Choice Hotels Bundle

How Does Choice Hotels Conquer the Hospitality World?

Choice Hotels International, a titan in the Choice Hotels SWOT Analysis, operates a vast network of franchised hotels globally, catering to a wide range of travelers. This strategic approach, focusing on franchising, allows Choice Hotels to rapidly expand its presence and market reach across various segments, from budget-friendly to luxury accommodations. Understanding how this model works is key to appreciating the company's influence in the competitive hotel industry.

This exploration will delve into the core operations of Choice Hotels, examining its diverse revenue streams and the strategic initiatives that have fueled its growth. Whether you're curious about the Choice Hotels franchise model, the benefits of the Choice Hotels rewards program, or simply seeking information on Choice Hotels near me, this analysis provides valuable insights. We'll uncover how this hotel company maintains its competitive edge and navigates the ever-evolving landscape of the hotel industry.

What Are the Key Operations Driving Choice Hotels’s Success?

Choice Hotels International operates primarily as a franchisor in the hotel industry. This means its main function is to license its brand names and operational systems to independent hotel owners. This strategy allows for rapid expansion with minimal capital investment, which is a key aspect of its business model.

The value proposition for those who choose to franchise with Choice Hotels includes access to its established brand recognition, a strong reservation system, marketing and sales support, and ongoing training. For travelers, Choice Hotels offers a wide range of accommodations across different price points and service levels, ensuring there is a brand to meet various needs and preferences. This diverse portfolio is a significant advantage in attracting a broad customer base.

Choice Hotels' core operations are multifaceted, with a central reservation system that manages bookings across all franchised properties, driving occupancy rates. Technology investments are crucial, including digital platforms like the mobile app and website, enhancing the guest experience and streamlining booking processes. The company also provides franchisees with property management systems and revenue management tools to optimize their operations and profitability. Sales channels include direct bookings, online travel agencies (OTAs), and global distribution systems (GDS).

Choice Hotels provides extensive support to its franchisees. This includes brand recognition, marketing, and operational best practices. The goal is to help franchisees succeed by leveraging the company's established systems and resources.

For guests, Choice Hotels offers a range of accommodations. This includes different brands catering to various budgets and preferences. The company focuses on providing consistent service and quality across its portfolio.

Choice Hotels invests in technology to enhance both franchisee and guest experiences. This includes a central reservation system, a mobile app, and property management tools. These technologies streamline operations and improve customer service.

The Choice Hotels loyalty program, Choice Privileges, is a key component of its customer retention strategy. Members earn points for stays, which can be redeemed for free nights and other rewards. This program encourages repeat business and brand loyalty.

Choice Hotels' operational model is centered around franchising, which allows for efficient expansion and a focus on providing support to franchisees. This asset-light approach enables the company to scale its operations while maintaining a strong financial position. Key aspects include:

- Franchise Support: Providing franchisees with brand recognition, marketing, and operational best practices.

- Technology: Utilizing a central reservation system, mobile app, and property management tools.

- Customer Service: Offering a centralized call center and a loyalty program to enhance guest experience.

- Brand Portfolio: Managing a diverse portfolio of hotel brands to cater to various customer segments.

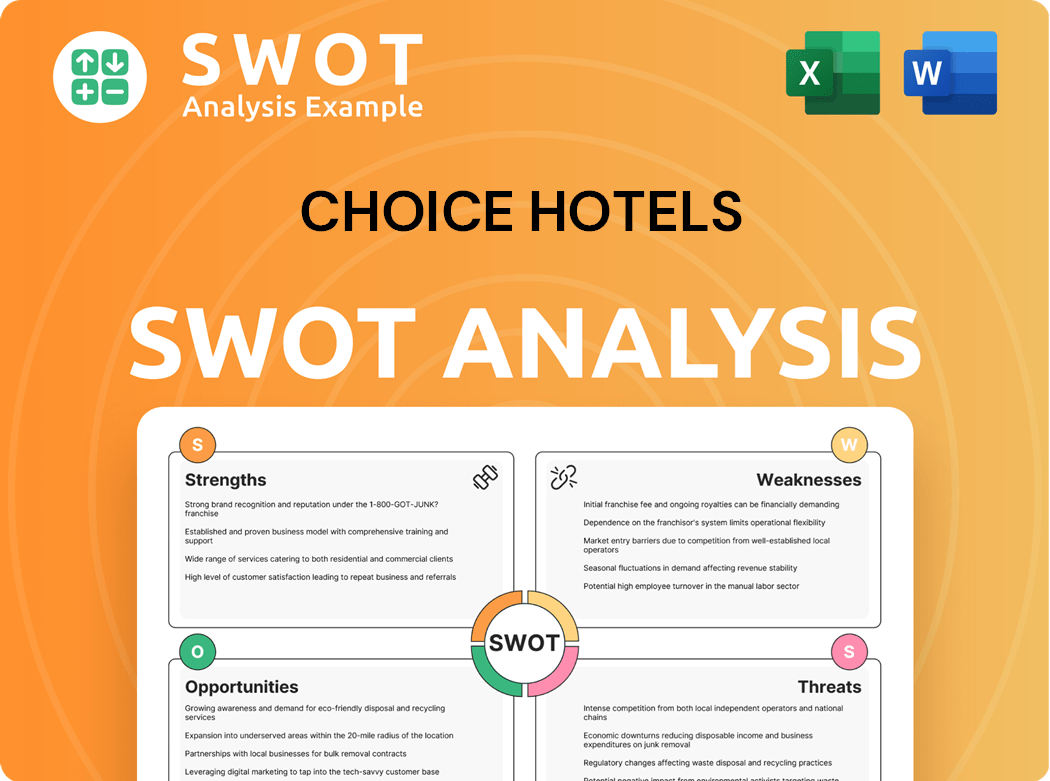

Choice Hotels SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Choice Hotels Make Money?

The primary revenue streams for Choice Hotels International are centered around its franchising model. This model generates income through various fees and services provided to its franchisees. The company's financial health is heavily reliant on these recurring revenue streams.

In fiscal year 2024, Choice Hotels reported total revenues of approximately $1.5 billion. A significant portion of this revenue came from franchise royalties and other recurring fees. The company's diversified approach includes technology solutions and its loyalty program.

Choice Hotels' monetization strategies are multifaceted, focusing on franchise fees, technology services, and its loyalty program. Strategic acquisitions, like the Radisson Hotels Americas purchase, have expanded its brand portfolio and global footprint, further diversifying its revenue base.

Recurring franchise fees, calculated as a percentage of gross room revenue, form the core of Choice Hotels' revenue. Initial franchise fees from new franchisees also contribute to the revenue stream. The franchise model provides a stable income source.

Choice Hotels generates revenue by providing proprietary technology solutions and services to franchisees. These include property management systems and revenue management tools. These services enhance operational efficiency for franchisees.

The Choice Privileges loyalty program drives repeat business and generates revenue through partnerships. Co-branded credit cards also contribute to revenue. This program enhances customer engagement and brand loyalty.

Acquisitions, such as Radisson Hotels Americas, have expanded the company's brand portfolio and global presence. This diversification strengthens the revenue base. These moves increase the company's market share.

While domestic franchising is a primary focus, international expansion is a growing area. This expansion enhances revenue potential from global markets. The company aims to increase its international presence.

The revenue mix is predominantly driven by domestic franchising activities. However, international expansion is a growing focus. This balance supports the company's financial growth.

In 2024, Choice Hotels reported approximately $1.5 billion in total revenues, with a significant portion from franchise royalties. The company's commitment to its loyalty program and strategic acquisitions, such as Radisson Hotels Americas, underscores its growth strategy.

- Franchise Fees: Percentage of gross room revenue.

- Technology Solutions: Property management systems and revenue management tools.

- Choice Privileges: Loyalty program partnerships and co-branded credit cards.

- Strategic Acquisitions: Expanding the brand portfolio and global presence.

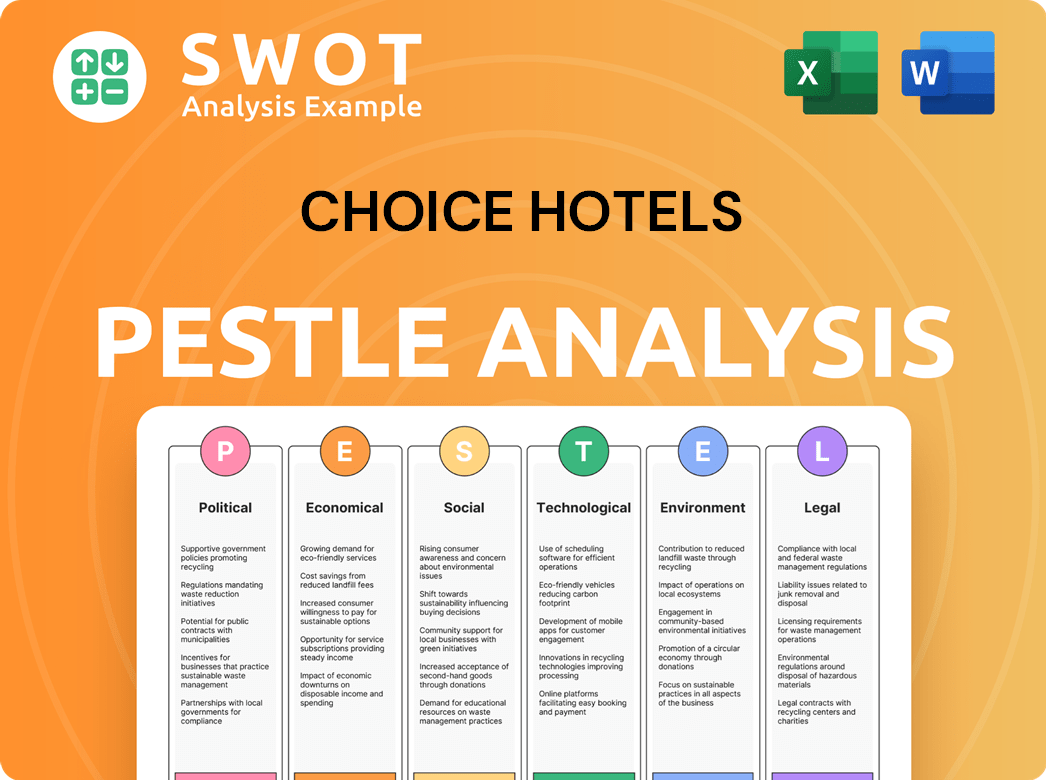

Choice Hotels PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Choice Hotels’s Business Model?

Choice Hotels International has a history marked by strategic milestones that have shaped its operational and financial success. A key strategy has been its expansion through franchising, which has enabled the company to grow its brand portfolio and geographic presence without significant capital investments. This approach has allowed for rapid growth and adaptation to market demands, establishing it as a leading player in the Growth Strategy of Choice Hotels.

The company's strategic moves have been crucial, especially in navigating challenges such as the COVID-19 pandemic, which severely impacted the hospitality sector. Choice Hotels responded by supporting its franchisees, including offering fee deferrals and operational guidance. Furthermore, the acquisition of Radisson Hotels Americas in 2022 for approximately $675 million was a transformative move, adding nine well-known brands and expanding its presence in the upscale and extended-stay segments within the Americas. This acquisition not only increased its unit count but also broadened its customer base and diversified its revenue streams.

Choice Hotels' competitive edge is built upon several key strengths. These include strong brand recognition across a diverse portfolio, catering to various traveler segments from economy to upscale. Its asset-light franchising model provides scalability and strong cash flow generation. Technology leadership, particularly in its central reservation system and digital platforms, gives it an edge in distribution and guest engagement. The company also benefits from significant economies of scale in marketing and loyalty programs.

The company's history is marked by strategic decisions that have significantly influenced its operational and financial trajectory. A notable strategic move was the consistent expansion through franchising, allowing for growth without major capital outlays. The 2022 acquisition of Radisson Hotels Americas for approximately $675 million was a transformative step, adding nine brands and expanding its presence in the upscale and extended-stay segments.

Navigating challenges, such as the COVID-19 pandemic, Choice Hotels implemented initiatives to support franchisees, including fee deferrals. The asset-light franchising model enables scalability and strong cash flow. Investing in technology and enhancing loyalty programs are ongoing strategies to maintain a competitive edge.

Choice Hotels has a strong brand recognition across a diverse portfolio, offering options for various traveler segments. The company benefits from significant economies of scale in marketing and loyalty programs. Technology leadership in its central reservation system and digital platforms gives it an edge in distribution and guest engagement.

In 2023, Choice Hotels reported a total revenue of approximately $1.4 billion. The company's adjusted EBITDA for the year was around $480 million. The company's brand portfolio includes over 7,400 hotels, representing approximately 630,000 rooms, as of the end of 2023.

Choice Hotels' competitive advantages are multifaceted, including a broad brand portfolio and an asset-light franchising model. The company benefits from strong brand recognition and significant economies of scale in marketing and loyalty programs, which attract both franchisees and guests.

- Diverse Brand Portfolio: Catering to various traveler segments from economy to upscale, offering options for different preferences and budgets.

- Asset-Light Model: The franchising model allows for scalability and strong cash flow generation, reducing capital expenditure.

- Technology Leadership: Advanced central reservation systems and digital platforms enhance distribution and guest engagement, improving operational efficiency.

- Loyalty Program: The rewards program attracts and retains guests, driving repeat business and increasing customer lifetime value.

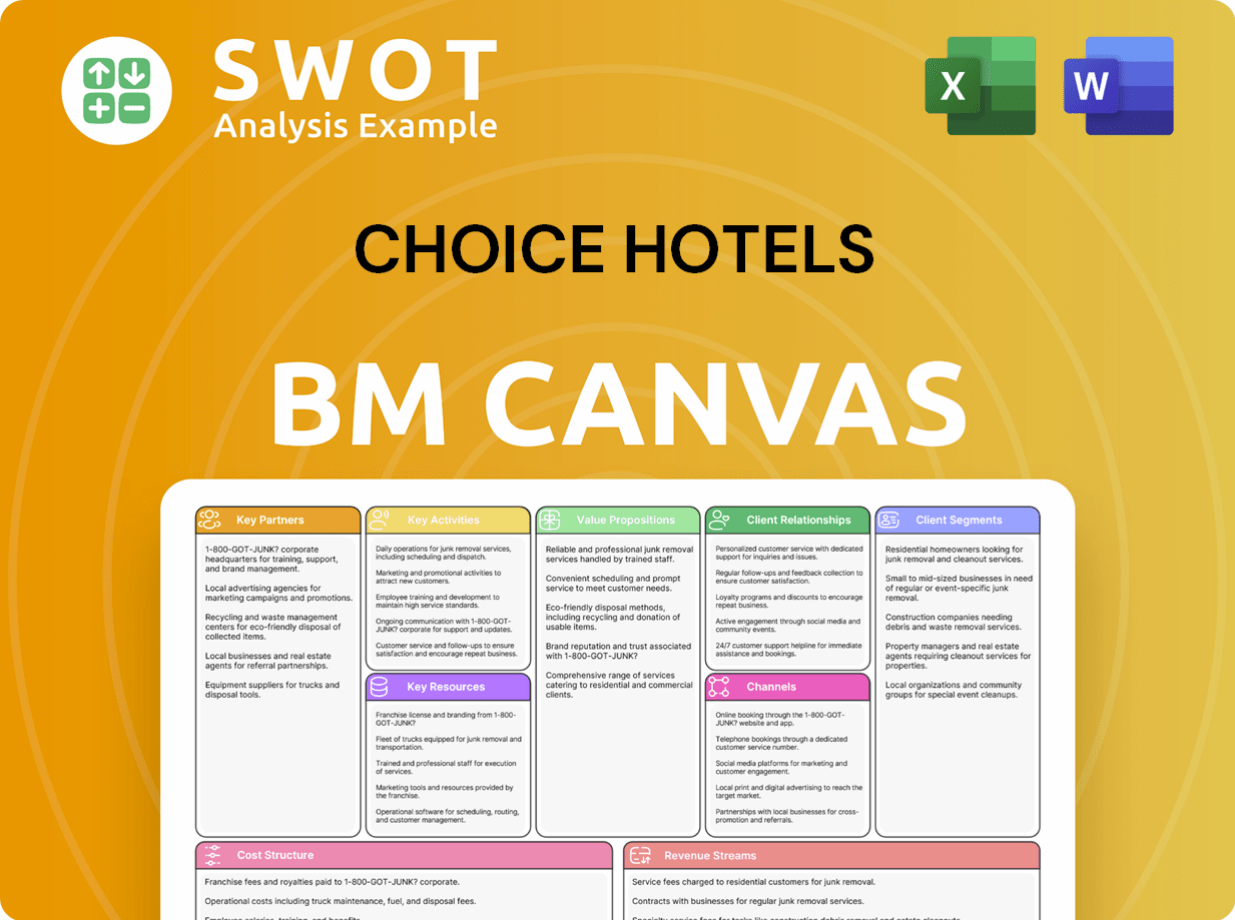

Choice Hotels Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Choice Hotels Positioning Itself for Continued Success?

Choice Hotels International holds a strong position in the global hospitality industry, particularly in the midscale and economy segments. Its extensive franchise network and brand recognition provide a significant advantage. The acquisition of Radisson Hotels Americas has solidified its position as one of the largest hotel companies globally by room count, boosting its market share. This makes Choice Hotels a key player in the hotel industry, offering a wide range of options for travelers.

However, the company faces risks such as economic downturns, competition from other hotel chains, and technological disruptions from online travel agencies. Regulatory changes and evolving consumer preferences also pose challenges. Despite these risks, Choice Hotels is actively working on strategic initiatives, including investments in its digital platforms and loyalty programs. The company's focus on segments like extended stay hotels aims to improve performance across different economic cycles.

Choice Hotels has a strong presence in the midscale and economy segments of the hotel industry. Its franchise model and diverse brand portfolio support its market position. The company's global reach extends to over 40 countries, with a significant presence in North America.

Key risks include economic downturns, competition from other hotel companies, and technological disruption. Regulatory changes and changing consumer preferences also pose challenges. The company must adapt to maintain its competitive edge in the dynamic hotel industry.

The future outlook for Choice Hotels is positive, with plans to leverage its expanded brand portfolio. The company aims to enhance its value proposition for both franchisees and guests. Strategic growth and operational efficiencies are key to expanding revenue. For further insights, check out the Competitors Landscape of Choice Hotels.

Choice Hotels focuses on digital platforms and loyalty programs to drive direct bookings. Expanding its presence in extended stay and upscale segments is also a priority. The company is committed to franchisee profitability and technological innovation.

Choice Hotels continues to invest in its loyalty program, which is crucial for customer retention. The company's focus on direct bookings helps reduce reliance on OTAs. As of early 2024, Choice Hotels had over 7,400 hotels open and operating, representing approximately 630,000 rooms worldwide.

- Expansion into the extended-stay segment has been a key growth area.

- Focus on improving the guest experience through technology and enhanced services.

- Emphasis on sustainability and eco-friendly practices to meet consumer demand.

- Continued efforts to support its franchisees and improve their profitability.

Choice Hotels Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Choice Hotels Company?

- What is Competitive Landscape of Choice Hotels Company?

- What is Growth Strategy and Future Prospects of Choice Hotels Company?

- What is Sales and Marketing Strategy of Choice Hotels Company?

- What is Brief History of Choice Hotels Company?

- Who Owns Choice Hotels Company?

- What is Customer Demographics and Target Market of Choice Hotels Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.