China Evergrande Group Bundle

What Went Wrong at Evergrande?

China Evergrande Group's story is a cautionary tale of ambition and risk in the China Evergrande Group SWOT Analysis. From its meteoric rise as a real estate giant to its current struggles, Evergrande's journey offers crucial lessons for investors and businesses. Understanding the intricacies of Evergrande's operations is essential for anyone seeking to navigate the complexities of the Chinese property market.

The Evergrande collapse has sent ripples through the Chinese property market, raising questions about its long-term stability. The company's massive Evergrande debt and its impact on the broader economy make it a critical case study. Exploring How does Evergrande make money and the factors behind its downfall provides valuable insights into the challenges faced by large-scale enterprises.

What Are the Key Operations Driving China Evergrande Group’s Success?

The core operations of China Evergrande Group, historically centered on large-scale residential property development, aimed to provide cost-effective, high-quality communities. The company strategically acquired land in prime locations across over 280 cities in China. Evergrande's value proposition focused on appealing to a broad range of buyers and tenants through quality and design, differentiating itself from competitors.

Evergrande's business model, explained through its operations, involved significant investments in research and development for innovative and sustainable building designs. Strategic partnerships were also crucial. This approach allowed the company to establish a strong presence in the Chinese property market.

Beyond its primary focus on real estate, Evergrande diversified into various segments, including property management, property investment, and new energy vehicles. Evergrande Property Services Group managed approximately 579 million square meters of gross floor area as of December 31, 2024. This covered around 3,000 projects, serving approximately 3.3 million owners.

Evergrande's main activities included residential property development. The company also ventured into property management, property investment, and new energy vehicles. Tourism and recreation, such as 'Hengda Children of the World' and 'Hengda Water World', were also part of its operations.

The company employed a compact group management model. It used a standardized operation model for planning, bidding, procurement, and distribution. Fine decoration in residential deliveries was a key feature. Its extensive network across over 300 cities in China provided a significant competitive edge.

Evergrande expanded beyond real estate, including property management and new energy vehicles. Evergrande New Energy Auto aimed to create an integrated 'car-home' intelligent mobility space. The company also invested in tourism and recreation with park brands like 'Hengda Children of the World' and 'Hengda Water World'.

- Residential Property Development: Primary source of revenue.

- Property Management: Services provided by Evergrande Property Services Group.

- New Energy Vehicles: Focused on developing and producing electric vehicles.

- Tourism and Recreation: Development of theme parks and related facilities.

China Evergrande Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does China Evergrande Group Make Money?

Historically, the primary revenue stream for China Evergrande Group, also known as Evergrande Group, stemmed from real estate development. This involved the sale of residential and commercial properties across China. The company employed a strategy of acquiring large land reserves, rapidly developing these properties, and selling them at high volumes to generate revenue.

Evergrande's monetization strategy in its core business focused on quick turnover. This often involved competitive pricing to accelerate sales and recoup investments. The company's rapid expansion and high-volume sales model were central to its revenue generation approach within the Chinese property market.

However, recent financial data reflects the impact of its restructuring. Evergrande Property Services Group, a subsidiary, reported operating revenue of approximately RMB 12,756.7 million for the year ended December 31, 2024, showing a modest 2.2% year-on-year increase. The company's gross profit margin decreased by 5.7 percentage points, and the net profit margin declined by 4.4 percentage points. The property management segment focuses on property management services, value-added services, and community living services.

Evergrande diversified into various sectors to create new revenue streams and reduce its dependence on the volatile real estate market. These included property investment (rental income), new energy vehicles, hotel operations, and financial services. The goal was to offset potential risks associated with the Competitors Landscape of China Evergrande Group and create a more resilient business model.

- Evergrande Health focused on health management and elderly care services.

- The financial contributions from these diversified segments have been overshadowed by the challenges in its core real estate business.

- Evergrande's debt and the Chinese property market have significantly impacted its financial performance.

- The company's focus has shifted towards restructuring and addressing its substantial debt obligations.

China Evergrande Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped China Evergrande Group’s Business Model?

The story of the China Evergrande Group, a major player in the China real estate market, is a tale of rapid expansion and subsequent financial turmoil. Founded in 1996, the company quickly rose to prominence, driven by aggressive growth strategies and a focus on large-scale residential projects. Evergrande's journey highlights the volatile nature of the Chinese property market and the risks associated with high leverage and rapid expansion.

Evergrande's strategic moves included diversification beyond real estate into sectors like electric vehicles and healthcare, aiming to reduce its reliance on the property market. However, a significant shift occurred around 2018 when the company aimed to transition to a 'low debt, low leverage, low cost, high turnover' model. This shift proved insufficient to address the underlying financial vulnerabilities. These vulnerabilities ultimately led to a severe debt crisis, culminating in a liquidation order in January 2024.

The company's competitive edge, historically, lay in its extensive scale, widespread project portfolio, and brand recognition. Evergrande's projects were present in major Chinese cities, and the company had cultivated customer loyalty. However, the unfolding debt crisis and the broader downturn in the Chinese property market have severely impacted these advantages, leading to a dramatic decline in the company's fortunes.

Founded in 1996, Evergrande quickly became a major force in the Chinese real estate sector. The company's growth was marked by aggressive expansion and a focus on large-scale residential projects. In 2009, Evergrande went public in Hong Kong, raising significant capital to fuel further expansion.

Evergrande diversified into sectors like electric vehicles, healthcare, and theme parks to reduce its dependence on the real estate market. Around 2018, the company aimed to shift to a 'low debt, low leverage, low cost, high turnover' model. However, these efforts were insufficient to address the underlying financial vulnerabilities.

Historically, Evergrande's competitive advantages included its extensive scale, widespread project portfolio, and brand recognition. The company's projects were present in major Chinese cities, and it had cultivated customer loyalty. Evergrande's size and scope allowed it to secure favorable terms with suppliers and contractors.

In January 2024, a Hong Kong court ordered the liquidation of Evergrande due to its inability to present a concrete debt restructuring plan. The China Securities Regulatory Commission (CSRC) found that Evergrande overstated its revenue significantly in 2019 and 2020. Evergrande Property Services reported a year-on-year increase of over 100% in newly signed contracted GFA from third parties in 2024.

The Evergrande debt crisis, which began to unfold in 2021, has had a profound impact on the company and the broader Chinese property market. The company's inability to meet its debt obligations led to a series of defaults and ultimately, a liquidation order.

- Evergrande defaulted on offshore debt obligations in early 2021, signaling the beginning of its financial troubles.

- In January 2024, a Hong Kong court ordered the liquidation of Evergrande due to its inability to present a concrete debt restructuring plan for its over $300 billion in liabilities.

- The CSRC found that Evergrande had overstated its revenue significantly in 2019 (by 214 billion yuan) and 2020 (by 350 billion yuan).

- The company's founder was banned from financial markets due to these findings.

China Evergrande Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is China Evergrande Group Positioning Itself for Continued Success?

Once a prominent player, China Evergrande Group, the second-largest property developer in China by sales, has seen its industry position severely decline. The company's financial woes led to a liquidation order for its Hong Kong unit in January 2024, signaling significant distress within the Chinese property market. This situation reflects broader challenges, including oversupply and declining consumer confidence, impacting the entire sector.

The risks facing Evergrande and the broader Chinese real estate sector are substantial. These include significant debt levels; Evergrande alone owed approximately $300 billion in debt as of 2024. Regulatory changes, such as the 'three red lines' policy, and a decline in consumer confidence have exacerbated the crisis. Issues of potential opacity and risks in the structuring and reporting of PRC firms further complicate the situation, making it difficult to assess the full extent of the damage.

Evergrande Group held a strong market position, but its standing has been severely impacted by its financial crisis. The liquidation order for its Hong Kong unit in January 2024 highlights the deep distress in the China real estate sector. This situation underscores the challenges the company faces in the current market environment.

Key risks include massive debt, regulatory changes, and declining consumer confidence. Evergrande's debt was approximately $300 billion as of 2024. The 'three red lines' policy has added pressure, and the crisis has exposed potential issues in financial reporting. These factors create significant headwinds for the company.

The future depends on the liquidation process, restructuring, and market recovery. The liquidators are tasked with minimizing disruption. The property services arm focuses on strategic determination and technological integration. The overall market is expected to face a deep adjustment, with fiscal stimulus aimed at supporting GDP growth in 2025.

The Evergrande collapse has had a significant impact on the Chinese property market and the broader economy. The crisis has triggered a decline in consumer confidence and led to concerns about the stability of the financial system. The company's struggles have also raised questions about corporate governance and risk management. For more details, read about the Target Market of China Evergrande Group.

The future of China Evergrande Group is largely shaped by the ongoing liquidation process and the broader recovery of the Chinese property market. The liquidators are working to manage the company's assets and minimize disruption for stakeholders. The company's property services arm aims to continue operations and focus on strategic development.

- Liquidation Process: The liquidation process will determine the fate of Evergrande's assets and investments.

- Market Recovery: The overall recovery and stability of the Chinese property market are crucial for Evergrande's future.

- Debt Restructuring: The company's ability to generate money will heavily depend on its restructuring and asset disposals.

- Strategic Focus: The property services arm is focusing on strategic determination, quality, and technological integration.

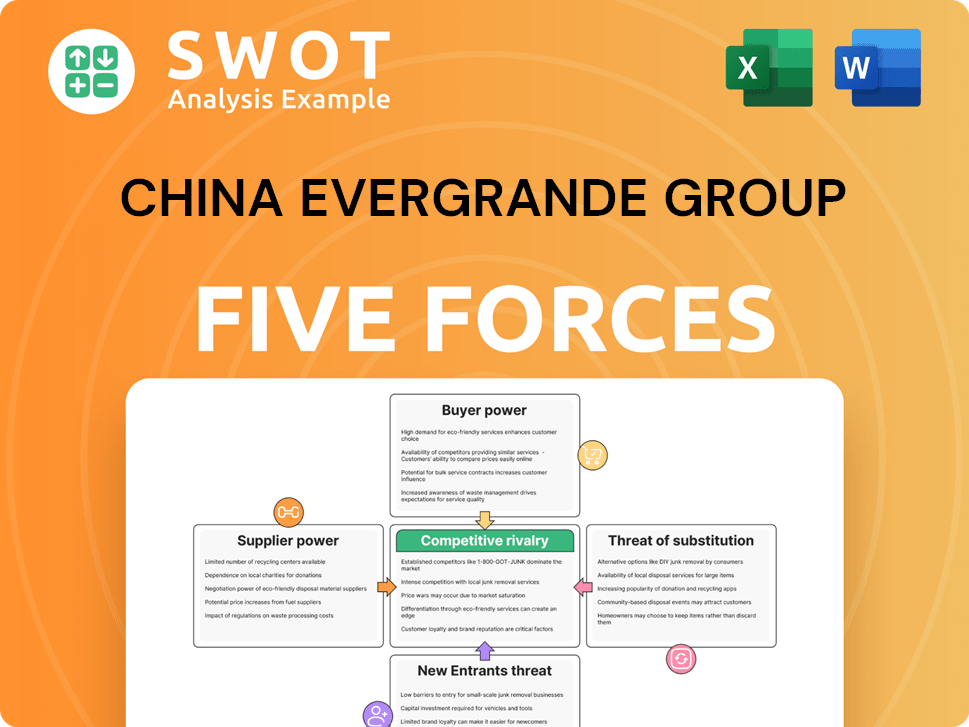

China Evergrande Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of China Evergrande Group Company?

- What is Competitive Landscape of China Evergrande Group Company?

- What is Growth Strategy and Future Prospects of China Evergrande Group Company?

- What is Sales and Marketing Strategy of China Evergrande Group Company?

- What is Brief History of China Evergrande Group Company?

- Who Owns China Evergrande Group Company?

- What is Customer Demographics and Target Market of China Evergrande Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.