Hilding Anders Bundle

Who Really Owns Hilding Anders?

Ever wondered who pulls the strings at a global bedding giant? The ownership of a company often dictates its future, influencing everything from product innovation to market strategy. Discover the intricate details of the Hilding Anders SWOT Analysis and the shifts in control that have shaped this leading mattress company.

The story of Hilding Anders ownership is a fascinating case study in corporate finance, highlighting the impact of private equity and debt restructuring on a major player in the bedding industry. Understanding "Who owns Hilding Anders" is crucial for anyone interested in the company's strategic direction, financial health, and future prospects. This analysis will explore the evolution of Hilding Anders company, providing insights into its ownership structure and the forces that continue to shape its trajectory in the competitive global market.

Who Founded Hilding Anders?

The story of Hilding Anders, a major player in the bedding industry, began in 1939 as a family-run furniture factory in Bjärnum, Sweden. Initially, the company produced various furniture items before focusing on beds and bedding solutions. Understanding the evolution of Hilding Anders ownership provides insights into its growth and strategic shifts over the years.

Early ownership of the company was primarily within the family. Bengt Adolfsson, who became the chairman in 2003, and his wife were the principal owners, taking over from his father-in-law, Olle Andersson. This transition marked a significant point in the company's history, setting the stage for future developments.

The company's expansion strategy, which involved both organic growth and acquisitions, gradually led to the involvement of external owners. A significant early shift occurred in 1999 when Hilding Anders merged with bed manufacturer APAX Intressenter AB. This merger brought Nordic Capital in as a major owner, controlling approximately 32% of Hilding Anders.

Hilding Anders started as a family-owned furniture factory in 1939. The company transitioned from general furniture to specializing in beds and bedding.

Bengt Adolfsson and his wife became the principal owners. He held approximately an 18% stake in Hilding Anders AB.

A merger with APAX Intressenter AB in 1999 brought Nordic Capital. Nordic Capital controlled roughly 32% of Hilding Anders.

Ratos acquired a 27% stake through an investment made by Atle M&A. The majority of Atle's holdings were transferred to Ratos in May 2001.

These early investments and mergers marked the transition from a family-owned entity. It reflected a strategic drive towards European expansion.

The company's expansion strategy involved both organic growth and acquisitions. This led to the involvement of external owners.

The early ownership structure of Hilding Anders evolved significantly. The involvement of private equity firms like Nordic Capital and Ratos was crucial for its growth. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Hilding Anders.

- 1939: Hilding Anders founded as a family-owned furniture factory.

- 1997: Nordic Capital invests in APAX.

- 1998: Atle M&A invests in Hilding Anders.

- 1999: Merger with APAX Intressenter AB; Nordic Capital becomes a major owner.

- 2001: Ratos acquires Atle's stake, becoming a significant shareholder.

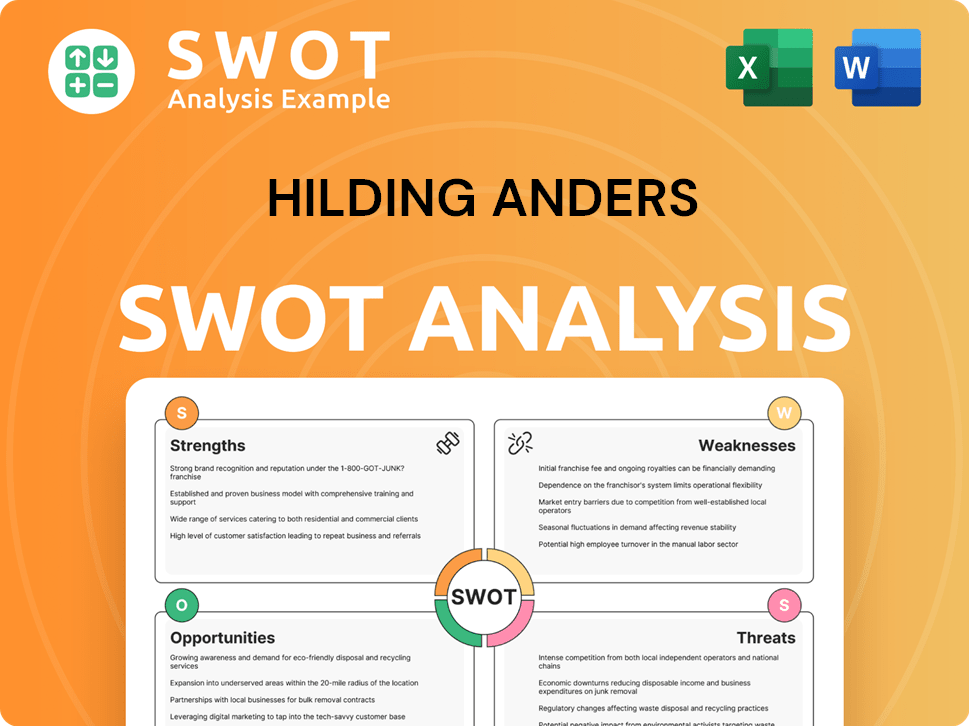

Hilding Anders SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Hilding Anders’s Ownership Changed Over Time?

The Hilding Anders ownership structure has seen significant changes, primarily due to private equity involvement and debt restructurings. Initially, Nordic Capital and Ratos were involved. In December 2003, Investcorp acquired 100% of the shares. This marked a pivotal moment in the Hilding Anders company's ownership history.

Later, KKR became the majority shareholder in 2016, acquiring Arle Capital Partners' stake. KKR had previously invested €350 million in 2013 as part of a refinancing effort. More recently, in June 2023, KKR & Co transferred ownership to its creditors as part of a second debt restructuring. This involved creditors exchanging debt for shares and injecting €20 million into the company. Bonds worth €273 million were converted into a 100% share, while €300 million in term loans remained valid. These shifts were significantly influenced by financial challenges, including issues with the 73% stake in Askona Group, a Russian manufacturer.

| Event | Year | Impact on Ownership |

|---|---|---|

| Investcorp Acquisition | 2003 | Investcorp acquired 100% of shares. |

| KKR Investment and Stake Acquisition | 2013, 2016 | KKR invested €350 million; KKR became majority shareholder. |

| Debt Restructuring and Transfer to Creditors | 2023 | Creditors received shares; €20 million capital injection. |

As of 2024, Hilding Anders is a privately held, private equity-backed company. The Hilding Anders ownership has been shaped by strategic investments and financial maneuvers to navigate market challenges. For a deeper dive, check out the Marketing Strategy of Hilding Anders.

The ownership structure of Hilding Anders has evolved significantly over the years, primarily influenced by private equity firms and debt restructuring. These changes reflect strategic responses to market conditions and financial challenges.

- Investcorp's acquisition in 2003 marked a major shift.

- KKR's involvement, including investments and stake acquisition, was crucial.

- The 2023 debt restructuring led to creditors gaining ownership.

- Hilding Anders remains a privately held company.

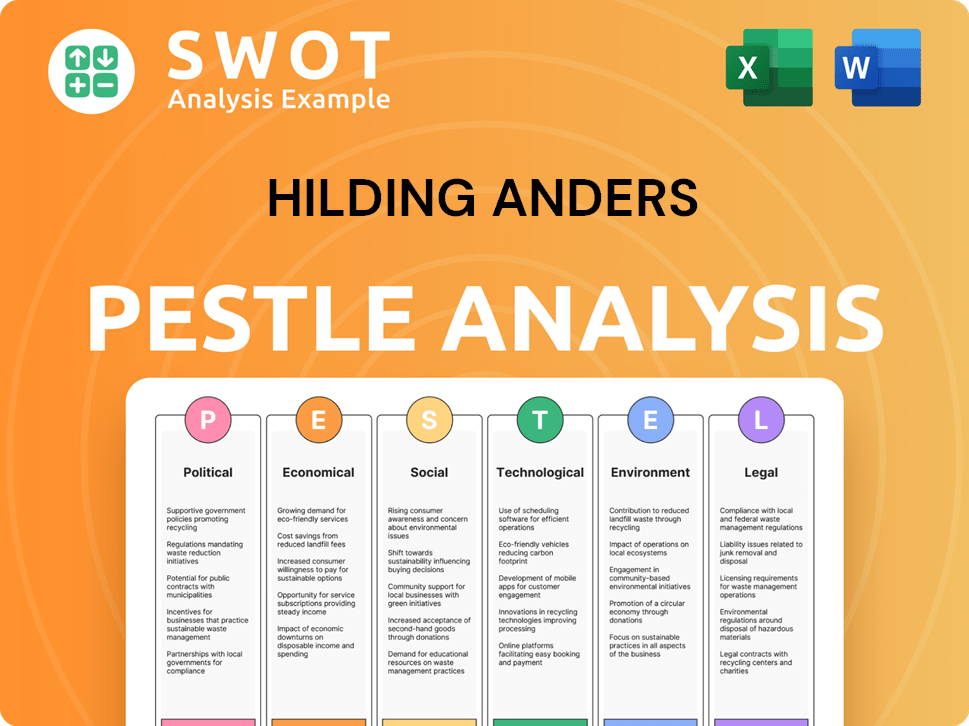

Hilding Anders PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Hilding Anders’s Board?

While specific details about the board of directors and voting power distribution for Hilding Anders are not fully available for 2024-2025, the company's status as a privately held, private equity-backed entity suggests a board structure strongly influenced by its major shareholders. These are primarily the creditors who recently obtained a 100% equity stake through debt-for-equity swaps. This restructuring significantly altered the Hilding Anders ownership landscape.

As of June 1, 2025, the board of directors for Hilding Anders Holdings 3 AB includes Ian William Andersson as Chairperson, along with Henrik Sjögren, Nathaniel Maurice Zilkha, Béatrice Madeleine Valérie Lafon, and Christopher Peter Davis as Board Members. Henrik Sjögren also serves as the Group CEO, and Anders Wester is the Group CFO. Peter Sturm is the Chief People Officer and a member of the supervisory board for Hilding Anders Baltic AS. This composition reflects the influence of the major stakeholders following the recent financial restructuring.

| Board Member | Role | Additional Information |

|---|---|---|

| Ian William Andersson | Chairperson | |

| Henrik Sjögren | Group CEO, Board Member | |

| Nathaniel Maurice Zilkha | Board Member | |

| Béatrice Madeleine Valérie Lafon | Board Member | |

| Christopher Peter Davis | Board Member | |

| Anders Wester | Group CFO | |

| Peter Sturm | Chief People Officer | Member of supervisory board for Hilding Anders Baltic AS |

In privately held companies like Hilding Anders, board members often represent the interests of investment firms or major creditors. This structure gives these stakeholders significant influence over strategic decisions. The recent debt restructuring and transfer of 100% ownership to creditors means they now hold substantial voting power, likely through their newly acquired equity stakes. This setup aligns decision-making with the interests of those who converted debt into equity, aiming to stabilize and improve the company's financial health. For more details on the company's background, you can read a Brief History of Hilding Anders.

The board of directors is currently composed of individuals representing the interests of major stakeholders, particularly creditors.

- The recent debt restructuring has transferred Hilding Anders ownership to creditors.

- Henrik Sjögren serves as both the Group CEO and a Board Member.

- The board structure reflects the influence of those who converted debt into equity.

- This arrangement aims to stabilize and improve the company's financial position.

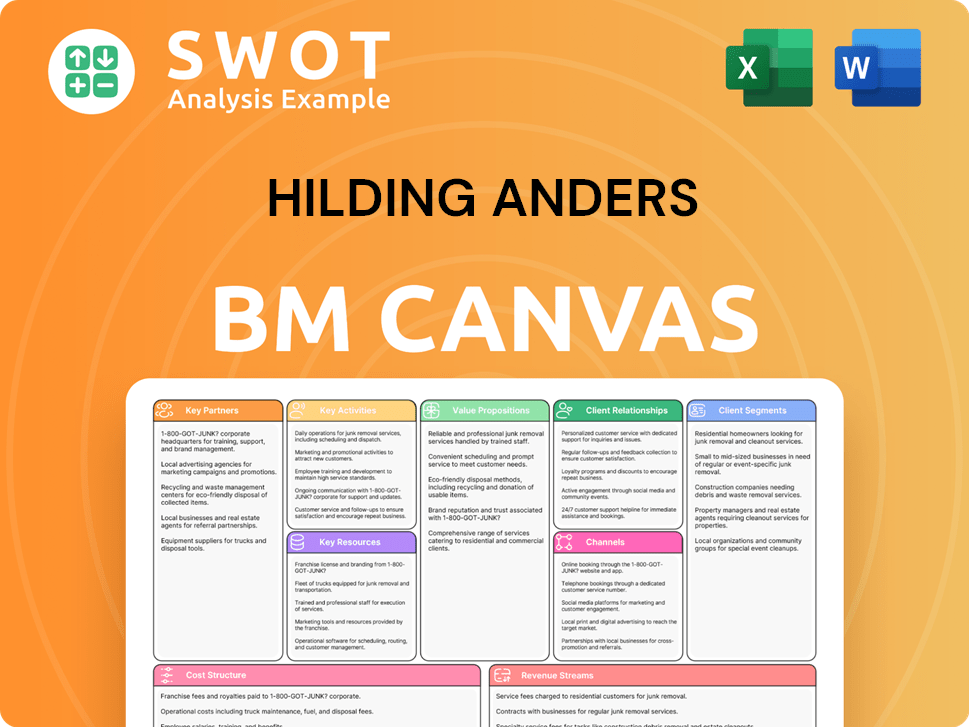

Hilding Anders Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Hilding Anders’s Ownership Landscape?

In recent years, the Hilding Anders ownership structure has undergone significant transformations. Primarily driven by financial restructuring, the company saw major shifts in its ownership profile. In June 2023, KKR & Co, the majority shareholder since 2016, transferred ownership to its creditors. This was part of a debt restructuring that involved creditors converting €273 million in bonds into a 100% equity stake, along with existing term loans of €300 million. This move was largely due to financial difficulties, partially stemming from the company's 73% ownership of the Russian manufacturer Askona Group, which faced challenges because of international sanctions.

The restructuring involved creditors also committing an additional €20 million ($21.9 million) to bolster the company's capital. Such debt-for-equity swaps are common in the bedding industry, where creditors take control to stabilize the company. This process often dilutes previous equity holders, including private equity firms like KKR, which saw its special situations arm, including investments in Hilding Anders, wound down in recent years. These changes are crucial for understanding who owns Hilding Anders and the company's current financial landscape.

| Date | Event | Details |

|---|---|---|

| June 2023 | Ownership Transfer | KKR & Co transferred ownership to creditors. |

| 2023 | Debt Restructuring | Creditors converted €273 million in bonds to equity. |

| 2024 | Capital Injection | Creditors committed to investing an additional €20 million. |

Beyond ownership changes, Hilding Anders continues to focus on product and market development. The company introduced a line of medical-grade mattresses in early 2024, targeting European healthcare facilities. In 2023, it unveiled a 100% compostable mattress, with over 60,000 units pre-booked in Germany and the Netherlands. The company is also expanding its retail footprint, with initiatives like Bico extending its direct-to-consumer presence and Slumberland opening its first experience store in Malaysia in April 2024. For more information on its business model, check out the Revenue Streams & Business Model of Hilding Anders.

Introduced medical-grade mattresses in early 2024, targeting healthcare facilities. Launched a 100% compostable mattress in 2023.

Bico expanded direct-to-consumer presence. Slumberland opened its first experience store in Malaysia in April 2024.

KKR transferred ownership to creditors in June 2023. Debt restructuring involved converting bonds to equity.

Hilding Anders Poland was awarded 'Supplier of the year' in December 2024. Approximately 5,000 employees as of 2024.

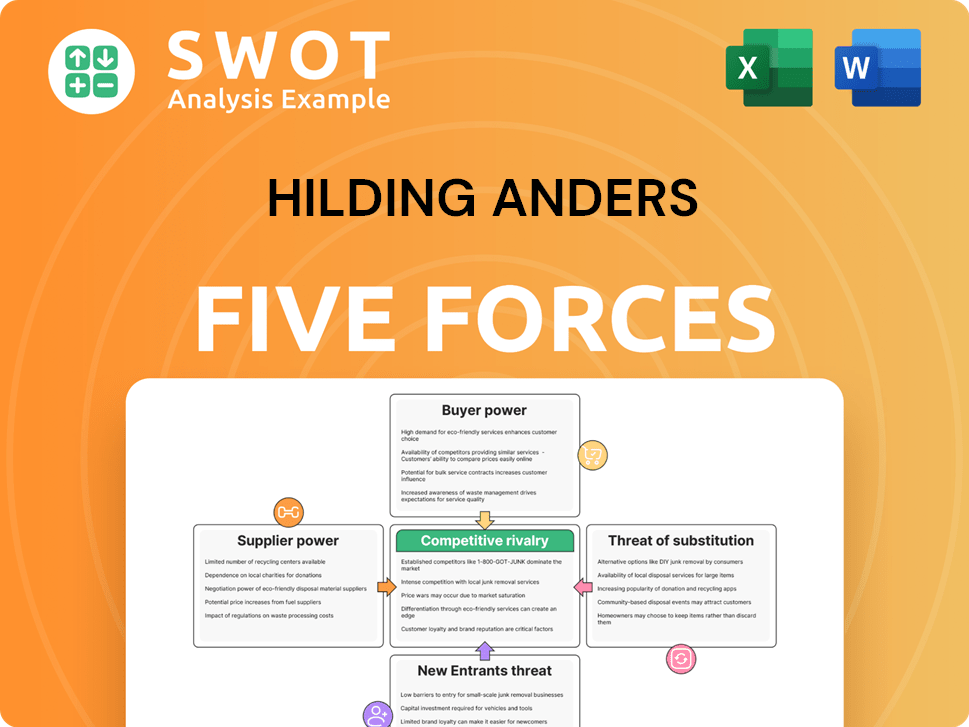

Hilding Anders Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hilding Anders Company?

- What is Competitive Landscape of Hilding Anders Company?

- What is Growth Strategy and Future Prospects of Hilding Anders Company?

- How Does Hilding Anders Company Work?

- What is Sales and Marketing Strategy of Hilding Anders Company?

- What is Brief History of Hilding Anders Company?

- What is Customer Demographics and Target Market of Hilding Anders Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.