Julius Baer Group Bundle

Decoding Julius Baer: How Does This Wealth Management Giant Operate?

Julius Baer Group, a prominent name in Swiss wealth management, consistently demonstrates its strength in the global financial arena. In 2023, the Julius Baer Group SWOT Analysis highlights the company's strategic positioning. The company's impressive net profit of CHF 472 million underscores its robust operational model and client-focused approach in the competitive private banking sector. With CHF 427 billion in Assets under Management (AuM) at the close of 2023, Julius Baer showcases its significant influence in the wealth management industry.

This exploration is crucial for anyone seeking to understand the intricacies of wealth management and private banking. Whether you're an investor evaluating Julius Baer's long-term potential, a client looking for reliable financial services, or an industry professional analyzing market dynamics, this analysis provides valuable insights. We will delve into Julius Baer's core offerings, including its investment strategies and client services, to understand how it generates profit and maintains its position as a leader in the financial services sector.

What Are the Key Operations Driving Julius Baer Group’s Success?

The core of the Julius Baer Group's operations revolves around providing comprehensive private banking and wealth management services. They cater to a global clientele, offering highly personalized advice and discretionary mandates. Their primary focus is on wealth preservation and growth for high-net-worth individuals and families.

Julius Baer Company's value proposition centers on delivering bespoke financial solutions. These solutions include investment management, financial planning, succession planning, and lending services. The operational model is deeply rooted in a client-centric approach, supported by a global network of relationship managers.

Technology plays a crucial role in supporting these operations, from portfolio management systems to secure digital platforms for client interaction. The company's investment solutions are backed by a robust research team that provides insights into global markets and asset classes. The company's distribution network is global, with a significant presence in key wealth hubs across Europe, Asia, the Middle East, and Latin America.

Julius Baer emphasizes a client-centric approach, with relationship managers serving as the primary point of contact. This ensures personalized service and tailored solutions. They focus on building long-term relationships with clients to understand their specific needs and goals.

The company offers a wide range of investment solutions. These include investment management, financial planning, and succession planning. They provide access to global markets and asset classes.

Julius Baer has a significant international presence, with offices in key wealth hubs worldwide. This global reach allows them to serve clients across different regions. Their global network supports their ability to offer international investment opportunities.

They leverage technology for portfolio management and client interaction. Their robust research team provides insights into global markets. This supports informed investment decisions and enhances client service.

Julius Baer distinguishes itself through its focus on pure wealth management. This specialization allows for deeper expertise and a more tailored approach to client needs. Their core capabilities in bespoke financial planning and discretionary portfolio management translate directly into customer benefits.

- Focus on pure wealth management.

- Personalized service model.

- Long-term client relationships.

- Global distribution network.

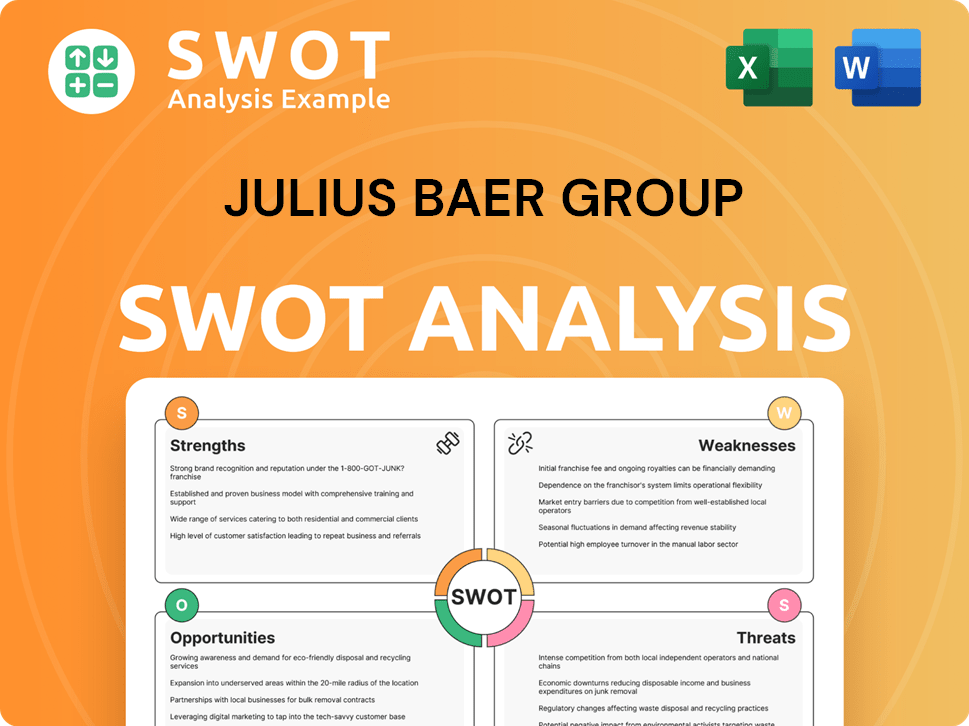

Julius Baer Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Julius Baer Group Make Money?

The Julius Baer Group generates revenue primarily through its wealth management services, focusing on recurring fees and commissions. This strategy underscores the importance of asset-based fees and transaction-based charges, which are key contributors to the company's financial performance. The firm's financial health is significantly tied to its ability to manage and grow client assets effectively.

Key revenue streams include net commission and fee income, net interest income, and net trading income. These streams reflect the company's diverse financial activities, including lending and client deposit management. The firm's ability to generate income from various sources highlights its robust business model within the financial services sector.

Monetization strategies are centered on Assets under Management (AuM). Julius Baer charges management fees based on the value of assets managed for clients, typically as a percentage of AuM. This approach ensures that the company's revenue grows in line with the success of its clients' investments. The company also focuses on expanding advisory and discretionary mandates, which are higher-margin services.

The primary revenue streams for Julius Baer include net commission and fee income, net interest income, and net trading income. These streams are essential for understanding the financial performance of the company. The firm's approach to generating revenue is closely linked to its wealth management services, which cater to high-net-worth individuals and families.

- Commission and Fee Income: This is a significant revenue source, derived from asset-based fees and transaction-based charges.

- Net Interest Income: This reflects income from lending activities and the management of client deposits.

- Net Trading Income: Generated from client trades in securities and foreign exchange.

- Asset-Based Fees: Management fees are charged based on the value of assets under management (AuM).

- Transaction Fees: Fees are generated from client trades in securities, foreign exchange, and other financial instruments.

- Credit Facilities: Income from providing credit facilities, such as Lombard loans.

The company's focus on wealth management and private banking services is evident in its revenue model. For more information, you can read about the Owners & Shareholders of Julius Baer Group. In 2023, commission and fee income was a substantial contributor to overall revenue, demonstrating the importance of asset-based fees and transaction-based charges. The company's financial performance is closely tied to its ability to manage and grow client assets effectively. The company implements tiered pricing models, where larger asset bases or more complex service requirements may lead to different fee structures, further enhancing its monetization strategies.

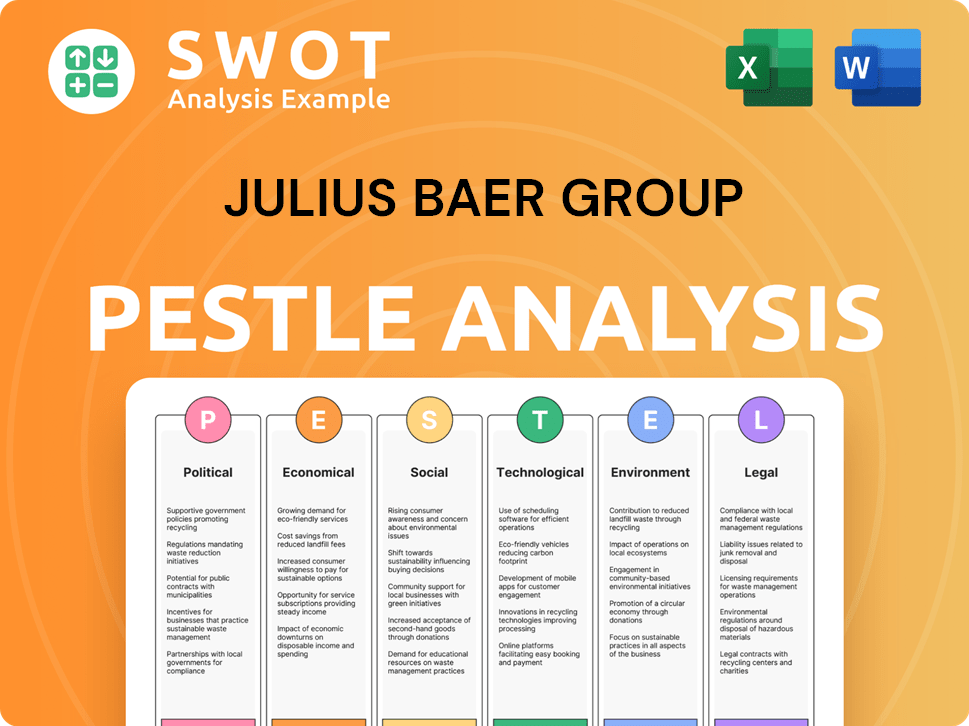

Julius Baer Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Julius Baer Group’s Business Model?

The journey of the Julius Baer Group has been marked by significant milestones and strategic decisions that have shaped its evolution in the financial services sector. A key aspect of its growth has been the continuous expansion of its international footprint, particularly in high-growth markets. This has been crucial for diversifying its client base and asset inflows, solidifying its position in the competitive landscape of private banking and wealth management.

Strategic moves, including partnerships and acquisitions, have been instrumental in enhancing its capabilities and market reach. These actions have allowed the company to expand its assets under management (AuM) and strengthen its talent pool. The company's ability to navigate fluctuating global financial markets, adapt to stringent regulatory environments, and manage cybersecurity risks has been critical to its sustained success.

Julius Baer has responded to operational challenges by investing in robust risk management frameworks, enhancing its compliance functions, and continuously upgrading its technology infrastructure to protect client assets and data. These efforts are essential for maintaining client trust and ensuring operational resilience. The company's focus on client service and adapting to market changes has been central to its strategy.

Julius Baer's history includes significant expansions, particularly in Asia and the Middle East. Strategic acquisitions have boosted AuM and talent. These moves have been essential for growth and market adaptation.

The company has focused on partnerships and acquisitions to enhance its market presence. Investments in risk management and technology have been crucial. Julius Baer continually adapts to market dynamics and client needs.

Julius Baer's brand strength built over decades instills client confidence. Its specialized focus on wealth management provides a personalized service. The company benefits from a strong network of skilled relationship managers.

The company faces challenges from market volatility and regulatory changes. It adapts by investing in risk management and technology. Julius Baer also focuses on sustainability and digital transformation.

Julius Baer distinguishes itself through several key competitive advantages. Its strong brand reputation, built over many years, fosters trust among high-net-worth clients globally, which is crucial for attracting and retaining clients in the wealth management industry. The company's focus on pure wealth management allows for deeper expertise and a highly personalized service offering.

- Strong Brand: Decades of trust in the private banking sector.

- Specialized Focus: Expertise in pure wealth management services.

- Client Relationships: A strong network of relationship managers.

- Adaptation: Integrating ESG considerations and digital transformation.

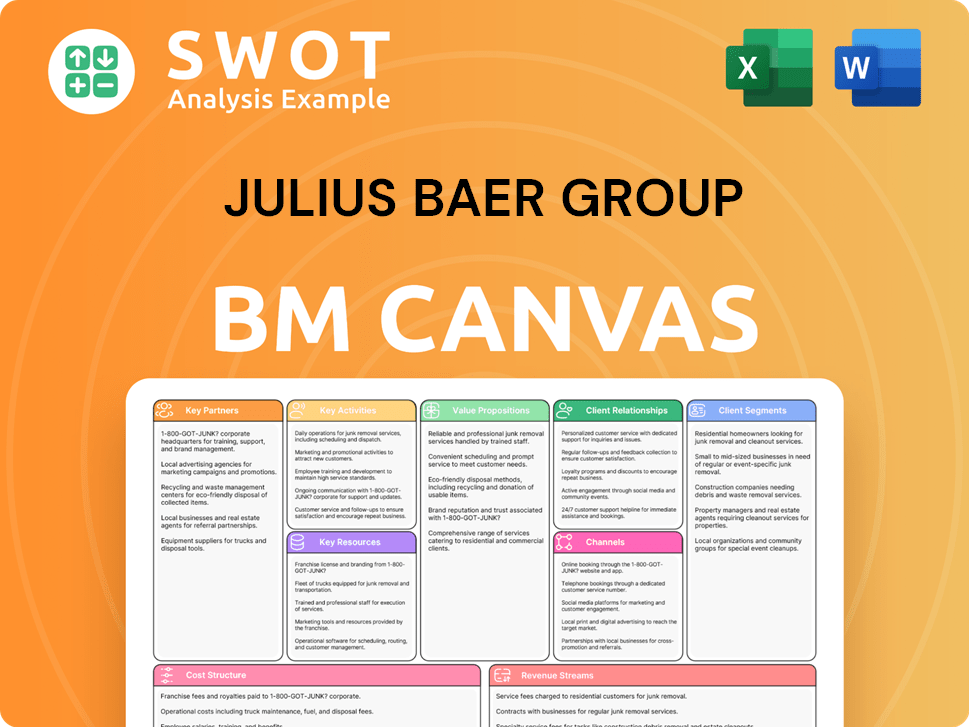

Julius Baer Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Julius Baer Group Positioning Itself for Continued Success?

The Julius Baer Group holds a strong position within the global wealth management industry, particularly as a pure-play private bank. It serves high-net-worth and ultra-high-net-worth individuals and family offices, with a significant market share in its niche. The company is known for strong client loyalty and a global reach across key wealth hubs.

However, the Julius Baer Company faces several risks, including regulatory changes, intense competition, and technological disruption. Geopolitical instability and economic downturns also pose challenges. Despite these risks, the company is focused on disciplined growth, particularly in Asia, enhancing digital offerings, and integrating sustainability into its core investment processes.

The Julius Baer Group ranks among the top independent wealth managers globally. It focuses on high-net-worth individuals and family offices. The company has a strong presence in Europe, Asia Pacific, the Middle East, and Latin America.

Regulatory changes and competition are key risks. Technological advancements require ongoing investment. Geopolitical instability and economic downturns can impact asset values. The company must adapt to evolving client expectations for digital services.

The future outlook involves attracting and retaining high-net-worth clients. Expanding the discretionary mandate business and pursuing growth in key international markets are also important. The company aims to deliver value through specialized expertise and personalized service.

Key initiatives include disciplined growth, especially in Asia. Enhancing digital offerings and integrating sustainability are also priorities. Leadership emphasizes client-centricity and responsible growth. The company is leveraging technology to improve client experiences.

In 2023, Julius Baer reported a rise in assets under management (AuM). The company is focused on expanding its business in Asia. The company is also investing in its digital platform to enhance client services and improve efficiency.

- The company is committed to sustainable investing and integrating ESG factors into its investment processes.

- Julius Baer is focused on managing costs and improving operational efficiency.

- The company is expanding its advisory services to meet client needs.

- Julius Baer continues to focus on its core business of wealth management, providing personalized services to its clients.

For further insights into the strategies employed by Julius Baer Group, you can explore the Marketing Strategy of Julius Baer Group.

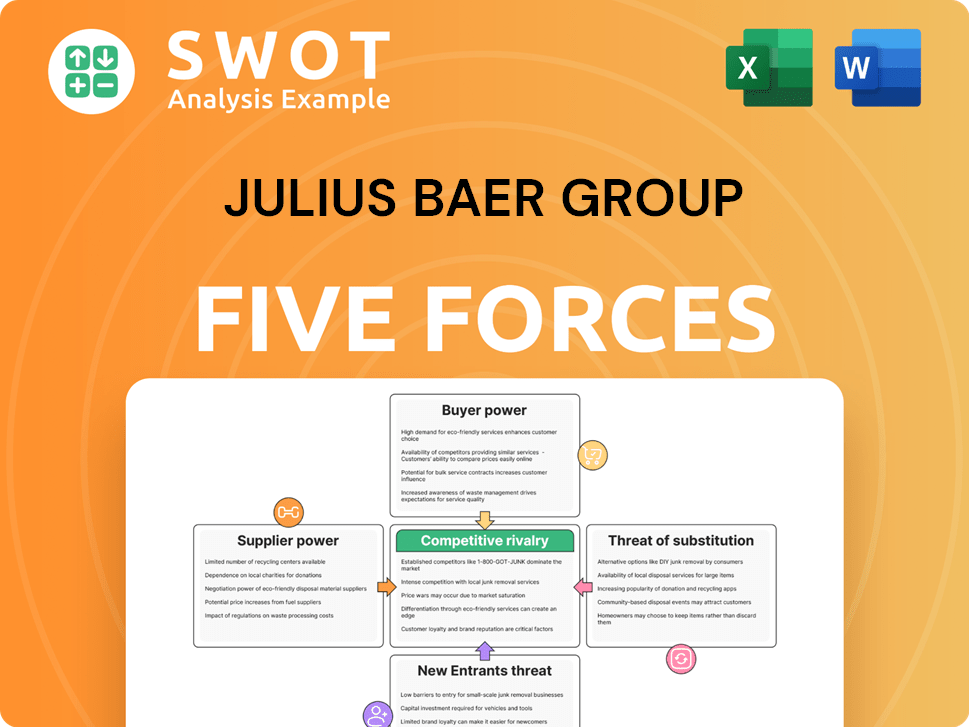

Julius Baer Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Julius Baer Group Company?

- What is Competitive Landscape of Julius Baer Group Company?

- What is Growth Strategy and Future Prospects of Julius Baer Group Company?

- What is Sales and Marketing Strategy of Julius Baer Group Company?

- What is Brief History of Julius Baer Group Company?

- Who Owns Julius Baer Group Company?

- What is Customer Demographics and Target Market of Julius Baer Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.