Honest Bundle

How Is The Honest Company Thriving?

Founded by Jessica Alba in 2012, The Honest Company has carved a niche in the consumer goods market with its commitment to eco-friendly and sustainable products. This focus on transparency and clean living has propelled the company into the spotlight, attracting a loyal customer base. But how does this brand, known for its Honest SWOT Analysis, actually work, and what drives its success?

The Honest Company's recent financial performance, including positive Adjusted EBITDA in 2024 and a strong Q1 2025 revenue, highlights its growing influence. Understanding the Honest Company business model, including its Honest Company subscription services and product offerings, is key to appreciating its market position. This analysis will explore the core operations, revenue streams, and strategic moves that have shaped the Honest Company, offering insights for investors and consumers alike.

What Are the Key Operations Driving Honest’s Success?

The core of the business revolves around creating and delivering value through a diverse range of baby, personal care, and household products. The company's offerings are designed to meet the needs of conscious consumers who seek safer, sustainably-designed, and cleanly-formulated everyday essentials. Their product line includes diapers and wipes, skincare and personal care items, and household and wellness products.

The company serves a broad customer base, particularly parents who prioritize high-quality, natural baby care products. This focus allows the company to build a strong brand reputation and customer loyalty. The company's commitment to transparency and sustainability further enhances its appeal to this demographic.

Operational processes involve careful sourcing, manufacturing, and distribution. The company emphasizes ethical sourcing and environmental responsibility, with approximately 85% of its packaging being recyclable, compostable, or made from sustainable materials as of 2024. They maintain stringent quality control measures, working with a concentrated base of about 37 specialized suppliers for organic, clean, and eco-friendly ingredients. The company is strategically shifting away from its direct-to-consumer (DTC) fulfillment operations on Honest.com to focus on more efficient retail and digital partnerships, though the website will remain a resource for consumer education and product showcasing.

The company's product range includes diapers and wipes, skincare and personal care items, and household and wellness products. These products are formulated with clean ingredients, catering to the preferences of health-conscious consumers. The company's product offerings are designed to provide safe and effective solutions for everyday needs.

The company prioritizes ethical sourcing, environmental responsibility, and stringent quality control. They work with specialized suppliers to ensure the use of organic, clean, and eco-friendly ingredients. Distribution is managed through an omnichannel approach, including strategic retail partnerships.

The company utilizes an omnichannel approach, expanding its reach through strategic partnerships with major retailers like Walmart. They are strategically shifting away from direct-to-consumer fulfillment to focus on retail and digital partnerships. This approach aims to optimize cost structures and enhance scalability.

The company offers a diverse portfolio of baby, personal care, and household products designed for conscious consumers. Their commitment to clean ingredients, sustainability, and transparency fosters strong consumer trust. This approach differentiates them from competitors.

The company's operational strategies focus on ethical sourcing, sustainable practices, and an omnichannel distribution model. This approach supports the company's mission to provide safe and effective products while minimizing its environmental impact. The company's commitment to transparency and clean ingredients is a core aspect of its value proposition.

- Ethical Sourcing: Emphasizing the use of organic, clean, and eco-friendly ingredients.

- Sustainable Packaging: Approximately 85% of packaging is recyclable, compostable, or made from sustainable materials.

- Omnichannel Distribution: Utilizing strategic partnerships with major retailers and digital platforms.

- Focus on Retail Partnerships: Shifting from DTC fulfillment to optimize cost and scalability.

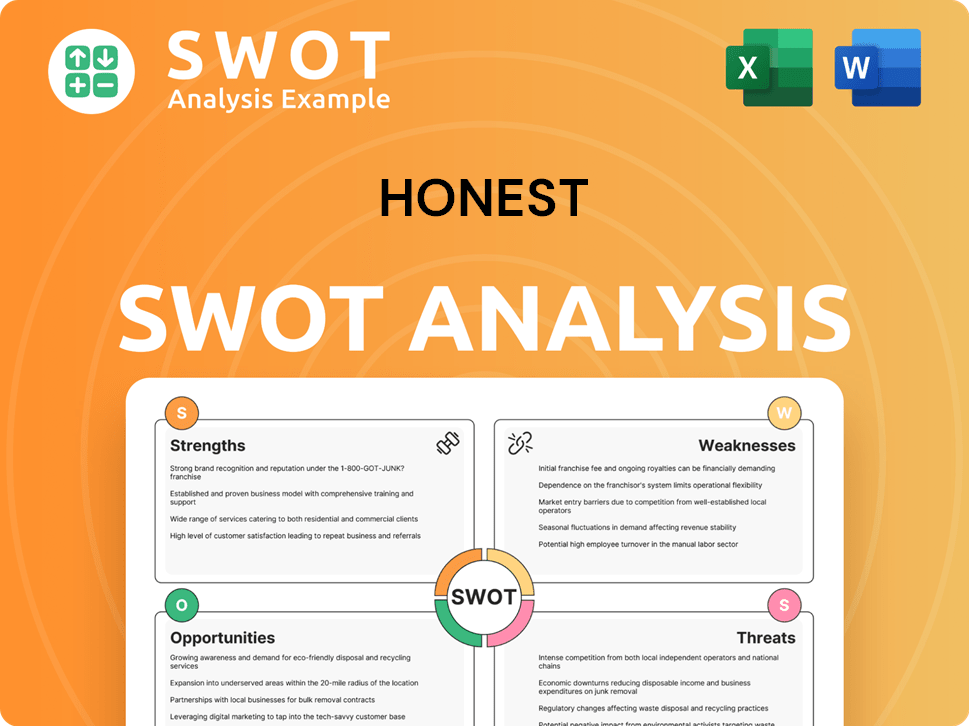

Honest SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Honest Make Money?

The Honest Company generates revenue primarily through the sale of its baby, personal care, and household products. The company's revenue streams are diversified across multiple product categories, with a strong emphasis on its core offerings.

For the full year 2024, the Honest Company reported a total revenue of $378 million, marking a 10% year-over-year increase. In the first quarter of 2025, revenue reached $97 million, reflecting a 13% increase compared to the prior year period, indicating continued growth.

The Honest Company's monetization strategies focus on product sales through various channels, including retail and digital platforms. The company has strategically shifted away from Honest.com as a primary shipping channel, focusing on more cost-effective distribution models through retail and digital partners. This approach aims to maximize revenue through efficient distribution and broaden its customer reach.

While specific breakdowns of revenue contribution by product category for 2024-2025 are not fully detailed in the latest reports, historical data from 2023 provides insights into the revenue composition. Diapers and wipes constituted 63% of revenue, skin and personal care accounted for 26%, and household and wellness products made up 11%. The company's strategic shifts include a focus on retail partnerships and digital platforms for distribution.

- The wipes portfolio saw a 17% increase in sales in Q4 2024, with repeat purchases climbing 26% for the year.

- The sensitive skin collection nearly doubled in consumption with 96% year-over-year growth.

- Product innovation, such as improved diaper designs, also drives sales.

- The company's business model focuses on direct-to-consumer sales and retail partnerships.

- For more information about the company's ownership, you can read about the Owners & Shareholders of Honest.

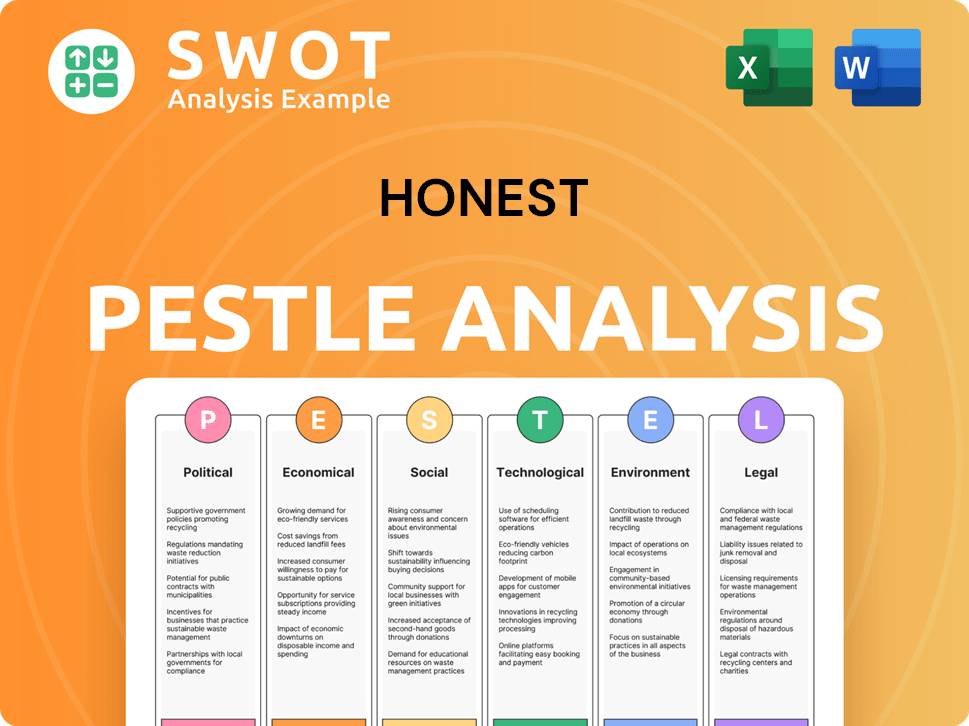

Honest PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Honest’s Business Model?

Since 2023, The Honest Company has focused on 'Brand Maximization, Margin Enhancement, and Operating Discipline,' leading to significant financial improvements. This strategic shift resulted in the company achieving its first full year of positive Adjusted EBITDA as a public company in 2024, reaching $26 million. This is a $37 million improvement compared to 2023. The company also reported record quarterly revenue of $100 million in Q4 2024.

Key strategic moves include expanding retail distribution and entering new channels. The company is also transitioning away from its direct-to-consumer (DTC) channel, Honest.com, for shipping and fulfillment. The company's competitive advantages stem from its strong brand reputation and commitment to ethical sourcing. This includes operational excellence, product innovation, and a focus on categories like wipes, where it holds a leading position.

The company's commitment to ingredient transparency and sustainability resonates with consumers. The appointment of a new SVP of supply chain in February 2025 further underscores its commitment to optimizing operational efficiency and supply chain management. The company is adapting to market trends by focusing on product innovation, particularly in categories like wipes where it holds a leading position as the number one natural wipes brand across the country.

Achieved its first full year of positive Adjusted EBITDA as a public company in 2024, reaching $26 million, a $37 million improvement compared to 2023. The company reported record quarterly revenue of $100 million in Q4 2024.

Expanded retail distribution, with Walmart distribution points increasing by 33% in 2024. Entering new channels like dollar stores and club stores. Transitioning away from its direct-to-consumer (DTC) channel, Honest.com, for shipping and fulfillment.

Strong brand reputation for clean, safe, and environmentally-friendly consumer products. Consistent sequential gross margin improvement over the past two years, from 24.2% in Q1 2023 to 38.8% in Q4 2024. Focus on product innovation, particularly in categories like wipes where it holds a leading position.

Gross margin expanded to 38% for the full year. Consumption at its largest digital customer surged by 32% annually in 2024. The company is focused on Growth Strategy of Honest.

The Honest Company's strategic initiatives are centered around brand maximization, margin enhancement, and operational discipline. These efforts have led to improved financial results and a stronger market position.

- Expanding retail distribution to reach more customers.

- Streamlining operations and improving supply chain management.

- Focusing on product innovation and expanding into new categories.

- Enhancing the brand's reputation for sustainability and transparency.

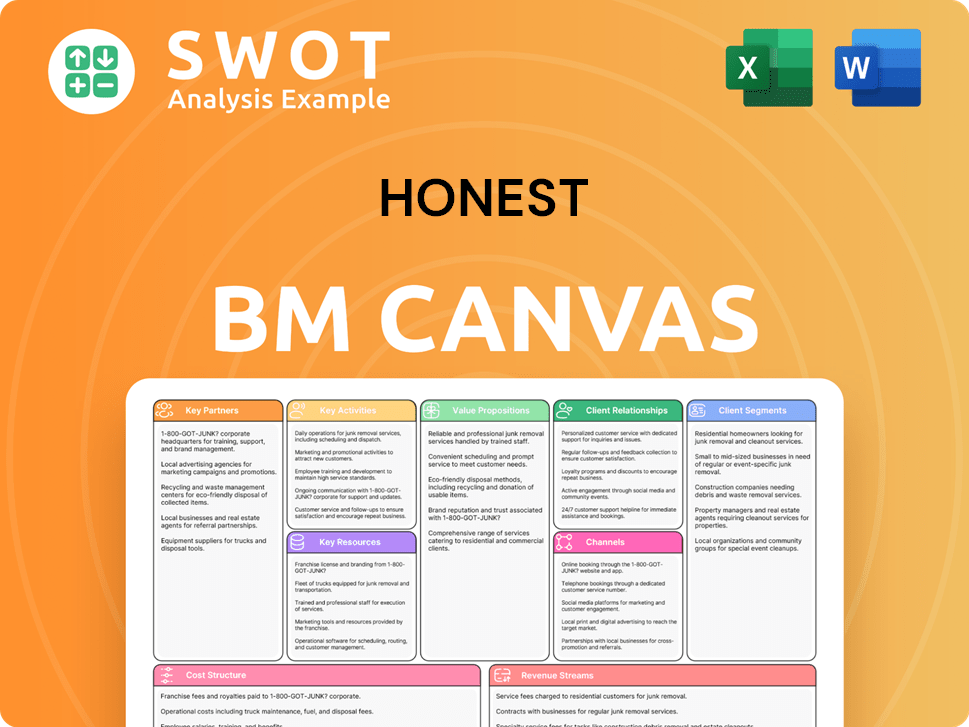

Honest Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Honest Positioning Itself for Continued Success?

The Honest Company holds a distinctive position in the consumer goods market, particularly in the baby, personal care, and household product sectors. Its focus on clean, sustainable, and eco-friendly offerings sets it apart. Despite facing competition from larger players, it leverages its brand reputation for transparency and clean ingredients. As of December 2024, the company's household penetration was at 7%.

Despite recent financial improvements, the company faces several risks. The diaper category is competitive, and tariffs on products from China and Mexico could pressure margins. Additionally, the shift away from the direct-to-consumer (DTC) channel, which historically contributed 25% of total revenue, requires careful management. The company has also experienced increased operating expenses due to non-recurring legal costs.

The Honest Company distinguishes itself through its commitment to clean and sustainable products within the competitive consumer goods market. It targets a customer base seeking eco-friendly alternatives in baby, personal care, and household categories. Its brand reputation for transparency is a key differentiator.

Key risks include intense competition in the diaper market and potential margin pressures from tariffs. The decrease in the direct-to-consumer (DTC) channel and increased operating expenses, including legal costs, also pose challenges. Managing these factors is critical for sustained growth.

The company aims to expand profitability through retail expansion and product innovation. For fiscal year 2025, it projects revenue growth of 4-6% and Adjusted EBITDA between $27 million and $30 million. Strategic initiatives include focusing on its transformation pillars: Brand Maximization, Margin Enhancement, and Operating Discipline.

With a strong cash balance of $75 million and no debt at the end of 2024, the company is financially stable. This provides resources for expansion and improving operating cash flow. The focus on operational efficiencies is designed to maintain gross margins near 38-39%.

The Honest Company is implementing several strategic initiatives to drive growth and profitability. These include expanding its retail presence and innovating its product offerings beyond the diaper category. The company is also focusing on operational efficiencies to maintain strong gross margins.

- Retail Expansion: Expanding into new channels like dollar stores and club stores.

- Product Innovation: Diversifying the product portfolio beyond diapers.

- Operational Efficiency: Maintaining gross margins near 38-39% through disciplined pricing and cost management.

- Financial Health: Leveraging a strong cash position for expansion and improved cash flow.

Honest Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Honest Company?

- What is Competitive Landscape of Honest Company?

- What is Growth Strategy and Future Prospects of Honest Company?

- What is Sales and Marketing Strategy of Honest Company?

- What is Brief History of Honest Company?

- Who Owns Honest Company?

- What is Customer Demographics and Target Market of Honest Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.