Carter’s Bundle

Who Truly Owns Carter's?

Unraveling the ownership structure of Carter's, Inc. is key to understanding its market position and strategic direction. With a recent leadership transition, the question of who controls this iconic brand is more relevant than ever. Discover the forces shaping the future of Carter's and how its ownership impacts its success.

Carter's, a leading provider of children's apparel, has a fascinating history, starting in 1865 with William Carter. As a publicly traded company under the ticker symbol CRI, understanding Carter’s SWOT Analysis is crucial for investors. This exploration will dive into the details of Carter's ownership, from its initial roots to its current structure, including its Carter's ownership and Carter's company details, revealing the key players behind the Carter's brand.

Who Founded Carter’s?

The story of Carter's company began in 1865. William Carter established the business in Needham, Massachusetts, marking the start of what would become a significant player in the children's apparel market. Initially focused on hand-knit mittens, the company expanded its offerings, eventually becoming a well-known Carter's brand.

Tracing the exact ownership structure from the very start is challenging. William Carter was the sole founder, and his family played a key role in the company's early years. His son, William Henry Carter, took over as president in 1918, demonstrating the family's enduring involvement.

Over time, the business evolved, with the Carter family eventually selling the enterprise in 1990. This transition marked a pivotal shift in the company's history, setting the stage for future ownership changes and its evolution into a major player in the industry. Understanding the Carter's ownership history provides valuable context.

The company went through several name changes early on. William Carter's brother, Edward Carter, joined in 1860, leading to the name 'William Carter and Bro.' Later, his cousin John W. Carter became involved in 1865, resulting in the name 'Carter Bros. & Company'.

John W. Carter's focus was on the ink division of the business. This division was later separated from the main operations.

In 2001, a significant change occurred when private equity firm Berkshire Partners partnered with management to acquire Carter's Inc from Investcorp. This move was a precursor to the company becoming publicly listed.

After the acquisition by Berkshire Partners and management, Carter's company eventually became a publicly traded entity. This transition allowed for broader investment and further growth.

The Carter family's involvement highlights the importance of family businesses in the early stages of the company. Their dedication helped shape the foundation of the company.

Key dates include the founding in 1865, the name changes in the 1860s, the family's sale in 1990, and the private equity acquisition in 2001. These dates are crucial for understanding Carter's ownership evolution.

Understanding the history of Carter's company provides insights into its evolution. The company's journey from a family-run business to a publicly traded corporation reflects its growth and adaptation. For more information, you can explore the Competitors Landscape of Carter’s.

The founder of Carter's Inc was William Carter. The Carter family played a significant role in the company's early years.

- The company's initial focus was on hand-knit mittens.

- The business expanded into infant and children's wear.

- The Carter family sold the business in 1990.

- Berkshire Partners acquired the company in 2001.

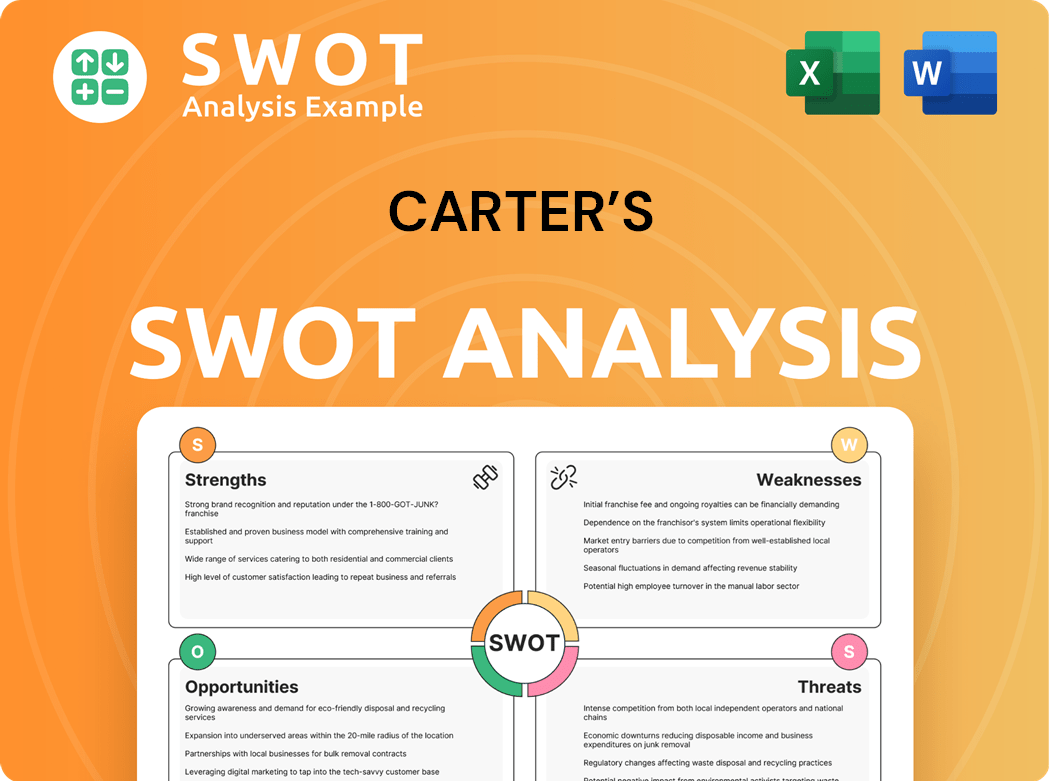

Carter’s SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Carter’s’s Ownership Changed Over Time?

The evolution of Carter's, Inc.'s ownership began with its initial public offering (IPO) in October 2003. The shares were priced at $19.00 each and traded on the New York Stock Exchange under the symbol 'CRI'. Before the IPO, Berkshire Funds, managed by Berkshire Partners LLC, held a significant stake, roughly 85% of the company's shares, which amounted to 20.3 million shares. By December 2004, Berkshire Funds' ownership had decreased to about 37% of the common stock, or 10.3 million shares, and announced a distribution of 3.0 million shares. As of June 12, 2025, the market capitalization of Carter's is approximately $1.18 billion.

As a publicly traded entity, the Carter's company, has a diverse ownership structure. It includes both individual and institutional investors. As of 2025, Carter's, Inc. (US:CRI) has 662 institutional owners and shareholders who have filed 13D/G or 13F forms with the SEC, collectively holding a total of 55,566,684 shares. Major institutional shareholders include BlackRock, Inc. (11.37%), Vanguard Group Inc (10.62%), JPMorgan Investment Management, Inc. (8%), and RWWM, Inc. (6.083%). The stock price on June 12, 2025, was $31.92 per share, reflecting a 51.16% decrease over the previous year. This Carter's ownership structure is a key aspect of understanding the company's financial landscape.

| Date | Event | Impact on Ownership |

|---|---|---|

| October 2003 | Initial Public Offering (IPO) | Transitioned from private to public ownership. |

| December 2004 | Berkshire Funds Share Distribution | Reduced Berkshire Funds' ownership percentage. |

| June 12, 2025 | Market Capitalization and Stock Price | Reflects the current valuation and investor sentiment. |

The shift from private to public ownership through the IPO in 2003 significantly altered the Carter's ownership structure details. The involvement of institutional investors, such as BlackRock and Vanguard, further shaped the company's shareholder base. Understanding these changes is crucial for anyone interested in the Carter's brand and its financial performance. To learn more about how the company is approaching its marketing, you can read this article about the Marketing Strategy of Carter’s.

Carter's, Inc. transitioned to a publicly traded company in October 2003.

- Berkshire Funds initially held a major stake but reduced its holdings over time.

- Institutional investors like BlackRock and Vanguard are significant shareholders.

- The company's stock price and market capitalization reflect its current financial health.

- Understanding who owns Carter's is vital for assessing its market position.

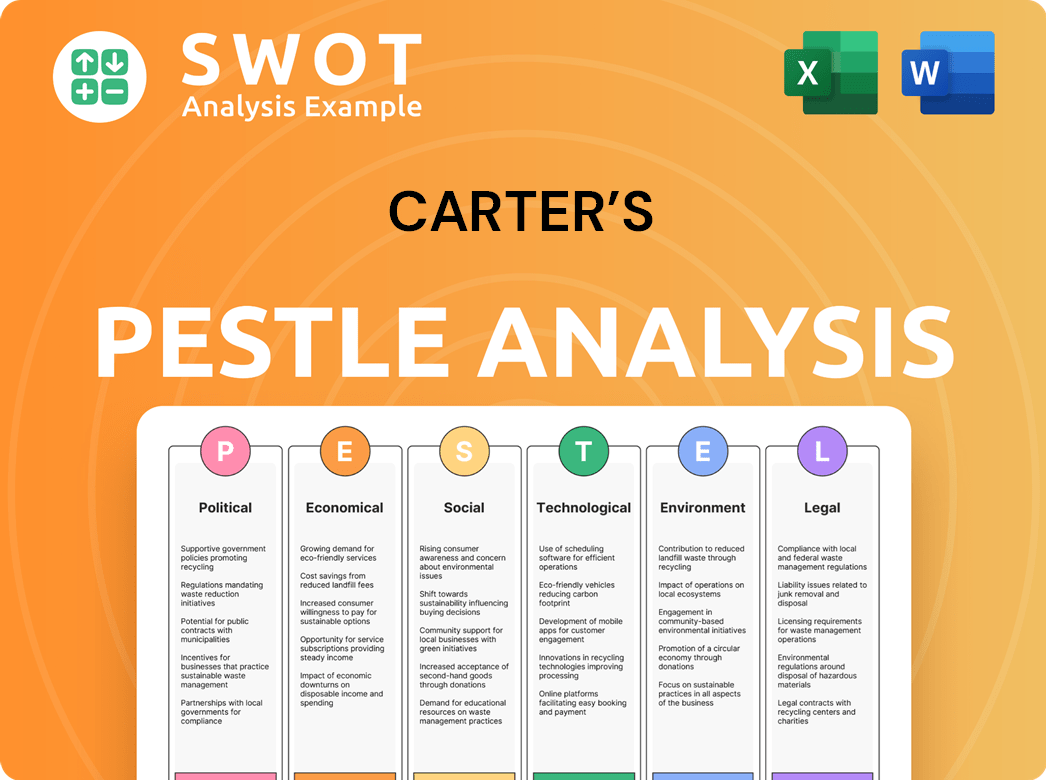

Carter’s PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Carter’s’s Board?

The current board of directors at Carter's, Inc. is pivotal in overseeing the company's strategy and governance. As of April 3, 2025, Douglas C. Palladini holds the positions of Chief Executive Officer, President, and board member. William J. Montgoris serves as the Non-Executive Chairman of the Board, a role he assumed in January 2025. The board also includes independent directors such as Gretchen Schar, Jevin Eagle, Luis Borgen, Stacey Rauch, Stephanie Stahl, Mark Hipp, Hali Borenstein, Jeffrey Black, and Rochester Anderson. The Compensation and Human Capital Committee manages executive compensation and succession planning, including for the CEO and other executive officers. The average tenure of the board members is approximately 3.6 years.

The Corporate Governance Principles allow for the roles of Chairman and CEO to be combined if the non-management directors deem it beneficial for the company. Regarding the question of Who owns Carter's, the board's composition reflects a mix of executive leadership and independent oversight, which is standard for publicly traded companies. The structure suggests a focus on both operational expertise and independent governance to ensure accountability and strategic direction. For more details about the company, you can read Revenue Streams & Business Model of Carter’s.

| Board Member | Role | Date of Appointment (approximate) |

|---|---|---|

| Douglas C. Palladini | CEO, President, Director | April 3, 2025 |

| William J. Montgoris | Non-Executive Chairman | January 2025 |

| Gretchen Schar | Independent Director | Recent |

| Jevin Eagle | Independent Director | Recent |

| Luis Borgen | Independent Director | Recent |

| Stacey Rauch | Independent Director | Recent |

| Stephanie Stahl | Independent Director | Recent |

| Mark Hipp | Independent Director | Recent |

| Hali Borenstein | Independent Director | Recent |

| Jeffrey Black | Independent Director | Recent |

| Rochester Anderson | Independent Director | Recent |

The institutional ownership structure, with significant holdings by major investment firms, indicates their influence through standard one-share-one-vote mechanisms. There have been no recent reports of proxy battles or activist investor campaigns. This structure helps answer the question of Who owns Carter's company, highlighting the role of institutional investors in the company's governance. The board's composition and the absence of dual-class shares or special voting rights further suggest a conventional governance model.

The board includes a mix of executive and independent directors.

- Douglas C. Palladini is the current CEO and President, appointed on April 3, 2025.

- William J. Montgoris serves as the Non-Executive Chairman, appointed in January 2025.

- The average tenure of the board members is approximately 3.6 years.

- Institutional investors hold significant shares, influencing the company's direction.

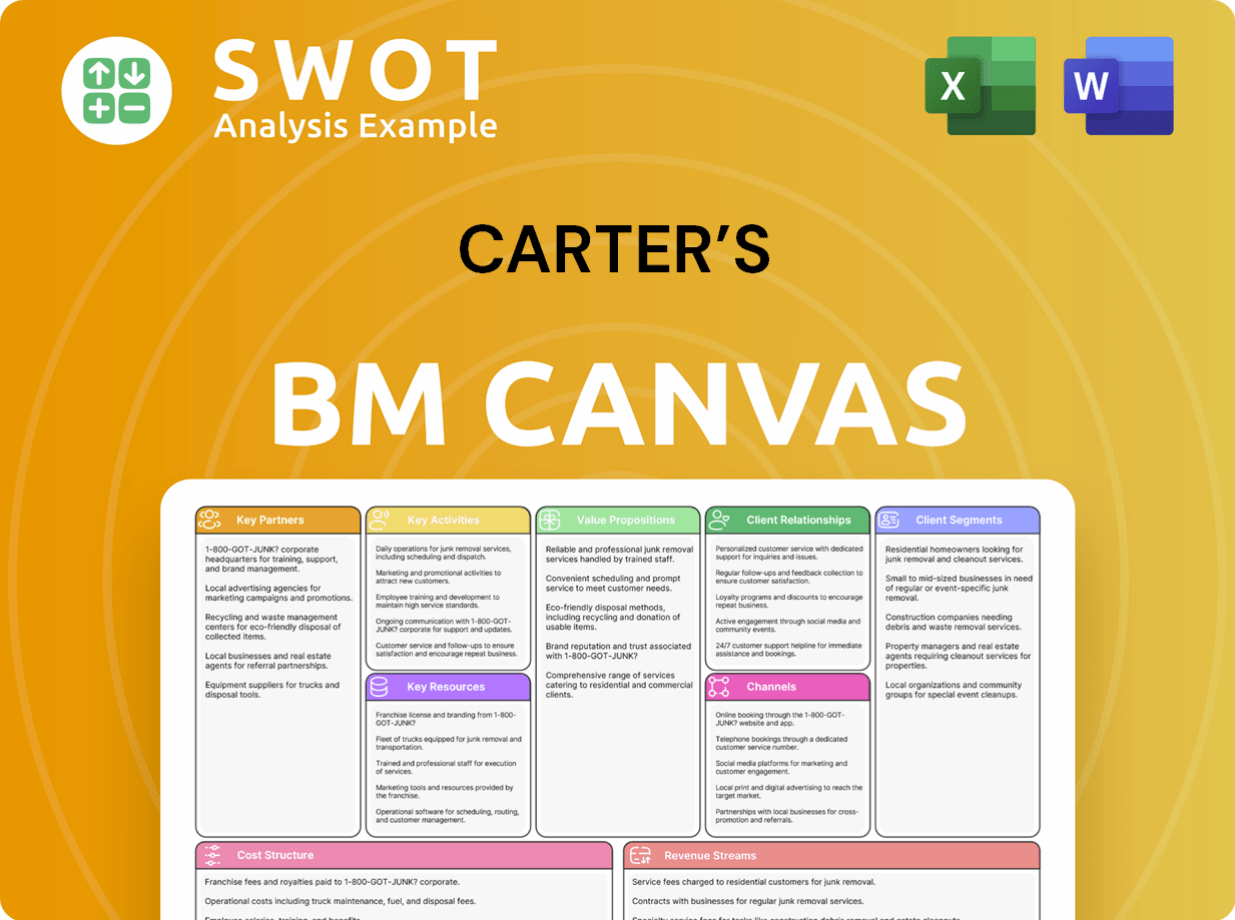

Carter’s Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Carter’s’s Ownership Landscape?

In the past few years, the ownership profile of Carter's Inc has seen shifts, notably in leadership. Michael D. Casey retired as Chairman and CEO in January 2025. Richard F. Westenberger served as interim CEO before Douglas C. Palladini was appointed CEO and President, effective April 3, 2025. William J. Montgoris became Non-Executive Chairman of the Board. These changes are part of a planned succession strategy, influencing the company's direction and potentially its ownership structure.

Financially, Carter's returned $166.7 million to shareholders in fiscal year 2024 through dividends and share repurchases. However, share repurchases were paused in late 2024 and early 2025. In April 2025, the quarterly dividend was cut by almost 70% to $0.25 per share. The company also withdrew its 2025 guidance due to the CEO transition and economic uncertainties. Net sales for Q1 2025 decreased by 4.8% to $630 million compared to $661 million in the prior year. The new CEO is expected to unveil a new strategic plan in late July 2025. These financial adjustments may affect investor confidence and ownership dynamics.

| Metric | Fiscal Year 2024 | Q1 2025 |

|---|---|---|

| Shareholder Returns | $166.7 million | N/A |

| Net Sales | $661 million (Prior Year) | $630 million |

| Dividend per Share (Q2 2025) | $0.80 (Prior Quarter) | $0.25 |

The ownership landscape of Carter's reflects industry trends, with increased institutional ownership. Major investment firms hold substantial stakes in the company. For more insight into the company's goals, you can read about Growth Strategy of Carter’s.

Recent leadership changes, including a new CEO in April 2025, are reshaping the company's direction. These shifts influence investor perceptions and potential ownership adjustments.

A dividend cut and paused share repurchases in 2024 and 2025 reflect economic uncertainty. Q1 2025 net sales decreased, signaling potential impacts on shareholder value.

Increased institutional ownership is a notable trend. Major investment firms hold significant stakes. This suggests a focus on long-term value and strategic decisions.

The new CEO's strategic plan, expected in late July 2025, will provide insights into the company's future. This plan could influence investor sentiment and ownership decisions.

Carter’s Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Carter’s Company?

- What is Competitive Landscape of Carter’s Company?

- What is Growth Strategy and Future Prospects of Carter’s Company?

- How Does Carter’s Company Work?

- What is Sales and Marketing Strategy of Carter’s Company?

- What is Brief History of Carter’s Company?

- What is Customer Demographics and Target Market of Carter’s Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.