GoDaddy Bundle

Unlocking the Digital Realm: How Does GoDaddy Thrive?

In a world increasingly reliant on online presence, GoDaddy stands as a digital cornerstone for millions. With billions in revenue and a vast array of services, understanding GoDaddy's inner workings is key. From domain registration to website building, this analysis unveils the strategies driving GoDaddy's success.

This exploration will dissect GoDaddy's business model, revealing how it generates revenue and maintains its competitive edge. We'll examine its core offerings, including GoDaddy SWOT Analysis, and strategic initiatives to understand its position in the market. Whether you're a small business owner wondering, "Is GoDaddy good for small businesses?" or an investor seeking insights, this guide provides a comprehensive overview of GoDaddy and its future.

What Are the Key Operations Driving GoDaddy’s Success?

GoDaddy delivers value by offering a comprehensive suite of online tools and services, empowering entrepreneurs and small businesses to build and manage their digital presence. Its core offerings include domain name registration, web hosting solutions, and a user-friendly website builder. These services are designed to simplify the process of establishing an online presence, making it accessible even for those without technical expertise. The company's focus is on providing a one-stop shop for various online needs.

The company extends its services to include professional email, digital marketing tools, security solutions like SSL certificates, and point-of-sale (POS) systems. This broad range caters to a diverse customer base, primarily microbusiness owners and solopreneurs. The company's commitment to providing a full suite of tools helps businesses manage all aspects of their online presence efficiently. Understanding the evolution of GoDaddy provides context for its current offerings.

Operationally, the company emphasizes technology development, particularly with AI-driven capabilities. The GoDaddy Airo® platform uses AI to automate website design, logo creation, email marketing, and social media posts. This integration aims to simplify the online setup process, enhance customer experience, and improve conversion rates. The company's 24/7 customer support also provides personalized guidance to customers at every stage of their entrepreneurial journey.

GoDaddy's domain registration service is a fundamental offering, providing a crucial first step for businesses establishing an online presence. It allows customers to secure their desired web address, ensuring they have a unique identity on the internet. The company is one of the largest domain registrars globally, managing millions of domain names.

GoDaddy offers various web hosting solutions, including shared hosting, WordPress hosting, and VPS hosting. These options cater to different needs and levels of technical expertise. Web hosting is essential for making a website accessible online, and the company provides scalable solutions to accommodate business growth.

The GoDaddy website builder is a user-friendly tool that allows users to create websites without coding knowledge. It features drag-and-drop editing, templates, e-commerce capabilities, and built-in SEO tools. This makes it easy for small businesses to establish a professional online presence quickly.

Beyond the core services, the company offers professional email, digital marketing tools, security solutions like SSL certificates, and POS systems. These additional services provide a comprehensive suite to support all aspects of a business's online and in-person operations. The company aims to be a one-stop shop for small business needs.

GoDaddy leverages AI through its GoDaddy Airo® platform to automate and simplify various aspects of website creation and digital marketing. This includes website design, logo creation, email marketing campaigns, and social media posts. The integration of AI aims to enhance customer experience and improve conversion rates.

- AI-powered website design tools.

- Automated email marketing campaigns.

- AI-driven social media post creation.

- Enhanced customer experience and conversion rates.

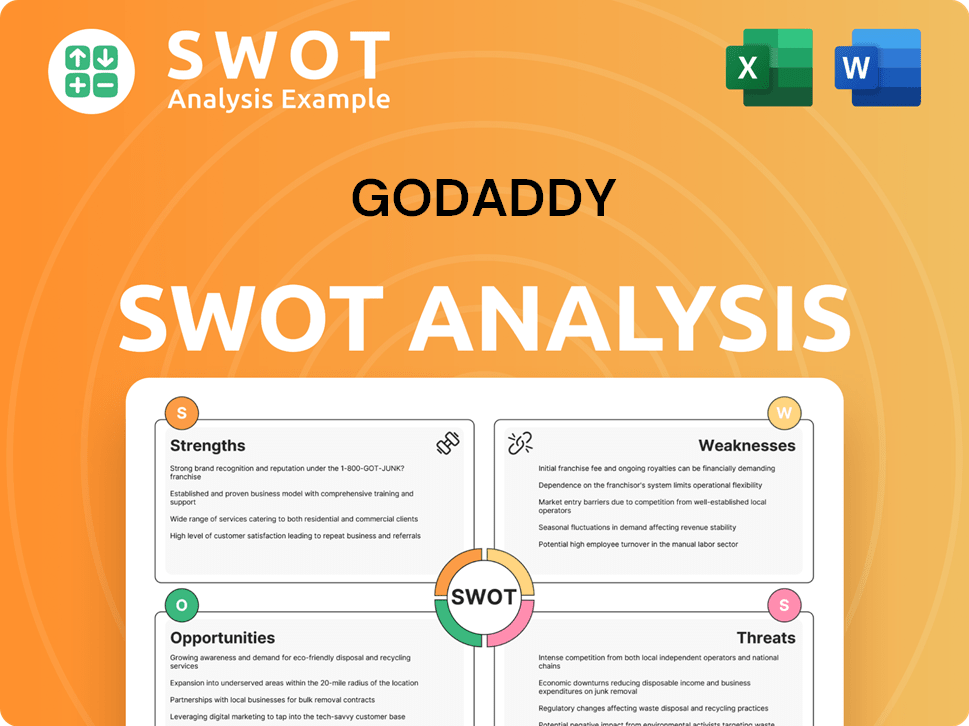

GoDaddy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GoDaddy Make Money?

GoDaddy, a prominent player in the web services industry, generates revenue through a diverse set of streams. Its financial performance is primarily segmented into Applications and Commerce (A&C) and Core Platform (Core) offerings. This structure supports a subscription-based model, which emphasizes customer retention and cross-selling to boost profitability.

In the first quarter of 2025, GoDaddy's total revenue reached $1.2 billion, marking an 8% year-over-year increase. The Applications and Commerce segment saw substantial growth, with revenue climbing by 17% year-over-year to $446.4 million. The Core Platform, including domain names and hosting, contributed $747.9 million, growing by 3% year-over-year.

The company’s monetization strategies are centered on subscriptions, tiered pricing, and bundling services. This approach enhances customer engagement and revenue generation, as seen by the rise in Average Revenue Per User (ARPU).

GoDaddy’s revenue model is designed to maximize customer value and recurring income. This is achieved through strategic pricing models and service bundles.

- Applications and Commerce (A&C): This segment includes e-commerce tools, marketing solutions, and AI-powered offerings like GoDaddy Airo®. In Q1 2025, this segment grew by 17% year-over-year.

- Core Platform (Core): Encompasses domain names and hosting services. In Q1 2025, Core revenue totaled $747.9 million, with domain aftermarket revenue contributing $128 million, a 5% year-over-year increase.

- Subscription-Based Model: GoDaddy uses tiered pricing for its website builder and hosting plans, offering various packages from basic to premium and e-commerce.

- Bundling and Cross-selling: Bundling core domain and hosting services with premium offerings like websites and marketing tools boosts customer retention. This has led to a 9% increase in Average Revenue Per User (ARPU) in Q4 2024.

- Expansion of Commerce Ecosystem: GoDaddy is expanding its commerce solutions, including GoDaddy Payments, which launched in Canada in 2024, and GoDaddy Capital, offering merchant cash advances and same-day payouts. This strategy aims to increase revenue from higher-margin payment processing and e-commerce services. For more insights into GoDaddy's approach, check out the Marketing Strategy of GoDaddy.

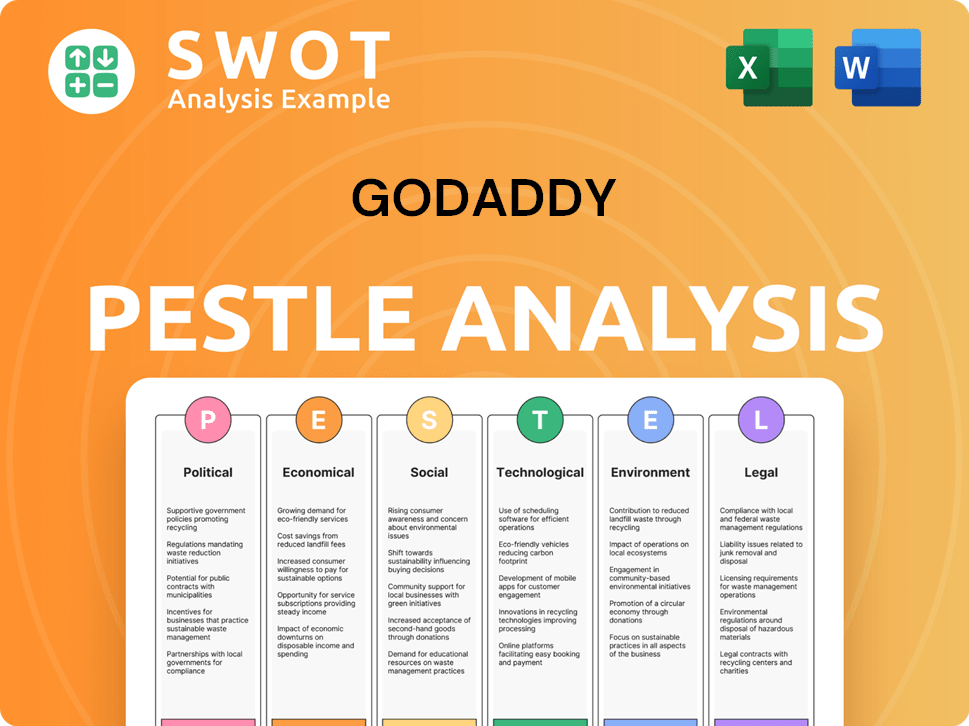

GoDaddy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped GoDaddy’s Business Model?

The evolution of the company, marked by significant milestones and strategic shifts, has shaped its operational and financial trajectory. A key development is the company's increasing focus on AI-driven solutions, particularly through the continuous enhancement of GoDaddy Airo®. This AI platform streamlines the process of establishing an online presence, from logo design and website creation to email and social campaigns, aiming to save small business owners time and attract new customers.

The company has actively pursued pricing and bundling strategies, transitioning from a product-centric to a customer-centric approach. This involves targeted price increases based on customer segmentation and offering integrated bundles of core domain and hosting services with premium features. These initiatives have reportedly outperformed internal expectations and are expected to contribute significantly to growth in 2025. Furthermore, the expansion of commerce offerings, including GoDaddy Payments in Canada in 2024, and the growth of GoDaddy Capital and same-day payouts, shows their commitment to providing comprehensive services.

The company's competitive advantages are rooted in its strong brand recognition and extensive customer base. As of Q1 2025, it has over 20 million customers, though the customer count has slightly decreased year-over-year. Its comprehensive suite of integrated services aims to be a one-stop solution for small businesses. The company continually adapts to technological shifts, particularly in AI, and competitive threats by investing in product innovation and marketing, aiming to differentiate itself through enhanced user experience and value-added services.

The launch and continuous improvement of GoDaddy Airo® is a significant milestone. The platform uses AI to simplify website creation and online marketing. The introduction of the GoDaddy Airo Plus tier in Q4 2024 further demonstrates the commitment to AI-driven monetization.

The company has shifted towards customer-centric pricing and bundling. This involves targeted price increases and integrated bundles of services. The expansion of commerce offerings, including GoDaddy Payments in Canada in 2024, is also a key strategic move.

Strong brand recognition and a large customer base give the company an edge. Its comprehensive suite of integrated services provides a one-stop solution. Operational discipline, with an expected Normalized EBITDA margin expansion of approximately 100 basis points in 2025, also contributes to its sustained business model.

The company focuses on maximizing free cash flow. The pricing and bundling strategies are expected to drive growth in 2025. The company continues to invest in product innovation and marketing to maintain its competitive position.

The company leverages its brand recognition and large customer base to maintain a competitive edge. Its focus on AI and integrated services, such as GoDaddy website, aims to simplify the online experience for small businesses. The company is also focused on operational discipline, with an emphasis on maximizing free cash flow.

- AI-Driven Solutions: GoDaddy Airo® streamlines website creation and marketing.

- Customer-Centric Approach: Targeted pricing and bundled services.

- Integrated Services: A one-stop solution for small businesses.

- Operational Discipline: Focus on maximizing free cash flow and margin expansion.

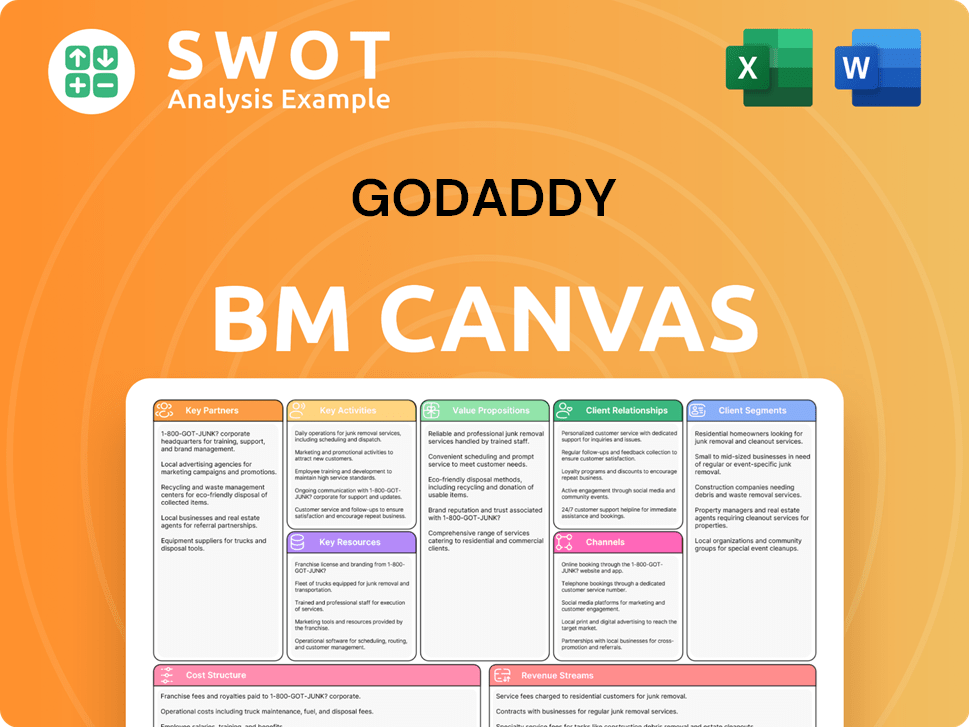

GoDaddy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is GoDaddy Positioning Itself for Continued Success?

GoDaddy maintains a strong position in the web hosting and domain registration industry, serving over 20 million customers globally. However, the company experienced a slight decrease in total customers, down 2.4% year-over-year in Q1 2025. GoDaddy focuses on attracting high-intent users to drive net customer growth later in 2025. Their market share in traditional services like hosting and domains remains stable, but they are shifting towards higher-margin areas like Applications & Commerce.

Several risks could impact GoDaddy's operations and revenue. Macroeconomic uncertainties put 'slight pressure' on small business sentiment. Currency fluctuations are expected to reduce international revenue growth by approximately $15 million in Q1 2025. Intense competition, potential bookings deceleration, and ongoing migrations from legacy platforms are further challenges. Cybersecurity incidents also pose a risk due to the nature of securing and transmitting payment information.

GoDaddy is a major player in the web hosting and domain registration space. They have a large customer base, but have seen a slight dip in customer numbers recently. The company is focusing on attracting the right kind of customers and expanding into more profitable areas.

GoDaddy faces risks from economic uncertainty and currency fluctuations. Competition in the market is fierce, and they must continually innovate. Issues like bookings deceleration and platform migrations also present challenges. Cybersecurity is a constant concern.

GoDaddy expects revenue between $4.860 billion and $4.940 billion in 2025, representing 7% year-over-year growth. They aim to expand their EBITDA margin and generate at least $1.5 billion in free cash flow in 2025. Their AI-driven Airo platform is key to their innovation strategy.

The company is focused on balancing growth and profitability. GoDaddy is committed to delivering long-term shareholder value. A new $3 billion share repurchase authorization through 2027 underscores their commitment to capital allocation.

GoDaddy is working to maintain its market position and drive future growth. They are focusing on higher-margin areas and leveraging AI. This strategy is supported by a strong business model and capital allocation plans.

- Focus on Applications & Commerce for higher margins.

- Expansion of the AI-driven Airo platform.

- Commitment to disciplined capital allocation, including share repurchases.

- Emphasis on balancing top-line growth with profitability.

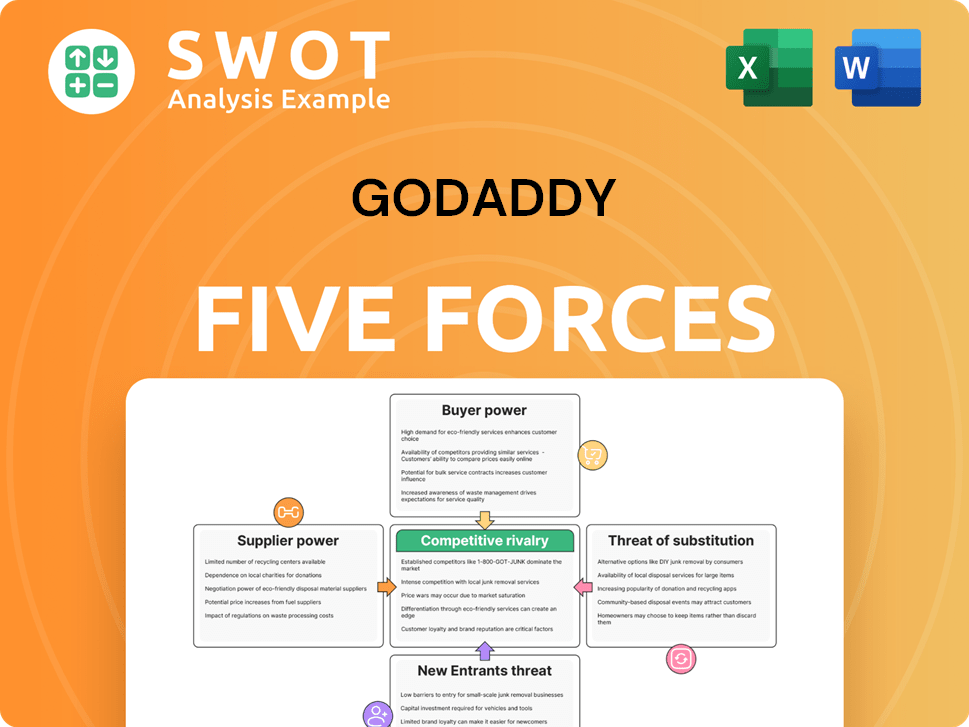

GoDaddy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GoDaddy Company?

- What is Competitive Landscape of GoDaddy Company?

- What is Growth Strategy and Future Prospects of GoDaddy Company?

- What is Sales and Marketing Strategy of GoDaddy Company?

- What is Brief History of GoDaddy Company?

- Who Owns GoDaddy Company?

- What is Customer Demographics and Target Market of GoDaddy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.