Hilding Anders Bundle

How Does the Hilding Anders Company Thrive in the Global Bedding Market?

From a humble Swedish workshop in 1939, Hilding Anders has become a global powerhouse in the sleep products sector. This Hilding Anders SWOT Analysis reveals the strategies behind its success, exploring how this mattress manufacturer has expanded its reach across Europe and Asia. With a vast array of sleep products, Hilding Anders continues to shape the bedding industry.

Understanding Hilding Anders' operations is key to grasping its significant influence in the home furnishings sector. The company's strategic approach, from its diverse brand portfolio to its extensive manufacturing capabilities, allows it to meet the varied demands of consumers worldwide. Examining the Hilding Anders company history and its current operations provides valuable insights into its adaptability and future potential in a market driven by evolving consumer preferences and technological advancements in sleep products.

What Are the Key Operations Driving Hilding Anders’s Success?

The Hilding Anders company operates within the bedding industry, focusing on the design, manufacturing, and distribution of sleep products. Their core business involves creating and delivering value through a comprehensive range of items, including mattresses, bed frames, duvets, pillows, and related accessories. The company serves a diverse customer base through both retail and contract markets, highlighting a strategic approach to market segmentation and revenue diversification.

Hilding Anders operations encompass a variety of processes, from manufacturing and sourcing to product development, logistics, and multi-channel sales. The company has established robust manufacturing capabilities with 18 factories and a substantial workforce. Their focus on quality and ergonomics is evident in their use of materials like foam and springs. Furthermore, their supply chain is supported by annual supplier sustainability and quality assessments, ensuring thorough reporting and mitigation of environmental impacts.

The Hilding Anders value proposition is built upon its extensive product portfolio, which includes luxury and premium brands. This multi-brand strategy allows the company to cater to a wide range of consumer preferences and price sensitivities, enabling market segmentation and broader reach. Their extensive European and Asian presence, with manufacturing and sales operations in multiple countries, enables them to adapt to diverse local market needs. For more information, you can read about the Brief History of Hilding Anders.

In 2024, the retail segment accounted for approximately 60% of sales, while the contract market, including hotel partnerships, contributed the remaining 40%. This dual-market focus enhances revenue stability and growth opportunities. This strategy helps in adapting to different market dynamics and consumer behaviors.

Hilding Anders produced over 3 million mattresses in 2024. Their manufacturing processes emphasize quality and ergonomics. This capacity allows them to meet high demand and maintain control over product quality.

In 2024, the Asian market share grew by 7% due to strong demand. The company focuses on enhancing in-store experiences through point-of-sale strategies, including in-store product configuration, which increased showroom conversion rates by 15% in 2024. This growth highlights the company's ability to adapt to diverse local market needs.

The product portfolio ranges from luxury and premium brands to private label offerings. This multi-brand strategy allows them to cater to varied consumer preferences and price sensitivities. This comprehensive approach ensures they can capture a significant share of the bedding market.

Hilding Anders focuses on several key operational aspects to maintain its market position and drive growth. These include a strong emphasis on manufacturing, product development, and supply chain management. Their ability to adapt to market changes and consumer demands is crucial.

- Manufacturing Excellence: With 18 factories, they maintain high production standards.

- Multi-Channel Sales: They cater to both retail and contract markets.

- Market Adaptation: Their presence in Europe and Asia allows them to adapt to local market needs.

- Customer Experience: They focus on enhancing in-store experiences and digital tools.

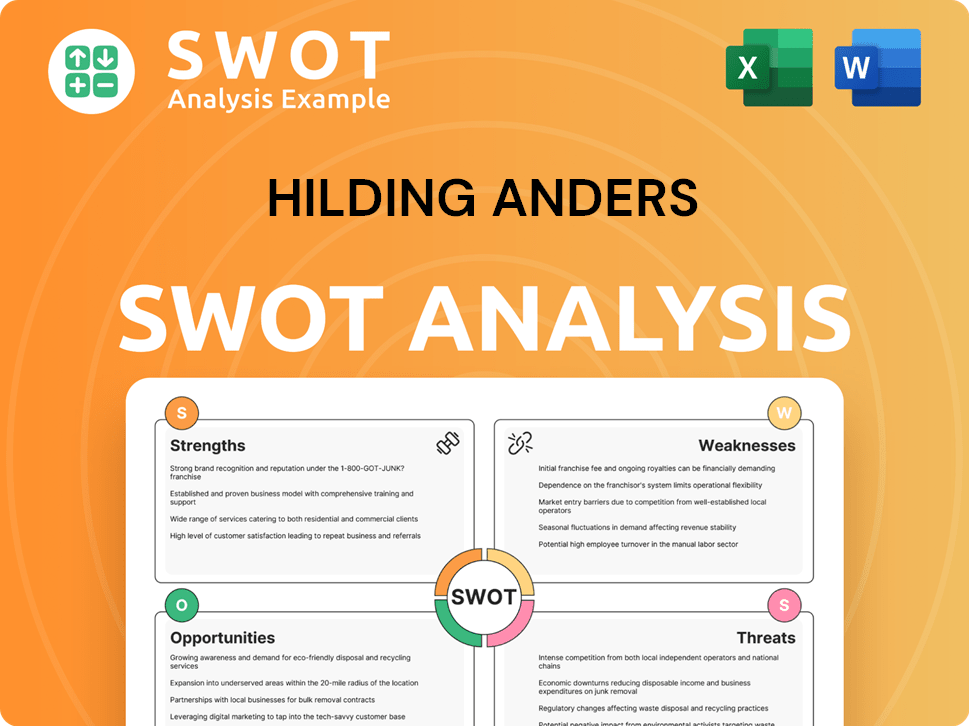

Hilding Anders SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hilding Anders Make Money?

The Growth Strategy of Hilding Anders focuses on generating revenue through diverse channels within the bedding industry. As a leading mattress manufacturer, the company employs a multifaceted approach to monetization, targeting both retail consumers and the contract market.

Hilding Anders' operations are structured to maximize profitability through a combination of product sales, strategic pricing, and digital engagement. This strategy is supported by a strong emphasis on brand development and a commitment to sustainability, which resonates with contemporary consumer preferences in the sleep products sector.

The company's revenue streams are primarily derived from selling a wide array of sleep products. These include mattresses, bed frames, duvets, pillows, and related accessories. These items are offered under various brand names and private labels, ensuring a broad market appeal.

Hilding Anders utilizes a tiered pricing strategy, catering to various customer segments from basic to luxury. This approach is a key component of their profitability. The company's revenue reached approximately €1.4 billion in 2024, showcasing the effectiveness of their multi-brand and tiered pricing approach. Another source indicates the company's revenue was around €1.2 billion in 2024, also highlighting successful price differentiation. In 2024, the retail segment accounted for roughly 60% of sales, with the contract market contributing the remaining 40%.

- Retail Sales: Sales to individual consumers through various retail channels.

- Contract Market: Partnerships with hotels and other businesses for bulk orders.

- E-commerce: Online sales through the company's website and other digital platforms. E-commerce sales in the broader bedding market are projected to reach $12.5 billion in 2024.

- Sustainability Initiatives: Focus on eco-friendly materials and reducing the carbon footprint. The sustainable products market was estimated at $1.5 billion in 2024.

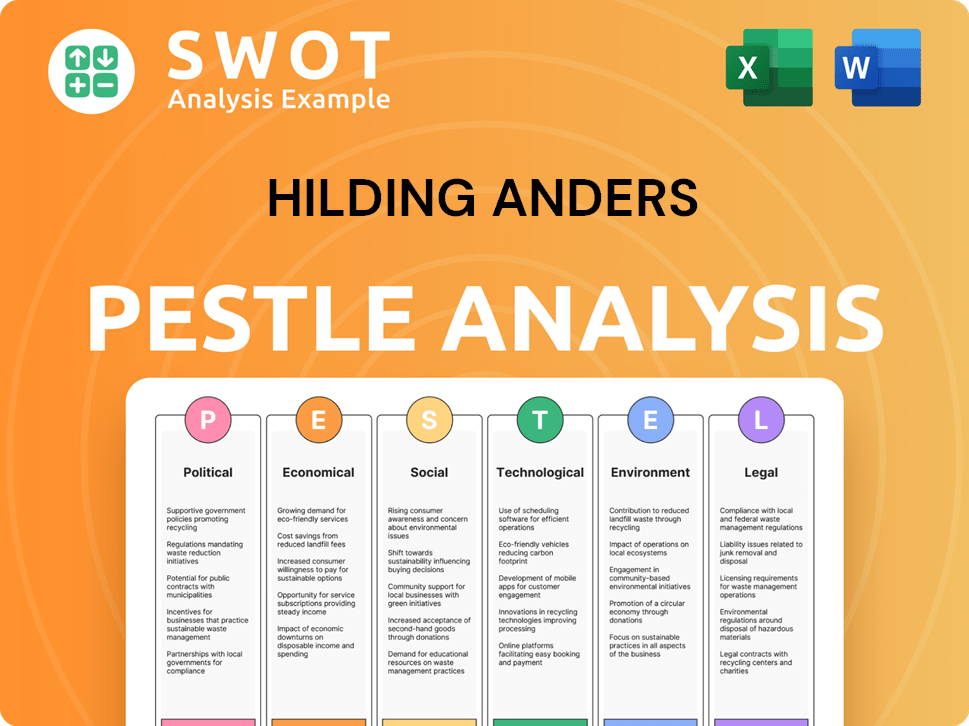

Hilding Anders PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hilding Anders’s Business Model?

Founded in 1939, the Hilding Anders company has established itself as a significant player in the bedding industry. The company's journey has been marked by strategic acquisitions and organic growth, expanding its footprint across Europe and Asia. A pivotal moment was the acquisition by KKR on November 29, 2016, which has shaped its strategic direction.

The Hilding Anders company has navigated various market challenges, including debt restructuring and economic volatility. Despite these hurdles, the company has maintained a strong position in the competitive landscape. Its ability to adapt to market trends and invest in innovation has been crucial to its continued success. The company's operations are diverse, with a focus on quality and sustainability.

The Hilding Anders company has a rich history of acquisitions, including brands like Slumberland Group, Carl Thögersen, and Dunlopillo. These strategic moves have broadened its product portfolio and market reach. The company's presence in Poland, since 2001, has been particularly significant, with its own brand, Hilding, becoming a major production component.

The company's history includes significant acquisitions, such as Slumberland and Dunlopillo, which expanded its brand portfolio. In 2003, the company introduced its own Hilding brand in Poland, which became a major part of its production. The KKR acquisition in 2016 was a pivotal strategic move.

The acquisition by KKR was a key strategic decision. The company has adapted to market changes by investing in digital marketing and e-commerce. They prioritize sustainability, aiming to reduce carbon emissions and invest in sustainable materials.

The company's strong brand portfolio, including Jensen and Slumberland, helps capture market share. Extensive manufacturing capabilities, with 18 factories producing over 3 million mattresses in 2024, provide economies of scale. The focus on quality and ergonomics, with some products having medical device status, differentiates its offerings.

The company is investing in digital marketing and e-commerce, recognizing the projected $12.5 billion e-commerce sales in the bedding market in 2024. It aims to reduce carbon emissions by 30% by 2030 and invests in sustainable material research. The company is exploring smart features in mattresses, a market expected to reach $6.8 billion by 2029.

The Hilding Anders company has faced financial challenges, including a debt restructuring proposal in 2022. They hold a strong position in the European mattress market, capturing 15% in 2024. The company is focused on innovation and sustainability to maintain its competitive edge.

- The bedding market's e-commerce sales are projected to reach $12.5 billion in 2024.

- The smart mattress market is expected to reach $6.8 billion by 2029.

- The company aims to reduce carbon emissions by 30% by 2030.

- The company has 18 factories producing over 3 million mattresses in 2024.

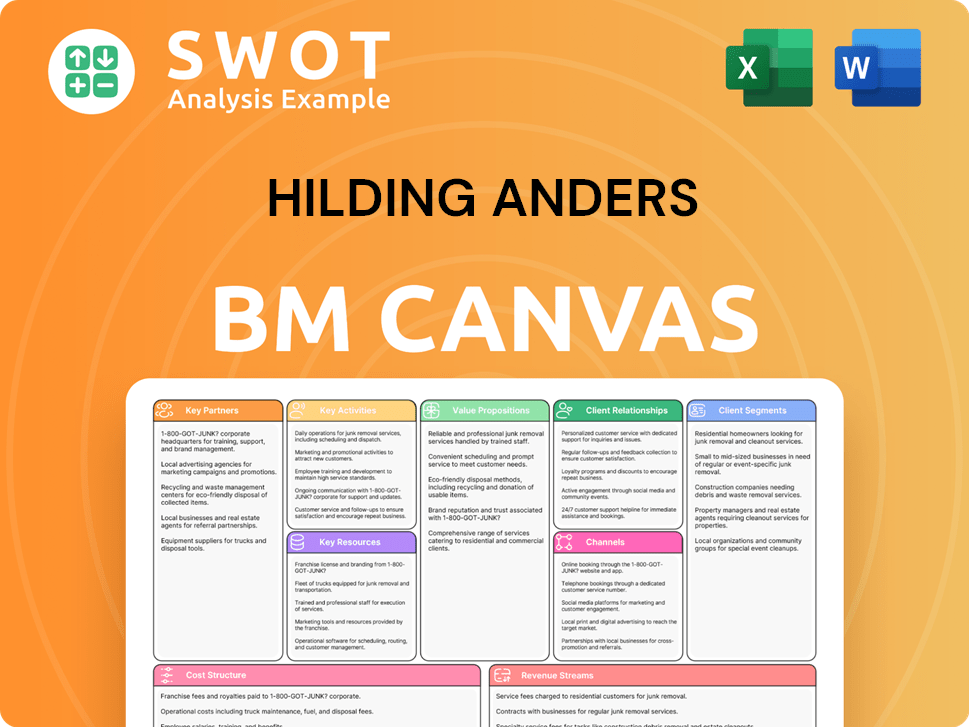

Hilding Anders Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hilding Anders Positioning Itself for Continued Success?

The Hilding Anders company holds a prominent position in the global bedding industry, standing alongside major players in the sleep products market. With a presence in over 40 countries across Europe and Asia, the company secured a 15% share of the European mattress market in 2024. Its diverse brand portfolio caters to various consumer preferences, enhancing customer loyalty. For example, Hilding Anders operations in Poland were recognized with the 'Supplier of the year' award in December 2024.

Despite its strong market position, the Hilding Anders company faces several risks. Economic downturns, predicted for late 2024/early 2025, could impact consumer spending on non-essential items like mattresses. Fluctuating raw material prices, particularly steel and foam, and high manufacturing costs, pose financial challenges. Intense competition from established and emerging brands, including online retailers, could lead to price wars. Supply chain disruptions and regulatory changes also present ongoing challenges for the mattress manufacturer.

Hilding Anders is a leading player in the bedding industry, with a significant market share in Europe. Its global presence spans over 40 countries, showcasing a strong distribution network.

Economic downturns and fluctuations in raw material prices are major risks. Intense competition and supply chain disruptions also pose challenges to the company's operations.

The company is focusing on growth in the Asia-Pacific market, estimated to reach $78 billion by 2025. It is also capitalizing on the growing demand for sustainable products and technological advancements.

Hilding Anders aims to expand into healthcare and hospitality sectors. They also plan to reduce carbon emissions and invest in sustainable material research.

The company is focusing on several strategic initiatives to sustain and expand its profitability. The Asia-Pacific market, projected to reach $78 billion by 2025, represents a significant growth opportunity. Furthermore, Hilding Anders is investing in sustainability.

- Expansion in the Asia-Pacific market.

- Capitalizing on the demand for sustainable products, which was valued at approximately $2.5 billion in 2024 and is projected to reach $4 billion by 2028.

- Focus on technological advancements, with the smart mattress market valued at $3.2 billion in 2024 and projected to reach $6.8 billion by 2029.

- Expansion into the healthcare and hospitality sectors.

- Commitment to sustainability, with plans to reduce carbon emissions by 30% by 2030.

For more insights into the company's marketing strategies, consider reading about the Marketing Strategy of Hilding Anders.

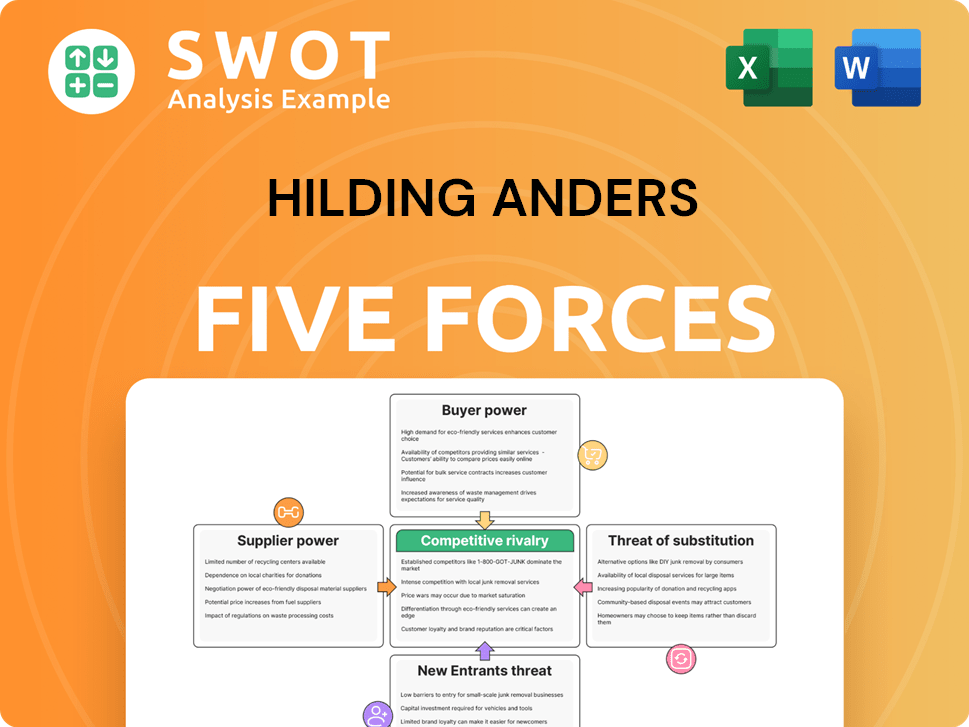

Hilding Anders Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hilding Anders Company?

- What is Competitive Landscape of Hilding Anders Company?

- What is Growth Strategy and Future Prospects of Hilding Anders Company?

- What is Sales and Marketing Strategy of Hilding Anders Company?

- What is Brief History of Hilding Anders Company?

- Who Owns Hilding Anders Company?

- What is Customer Demographics and Target Market of Hilding Anders Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.