Church & Dwight Bundle

Who Really Owns Church & Dwight?

Uncover the ownership structure of a consumer goods giant and its impact on strategic decisions. With a significant CEO transition on the horizon, understanding the Church & Dwight SWOT Analysis and its ownership is more critical than ever. From its humble beginnings to its current status as an S&P 500 component, the evolution of Church & Dwight's ownership tells a compelling story.

Delving into the Church & Dwight ownership reveals insights into the Arm & Hammer owner and the company's future trajectory. This company profile explores the corporate structure, key shareholders, and the influence of its public status. Discover how the parent company dynamics shape the Church & Dwight story, from its founding to its current market position, and understand the implications of its financial performance and strategic direction.

Who Founded Church & Dwight?

The story of Church & Dwight begins in 1846 with a partnership between John Dwight and Austin Church. This partnership marked the start of refining and packaging baking soda for commercial use, setting the stage for a company that would become a household name. This initial venture laid the groundwork for what would evolve into a major player in the consumer goods industry.

In 1847, the company introduced Arm & Hammer Baking Soda, a product that quickly became central to its brand identity. The early years saw the company establish its presence in the market, focusing on the distribution of its flagship product. This strategic move was crucial in building brand recognition and customer loyalty.

The company's evolution continued in 1867 when Austin Church's sons formed Church & Co., which then competed with John Dwight & Co. That same year, Church & Co. acquired a spice and mustard business, which is where the Arm & Hammer trademark and logo originated. The merging of the two companies in 1896 to form Church & Dwight Co. marked a significant consolidation. The merged entity continued to market baking soda under both the Arm & Hammer and 'Cow' brand trademarks.

John Dwight and Austin Church started their business by refining and packaging baking soda. They began their operations from Dwight's kitchen. This simple start was the foundation for a future industry giant.

In 1847, the company launched Arm & Hammer Baking Soda. This product quickly became a critical part of their business strategy. The brand's early success set the stage for future growth.

Church & Co. was formed in 1867 by Austin Church's sons. The company acquired a spice and mustard business, which is where the Arm & Hammer trademark and logo originated. These strategic moves helped shape the company's identity.

The merger of John Dwight & Co. and Church & Co. in 1896 created Church & Dwight Co. This merger streamlined operations and strengthened their market position. The consolidation was a key step in the company's history.

The exact details of the initial capital or equity split are not readily available. The consolidation of the two founding families' businesses into a single entity highlights a strategic alignment aimed at unified control and market presence. Early agreements or disputes regarding ownership during these initial phases are not extensively documented in public records.

The company marketed baking soda under both the Arm & Hammer and 'Cow' brand trademarks for a period. This dual-brand strategy helped the company reach a wider audience. This approach helped the company gain market share.

The Church & Dwight ownership structure has evolved significantly since its founding. Today, it operates as a publicly traded company. Understanding the Church & Dwight company history provides insights into its strategic decisions and market positioning. To learn more about the current Arm & Hammer owner and its growth strategies, you can read about the Growth Strategy of Church & Dwight. The company has a diverse portfolio of products, including household, personal care, and specialty products. The company's financial performance in 2024 showed net sales of approximately $6.2 billion, demonstrating its continued success and strong market presence. The headquarters are located in Ewing, New Jersey. Its major shareholders include institutional investors.

The founders, John Dwight and Austin Church, established the company in 1846.

- Arm & Hammer Baking Soda was introduced in 1847, becoming a core brand.

- Church & Co. was established in 1867 by Austin Church's sons.

- The merger in 1896 created Church & Dwight Co.

- The company is now publicly traded, with significant institutional ownership.

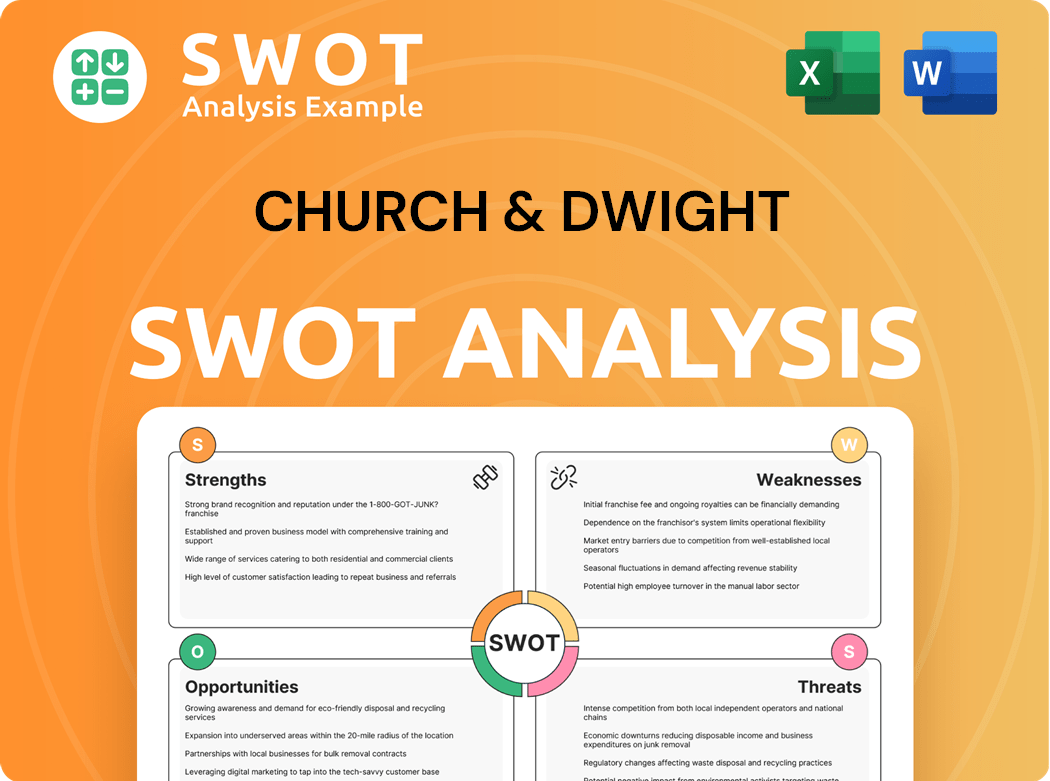

Church & Dwight SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Church & Dwight’s Ownership Changed Over Time?

The ownership of Church & Dwight Co., Inc. (a publicly traded company on the NYSE: CHD) is primarily distributed among various shareholders. The company's financial performance has been consistent, with net sales reaching $6,107.1 million in 2024. Understanding the ownership structure is crucial for assessing the company's strategic direction and stability. The evolution of its ownership reflects its growth and market position, influenced by acquisitions and strategic decisions.

Institutional investors are the major stakeholders, holding a significant portion of the company's shares. This ownership structure is a key aspect of the company's corporate structure and influences its governance. The company's strategic moves, such as the acquisition of Waterpik in 2017 and TheraBreath and Hero Cosmetics in October 2022, have played a role in shaping its market position. These acquisitions, along with consistent investments in research and development, have been key drivers of the company's strategy and governance.

| Metric | April 2025 | May 2025 |

|---|---|---|

| Institutional Ownership | Approximately 87.02% | Approximately 87.03% |

| Insider Holdings | 0.07% | 0.07% |

| Mutual Fund Ownership | 72.51% | 72.66% |

As of May 2025, the largest institutional shareholders include Vanguard Group Inc. (12.78%), BlackRock, Inc. (8.78%), and State Street Corp (5.317%). Capital Research and Management Company (International Investors) also holds a notable stake (3.658%). This ownership distribution highlights the influence of institutional investors on the company's strategic decisions. To learn more about the company's financial performance, you can read Revenue Streams & Business Model of Church & Dwight.

Church & Dwight's ownership is primarily held by institutional investors, indicating strong market confidence.

- Institutional investors hold a significant majority of shares.

- Insider holdings remain relatively stable.

- The company's strategic acquisitions have enhanced its market position.

- Understanding the ownership structure is key to assessing the company's direction.

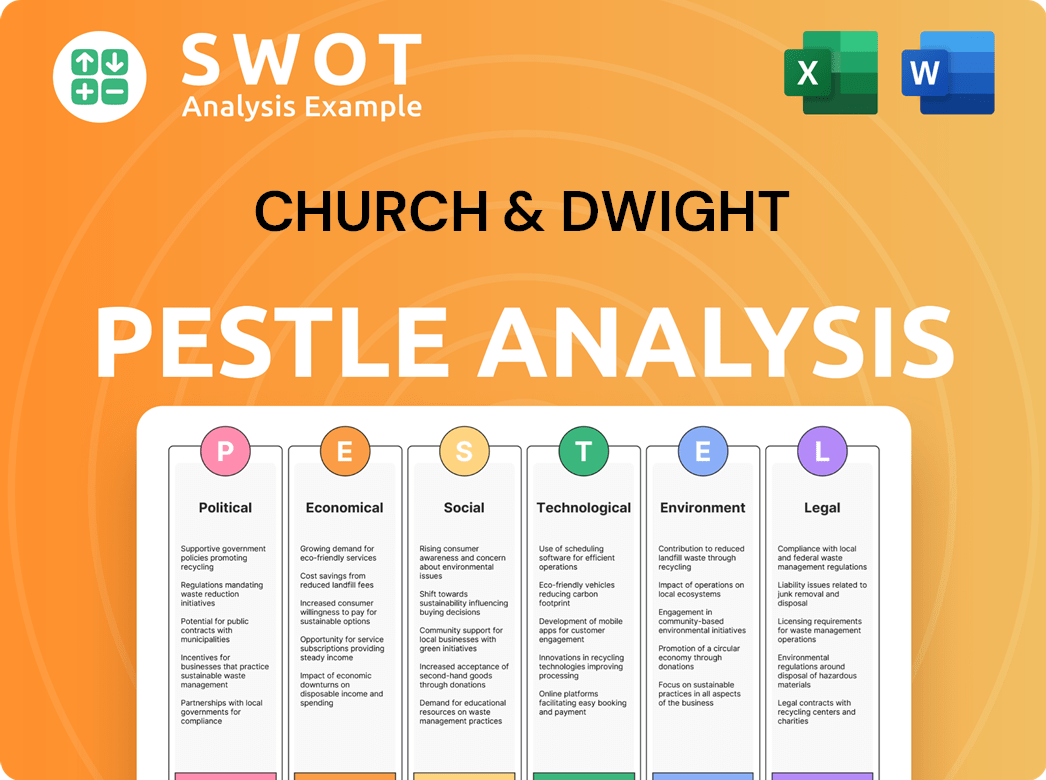

Church & Dwight PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Church & Dwight’s Board?

The Board of Directors at Church & Dwight plays a key role in the company's strategic direction. Until March 31, 2025, Matthew T. Farrell served as Chairman of the Board, President, and CEO. Following his retirement as CEO on March 31, 2025, Richard Dierker, formerly Executive Vice President and Chief Financial Officer, was promoted to President and Chief Executive Officer by unanimous vote of the Board and was also elected to the Board of Directors. Matthew Farrell will continue as Chairman of the Board for a transition period. Lee McChesney became Executive Vice President and Chief Financial Officer on March 24, 2025, succeeding Richard Dierker in that role.

The composition of the board reflects a transition in leadership, with a focus on maintaining stability and continuity. The unanimous vote for the CEO transition indicates a cohesive board. The significant institutional ownership, exceeding 87% as of April-May 2025, suggests that large institutional investors likely have considerable influence through their voting power. This ownership structure helps shape the company's strategic decisions and operational oversight. For more context, you can explore the Competitors Landscape of Church & Dwight.

| Board Member | Title | Notes |

|---|---|---|

| Matthew T. Farrell | Chairman of the Board | Transition period |

| Richard Dierker | President and CEO | Effective March 31, 2025 |

| Lee McChesney | Executive Vice President and CFO | Effective March 24, 2025 |

The board's influence is amplified by the substantial institutional ownership, which likely shapes the company's strategic direction and operational execution. The transition in leadership, marked by unanimous board decisions, indicates a stable governance environment. The board's actions are critical in steering the company's future, ensuring alignment with shareholder interests, and navigating the competitive landscape. The company's financial performance and strategic initiatives are closely monitored and guided by the board.

The Board of Directors at Church & Dwight is crucial for guiding the company. Recent leadership changes, including the promotion of Richard Dierker to CEO, reflect a strategic transition. The board's decisions are significantly influenced by substantial institutional ownership.

- Matthew T. Farrell is Chairman of the Board during a transition period.

- Richard Dierker is the new President and CEO, effective March 31, 2025.

- Lee McChesney is the new Executive Vice President and CFO, effective March 24, 2025.

- Institutional investors hold over 87% of the company's shares.

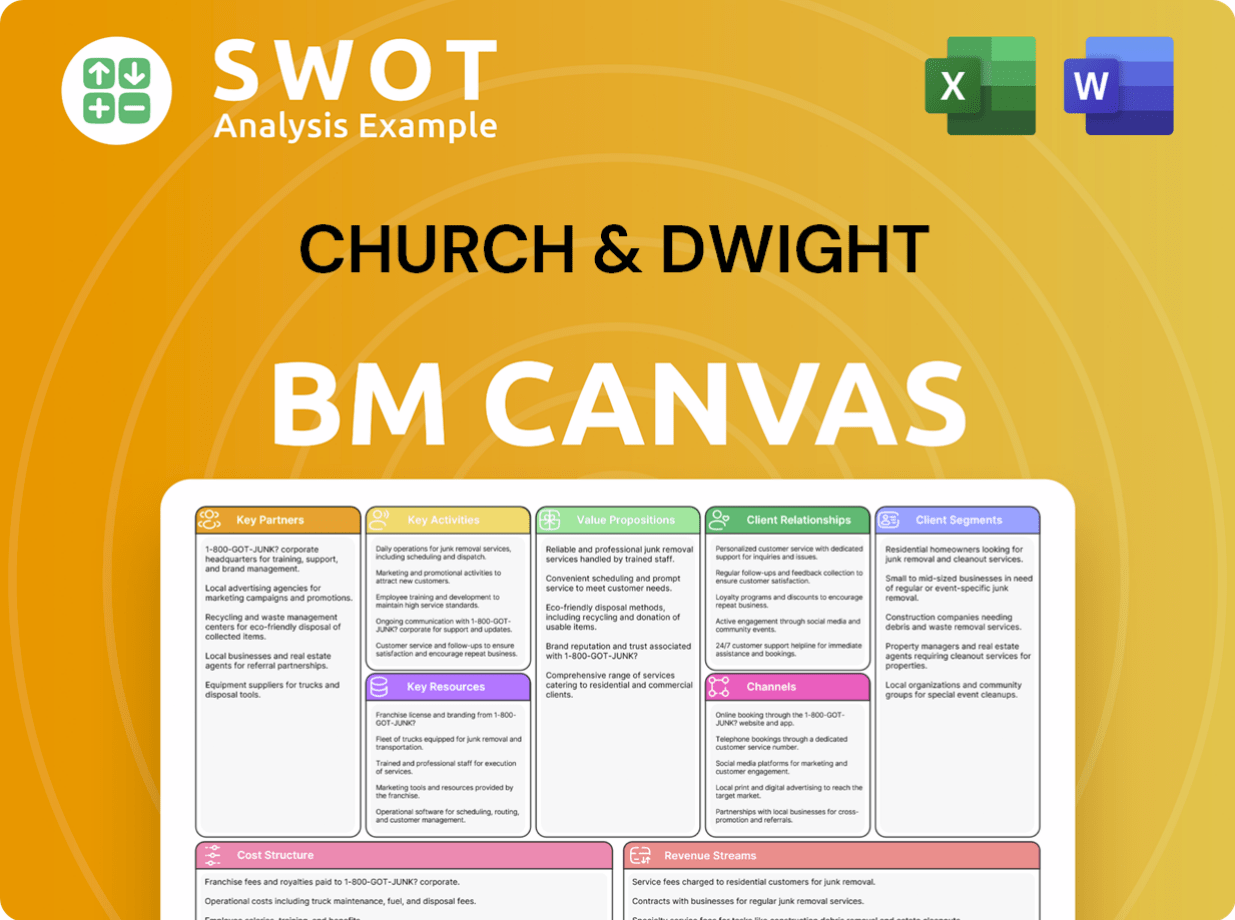

Church & Dwight Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Church & Dwight’s Ownership Landscape?

In the past few years, Church & Dwight has maintained its growth strategy through acquisitions. The company's net sales increased by 4.1% to $6,107.1 million in 2024, with organic sales growing by 4.6%, primarily driven by volume. For 2025, the company anticipates reported sales growth of approximately 2.5% to 3.5% and organic sales growth of 3-4%, driven by volume. These trends reflect a consistent approach to expanding the company's portfolio and market presence.

A significant development is the acquisition of the Touchland brand, aimed at bolstering Church & Dwight's presence in the personal care sector. The acquisition, expected to close in the second quarter of 2025, involves a base purchase price of $700 million, with an earn-out of up to $180 million contingent on 2025 net sales, totaling up to $880 million. Touchland, the #2 hand sanitizer brand in the U.S., reported approximately $130 million in sales for the twelve months ending March 2025 and is projected for double-digit growth in 2025 and 2026. This strategic move underscores Church & Dwight's commitment to expanding its brand offerings and market share.

| Ownership Category | Percentage (April 2025) | Percentage (May 2025) |

|---|---|---|

| Institutional Investors | Approximately 87.02% | Approximately 87.03% |

| Insider Holdings | 0.07% | 0.07% |

Institutional investors continue to dominate the Church & Dwight ownership structure, holding approximately 87.02% to 87.03% of the company's shares as of April and May 2025. Notable shareholders include Vanguard Group Inc., BlackRock, Inc., and State Street Corp. Insider holdings have remained stable at 0.07% during the same period. Furthermore, the company has been actively engaged in share buybacks, including $300.09 million in December 2023 and $1.95 million in March 2025. Leadership changes include the CEO transition, with Richard Dierker taking over from Matthew Farrell on March 31, 2025, and Lee McChesney becoming the new CFO on March 24, 2025. These factors indicate a focus on strategic financial management and leadership continuity within Church & Dwight.

Institutional investors hold the majority of shares. The company's ownership structure remains relatively stable. Share buybacks and leadership transitions reflect active financial management.

The Touchland acquisition is a significant recent move. The acquisition is set to enhance the company's presence in the personal care sector. Expected double-digit growth for Touchland in 2025 and 2026.

Net sales increased by 4.1% in 2024. Organic sales grew by 4.6%, driven by volume. Projected sales growth of approximately 2.5% to 3.5% for 2025.

Richard Dierker became CEO on March 31, 2025. Lee McChesney became CFO on March 24, 2025. These changes highlight a focus on leadership continuity.

Church & Dwight Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Church & Dwight Company?

- What is Competitive Landscape of Church & Dwight Company?

- What is Growth Strategy and Future Prospects of Church & Dwight Company?

- How Does Church & Dwight Company Work?

- What is Sales and Marketing Strategy of Church & Dwight Company?

- What is Brief History of Church & Dwight Company?

- What is Customer Demographics and Target Market of Church & Dwight Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.