Church & Dwight Bundle

How Does Church & Dwight Thrive in the Consumer Goods Market?

Church & Dwight Co., Inc., a powerhouse in the consumer goods sector, captivates consumers with its iconic brands. From Church & Dwight SWOT Analysis to understanding its core operations, investors and industry watchers need to understand its market position. Its strategic brand management and expansive product portfolio, including the well-known Arm & Hammer, have solidified its global presence.

This exploration into the Church & Dwight Company unveils its inner workings, revealing how it generates revenue and maintains its competitive edge. Understanding the company structure and its diverse product portfolio is key to grasping its financial performance. Delving into its business model provides valuable insights for anyone tracking the consumer goods industry, from the Church & Dwight stock price to its sustainability initiatives.

What Are the Key Operations Driving Church & Dwight’s Success?

The core of Church & Dwight Company's operations lies in the development, manufacturing, and marketing of a wide variety of consumer products. Its diverse product portfolio includes household staples like ARM & HAMMER baking soda and OxiClean stain removers, personal care items such as Trojan condoms and Batiste dry shampoo, and a range of specialty products. This broad offering caters to a vast customer base, from individual consumers to industrial clients.

The company's integrated operational processes are critical to its success. These processes encompass research and development, raw material sourcing, manufacturing across multiple facilities, and efficient logistics. This integrated approach ensures that products are readily available to consumers. The company's supply chain is designed for both efficiency and responsiveness, utilizing internal manufacturing and strategic partnerships.

Distribution is a key strength, with products reaching consumers through various channels, including mass merchandisers, supermarkets, drugstores, club stores, and e-commerce platforms. A unique aspect of Church & Dwight's strategy is its focus on acquiring and nurturing brands with strong consumer loyalty. This approach allows the company to maximize the potential of these brands by leveraging its operational expertise. This translates into customer benefits through trusted, effective products and market differentiation.

The company invests significantly in research and development to innovate and improve its product offerings. This includes both incremental improvements to existing products and the development of new products to meet evolving consumer needs. Innovation is a continuous process, ensuring that the company's products remain relevant and competitive in the market.

The company operates multiple manufacturing facilities to produce its diverse product range. Its supply chain is designed for efficiency and resilience, with a focus on sourcing raw materials and managing production to meet demand. Strategic partnerships also play a crucial role in optimizing the supply chain.

Products are distributed through various channels, including mass merchandisers, supermarkets, drugstores, club stores, and e-commerce platforms. This multi-channel approach ensures broad market reach and accessibility for consumers. The company continuously evaluates and optimizes its distribution network to improve efficiency.

The company focuses on building and maintaining strong brand equity for its diverse portfolio of brands. This involves strategic marketing campaigns, product positioning, and consumer engagement. Effective brand management is crucial for driving sales and maintaining consumer loyalty.

The value proposition of Church & Dwight centers on providing consumers with trusted, effective products across various categories. This is achieved through a combination of established brand recognition, product innovation, and efficient operations. The company's diverse brand portfolio caters to a wide range of consumer needs, offering both everyday essentials and specialized products.

- Trusted Brands: Building on the legacy of ARM & HAMMER and other well-known brands, the company offers products consumers trust.

- Product Effectiveness: Products are designed to deliver on their promises, providing consumers with effective solutions for their needs.

- Market Differentiation: The diverse brand portfolio allows the company to address distinct consumer needs and maintain a competitive advantage.

- Operational Efficiency: Efficient manufacturing, supply chain management, and distribution ensure product availability and cost-effectiveness.

- Customer Loyalty: By focusing on quality and brand recognition, the company cultivates strong customer loyalty, which is key to long-term success.

Church & Dwight SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Church & Dwight Make Money?

The Church & Dwight Company generates revenue through the sale of consumer domestic, consumer international, and specialty products. The company's diverse product portfolio includes well-known brands like Arm & Hammer, OxiClean, and Trojan. This multi-faceted approach allows the company to capture a broad market share and maintain a strong financial position.

In the first quarter of 2024, Church & Dwight reported net sales of $1,402.7 million, marking a 5.2% increase compared to the previous year. Organic sales grew by 4.7%, driven by a 3.4% increase in price/mix and a 1.3% increase in volume. This growth indicates the effectiveness of the company's monetization strategies and its ability to adapt to market dynamics.

The consumer international segment and specialty products segment also contribute significantly to the company's revenue streams. These segments help diversify the company's revenue base and expand its global footprint. This diversification is crucial for long-term sustainability and resilience in a competitive market. If you are interested in the company's ownership, you can find more information at Owners & Shareholders of Church & Dwight.

The monetization strategy of Church & Dwight revolves around volume sales, brand loyalty, and strategic pricing. The company focuses on maintaining competitive pricing while continuously innovating to offer premium products that justify higher price points. This approach allows the company to maximize profitability while remaining attractive to consumers.

- Volume Sales: Driving revenue through high sales volumes of its products.

- Brand Loyalty: Leveraging strong brand recognition and customer loyalty to ensure repeat purchases.

- Strategic Pricing: Implementing pricing strategies that balance competitiveness with profitability.

- Product Innovation: Continuously developing and introducing new products to meet consumer demands.

Church & Dwight PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Church & Dwight’s Business Model?

The evolution of the Church & Dwight Company has been shaped by strategic acquisitions and a focus on brand building. The company's journey includes significant acquisitions, such as the addition of brands like OxiClean and Waterpik, which have expanded its market presence and product offerings. These moves have allowed the company to enter new categories and strengthen its position in existing ones, driving both revenue and market share growth. The Church & Dwight Company has consistently demonstrated an ability to adapt and innovate, which is crucial for long-term success.

The Church & Dwight Company has also navigated operational challenges, including supply chain disruptions, by optimizing its manufacturing and distribution networks. This proactive approach has ensured product availability and maintained consumer trust. The company's commitment to operational excellence has been a key factor in its ability to consistently deliver strong financial results. This strategic agility is evident in its response to changing market dynamics and consumer preferences.

The company's competitive advantages include strong brand equity, with many of its brands holding leading positions in their respective categories. Church & Dwight benefits from economies of scale in manufacturing and distribution, leading to cost efficiencies. Furthermore, consistent investment in marketing and product innovation helps sustain brand relevance and drive consumer demand. The company continually adapts to new trends, such as the growing demand for natural and sustainable products, by developing and marketing environmentally friendly alternatives within its portfolio.

The acquisition of established brands like OxiClean and Waterpik has been pivotal in expanding the Church & Dwight Company's product portfolio. These acquisitions have allowed the company to diversify its offerings and enter new market segments. This strategic approach has significantly contributed to the company's revenue growth and market share expansion over time.

The company's strategic moves involve continuous innovation and adaptation to consumer trends. The focus on sustainable products and environmentally friendly alternatives reflects a commitment to meeting evolving consumer demands. This proactive approach helps maintain brand relevance and drive long-term growth within the market.

Strong brand equity and economies of scale provide a significant competitive advantage for Church & Dwight. Consistent investment in marketing and product innovation helps sustain brand relevance and drive consumer demand. The company's ability to adapt to new trends, such as the growing demand for natural and sustainable products, further strengthens its market position.

In 2024, Church & Dwight reported net sales of approximately $6.3 billion. This financial performance reflects the effectiveness of the company's strategic initiatives and its ability to navigate market challenges. The company's consistent financial results demonstrate its resilience and strategic foresight in the consumer goods industry.

The Church & Dwight brand portfolio includes leading brands in various categories, such as Arm & Hammer, OxiClean, and Waterpik. These brands hold strong market positions and contribute significantly to the company's overall revenue. The company's success is also driven by its effective Marketing Strategy of Church & Dwight, which focuses on brand building and consumer engagement.

- The Arm & Hammer brand is a household name, recognized for its baking soda and other products.

- OxiClean is a leading brand in the stain remover category, known for its effective cleaning power.

- Waterpik holds a significant share in the oral health market, offering innovative products.

- These brands collectively contribute to Church & Dwight's strong market presence and financial performance.

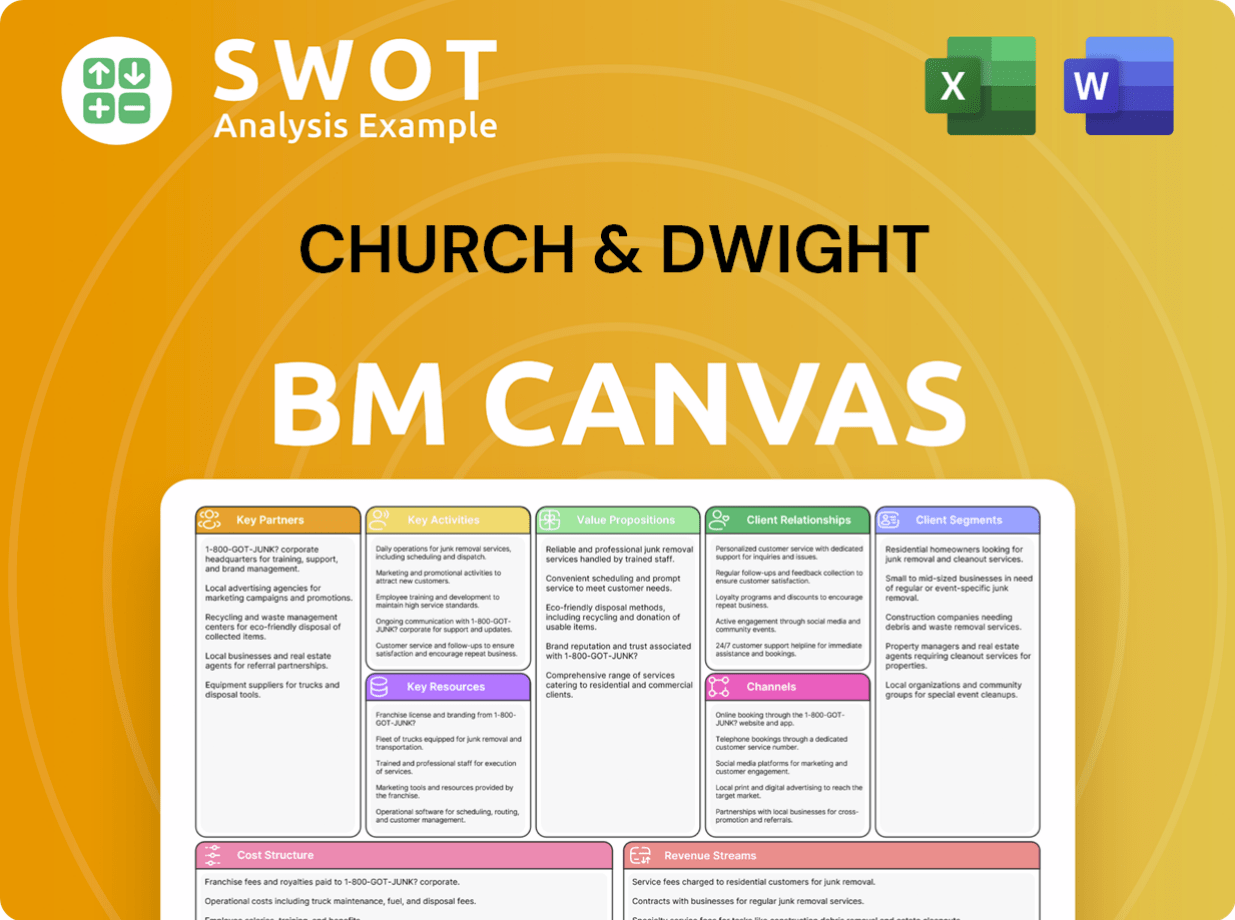

Church & Dwight Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Church & Dwight Positioning Itself for Continued Success?

The Church & Dwight Company holds a strong position in the consumer goods industry, competing with major players like Procter & Gamble and Unilever. Its market share is robust across several categories, supported by high brand loyalty for its established products, including the popular Arm & Hammer brand. The company's global reach, especially through its consumer international segment, further solidifies its industry standing. To understand more about its origins, you can read a Brief History of Church & Dwight.

However, the company faces inherent risks, including intense competition and potential shifts in consumer preferences towards private label brands. Fluctuations in raw material costs also pose a challenge. Regulatory changes related to product formulations or environmental standards could also impact operations. The company must navigate these challenges to maintain its market position and financial performance.

The company's market share is significant in several categories, supported by strong brand recognition and loyalty. The consumer international segment contributes substantially to the company's global reach and revenue. Competitive analysis reveals a landscape dominated by large consumer goods companies.

Intense competition from larger companies and private label brands poses a constant threat. Fluctuations in raw material costs, such as those for key ingredients, can impact profitability. Regulatory changes and evolving consumer preferences require continuous adaptation.

The company is focused on strategic initiatives to sustain and expand revenue, including brand building and product innovation. Expanding e-commerce capabilities and strategic acquisitions are key growth drivers. The company aims for consistent financial performance in the evolving consumer landscape.

The company projects full-year 2024 reported sales growth of 4-5% and organic sales growth of 3-4%. This indicates continued growth and resilience in a competitive market. These projections reflect the company's confidence in its strategic initiatives.

The company's strategic initiatives are designed to drive sustainable growth and enhance shareholder value. These initiatives include investments in brand building, product innovation, and expanding e-commerce capabilities. Strategic acquisitions are also part of the growth strategy.

- Continued investment in brand building to maintain and enhance brand loyalty.

- Product innovation to meet evolving consumer needs and preferences.

- Expansion of e-commerce capabilities to reach a wider customer base.

- Strategic acquisitions that align with the company's core business.

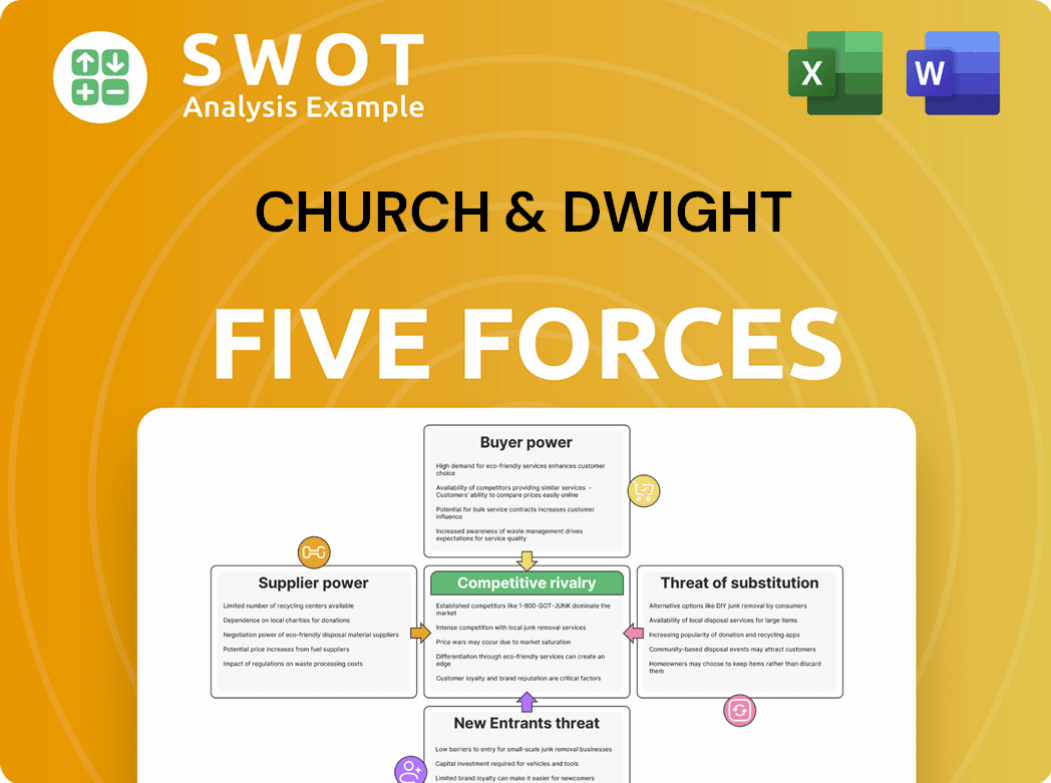

Church & Dwight Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Church & Dwight Company?

- What is Competitive Landscape of Church & Dwight Company?

- What is Growth Strategy and Future Prospects of Church & Dwight Company?

- What is Sales and Marketing Strategy of Church & Dwight Company?

- What is Brief History of Church & Dwight Company?

- Who Owns Church & Dwight Company?

- What is Customer Demographics and Target Market of Church & Dwight Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.