Guess' Bundle

How Does the Guess Company Thrive in the Fashion World?

Founded in 1981, the Guess' SWOT Analysis reveals a compelling story of a global fashion powerhouse. From its iconic

This exploration delves into the core of

What Are the Key Operations Driving Guess'’s Success?

The core operations of the company revolve around the design, marketing, distribution, and licensing of a lifestyle collection, primarily targeting young adults and teenagers. This includes a wide array of products such as denim, clothing for both women and men, handbags, watches, footwear, and fragrances. The company aims to establish itself as a global lifestyle brand, focusing on its image and extensive product range, which includes both apparel and accessories.

The value proposition of the company centers on offering fashionable and trendy apparel and accessories through a multi-channel distribution strategy. This encompasses direct-to-consumer channels, such as company-operated stores and e-commerce platforms, alongside a network of wholesale partners and licensees. The company continuously invests in product design and development, marketing, and store environments to maintain a distinctive brand image and shopping experience.

As of 2024, the company operates approximately 1,100 retail stores globally and collaborates with over 3,500 wholesale partners. Its supply chain emphasizes sustainable materials and waste reduction strategies in production. The company's diversified global platform supports the growth of its brands, including Guess and Marciano, along with newer additions like rag & bone and GUESS JEANS. This strategy is designed to enhance customer benefits and differentiate it within the market.

The company utilizes a multi-channel distribution strategy to reach its customers. This includes company-operated stores, e-commerce platforms, wholesale partners, and licensing agreements. This approach allows the company to reach a broad customer base and offer its products through various channels.

Innovation in product design and development is a key focus. The company continuously introduces new products and collections to stay ahead of fashion trends and meet customer demands. This includes incorporating sustainable materials and waste reduction strategies in its supply chain.

The company invests in marketing and store environments to maintain its distinctive brand image. This includes creating impactful experiences and personalized service, such as expanding its loyalty program and implementing AI-powered recommendation engines. These efforts aim to build a strong brand reputation and customer loyalty.

The company has a significant global presence with retail stores and wholesale partners worldwide. This global reach allows the company to cater to diverse markets and expand its customer base. The company's multi-channel approach, combining retail, wholesale, and digital, helps it compete effectively.

The company's operations are marked by a focus on product innovation, brand building, and a strong global presence. This approach includes a multi-channel distribution strategy, encompassing retail, wholesale, and digital platforms, to reach a broad customer base.

- Continuous investment in product design and development.

- Expansion of loyalty programs and implementation of AI-powered recommendation engines.

- Emphasis on sustainable materials and waste reduction in the supply chain.

- A diversified global platform supporting the growth of the Guess and Marciano brands.

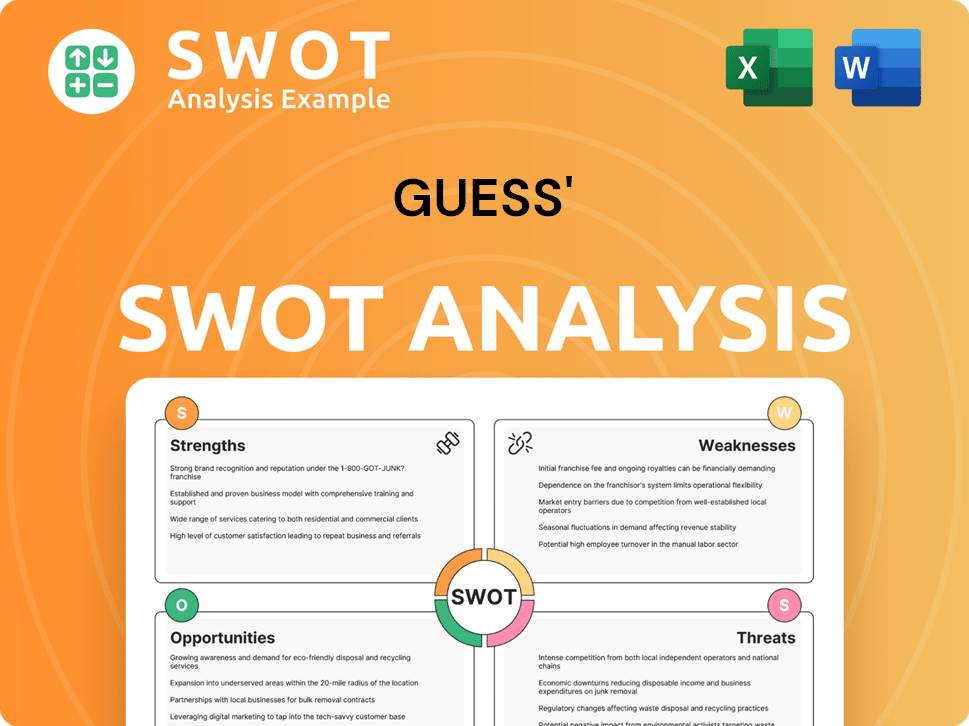

Guess' SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Guess' Make Money?

The revenue streams and monetization strategies of the company, a global fashion brand, are multifaceted, encompassing retail, wholesale, and licensing. This diversified approach enables the company to reach a broad customer base and maintain financial stability. The company's ability to adapt to market trends and consumer behavior is crucial for its continued success.

The company's financial performance reflects its strategic initiatives and market conditions. In fiscal year 2025, the company reported total net revenue of $3.00 billion, marking an 8% increase from fiscal year 2024. This growth underscores the effectiveness of its revenue model and its ability to capitalize on various market opportunities.

The company's business model is designed to maximize revenue across multiple channels. The company's strategic approach to revenue generation is essential for sustained growth and profitability.

Retail sales from its global network of approximately 1,100 company-operated stores and e-commerce platforms are a key revenue driver for the company. Direct-to-consumer sales accounted for a substantial portion of the company's revenue in fiscal year 2024. The company's retail segment faces challenges, including slower customer traffic in North America and Asia.

- In the first quarter of fiscal year 2026 (ending May 3, 2025), the company reported overall revenue growth of 9% to $648 million.

- Americas Retail revenues increased by 9% in U.S. dollars in Q1 2026.

- The company's online store continues to be a significant part of its direct-to-consumer business.

Wholesale distribution through third-party retailers expands the company's market reach. The wholesale business has shown strong momentum, particularly in Europe and the Americas. This channel provides a significant contribution to overall revenue growth.

- Americas Wholesale revenues increased 21% in Q1 2025 and 63% in Q1 2026.

- Europe wholesale also contributed positively to revenue growth.

- The wholesale segment is a crucial part of the company's business model, allowing it to reach a wider audience.

The company licenses its brand to other manufacturers, generating revenue from royalties on products such as eyewear, fragrances, and watches. This strategic move not only amplifies brand presence but also mitigates risks associated with brick-and-mortar retail decline.

- Licensing revenues have shown strong growth, increasing by 21% in Q1 2025 and 10% in fiscal year 2025.

- Licensing agreements are a key component of the company's revenue diversification strategy.

- The company's licensing partners help extend the brand's reach into various product categories.

The company employs innovative monetization strategies, such as loyalty programs, to enhance customer engagement and drive repeat business. The company's revenue mix has varied by region, reflecting different market dynamics and consumer preferences. Understanding the Brief History of Guess' can provide insights into the brand's evolution and strategic decisions.

- Loyalty programs had 1.8 million active members and generated $76.5 million in repeat customer revenue in 2022.

- Europe revenues increased by 4% in U.S. dollars and 7% in constant currency in fiscal year 2025.

- Asia revenues decreased by 5% in U.S. dollars in the same period.

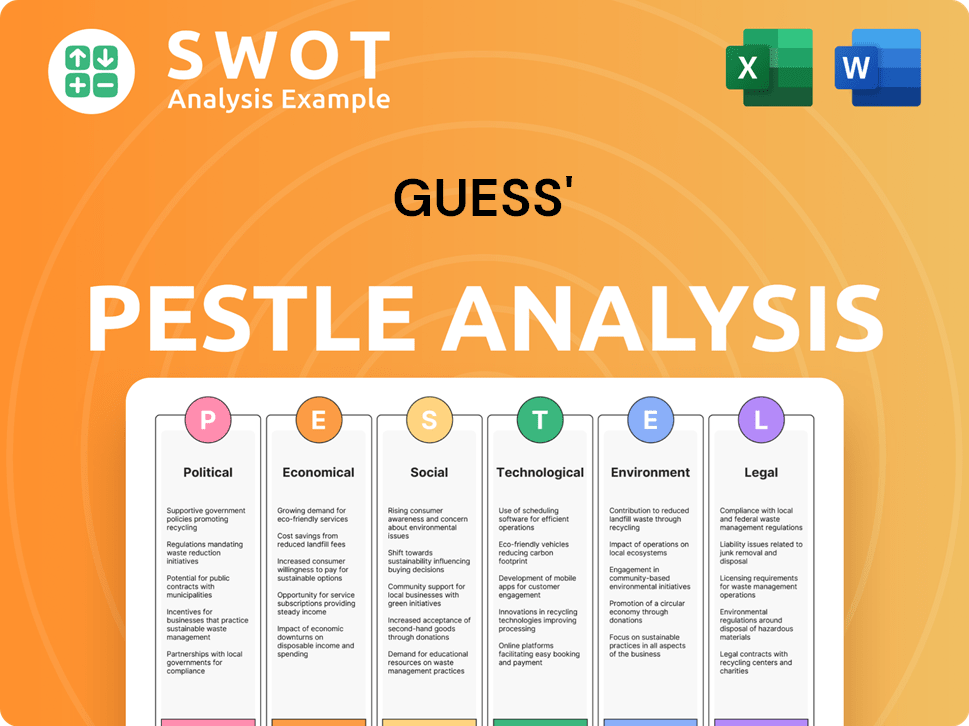

Guess' PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Guess'’s Business Model?

The evolution of the Guess company involves key milestones, strategic shifts, and competitive advantages. The company has navigated market challenges while leveraging its brand recognition and global presence. Recent strategic moves include acquisitions and expansions, reflecting its adaptation to changing consumer behaviors and market dynamics. The company's focus on profitability and global expansion continues to shape its trajectory.

A pivotal strategic move for the Guess brand was the acquisition of rag & bone in April 2024, aimed at diversifying its portfolio. This acquisition was integrated into Guess?'s existing segments and contributed to revenue growth, especially in wholesale. The launch of GUESS JEANS, targeting the Gen Z market, is another key growth driver. The company has also been adapting its direct-to-consumer strategies and exploring new market opportunities.

Guess? has faced operational and market challenges, including shifting consumer preferences and macroeconomic volatility. In response, the company is investing in developing a seamless omnichannel shopping experience and is exploring transitioning out of direct operations in Greater China to local partners. The company reported a 30% drop in sales to $84 million in the 2024 sales season, leading to plans to close 20 underperforming stores in North America.

Key milestones include the acquisition of rag & bone in April 2024, which broadened its product offerings and customer base. The launch of GUESS JEANS targeted the Gen Z market, driving growth. The company has also adapted its operational strategies to meet evolving consumer demands.

Strategic moves include diversifying its portfolio through acquisitions and expanding into new markets. The company is investing in omnichannel experiences and exploring partnerships in regions like Greater China. These moves reflect an effort to adapt to changing market conditions and consumer preferences.

The Guess brand benefits from strong brand recognition, with a brand value estimated at $1.2 billion as of 2023. Its global presence across over 100 countries, diversified product range, and effective marketing strategies also provide a competitive edge. The company's ability to anticipate fashion trends is another key differentiator.

Challenges include shifting consumer preferences and macroeconomic volatility. In response, the company is focusing on profitability and global expansion. The company is also adapting its direct-to-consumer strategies and exploring new market opportunities. For a broader perspective, consider the Competitors Landscape of Guess'.

In 2024, the company reported a 30% drop in sales to $84 million in the sales season, leading to plans to close 20 underperforming stores in North America. The brand value was estimated at $1.2 billion as of 2023, highlighting its strong market position. The company's global presence spans over 100 countries.

- The acquisition of rag & bone in April 2024 aimed at portfolio diversification.

- GUESS JEANS launch targeting the Gen Z market.

- Investment in omnichannel shopping experiences.

- Exploration of transitioning out of direct operations in Greater China.

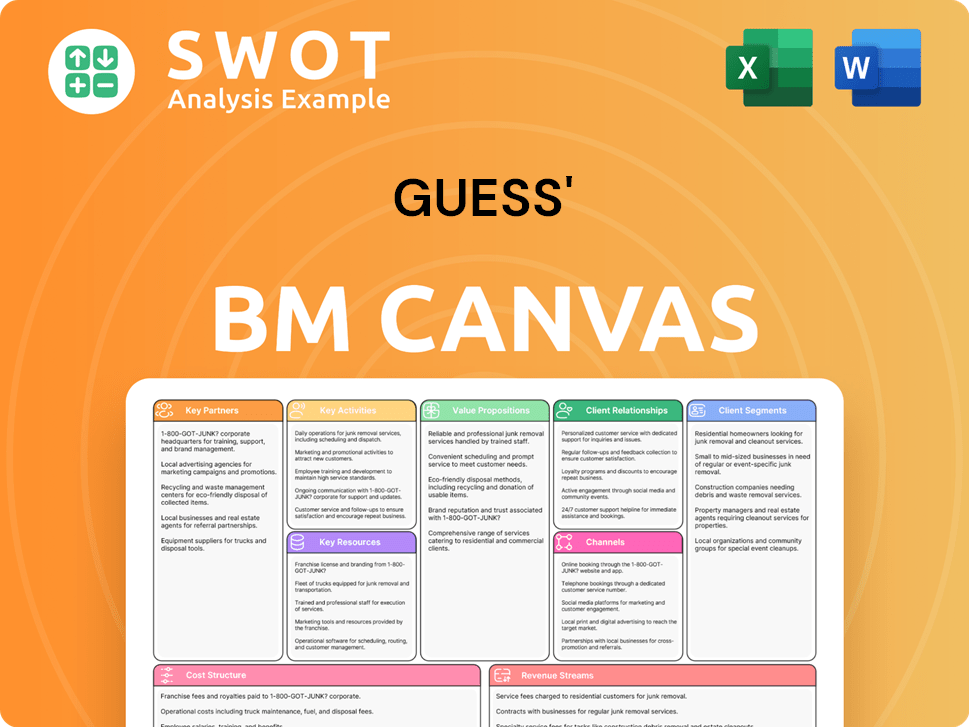

Guess' Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Guess' Positioning Itself for Continued Success?

The Guess company holds a significant position within the global fashion and lifestyle market, competing with major brands like Levi's and Ralph Lauren. The company differentiates itself through strong brand recognition and a multi-channel approach. As of the fourth quarter of fiscal year 2024, the Guess brand had a market share of approximately 1.38% based on total revenue. This highlights its established presence and competitive standing within the industry, emphasizing its ability to attract and retain customers.

Looking at the risks and the future outlook, the Guess brand faces challenges like intense competition and changing consumer preferences. Economic downturns and potential supply chain disruptions also pose threats. However, the company is focused on strategic initiatives to drive growth. For fiscal year 2026, Guess anticipates consolidated net revenue to increase between 5.5% and 7.4%, demonstrating a commitment to sustainable growth and market expansion.

The Guess brand competes with well-known brands like Levi's and Ralph Lauren in the global fashion market. The company utilizes a multi-channel approach to reach consumers. As of the fourth quarter of fiscal year 2024, Guess held a market share of about 1.38% based on total revenue.

Key risks include intense competition and rapidly changing fashion trends. Economic downturns and supply chain issues also pose challenges. Currency fluctuations, increased freight costs, and elevated taxes have impacted financial outlook. Geopolitical issues also present risks.

The company is focused on initiatives to drive revenue and operating profit growth. Guess aims to improve brand relevance and expand its digital presence. For fiscal year 2026, net revenue is expected to increase between 5.5% and 7.4%.

The company plans to enhance its organization, improve brand relevancy, and expand customer centricity. Business and portfolio optimization is expected to unlock approximately $30 million in operating profit by fiscal year 2027. Guess is considering transitioning out of its direct operations in Greater China.

For fiscal year 2025, Guess expects GAAP EPS to reach $2.59-$2.89. The company's focus on operational efficiency and strategic partnerships aims to improve profitability. These efforts are crucial for sustaining growth and navigating market challenges.

- Revenue growth is projected between 5.5% and 7.4% for fiscal year 2026.

- Business and portfolio optimization is expected to yield approximately $30 million in operating profit by fiscal year 2027.

- The company is adapting its strategies in response to market dynamics.

- The company's vision emphasizes connecting passion and creativity to consumers, aiming to build lasting relationships and drive loyalty. Learn more about the Growth Strategy of Guess'.

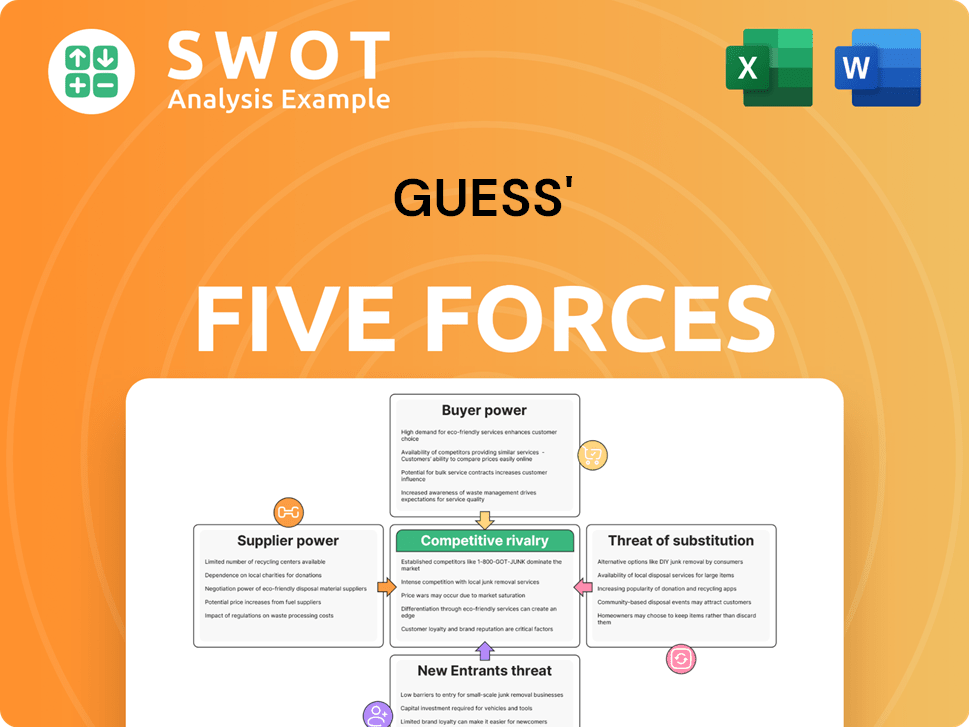

Guess' Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Guess' Company?

- What is Competitive Landscape of Guess' Company?

- What is Growth Strategy and Future Prospects of Guess' Company?

- What is Sales and Marketing Strategy of Guess' Company?

- What is Brief History of Guess' Company?

- Who Owns Guess' Company?

- What is Customer Demographics and Target Market of Guess' Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.