flat or slightly down. A new strategic plan, to be shared by the new CEO in late July, aims to return the company to growth.

The company is focused on strategic initiatives to achieve consistent, profitable growth. These include improving product offerings, enhancing marketing capabilities, and optimizing its retail footprint. Carter's ended 2024 with over $1 billion in total liquidity, providing flexibility to manage uneven consumer demand. In addition, you can take a look at the Competitors Landscape of Carter’s to understand the market dynamics.

In response to challenges, Carter's has taken financial measures. The company cut its quarterly dividend by almost 70% to $0.25 per share, effective June 2025. Share repurchases have been paused, reflecting a focus on liquidity preservation and strategic investments.

- The company is prioritizing financial stability.

- These actions aim to navigate economic uncertainties.

- Strategic investments are planned for future growth.

- The focus is on adapting to market conditions.

Carter’s Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Carter’s Company?

- What is Competitive Landscape of Carter’s Company?

- What is Growth Strategy and Future Prospects of Carter’s Company?

- What is Sales and Marketing Strategy of Carter’s Company?

- What is Brief History of Carter’s Company?

- Who Owns Carter’s Company?

- What is Customer Demographics and Target Market of Carter’s Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.