Helvetia Holding Bundle

Unveiling Helvetia: How Does This Swiss Insurance Giant Thrive?

Helvetia Holding AG, a leading Swiss insurance company, commands a significant presence in the European insurance market. Offering a wide array of insurance and financial services, Helvetia Group caters to both individual and corporate clients with its life, non-life, and reinsurance offerings. Understanding the inner workings of Helvetia is crucial for anyone looking to navigate the complexities of the financial landscape.

To truly grasp the potential of Helvetia Holding SWOT Analysis, we must first understand its operational framework and revenue streams. With a strong 2024 business volume of CHF 11,223.3 million, the Helvetia insurance company demonstrates its robust market position. This exploration will dissect the core operations, strategic moves, and future outlook of this influential Swiss insurance company, providing a comprehensive understanding of its financial performance and market dynamics.

What Are the Key Operations Driving Helvetia Holding’s Success?

The core operations of the Helvetia Holding Company are centered on providing a wide array of insurance and financial services. This Swiss insurance company focuses on creating and delivering value through its comprehensive offerings. These include life insurance products, non-life insurance, and reinsurance services, catering to both individual and corporate clients.

The value proposition of Helvetia Group lies in its ability to offer financial security and risk management solutions. They provide long-term financial security through life insurance and address various risks with non-life insurance. This approach helps customers manage their financial futures and protect their assets. The company's commitment to digital transformation, as outlined in its Helvetia 2025 strategy, aims to enhance customer experience and streamline internal processes, thereby improving operational efficiency and customer benefits.

Operational efficiency is a key focus for the Helvetia insurance company. They achieve this through sophisticated underwriting, robust claims management, and advanced IT infrastructure. Their distribution network includes direct sales, independent brokers, and bancassurance partnerships. The acquisition of Nationale Suisse in 2014 expanded their market reach, especially in specialty lines.

Helvetia offers a diverse range of insurance products. These include life insurance, encompassing traditional and unit-linked policies, designed for long-term financial security. Non-life insurance covers property, casualty, motor, health, and travel, addressing various risks.

Reinsurance is a crucial part of Helvetia's operations, helping to diversify its risk portfolio. This strategy provides stability and supports the company's overall financial health. Strategic partnerships with reinsurers optimize risk transfer and enhance product offerings.

Helvetia utilizes a multi-channel distribution network. This includes direct sales, independent brokers, and bancassurance partnerships. These channels ensure broad market reach and accessibility for its diverse customer segments.

The company is focused on digital transformation, as seen in its Helvetia 2025 strategy. This strategy aims to enhance customer experience through digital solutions and streamline internal processes. This improves operational efficiency and customer benefits.

Helvetia's operational processes are meticulously managed to ensure efficient service delivery and customer satisfaction. This includes sophisticated underwriting procedures and robust claims management systems. Advanced IT infrastructure supports digital platforms and customer interactions.

- Underwriting: Accurate risk assessment and pricing.

- Claims Management: Timely and fair payouts.

- IT Infrastructure: Support for digital platforms and customer interactions.

- Distribution: Multi-channel approach for broad market reach.

Helvetia Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Helvetia Holding Make Money?

Understanding the revenue streams and monetization strategies of the Helvetia Holding Company is crucial for investors and stakeholders. The company, a prominent player in the Swiss insurance market, employs a multifaceted approach to generate income and maximize profitability. This involves a combination of core insurance operations, strategic investments, and diversified service offerings.

The Helvetia Group leverages its established market position and customer base to drive revenue growth. By examining its financial performance and strategic initiatives, one can gain valuable insights into how Helvetia insurance sustains its financial health and achieves its business objectives.

The primary revenue streams for Helvetia Holding Company are centered around insurance premiums and investment income. These two pillars support the company's financial stability and growth, contributing significantly to its overall business volume and profitability.

Insurance premiums are the largest source of revenue for Helvetia. These premiums are generated from both life and non-life insurance products, reflecting the company's diverse offerings.

Investment income is a critical revenue stream, derived from managing Helvetia's investment portfolio. This portfolio includes bonds, equities, real estate, and other financial assets.

In 2024, Helvetia reported a strong business volume of CHF 11,223.3 million, showcasing the significance of premiums. The non-life segment saw a 7.0% increase, reaching CHF 7,227.4 million, while life insurance grew by 2.5% to CHF 3,995.9 million.

Helvetia generates revenue through fees for services such as asset management for institutional clients and specialized risk management consulting.

The company uses tiered pricing for its insurance products. This strategy allows Helvetia to cater to different customer needs and budgets by offering various levels of coverage and benefits.

Cross-selling is a key strategy, leveraging the existing customer base. This approach allows Helvetia to offer additional insurance products or financial services to its current clients.

Helvetia employs several strategies to enhance revenue and profitability, including a focus on international markets and strategic initiatives. These efforts are designed to optimize the revenue mix and drive sustainable growth.

- International Markets: Helvetia's operations in Germany, Spain, and Austria contribute significantly to revenue diversification.

- Strategic Initiatives: The Helvetia 2025 strategy aims to optimize the revenue mix by focusing on profitable growth areas and enhancing digital sales channels. This is a key part of Helvetia's long-term vision.

- Market Share: As a leading Swiss insurance company, Helvetia maintains a strong market share in Switzerland, which is crucial for its overall financial performance.

- Financial Performance: The company's financial results, including the Helvetia share price, are closely watched by investors. For more details, you can explore the Growth Strategy of Helvetia Holding.

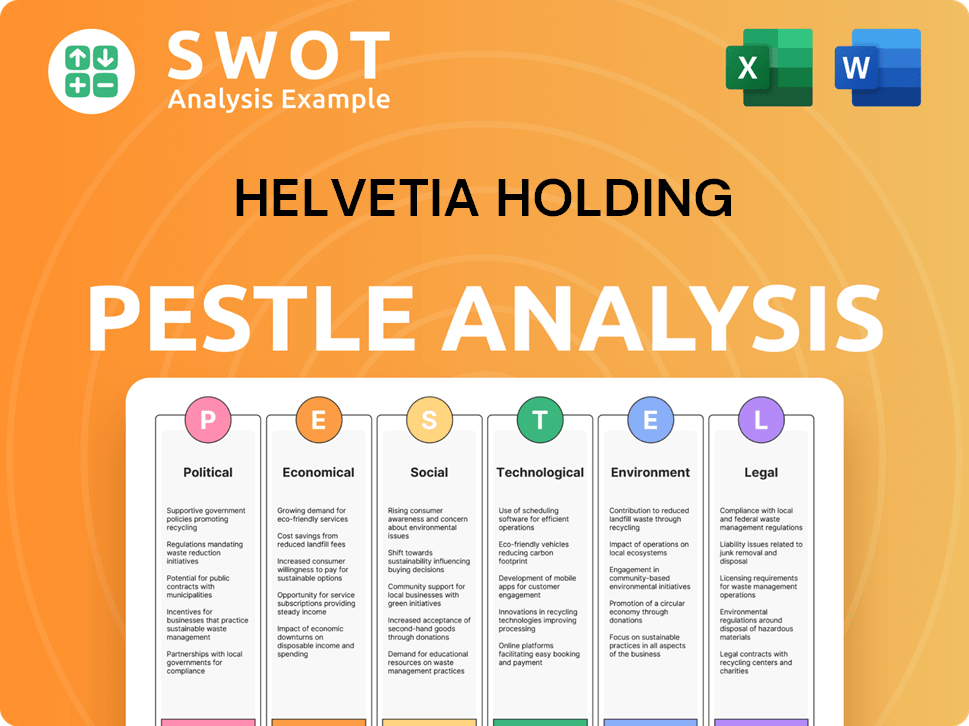

Helvetia Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Helvetia Holding’s Business Model?

The journey of Helvetia Holding Company has been marked by significant milestones and strategic decisions that have shaped its market position and financial outcomes. One of the most impactful moves was the acquisition of Nationale Suisse in 2014, which significantly strengthened its presence in Switzerland and broadened its expertise in specialized insurance lines. This strategic acquisition was a pivotal step in consolidating its domestic market share and enhancing its product offerings.

Another key strategic initiative is the ongoing implementation of the Helvetia Group's 2025 strategy. This strategy centers on profitable growth, a customer-centric approach, and digital transformation. The aim is to adapt to evolving customer behaviors and technological advancements, ensuring the company remains competitive in a rapidly changing industry. This forward-thinking approach is crucial for maintaining its relevance and driving future success.

Operational challenges, such as the persistent low-interest rate environment and increasing regulatory demands, have been addressed through proactive measures. Helvetia insurance has responded by optimizing its investment strategies and enhancing its operational efficiency to navigate these complexities effectively. These adjustments are critical for maintaining financial stability and driving sustainable growth.

The acquisition of Nationale Suisse in 2014 was a major milestone, boosting its market position in Switzerland. This strategic move expanded its expertise in specialty insurance lines. The ongoing implementation of the Helvetia 2025 strategy is another key initiative.

The Helvetia 2025 strategy focuses on profitable growth, customer centricity, and digital transformation. This strategy aims to adapt to changing customer behaviors and technological advancements. The company is also optimizing investment strategies and enhancing operational efficiency.

Helvetia benefits from strong brand recognition and a reputation for reliability in its core markets. Its diversified product portfolio provides resilience against market fluctuations. Economies of scale and a commitment to innovation further enhance its competitive position.

In 2023, Helvetia reported a Group profit of CHF 585.6 million, a significant increase compared to the previous year. The company's focus on operational excellence and strategic investments contributed to these positive results. The Helvetia share price reflects the company's solid financial performance and market position.

Helvetia's competitive advantages are rooted in its strong brand recognition and long-standing reputation. Its diversified product portfolio across life, non-life, and reinsurance segments provides resilience against market fluctuations. The company's commitment to innovation, particularly in digital solutions and new product development, ensures its continued relevance.

- Strong brand recognition and customer loyalty.

- Diversified product portfolio mitigating market risks.

- Economies of scale leading to cost efficiencies.

- Commitment to innovation and digital transformation.

For more in-depth information on the ownership structure and shareholder details, you can refer to Owners & Shareholders of Helvetia Holding. This provides valuable insights into the company's governance and financial stakeholders.

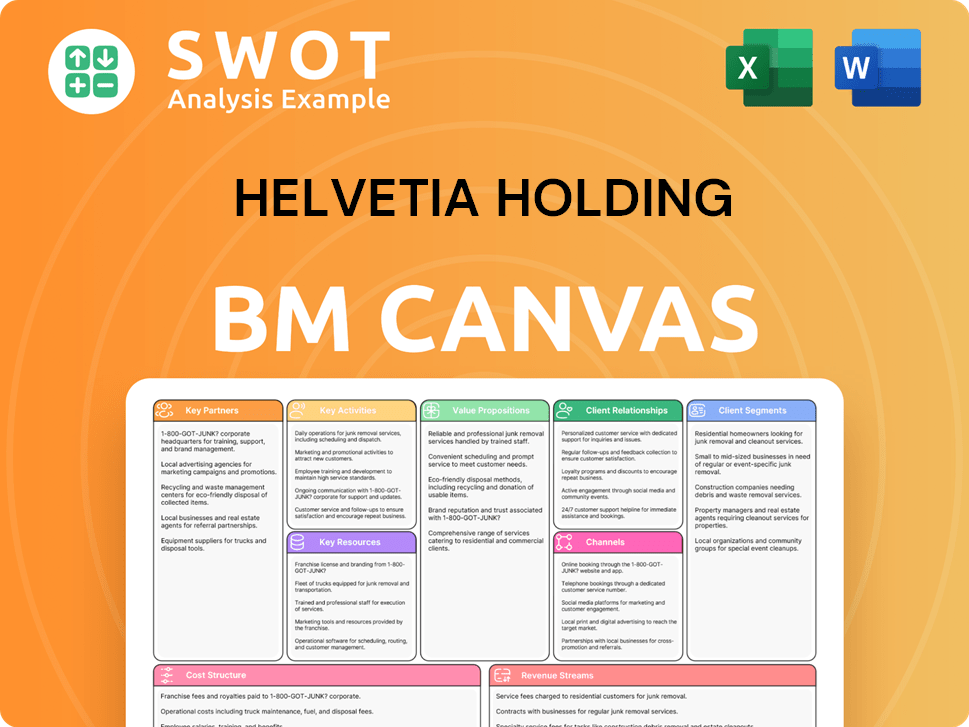

Helvetia Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Helvetia Holding Positioning Itself for Continued Success?

The Helvetia Holding Company maintains a robust position within the European insurance sector, particularly in Switzerland, Germany, Spain, and Austria. As a leading insurer, Helvetia insurance boasts a substantial customer base and a strong brand reputation, supported by a diversified business model across life, non-life, and reinsurance segments.

However, Helvetia Group faces several risks, including regulatory changes and competition from Insurtech startups. Technological advancements and evolving customer preferences also require constant adaptation. The company's future outlook is shaped by its strategic initiatives, focusing on digitalization, innovative product development, and operational efficiency.

Helvetia is a prominent player in the European insurance market, particularly in Switzerland, Germany, Spain, and Austria. Its strong brand and diversified business model contribute to its resilience. The company's focus on customer loyalty and personalized service strengthens its market position.

Regulatory changes, such as Solvency II, can impact capital allocation. Competition from Insurtech startups and tech giants poses a threat. Technological disruption and changing consumer preferences demand continuous adaptation. For a look at its competitors, check out this article: Competitors Landscape of Helvetia Holding.

The company's future is guided by its Helvetia 2025 strategy, emphasizing profitable growth and digitalization. It aims to enhance operational efficiency and explore new growth areas, such as corporate venturing. The focus remains on sustainable value creation for stakeholders.

Helvetia is prioritizing profitable growth, digitalization, and innovative product development. The company is leveraging data analytics to improve underwriting and claims management. Strategic partnerships and corporate venturing are key to expanding its ecosystem.

In the first half of 2024, Helvetia reported a Group profit of CHF 307.3 million. The non-life business saw a strong performance, with premiums increasing. The company's focus on digitalization and innovation is reflected in its strategic initiatives.

- The Swiss business contributed significantly to the overall results.

- Helvetia is actively managing its investment portfolio to navigate market volatility.

- The company continues to invest in its digital platforms to enhance customer experience.

- Helvetia's solvency ratio remains strong, providing financial stability.

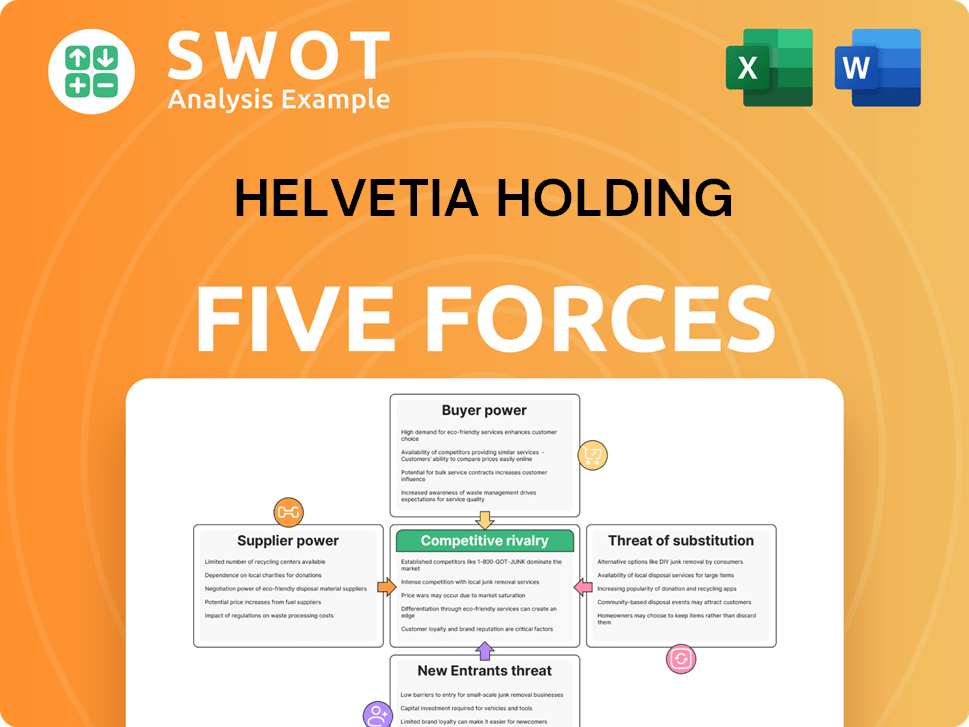

Helvetia Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Helvetia Holding Company?

- What is Competitive Landscape of Helvetia Holding Company?

- What is Growth Strategy and Future Prospects of Helvetia Holding Company?

- What is Sales and Marketing Strategy of Helvetia Holding Company?

- What is Brief History of Helvetia Holding Company?

- Who Owns Helvetia Holding Company?

- What is Customer Demographics and Target Market of Helvetia Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.