Eutelsat Group Bundle

How Does Eutelsat Group Stay Ahead in the Space Race?

Eutelsat Group, a leading Eutelsat Group SWOT Analysis, is a pivotal player in the space industry, offering vital satellite services globally. This satellite company provides essential connectivity and broadcasting solutions, impacting various sectors. Understanding Eutelsat's operations is key to grasping its influence in the evolving telecommunications landscape.

This exploration into Eutelsat Group delves into its core functions and revenue strategies, offering insights for investors and industry professionals. We'll examine its business model, driven by a vast satellite fleet, and how it adapts to technological advancements. From broadcasting to internet services, Eutelsat's impact on the space economy and its strategic moves, including the OneWeb merger, will be thoroughly analyzed. Discover how this satellite company is shaping the future of global communication.

What Are the Key Operations Driving Eutelsat Group’s Success?

Eutelsat Group, a leading satellite company, generates value through its extensive satellite fleet and ground infrastructure. It offers a wide array of communication services, including satellite capacity for video broadcasting, data connectivity, and mobile solutions. This comprehensive approach serves a diverse clientele, from broadcasters to government agencies, solidifying its position in the telecommunications sector.

The company's core operations encompass the design, launch, and management of geostationary (GEO) satellites, complemented by its growing low Earth orbit (LEO) constellation through OneWeb. Eutelsat's infrastructure includes teleport facilities and network operations centers, ensuring efficient capacity management and reliable service delivery. These capabilities enable the company to meet the evolving demands of its global customer base.

Eutelsat Group's business model is centered on providing essential satellite services. Its hybrid approach, combining GEO and LEO satellites, offers differentiated solutions. This allows the company to cater to various needs, from traditional video distribution to demanding broadband applications. This operational strength translates into reliable global connectivity and high-quality video transmission, setting Eutelsat apart in the space industry.

Eutelsat offers a range of satellite services. These include video broadcasting, fixed data connectivity, mobile connectivity, and government communications. The company's services are crucial for various sectors, supporting global communication needs.

The operational backbone includes GEO satellites and a growing LEO constellation through OneWeb. This is supported by ground infrastructure like teleport facilities and network operations centers. This setup ensures efficient capacity management and service delivery.

Eutelsat serves a diverse customer base. This includes broadcasters, media companies, telecom operators, and government agencies. This broad customer base highlights the company's versatility and market reach.

The value proposition centers on reliable global connectivity and high-quality video transmission. The hybrid approach, combining GEO and LEO satellites, provides differentiated solutions. This positions Eutelsat strongly in a competitive market.

Eutelsat's unique hybrid approach, incorporating both GEO and LEO satellites, sets it apart. This allows for a broader range of services and enhanced connectivity. The OneWeb merger significantly enhanced Eutelsat's capabilities.

- Offers both widespread coverage and low-latency connectivity.

- Caters to a wide range of customer needs.

- Provides reliable global connectivity.

- Ensures high-quality video transmission.

Eutelsat Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eutelsat Group Make Money?

The Eutelsat Group, a prominent satellite company, generates revenue through diverse streams, primarily centered on providing satellite capacity and related services. These services are crucial for the telecommunications and space industry. The company's financial performance is a key indicator of its success in these areas.

Historically, video services have been a major revenue driver for Eutelsat. This includes broadcasting and media services, where the company offers satellite capacity for direct-to-home (DTH) broadcasting, professional video links, and contribution services. Fixed data services, which provide connectivity for corporate networks, internet backbone access, and cellular backhaul, also contribute significantly to the revenue. Government services represent a stable revenue source, providing secure satellite communications for defense and governmental applications.

In fiscal year 2023, Eutelsat reported total revenues of €1.15 billion. The broadcast services accounted for 61% of this figure, highlighting the continued importance of video services. The company is actively diversifying its revenue base towards data and mobile applications to capture new growth opportunities. This strategic shift is driven by the increasing demand for broadband and the complementary nature of GEO and LEO technologies.

Eutelsat employs various monetization strategies to maximize its revenue streams. These strategies include long-term capacity leases, service-based contracts, and bundled solutions. The company's approach reflects its adaptability in the rapidly evolving satellite services market.

- Long-Term Capacity Leases: Provides stable and predictable revenue streams by leasing satellite capacity to broadcasters, telecommunications providers, and other customers for extended periods.

- Service-Based Contracts: Offers tailored services that include bandwidth, coverage, and service level agreements (SLAs), allowing for flexible pricing models.

- Bundled Solutions: Leverages the merger with OneWeb to offer integrated connectivity solutions that combine GEO and LEO capabilities. This includes cross-selling opportunities and bundled services for specific market needs.

- Tiered Pricing Models: Offers tiered pricing based on bandwidth, coverage, and service level agreements (SLAs).

For more on the company's strategic market positioning, see Target Market of Eutelsat Group.

Eutelsat Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Eutelsat Group’s Business Model?

The Eutelsat Group, a prominent satellite company, has navigated a dynamic landscape marked by significant milestones and strategic shifts. A pivotal moment was the merger with OneWeb, finalized in September 2023, which reshaped the company's capabilities. This move expanded Eutelsat's reach beyond its traditional geostationary (GEO) fleet to include the rapidly growing low Earth orbit (LEO) satellite constellation market, establishing a hybrid connectivity offering.

Operationally, Eutelsat has consistently invested in new satellite technologies and launches to refresh and expand its fleet, ensuring state-of-the-art capacity. This has involved launching new satellites to enhance coverage and service offerings across various regions. The company has also faced challenges, including intense competition and the emergence of new connectivity technologies. Eutelsat has responded by focusing on innovation, diversifying its service portfolio, and pursuing strategic partnerships.

Eutelsat's strategic initiatives and technological advancements are designed to maintain its competitive edge in the telecommunications sector. The company's approach includes a focus on software-defined satellites, spectrum efficiency, and integrated ground infrastructure to support its hybrid network. These efforts are aimed at adapting to evolving market demands and maintaining a strong position in the space industry.

The merger with OneWeb in September 2023 was a transformative event, creating a hybrid satellite operator. This expanded the company's capabilities to include both GEO and LEO satellite services. The integration of OneWeb's LEO constellation has been a key strategic move.

Eutelsat has focused on diversifying its services and expanding its global footprint. The company has invested in new satellite technologies and launches. Strategic partnerships and acquisitions have been instrumental in enhancing its market position.

Eutelsat benefits from an extensive global footprint with a fleet of 35 geostationary satellites and the OneWeb LEO constellation. This provides broad coverage and redundancy. Long-standing customer relationships and a reputation for reliability also contribute to its competitive advantage.

In the fiscal year 2023-2024, Eutelsat Group reported a revenue of approximately €1.2 billion. The integration of OneWeb is expected to drive future growth and profitability. The company's financial strategy includes investments in innovation and expansion of its service offerings.

Eutelsat's competitive advantages stem from its extensive global footprint, a fleet of geostationary satellites, and the OneWeb LEO constellation, providing broad coverage and redundancy. This scale allows for economies of scale and a robust infrastructure. Its long-standing relationships with key customers and its reputation for reliability also contribute to its competitive edge.

- Global Coverage: A vast network of satellites providing services worldwide.

- Hybrid Connectivity: Combining GEO and LEO satellites for diverse service offerings.

- Customer Relationships: Strong, long-term relationships with key clients.

- Innovation: Continuous investment in new technologies and services.

Eutelsat Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Eutelsat Group Positioning Itself for Continued Success?

Eutelsat Group is a prominent player in the global satellite communications sector, ranking among the top satellite operators worldwide. Its substantial market share in video broadcasting services and its recent integration of OneWeb position it strongly in the rapidly expanding low Earth orbit (LEO) broadband connectivity market. Serving a worldwide customer base, Eutelsat benefits from strong customer loyalty due to the essential nature of its services and its established infrastructure.

However, Eutelsat faces several challenges. Intense competition from both established satellite operators and new entrants, especially in the LEO broadband space, poses a significant risk. Regulatory changes, such as those related to spectrum allocation and licensing, add further complexities. Technological disruptions, while also presenting opportunities, require the company to adapt quickly to advancements in satellite technology and alternative communication methods. Economic downturns or geopolitical instability could also affect demand for satellite services and thus, revenue.

Eutelsat is a leading satellite company with a strong presence in the space industry. Its market share in video broadcasting services is significant, and the OneWeb acquisition has expanded its reach into the LEO broadband market. The company's global customer base and established infrastructure contribute to its strong market position.

Eutelsat faces considerable risks, including intense competition from other satellite operators and new entrants. Regulatory changes and technological disruptions also pose challenges. Economic downturns or geopolitical instability could affect the demand for satellite services and impact revenue.

Eutelsat aims to leverage synergies from the OneWeb merger to drive growth in connectivity services. The company is focusing on next-generation satellites and advanced ground segment technologies. Eutelsat plans to diversify revenue streams, optimize operational efficiency, and invest in cutting-edge technology.

As of the end of 2024, Eutelsat's revenue was approximately €1.2 billion. The company is aiming for a revenue of around €1.3 billion by the end of 2025. These figures reflect the company's performance in the satellite services and telecommunications sectors.

Eutelsat is focused on several key strategic initiatives to sustain and expand its revenue generation capabilities. These initiatives involve leveraging the OneWeb merger to drive growth in the connectivity segment and deploying next-generation satellites.

- Integrating GEO-LEO solutions for applications like maritime, aviation, and government.

- Deploying next-generation satellites with enhanced capabilities.

- Developing advanced ground segment technologies.

- Diversifying revenue streams and optimizing operational efficiency.

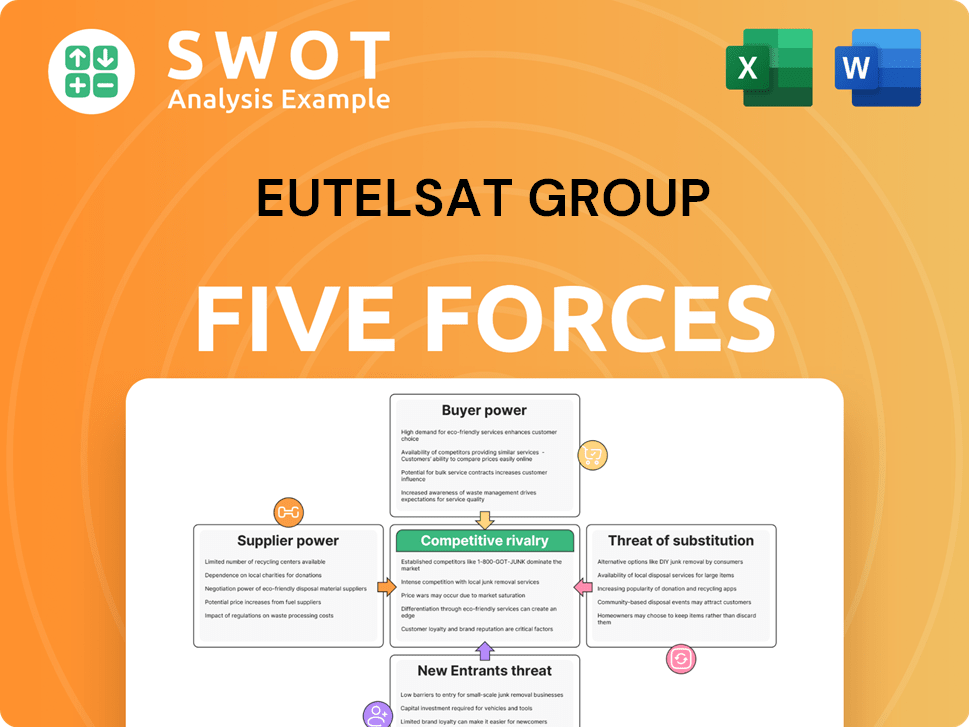

Eutelsat Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eutelsat Group Company?

- What is Competitive Landscape of Eutelsat Group Company?

- What is Growth Strategy and Future Prospects of Eutelsat Group Company?

- What is Sales and Marketing Strategy of Eutelsat Group Company?

- What is Brief History of Eutelsat Group Company?

- Who Owns Eutelsat Group Company?

- What is Customer Demographics and Target Market of Eutelsat Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.