Helios Technologies Bundle

How Does Helios Technologies Thrive in a Changing Market?

Helios Technologies, a global force in motion and electronic controls, is making waves. Recent financial results, including Q1 2025 net sales of $195.5 million, showcase the Helios Technologies SWOT Analysis resilience of this Helios company. But how does this company, with a market cap of around $1.09 billion as of June 2025, navigate the complexities of its diverse markets and maintain its competitive edge?

This deep dive into the Helios business will explore the core operations, value proposition, and strategic moves that define Helios Technologies. We'll examine its revenue streams, industry standing, and key performance indicators, providing a comprehensive understanding of how this industry leader manufactures its products and services, and what industries it serves. Investors and industry observers alike will gain valuable insights into the company's financial performance and future growth potential.

What Are the Key Operations Driving Helios Technologies’s Success?

Helios Technologies operates through two main segments: Hydraulics and Electronics. The company's core strategy centers on delivering value through these segments, catering to diverse industrial needs. This approach allows Helios Technologies to provide comprehensive solutions, from individual components to complete systems, enhancing its market presence.

The company's value proposition is built on a 'in the region for the region' manufacturing model. This strategy supports cost optimization and adaptability to regional trade conditions. By focusing on product innovation and customer-centric strategies, Helios Technologies differentiates itself by offering reliable solutions for critical applications. It is important to understand How does Helios Technologies manufacture products, and what industries does it serve to fully grasp its operational scope.

Helios Technologies emphasizes strong engineering expertise. This is backed by significant R&D investment, with $24.6 million invested in 2023, and a substantial patent portfolio of 126 active patents. This commitment ensures that its core capabilities translate into customer benefits and market differentiation, which is crucial for understanding Helios Technologies company overview.

The Hydraulics segment focuses on cartridge valve technology, quick-release hydraulic couplings, and complete hydraulic system design. These products are essential for applications in agriculture, construction, and industrial markets. The segment operates under brands like Sun Hydraulics, Faster, and others.

The Electronics segment provides manufacturing and engineering capabilities for off-highway, recreational marine, and health and wellness markets. It designs and manufactures customized electronic control systems, displays, and software solutions. Key brands include Enovation Controls and Balboa Water Group.

Helios Technologies has invested in its operational footprint. The North American Hydraulics Centers of Excellence have been fully operational since Q4 2023. This includes an expanded Hydraulic Manifold Solutions CoE in Mishawaka, Indiana.

Recent product launches, such as the Purezone™ for spa experiences and the No Roads™ App for off-roading, highlight the company's commitment to innovation. These launches showcase Helios Technologies's focus on digital transformation and its ability to meet evolving market demands.

Helios Technologies differentiates itself through its 'in the region for the region' manufacturing approach, which optimizes costs and navigates trade environments. The company's focus on product innovation, backed by significant R&D investment, and customer-centric strategies are key differentiators. For further insights, consider exploring the Competitors Landscape of Helios Technologies.

- Strong engineering expertise and a robust patent portfolio.

- Commitment to product innovation and digital transformation.

- Customer-centric approach, providing reliable solutions for critical applications.

- Strategic manufacturing footprint to optimize costs and trade conditions.

Helios Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Helios Technologies Make Money?

The primary revenue stream for Helios Technologies comes from sales of its engineered solutions, primarily within its Hydraulics and Electronics segments. The company focuses on delivering profitable sales growth while improving its overall financial profile. This approach includes strategies to enhance operational efficiency and optimize the cash conversion cycle.

In Q1 2025, Helios Technologies reported net sales of $195.5 million. The Hydraulics segment contributed significantly, accounting for 65% of total sales, with $126.4 million in revenue. The Electronics segment saw relatively flat performance during the same period. For the full year 2024, the company reported net sales of $805.9 million, a 4% decrease compared to the previous year.

Helios Technologies is also exploring opportunities to diversify its revenue sources. This includes expanding into specialty vehicles, commercial HVAC, commercial foodservice, manufacturing, and off-road vehicles. Furthermore, the company is leveraging open-source software and a new patented remote field service platform to potentially establish recurring revenue streams through SaaS (Software as a Service) models.

Helios Technologies generates revenue primarily through the sale of its products across the Hydraulics and Electronics segments. The company's monetization strategies include driving operational leverage and shortening the cash conversion cycle. They are also focused on expanding into new markets and developing recurring revenue models.

- Hydraulics Segment: This segment accounted for 65% of total sales in Q1 2025, with revenue of $126.4 million. However, it experienced an 11% year-over-year decline due to market softness.

- Electronics Segment: This segment saw relatively flat performance in Q1 2025, with a 1% decrease year-over-year. Growth in some markets offset declines in others.

- Full Year 2024 Performance: For the full year 2024, net sales were $805.9 million, a 4% decrease. Despite this, gross margin expanded by 150 basis points in Q4 2024, and the operating margin improved by 120 basis points.

- Diversification and New Initiatives: The company is exploring opportunities in specialty vehicles, commercial HVAC, and other sectors to expand revenue. They are also leveraging technology for potential SaaS revenue streams. To learn more about the company's approach, you can read about the Marketing Strategy of Helios Technologies.

Helios Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Helios Technologies’s Business Model?

Helios Technologies has achieved significant milestones and strategic moves that have shaped its business. The company's financial performance in 2024 included record cash flow from operations, reaching $122.1 million, marking a 46% increase compared to 2023. This strong cash flow enabled a substantial debt reduction of $75.3 million, demonstrating effective financial management.

The company has consistently focused on reducing its debt. By March 29, 2025, total debt stood at $445.6 million, a decrease of nearly 15% from the previous year. This marks the seventh consecutive quarter of debt reduction, showcasing a commitment to financial stability. Despite facing operational challenges such as weak markets and severe weather impacts, Helios Technologies has adapted through strategic initiatives.

Helios Technologies' strategic approach includes driving efficiencies, controlling costs, and focusing on product innovation. In 2024, the company launched 11 new cartridge valves and a commercialized Energen valve. Furthermore, the opening of two North American Hydraulics Centers of Excellence in Q4 2023 expanded facilities for manifold machining and assembly, enhancing operational capabilities. For more details on the company's growth strategy, you can read about the Growth Strategy of Helios Technologies.

Helios Technologies achieved record cash flow from operations in 2024, reaching $122.1 million, a 46% increase over the prior year. The company has consistently reduced its debt, with total debt at $445.6 million by March 29, 2025, down nearly 15% from the previous year. This marks the seventh consecutive quarter of debt reduction.

The company has focused on product innovation, launching 11 new cartridge valves and a commercialized Energen valve in 2024. Helios Technologies opened two North American Hydraulics Centers of Excellence in Q4 2023. Helios has also made strategic acquisitions to expand its technological capabilities.

Helios Technologies has a diverse product portfolio and a strong brand reputation. The company's specialized motion control and fluid power technologies give it a competitive advantage. Helios also maintains a long track record of consistent dividend payments, demonstrating financial stability.

Helios has a history of consistent dividend payments. The company paid its 113th consecutive quarterly cash dividend on April 22, 2025. This underscores the company's financial health and commitment to shareholders.

Helios Technologies' competitive advantages include its specialized motion control and fluid power technologies, a diverse product portfolio, a strong brand reputation, and a global manufacturing presence. The company has a history of strategic acquisitions to expand its technological capabilities, with 7 acquisitions across various sectors, including i3 Product Development in May 2023.

- Specialized Technology: Focus on motion control and fluid power.

- Product Diversity: A wide range of products to serve various industries.

- Strategic Acquisitions: Expanding capabilities through acquisitions.

- Dividend Payments: Consistent quarterly cash dividends.

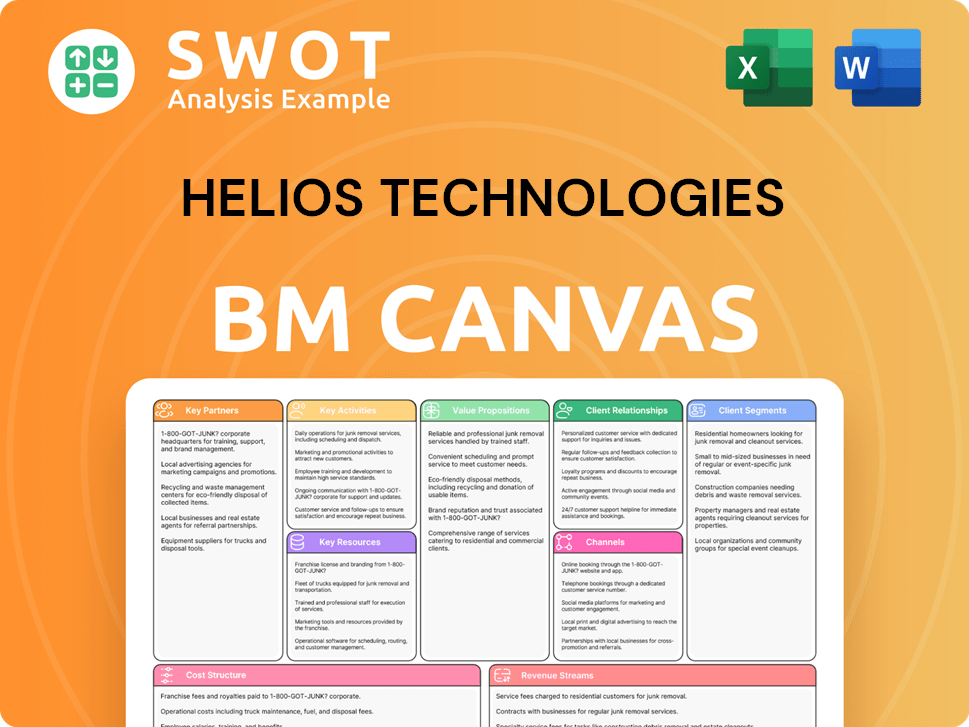

Helios Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Helios Technologies Positioning Itself for Continued Success?

Helios Technologies, a global leader in motion control and electronic controls technology, serves diverse end markets across 90 countries. Despite facing challenging market conditions, the company has demonstrated resilience. Understanding the Owners & Shareholders of Helios Technologies is crucial for grasping the company's strategic direction and financial health.

In Q1 2025, the company saw sales growth in Asia Pacific (7%), the Americas (6%), and EMEA (20%) compared to Q4 2024. However, year-over-year sales declined in all regions for the Hydraulics segment. This highlights the dynamic nature of the business and the importance of adapting to evolving market demands.

Helios Technologies holds a significant position as a global leader in its industry. It serves diverse end markets worldwide, showcasing a broad reach and market penetration. The company's ability to adapt to changing global economic conditions is key to its continued success.

Key risks include global supply chain disruptions, geopolitical tensions, and economic uncertainties. Tariffs, particularly those on U.S. and Chinese imports, pose a significant financial risk. The company is actively managing these risks through strategic initiatives.

For Q2 2025, total net sales are expected to be between $198 million and $206 million. For the full year 2025, sales are anticipated to range from -4% to +2% compared to 2024. Strategic initiatives focus on working capital management and cost discipline.

The company is focused on working capital management, operational efficiencies, and cost discipline. It aims to leverage positive trends in order intake and maintain customer relationships. Share repurchases are planned for 2025.

In Q1 2025, sales in Asia Pacific grew by 7%, the Americas by 6%, and EMEA by 20% compared to Q4 2024. The company anticipates a direct cost impact of approximately $15 million from tariffs in the second half of 2025. Helios Technologies is actively managing these challenges.

- Focus on 'in the region for the region' manufacturing infrastructure.

- Expect to mitigate $10-15 million of tariff costs.

- Strategic initiatives include debt reduction and share repurchases.

- Continued focus on customer centricity and product innovation.

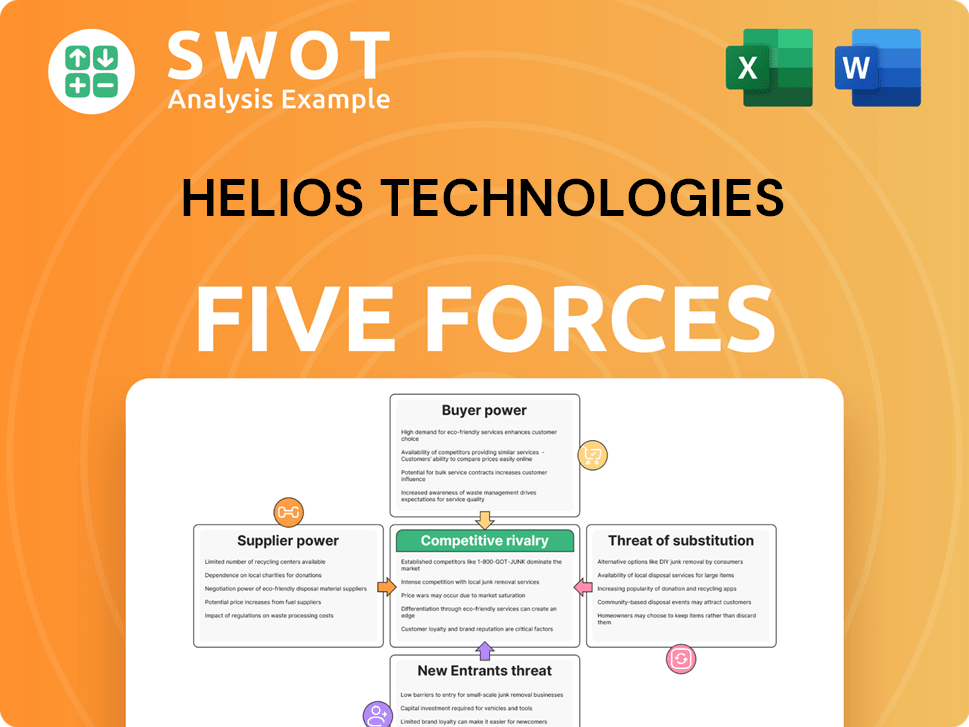

Helios Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Helios Technologies Company?

- What is Competitive Landscape of Helios Technologies Company?

- What is Growth Strategy and Future Prospects of Helios Technologies Company?

- What is Sales and Marketing Strategy of Helios Technologies Company?

- What is Brief History of Helios Technologies Company?

- Who Owns Helios Technologies Company?

- What is Customer Demographics and Target Market of Helios Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.