Helios Technologies Bundle

Who Really Owns Helios Technologies?

Understanding the ownership structure of a company is paramount for investors and strategists alike. It reveals the power dynamics, strategic priorities, and potential future of the business. With the recent listing on the New York Stock Exchange, the story of Helios Technologies SWOT Analysis and its ownership is more relevant than ever.

From its roots as Sun Hydraulics to its current status as a global leader, the evolution of Helios Technologies' ownership provides crucial insights. This analysis will dissect the ownership of the Helios company, exploring its major shareholders, the influence of its Board of Directors, and emerging trends impacting Helios investors. Discover the key players shaping the future of Helios Technologies, from its stock to its strategic direction.

Who Founded Helios Technologies?

The story of Helios Technologies, formerly Sun Hydraulics, began in Sarasota, Florida, in 1970. While the exact details of the initial equity distribution among the founders remain unavailable in the provided sources, the company's early focus was clear: the development and manufacturing of advanced motion control and electronic controls technology. This laid the groundwork for what would become a publicly traded company.

The company's journey from its founding to its initial public offering (IPO) involved several key milestones. The IPO, which took place on January 9, 1997, marked a significant turning point, with shares initially priced at $9.50. This transition to a public entity provided access to capital and opened new avenues for growth and expansion, solidifying its position in the market.

Since its IPO, Helios Technologies has demonstrated a commitment to returning value to its shareholders. The company has consistently paid a quarterly cash dividend for over 28 years, reflecting its sustained financial performance and stability. This long-term commitment to dividends is a key indicator of the company's financial health and its dedication to its investors.

Understanding the founders and early ownership of Helios Technologies provides context for its current success. While specific details about the founders' backgrounds and initial equity splits are not available, the company's trajectory is clear. Here are some key takeaways:

- The company was founded in 1970 in Sarasota, Florida, originally as Sun Hydraulics.

- The company went public on January 9, 1997, with an IPO price of $9.50 per share.

- Helios Technologies has a history of returning value to its shareholders through consistent quarterly cash dividends.

- For more information on the Target Market of Helios Technologies, read this article.

Helios Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Helios Technologies’s Ownership Changed Over Time?

The journey of Helios Technologies from a private entity to a publicly traded company on January 9, 1997, marked a pivotal shift in its ownership structure. The initial public offering (IPO) priced shares at $9.50 each. As of June 6, 2025, the stock price had risen to $32.34, reflecting market performance and investor confidence. This transition opened the doors for a diverse group of investors, including institutional, retail, and individual shareholders, to participate in the company's growth.

The ownership landscape of Helios Technologies (HLIO) has evolved significantly since its IPO. Initially, ownership was concentrated among early investors and insiders. However, the structure has transformed, with institutional investors now holding a substantial portion of the company's stock. This shift has implications for corporate governance and strategic decision-making, as institutional investors often have a more significant influence on company direction.

| Ownership Category | Percentage (Approximate) | Notes |

|---|---|---|

| Institutional Shareholders | Approximately 95.33% | Includes firms like Wasatch Advisors Inc., Vanguard Group Inc., and BlackRock, Inc. |

| Insiders | Around 8.18% | Includes company executives and board members. |

| Retail Investors | 0.00% | Represents individual investors. |

Major institutional shareholders play a crucial role in shaping Helios Technologies' trajectory. As of recent filings, prominent institutional investors include Wasatch Advisors Inc., Vanguard Group Inc., BlackRock, Inc., Conestoga Capital Advisors, LLC, Dimensional Fund Advisors Lp, and Brown Capital Management Llc. Vanguard is noted as owning the most shares of Helios Technologies. For example, Brown Capital Management, according to a 13G/A form filed with the SEC in February 2023, held 2.99 million shares, representing 9.18% of the company. Christine L. Koski is the largest individual shareholder, holding 1.27 million shares, equivalent to 3.80% of the company. These shifts in major shareholding can significantly impact company strategy and governance, as large institutional investors can exert influence on management.

Understanding the ownership structure of Helios Technologies is crucial for investors and stakeholders. The company's ownership is primarily held by institutional investors, with a smaller percentage held by insiders. The stock price has increased significantly since its IPO, indicating growth and investor confidence.

- Institutional investors hold the majority of Helios Technologies stock.

- Insiders also have a significant stake in the company.

- The stock price has increased since the IPO.

- Major shareholders can influence company strategy and governance.

Helios Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Helios Technologies’s Board?

The current Board of Directors of Helios Technologies significantly influences the company's strategic direction and governance. As of June 5, 2025, Ian Walsh joined the Board, also serving on the Audit and Governance Committees. Sean Bagan, appointed President and Chief Executive Officer on January 6, 2025, and Chief Financial Officer since August 9, 2023, also holds these roles. Laura Dempsey Brown chairs the Board, with independent directors including Douglas Britt, Cariappa M. Chenanda, Diana Sacchi, and Alexander Schuetz. This structure ensures a diverse range of perspectives and expertise to guide the company's operations.

The composition of the board reflects a commitment to independent oversight and strategic leadership. The presence of various committees, such as the Audit and Governance Committees, highlights the company's dedication to financial transparency and ethical practices. The leadership team, including the CEO and CFO, plays a critical role in executing the company's vision and managing its financial performance. Understanding the roles and responsibilities of each member of the board is crucial for investors and stakeholders seeking to assess the company's governance practices.

| Director | Role | Committee Memberships |

|---|---|---|

| Laura Dempsey Brown | Chair of the Board | N/A |

| Sean Bagan | President and CEO, CFO | N/A |

| Ian Walsh | Director | Audit Committee, Governance Committee |

| Douglas Britt | Independent Director | N/A |

| Cariappa M. Chenanda | Independent Director | N/A |

| Diana Sacchi | Independent Director | N/A |

| Alexander Schuetz | Independent Director | N/A |

Regarding voting power, each shareholder of Common Stock is entitled to one vote per share. As of April 9, 2024, there were 33,159,682 shares of Common Stock issued and outstanding. The company actively engages with its investors, consulting with holders of approximately 83% of its outstanding shares on matters, including board structure and capital allocation. Discussions are underway regarding a potential transition to a declassified board and a majority voting structure. This could enhance shareholder influence and accountability within Helios Technologies. For further insights into the company's strategic direction, consider reading about the Growth Strategy of Helios Technologies.

Shareholders have one vote per share, with the board considering a shift to a declassified board and majority voting. This could increase shareholder influence.

- Shareholders' voting rights are directly tied to their share ownership.

- The company engages with investors to understand their perspectives.

- Changes in governance could lead to greater accountability.

- The board is evaluating its structure to enhance shareholder engagement.

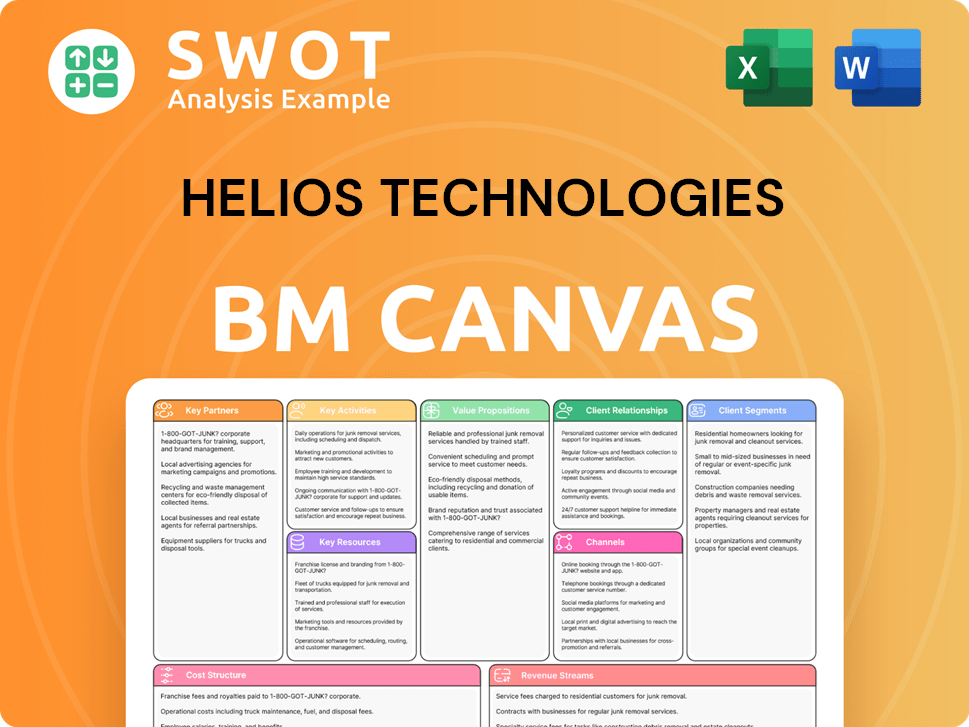

Helios Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Helios Technologies’s Ownership Landscape?

Over the past few years, Helios Technologies has seen several key developments influencing its ownership structure. In February 2025, the company initiated a share repurchase program, authorizing the buyback of up to $100 million of its common stock. This initiative is supported by the company's robust financial performance, including a record $122.1 million in cash generated from operations in 2024, a substantial 46% increase compared to the previous year. As of March 31, 2025, no shares have been repurchased under this program.

Another significant trend is the company's focus on reducing debt. By the end of 2024, total debt stood at $449.5 million, representing a 14% decrease from the prior year. The net debt-to-adjusted EBITDA leverage ratio improved to 2.6x at the end of 2024, down from 3.0x at the end of 2023. Additionally, the company has maintained its quarterly cash dividend at $0.09 per share, with the 113th consecutive dividend paid on April 22, 2025.

| Metric | 2023 | 2024 |

|---|---|---|

| Cash from Operations (millions) | $83.6 | $122.1 |

| Total Debt (millions) | $522.7 | $449.5 |

| Net Debt to Adjusted EBITDA | 3.0x | 2.6x |

Institutional investors currently hold approximately 95.33% of the company's stock, reflecting the industry's increased institutional ownership. This concentration can significantly influence the company's strategic decisions. The company's strategic priorities include continued investment in organic growth, evaluating strategic acquisitions, and enhancing returns for shareholders. Despite facing market challenges in 2024, Helios Technologies reported improved margins and record cash generation. The company anticipates a potential $15 million gross impact from tariffs in the second half of 2025, but is actively working to mitigate this through pricing adjustments, local manufacturing, and operational efficiencies. For the second quarter of 2025, net sales are expected to be between $198 million and $206 million.

The company authorized a share repurchase program for up to $100 million of common stock in February 2025, funded by cash on hand and operational cash flow.

Total debt decreased by 14% in 2024, reaching $449.5 million, with the net debt-to-adjusted EBITDA leverage ratio improving to 2.6x.

Institutional investors hold approximately 95.33% of the company's stock.

The company expects Q2 2025 net sales to be between $198 million and $206 million, while mitigating tariff risks.

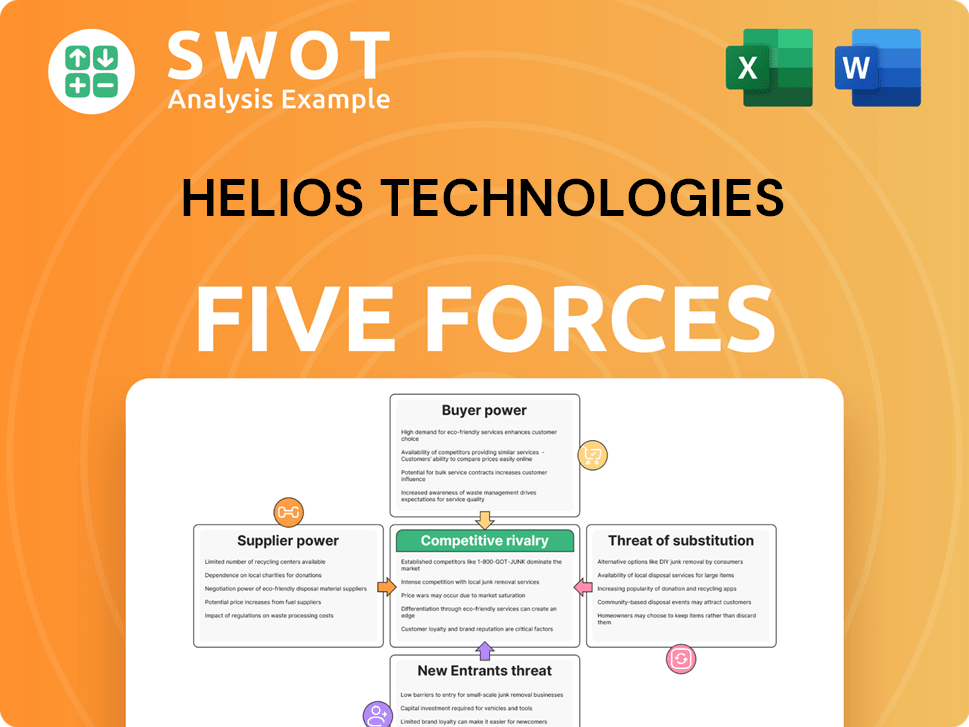

Helios Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Helios Technologies Company?

- What is Competitive Landscape of Helios Technologies Company?

- What is Growth Strategy and Future Prospects of Helios Technologies Company?

- How Does Helios Technologies Company Work?

- What is Sales and Marketing Strategy of Helios Technologies Company?

- What is Brief History of Helios Technologies Company?

- What is Customer Demographics and Target Market of Helios Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.