Consolidated Elec Distributors Bundle

How Does Consolidated Elec Distributors Thrive in the Electrical Market?

Ever wondered who keeps the lights on and the power flowing in homes, businesses, and factories across the nation? Consolidated Electrical Distributors (CED), a leading Consolidated Elec Distributors SWOT Analysis, is a key player in the electrical supply chain, a $160 billion market in 2024, projected to surge to $235.8 billion by 2025. With over 700 locations, CED company provides essential electrical supplies, making it a critical, yet often overlooked, component of modern infrastructure.

This article dives deep into the inner workings of this electrical distributor, exploring its unique decentralized approach that fosters strong customer relationships and customized service. Discover how CED company leverages its extensive network and broad product line, including CED products, to maintain a leadership position in a dynamic market. Understanding CED’s operations is crucial for anyone seeking to grasp the intricacies of the electrical industry and the strategies behind its success.

What Are the Key Operations Driving Consolidated Elec Distributors’s Success?

The core operations of the CED company revolve around a decentralized model, leveraging a network of over 700 independently operated business units across the United States. This structure allows each location to function as a localized 'profit center,' making decisions tailored to its specific market and customer needs. This approach fosters strong local relationships and provides customized service, which is crucial for an electrical distributor.

The value proposition of Consolidated Elec Distributors lies in its ability to serve diverse customer segments directly. These include commercial and residential electrical contractors, industrial facilities, agricultural businesses, government entities, and utilities. By offering a comprehensive range of electrical supplies and value-added services, CED aims to be a one-stop shop for its customers, supporting a wide array of project requirements.

The company's focus on efficiency and cost-effectiveness is evident in its streamlined supply chains and distribution networks. This allows CED to offer competitive pricing while maintaining high service standards. The company's commitment to quality and reliability is further enhanced through partnerships with top electrical manufacturers, ensuring the delivery of dependable products. To learn more about the company's journey, you can read the Brief History of Consolidated Elec Distributors.

CED provides a wide range of electrical supplies, including wiring, lighting, control systems, and automation components. They also offer value-added services such as project management and technical support. These offerings are designed to meet the diverse needs of their customer base.

The company prioritizes efficiency and cost-effectiveness through streamlined supply chains and distribution. In 2024, CED reported a 2.5% reduction in distribution costs. Supply chain efficiency increased by 3% in Q1 2025, reflecting their commitment to operational excellence.

CED serves a broad range of customers, including commercial and residential electrical contractors, industrial facilities, and government entities. This wide customer base allows CED to maintain a strong market presence. They also serve agricultural businesses and utilities.

Partnerships with top electrical manufacturers are crucial for ensuring product quality and reliability. Collaborations with leading brands boosted sales by 15% in 2024. The electrical equipment market is projected to reach $235.8 billion by 2025.

Key operational processes include robust inventory management and efficient distribution networks. Local stock availability ensures on-time delivery, enhancing customer satisfaction. Value-added services transform CED from a product supplier to a project partner.

- Inventory Management: Local stock availability and efficient distribution.

- Distribution Networks: Ensuring on-time delivery.

- Value-Added Services: Project management, lighting design, and technical support.

- Customer Focus: Enhancing customer satisfaction and driving repeat business.

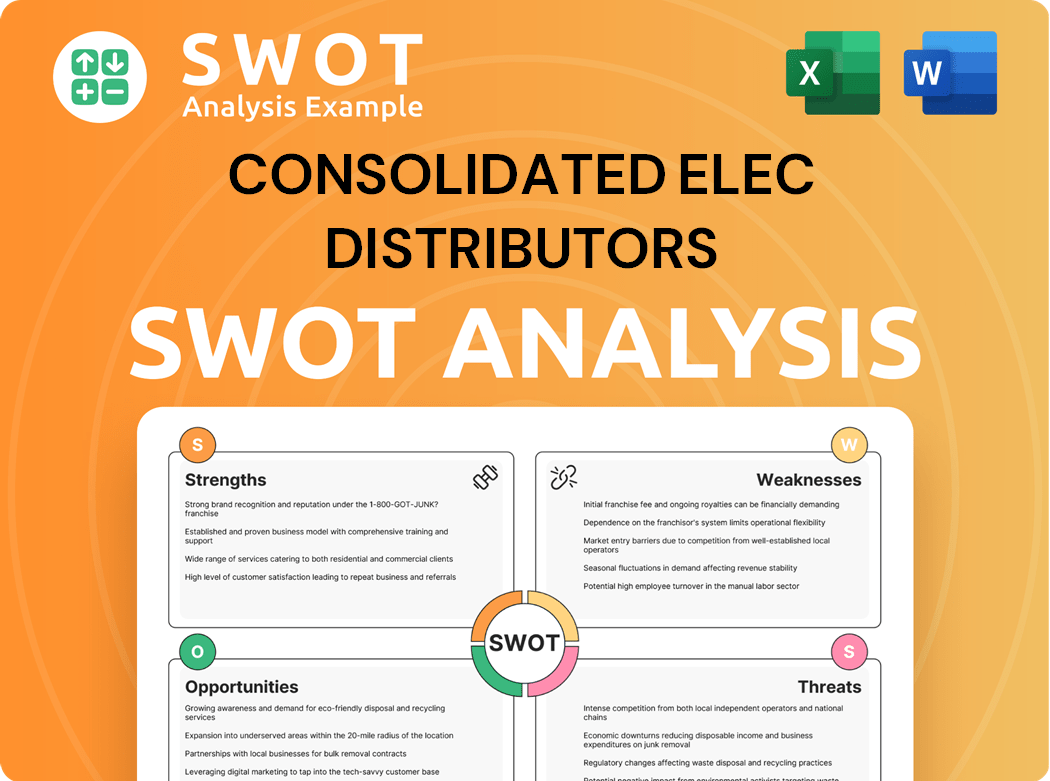

Consolidated Elec Distributors SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Consolidated Elec Distributors Make Money?

Consolidated Electrical Distributors (CED) generates revenue primarily through the sale of a wide array of electrical products and solutions. This electrical distributor focuses on providing essential components for various electrical projects. The company's financial performance is driven by its ability to efficiently distribute these products to a diverse customer base.

The main revenue streams for CED include product sales of items such as wiring, lighting, and control systems. CED products also encompass automation and controls, communications and security equipment, and wire, cable, and conduit. The company's extensive product range supports a broad customer base, driving consistent sales.

CED’s monetization strategies extend beyond product sales to include value-added services. These services, such as project management and technical support, enhance customer satisfaction. The company’s decentralized structure allows for localized strategies.

CED's primary revenue stream comes from selling a wide range of electrical supplies. This includes everything from basic wiring to advanced control systems. In 2024, diverse product sales increased by 15%.

CED offers project management, lighting design, and technical support. These services enhance customer satisfaction and encourage repeat business. While specific revenue contributions aren't detailed, they play a key role.

Each of CED’s locations operates as an independent profit center. This allows for localized monetization strategies and responsiveness to market needs. Over 700 locations contribute to the company's overall success.

CED engages in strategic partnerships with top electrical manufacturers. These collaborations boost sales and expand market reach. Partnerships helped boost sales by 15% in 2024.

CED focuses on efficiency to improve profitability. This includes reducing distribution costs and enhancing supply chain efficiency. Distribution costs were reduced by 2.5% in 2024.

CED is expanding into new, high-demand technology segments, such as AI-based cybersecurity solutions. This diversification supports future revenue growth. A recent partnership with ARIA Cybersecurity Solutions is a key example.

CED's financial performance reflects its robust revenue streams and effective monetization strategies. In 2022, CED's total revenue reached $5.5 billion, and in 2024, sales exceeded $10 billion. As of June 2025, the company's annual revenue reached $750 million. The company's ability to maintain a strong supply chain and strategic partnerships, as mentioned in Target Market of Consolidated Elec Distributors, contributes to its success.

Here's a summary of key financial data and operational highlights for CED, showcasing how the company generates revenue as an electrical distributor:

- 2022 Revenue: $5.5 billion.

- 2024 Sales: Exceeded $10 billion.

- June 2025 Annual Revenue: $750 million.

- 2024 Product Sales Increase: 15%.

- 2024 Distribution Cost Reduction: 2.5%.

- Q1 2025 Supply Chain Efficiency Increase: 3%.

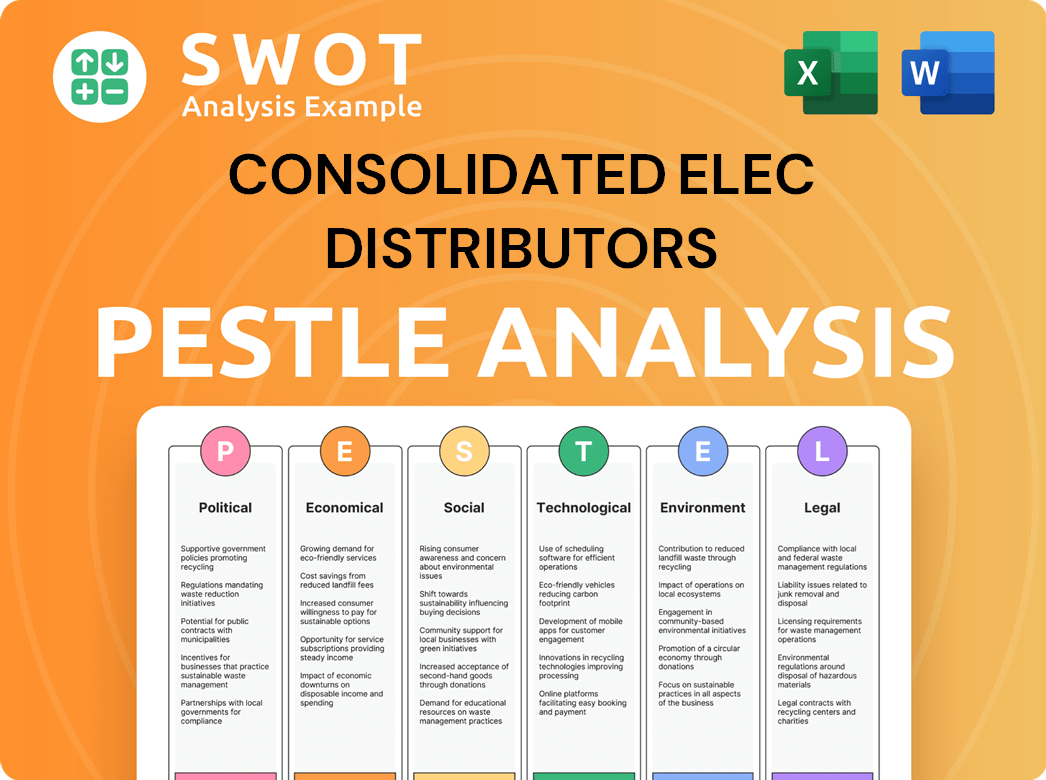

Consolidated Elec Distributors PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Consolidated Elec Distributors’s Business Model?

Understanding the operational dynamics of Consolidated Electrical Distributors (CED) involves examining its key milestones, strategic maneuvers, and competitive advantages. Founded in 1957 as Incandescent Supply, the company has evolved significantly, establishing itself as a major player in the electrical distribution sector. Its journey is marked by strategic acquisitions and a focus on customer-centric service, contributing to its current standing in the industry.

The evolution of CED, from its inception to its present form, showcases a proactive approach to market dynamics. The rebranding to Consolidated Electrical Distributors in 1964 was a crucial step, followed by a strategic focus on growth through acquisitions. This approach has allowed CED to expand its footprint and enhance its service offerings, solidifying its position in the competitive landscape of wholesale electrical supplies.

CED's operational framework is designed to meet the specific needs of its customers, with a strong emphasis on local service. The company's decentralized structure enables local managers to make decisions that are tailored to their markets. This operational model, combined with strategic partnerships and a focus on emerging technologies, positions CED to adapt to market changes and maintain a competitive edge.

CED was established in 1957 as Incandescent Supply. The company rebranded to Consolidated Electrical Distributors in 1964. It has grown significantly through strategic acquisitions, including All-Phase Electric Supply in 1999.

CED's strategy includes consistent acquisitions to expand its network, with over 700 locations nationwide. Recent acquisitions such as Parrish-Hare Electrical Supply in 2024 and Bayou Electric in November 2024, continue this trend. The company focuses on providing exceptional localized service and value-added solutions.

CED's competitive advantages include its extensive distribution network and strong customer relationships. The decentralized business model empowers local managers, fostering a customer-centric approach. CED emphasizes quality and reliability through partnerships with top electrical manufacturers.

CED faces challenges like limited brand recognition and potential inventory management inefficiencies. The company is also exposed to economic downturns in sectors like construction. CED adapts by investing in AI and technology, such as the 2024 partnership with ARIA Cybersecurity Solutions.

CED's operational model is characterized by a decentralized structure that allows for localized decision-making, which supports its customer-centric approach. The company's extensive distribution network, with over 700 locations, enables it to serve a wide range of customers across the United States. CED's focus on value-added solutions and strategic partnerships with top manufacturers further enhances its market position.

- Acquisitions: CED's growth strategy includes acquiring other electrical distributors, such as the 2024 acquisition of Parrish-Hare Electrical Supply.

- Market Challenges: The company faces challenges such as brand recognition and economic impacts on the construction and industrial sectors.

- Technological Advancements: CED is investing in AI and other technologies to streamline operations and improve customer service.

- Strategic Partnerships: Collaborations, like the one with ARIA Cybersecurity Solutions, demonstrate CED's commitment to adapting to emerging market needs.

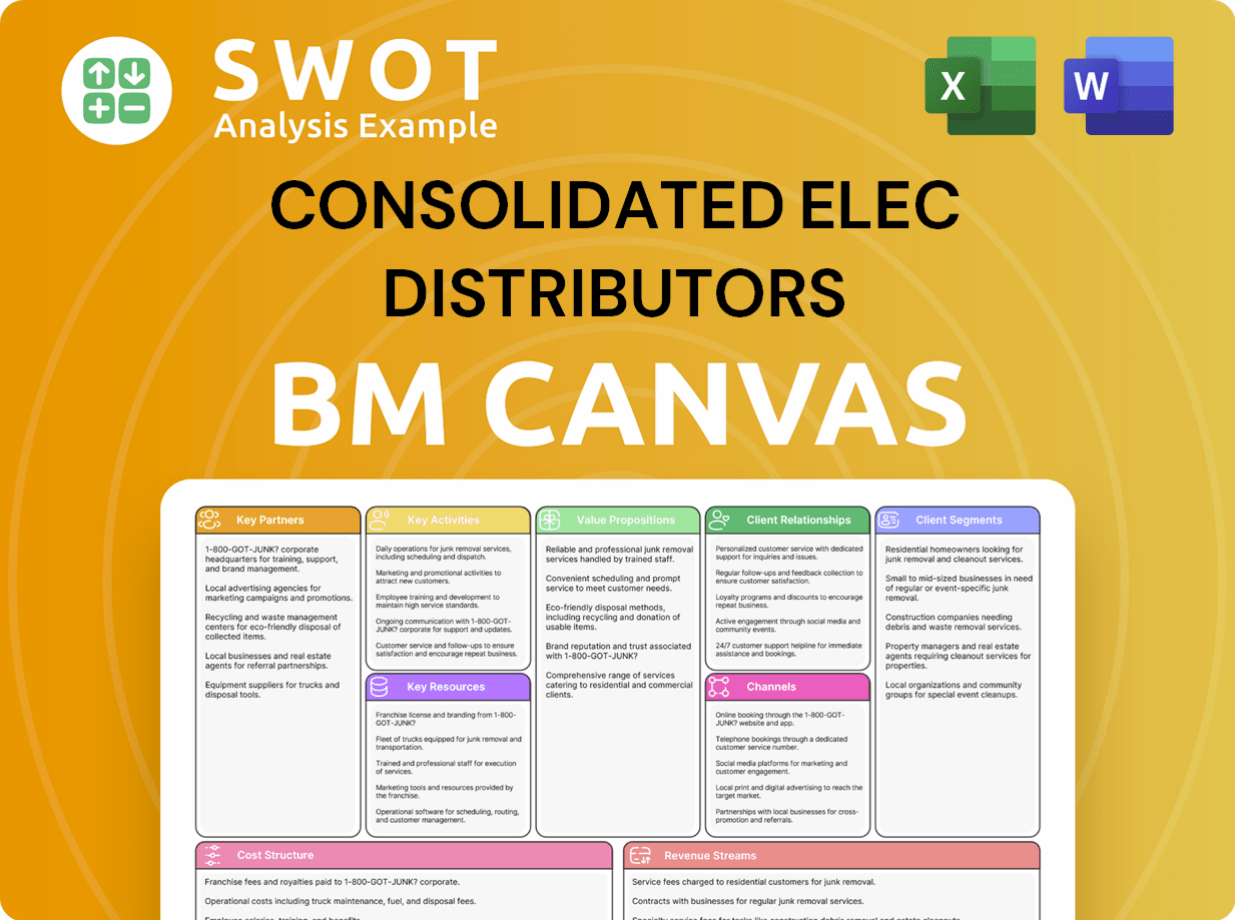

Consolidated Elec Distributors Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Consolidated Elec Distributors Positioning Itself for Continued Success?

Consolidated Electrical Distributors (CED) holds a strong position in the electrical distribution market. As one of the largest electrical solutions distributors in the U.S., CED has a significant market presence. With over 700 locations nationwide, the company generated over $10 billion in sales in 2024, solidifying its status as a key player in the wholesale electrical sector.

Despite its strong industry standing, CED faces risks. The company's dependence on cyclical sectors and increasing competition could squeeze profit margins. Supply chain disruptions, especially with switchgear, remain a concern, impacting operations and potentially affecting customer satisfaction. Understanding these factors is crucial for evaluating the long-term viability of the CED company.

CED is a major electrical distributor in the U.S., consistently ranking among the top players. Its extensive network of over 700 locations supports a strong market presence. In 2024, CED's estimated market share was approximately 3%, reflecting its significant influence in the electrical supplies industry.

CED faces risks from cyclical sectors like construction and industrial markets. Competition from national and local players can impact pricing and margins. Limited brand recognition compared to larger competitors is another hurdle. Supply chain issues, particularly with switchgear, continue to pose challenges.

CED is positioned for growth through acquisitions and technology investments. It aims to capitalize on the consolidation in the electrical equipment market. The company is focusing on high-growth segments like renewable energy and infrastructure upgrades. CED's adaptability will be key to its success.

CED is actively pursuing acquisitions to broaden its market reach. Investments in AI are aimed at streamlining operations and improving customer service. The company is targeting high-growth areas like renewable energy. This strategy aligns with the anticipated growth in the electrical equipment market.

CED is strategically positioned to capitalize on several market trends. The company's focus on renewable energy and infrastructure aligns with the increasing demand for sustainable solutions. The U.S. solar market's growth of 52% in Q1 2024 and planned spending of $65 billion on grid improvements by 2025 present significant opportunities. CED's commitment to customer service and its adaptable business model will be crucial in sustaining and expanding its ability to generate profit in the evolving electrical distribution landscape. Learn more about the Growth Strategy of Consolidated Elec Distributors.

- Acquisitions to expand market presence.

- Investment in AI to streamline operations and improve customer service.

- Focus on high-growth segments like renewable energy.

- Adaptable decentralized model to maintain customer relationships.

Consolidated Elec Distributors Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Consolidated Elec Distributors Company?

- What is Competitive Landscape of Consolidated Elec Distributors Company?

- What is Growth Strategy and Future Prospects of Consolidated Elec Distributors Company?

- What is Sales and Marketing Strategy of Consolidated Elec Distributors Company?

- What is Brief History of Consolidated Elec Distributors Company?

- Who Owns Consolidated Elec Distributors Company?

- What is Customer Demographics and Target Market of Consolidated Elec Distributors Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.