Julius Baer Group Bundle

Who are Julius Baer's Ideal Clients?

Navigating the complexities of the global wealth management sector requires a deep understanding of its clientele. For Julius Baer Group, a precise grasp of Julius Baer Group SWOT Analysis, customer demographics, and its target market is crucial for sustained growth. This analysis delves into the evolving landscape of Julius Baer Group SWOT Analysis, highlighting the importance of adapting to changing investor preferences and demographic shifts. The insights gained are vital for anyone seeking to understand the firm's strategic positioning and client-centric approach.

The Julius Baer Group SWOT Analysis, client profile, and target market are not static; they evolve with global economic trends and societal changes. Understanding the Julius Baer Group SWOT Analysis, customer age range, geographic target markets, and client income levels provides a comprehensive view of the firm's strategic focus. This exploration will cover Julius Baer Group SWOT Analysis, including investment preferences, customer segmentation strategies, and the company's approach to client acquisition and retention within the Julius Baer Group SWOT Analysis, wealth management, and financial services sectors.

Who Are Julius Baer Group’s Main Customers?

Understanding the Julius Baer target market requires a deep dive into their primary customer segments. The firm focuses on serving high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals, as well as family offices, globally. These clients are characterized by significant investable assets, typically ranging from several million to billions of dollars. This focus shapes the Julius Baer client profile and the services offered.

The customer demographics within these segments are diverse, reflecting the global nature of wealth. While specific data is proprietary, general industry trends indicate a client base that includes a growing number of younger entrepreneurs and inheritors, alongside established wealth holders. Education levels are generally high, and clients often come from professional backgrounds, including business owners, executives, and professionals.

Julius Baer operates primarily in a Business-to-Consumer (B2C) model, directly serving individual clients and family offices. The UHNW segment and family offices likely represent a significant share of revenue due to their larger asset bases and complex service requirements. This strategic focus allows the company to tailor its services to meet the sophisticated needs of its clientele.

The firm primarily caters to clients with substantial assets. While specific minimums vary, the focus is on individuals with investable assets in the millions. This ensures the firm can provide the specialized services required by high-net-worth clients.

The firm has a global presence, with a significant focus on key wealth centers worldwide. This includes a strong presence in Europe, Asia, and the Americas. This global reach allows the firm to serve a diverse international client base.

The firm serves both individual clients and family offices. Family offices often manage the wealth of multiple generations, requiring comprehensive wealth management solutions. This dual focus allows the firm to cater to a wide range of client needs.

The firm offers a range of services tailored to the needs of HNW and UHNW clients, including investment management, wealth planning, and lending. These services are designed to help clients preserve and grow their wealth. This focus is aligned with the firm's core business model.

The Julius Baer target market is defined by high levels of wealth and a need for sophisticated financial services. These clients often have complex financial needs and require personalized solutions. The firm's ability to meet these needs is critical to its success.

- High Net Worth: Clients typically have significant assets under management, often exceeding several million dollars.

- Global Presence: A diverse client base spread across key wealth centers worldwide.

- Sophisticated Needs: Clients require comprehensive wealth management solutions, including investment management, wealth planning, and lending.

- Long-Term Focus: Clients are typically focused on long-term wealth preservation and growth strategies.

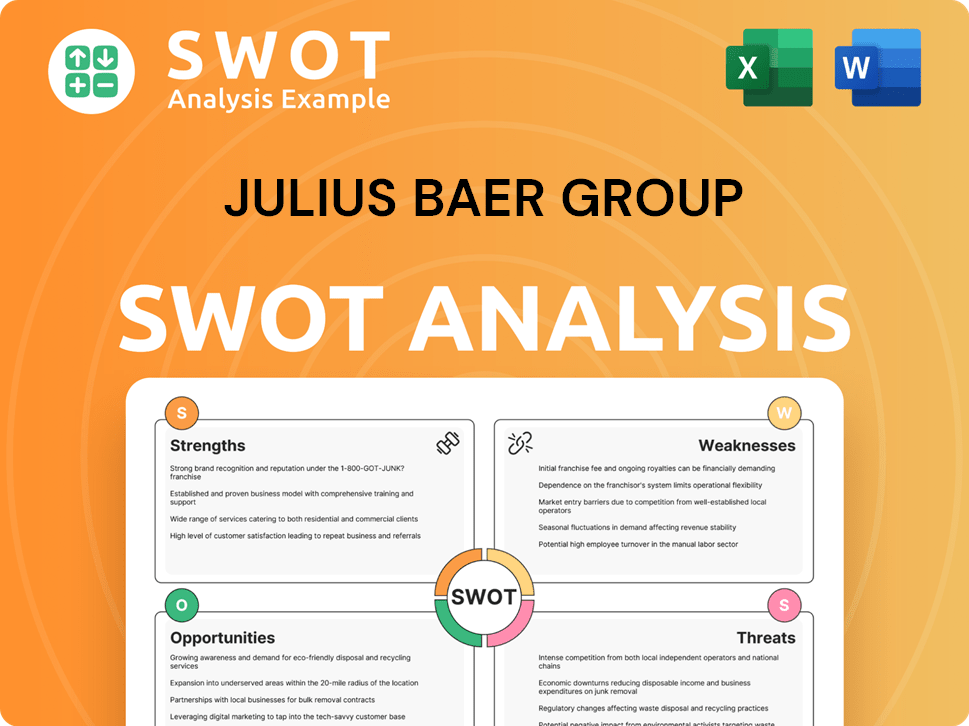

Julius Baer Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Julius Baer Group’s Customers Want?

Understanding the customer needs and preferences is crucial for any financial institution, and this is especially true for a wealth management firm like Julius Baer. The firm's clients, often high-net-worth individuals, have specific expectations and demands that shape the services provided. A deep dive into these needs reveals a focus on long-term financial security and sophisticated investment solutions.

The primary drivers for clients of Julius Baer include wealth preservation, growth, and the seamless transfer of wealth across generations. Their preferences are heavily influenced by a desire for personalized advice, discretion, and a strong emphasis on trust. The firm's success hinges on its ability to meet these needs while navigating complex financial landscapes.

The Revenue Streams & Business Model of Julius Baer Group highlights the importance of understanding the client base. The firm's strategies are tailored to meet the evolving demands of its sophisticated clientele, ensuring that it remains a trusted partner in managing their financial affairs.

Clients prioritize wealth preservation and growth. They seek solutions that offer long-term financial security and stability. These needs are central to the services offered by Julius Baer.

Clients value highly personalized advice tailored to their specific financial situations. Discretion and confidentiality are paramount, reflecting the sensitive nature of wealth management. Trust in the advisor and the institution is crucial.

Expertise of the advisor, the institution's reputation, and its performance track record are key. The breadth of available products and services also influences decisions. Clients assess these factors carefully.

Clients often require comprehensive services, including investment management, tax planning, and estate planning. Philanthropic advisory services are also increasingly important. This integrated approach is favored.

A desire for financial security and peace of mind is a significant motivator. Clients seek effective management of complex financial affairs. These emotional needs are carefully addressed.

Optimizing investment returns and mitigating risks are primary goals. Navigating the complexities of regulatory environments is also essential. Clients seek efficient solutions.

Julius Baer actively addresses common client pain points such as market volatility and geopolitical uncertainties. The firm adapts to evolving market trends, including the growing demand for sustainable investing and digital wealth management solutions.

- Market Volatility: Clients are concerned about the impact of economic fluctuations on their portfolios.

- Inflationary Pressures: Rising inflation erodes the value of investments, requiring proactive strategies.

- Geopolitical Uncertainties: Global events can significantly affect investment performance, necessitating careful risk management.

- Sustainable Investing: The demand for environmental, social, and governance (ESG) investments is increasing.

- Digital Wealth Management: Clients expect seamless access to their portfolios and digital tools for oversight.

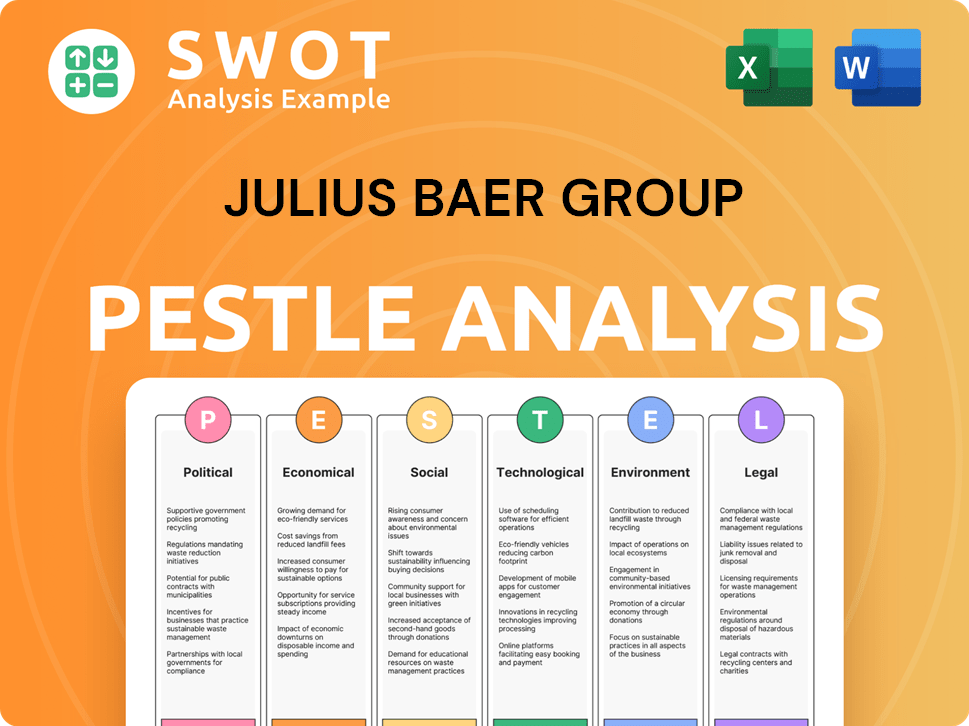

Julius Baer Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Julius Baer Group operate?

The geographical market presence of Julius Baer is extensive, extending far beyond its Swiss roots. Key regions include Switzerland, Europe, Asia, the Middle East, and Latin America. This global footprint allows the company to cater to a diverse range of clients and wealth management needs.

Julius Baer strategically targets high-net-worth individuals (HNWIs) across various regions, tailoring its services to meet specific customer demographics. Understanding the nuances of each market, from investment preferences to regulatory frameworks, is crucial for success. This approach ensures that the firm remains competitive and relevant in a dynamic global landscape.

The company's focus on international clients is evident in its sales and growth distribution. Marketing Strategy of Julius Baer Group highlights the firm's commitment to adapting to local market conditions and client preferences.

Switzerland remains a core market for Julius Baer, benefiting from its strong financial infrastructure and reputation. The company leverages its local expertise to serve a sophisticated client base. Customer demographics in Switzerland typically include high-net-worth individuals seeking wealth preservation and sophisticated financial planning.

Julius Baer has a significant presence in key European markets, such as Germany, the UK, Spain, and Italy. The European client base often prioritizes wealth preservation and diversified portfolios. The company adapts its services to comply with regional regulations and cater to local investment preferences.

Asia, particularly Singapore and Hong Kong, represents a crucial growth market for Julius Baer. The region's rapidly expanding wealth and dynamic investment landscape provide significant opportunities. Asian clients often exhibit a higher propensity for direct equity investments and a focus on capital appreciation.

The Middle East, including the UAE, is another key area for expansion. The company caters to the region's high-net-worth individuals with tailored wealth management solutions. This market benefits from significant wealth creation and a growing demand for financial services.

Julius Baer employs local relationship managers with cultural understanding and language proficiency. This approach ensures effective communication and builds strong client relationships. The firm's focus on local expertise is a cornerstone of its global strategy.

Investment solutions are tailored to regional regulatory frameworks and market conditions. This customization ensures compliance and relevance. The company adapts its offerings to meet the specific needs and preferences of each client segment.

Recent expansions have focused on strengthening its presence in key growth markets like Asia and the Middle East. Conversely, strategic withdrawals or realignments may occur where scale or profitability does not meet strategic objectives. This strategic approach ensures efficient resource allocation and sustainable growth.

Julius Baer employs customer segmentation strategies to better understand its client base. This allows the company to provide more personalized services and investment recommendations. Understanding the Julius Baer client profile is key to success.

The company uses various customer acquisition strategies to attract new clients. These include referrals, partnerships, and targeted marketing campaigns. Effective customer acquisition is crucial for expanding its client base and market share.

Julius Baer focuses on client retention strategies to maintain long-term relationships. This includes providing excellent service, personalized advice, and consistent performance. Client satisfaction is a key priority for the firm.

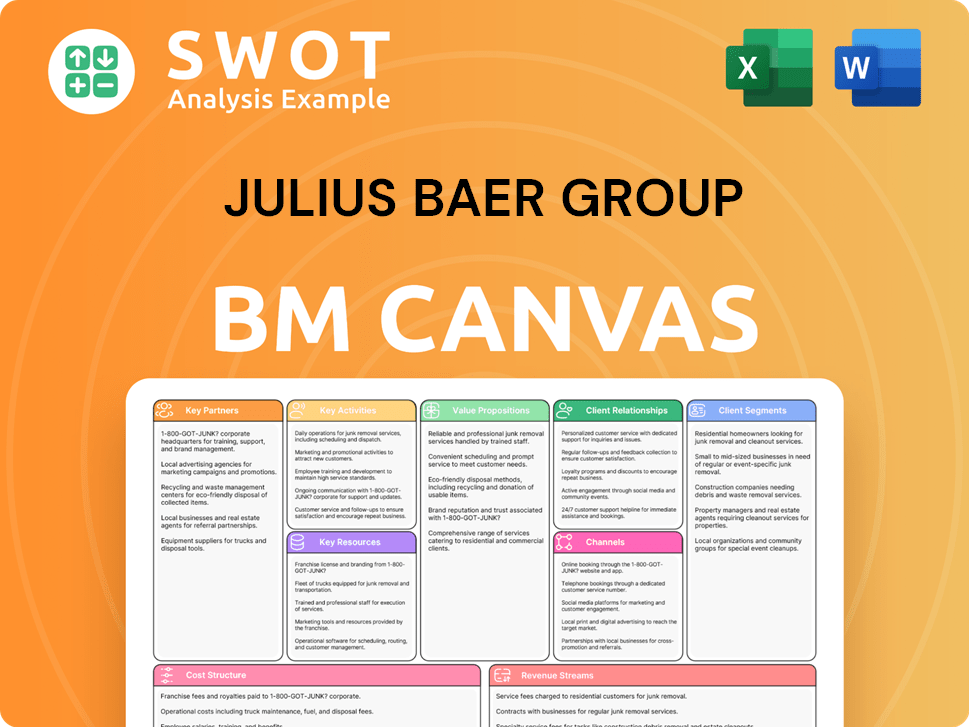

Julius Baer Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Julius Baer Group Win & Keep Customers?

Customer acquisition and retention strategies are crucial for the success of any financial institution, and the [Company Name] is no exception. The firm employs a multifaceted approach, combining traditional relationship-based strategies with modern digital marketing techniques. Their focus is on attracting and maintaining a high-net-worth clientele, leveraging a combination of personalized services and a strong brand reputation. Understanding the Julius Baer target market and Julius Baer client profile is key to their success.

The firm's approach to client relations is deeply rooted in personalized service. Relationship managers play a pivotal role in building and maintaining client relationships, acting as the primary point of contact for all client needs. This emphasis on personal interaction, coupled with tailored financial solutions, is central to both acquiring and retaining clients. The firm's commitment to providing bespoke wealth management solutions is a key differentiator in the competitive financial services market.

The company's strategy includes a blend of traditional and modern methods. Referrals from existing clients and professional networks are a significant source of new business. Digital marketing, including targeted campaigns and thought leadership content, is also used to reach potential clients. The company's focus on wealth management services for high-net-worth individuals is evident in its marketing and client engagement strategies. To understand the competitive landscape, explore the Competitors Landscape of Julius Baer Group.

Referrals from existing clients and professional networks are a significant driver of new client acquisition. This leverages the trust and satisfaction of current clients to attract new business. These programs are often incentivized to encourage participation and generate a steady stream of qualified leads.

Targeted digital campaigns are employed to reach potential clients. This includes search engine optimization (SEO), social media marketing, and online advertising. The campaigns are designed to highlight the firm's expertise and tailored solutions for high-net-worth individuals.

The firm creates and distributes thought leadership content, such as white papers and market outlook reports. This positions the firm as an expert in wealth management and attracts clients seeking informed financial advice. This content is often shared on the firm's website and through various digital channels.

Exclusive industry events and seminars are organized to engage with existing and potential clients. These events provide opportunities for networking, education, and showcasing the firm's services. These events are often tailored to the specific interests of high-net-worth individuals.

Client retention is driven by exceptional service, investment performance, and bespoke solutions. The firm focuses on building long-term relationships with its clients, providing personalized advice and support. Key retention strategies include:

- Personalized consultations and proactive advice.

- Exclusive client events and educational seminars.

- Digital tools for enhanced client engagement and transparency.

- Consistent investment performance and tailored solutions.

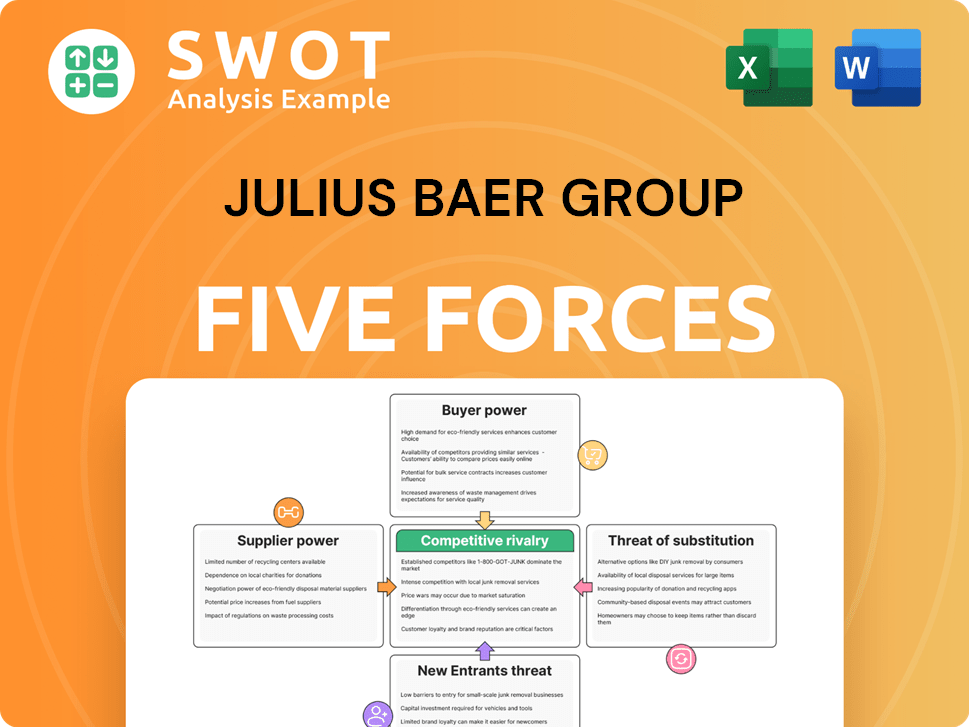

Julius Baer Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Julius Baer Group Company?

- What is Competitive Landscape of Julius Baer Group Company?

- What is Growth Strategy and Future Prospects of Julius Baer Group Company?

- How Does Julius Baer Group Company Work?

- What is Sales and Marketing Strategy of Julius Baer Group Company?

- What is Brief History of Julius Baer Group Company?

- Who Owns Julius Baer Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.