Kajima Bundle

How Does Kajima Company Thrive?

Kajima Corporation, a titan in the construction and real estate sectors, has consistently demonstrated impressive financial growth, making it a compelling case study for investors and business strategists alike. With revenues and income on the rise for five consecutive years, including a reported 2.91 trillion JPY in annual revenue for the fiscal year ending March 2025, Kajima presents a picture of sustained success. Its strategic global expansion and commitment to innovation further solidify its position as a leader in the industry.

This analysis will explore the inner workings of the Kajima SWOT Analysis, examining its core strategies and diverse revenue streams. We'll dissect how Kajima business operates, from its extensive Kajima projects to its commitment to sustainability initiatives and employee benefits, providing a comprehensive view of this industry leader. Understanding Kajima's construction services and its impact on the economy is key to grasping its enduring success and future plans.

What Are the Key Operations Driving Kajima’s Success?

Kajima Corporation, a prominent player in the construction and real estate sectors, generates value through its comprehensive involvement in various projects. The company's core operations encompass public works, civil engineering, and building construction, complemented by real estate development and related services. These Kajima services include design, engineering, and facility management, ensuring a holistic approach to project delivery.

The company's value proposition lies in its ability to undertake diverse projects, ranging from residential and commercial buildings to large-scale infrastructure. Kajima Company serves a wide array of clients, including government entities, private sector clients, and industrial clients, demonstrating its versatility and adaptability. This diverse portfolio allows Kajima business to maintain a strong market presence.

Operational processes are meticulously managed across all projects, involving planning, development, maintenance, and renovation. Kajima projects are supported by a global network, enabling access to diverse resources and expertise. The company's commitment to innovation and cost-effectiveness is evident in its adoption of advanced technologies like A4CSEL®, enhancing productivity and competitiveness. For more information on how Kajima approaches its market, check out the Marketing Strategy of Kajima.

Kajima's core operations include public works, civil engineering, and building construction. These operations are supported by real estate development and related services. The company manages these processes through planning, development, maintenance, and renovation.

Kajima Corporation serves government entities, private sector clients, and industrial clients. This diverse customer base includes those involved in commercial and residential developments. Industrial clients often require specialized facilities like semiconductor factories.

Kajima Company operates in over 20 countries worldwide, supported by a global network. This global presence allows access to diverse resources and expertise. This network supports the company's construction and engineering projects.

The company actively promotes the application of A4CSEL®, its automated construction system. This system enhances productivity and strengthens competitiveness. Kajima construction also focuses on proposal capabilities to meet client needs.

Kajima Company's long-standing expertise in construction and engineering is a key strength. This expertise is backed by highly skilled professionals capable of handling complex projects. The company's focus on delivering high-quality, innovative, and cost-effective solutions sets it apart.

- Expertise in construction and engineering.

- Global network and diverse resources.

- Focus on innovation and cost-effectiveness.

- Strong client relationships across various sectors.

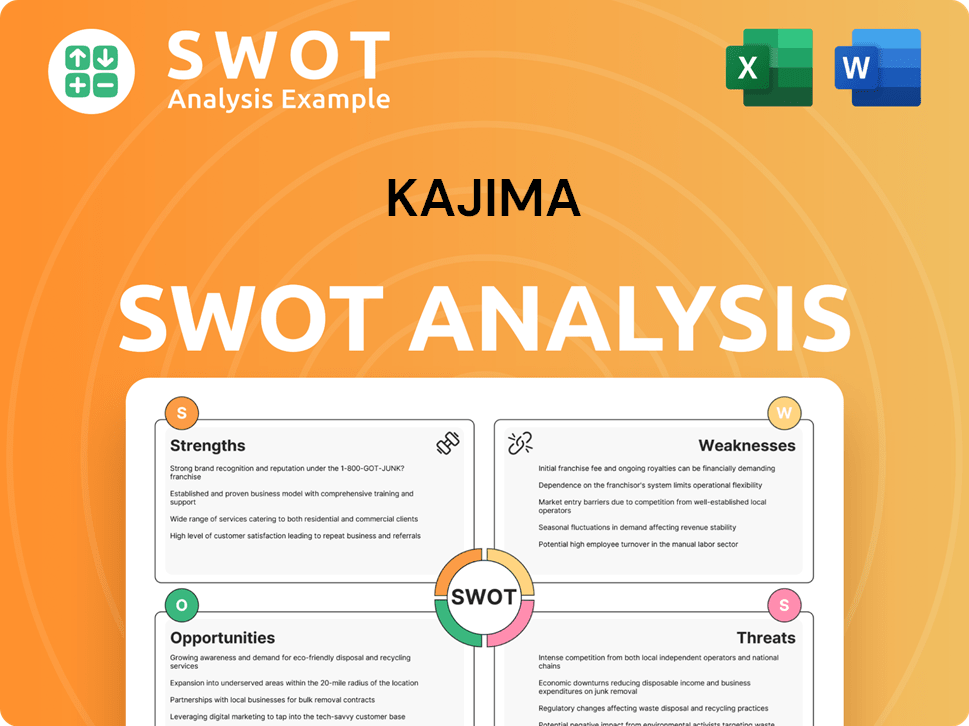

Kajima SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kajima Make Money?

The Kajima Corporation, a major player in the construction and real estate sectors, generates revenue through a combination of construction, civil engineering, and real estate development. The company's financial performance is heavily influenced by its ability to secure and execute construction projects, as well as its success in property sales and development activities. Understanding the revenue streams and monetization strategies of Kajima business is crucial for assessing its overall financial health and future prospects.

Kajima Company's revenue streams are primarily derived from construction projects, real estate development, and related services. The company's monetization strategies involve direct project contracts for construction and civil engineering, along with property sales from its real estate development segment. The company focuses on maximizing sales gains from property sales and improving gross profit margins across its business segments.

For the fiscal year ending March 31, 2025, Kajima Company reported an annual revenue of 2.91 trillion JPY, reflecting a 9.25% growth. The third quarter of fiscal year 2024 saw revenues reach 2,026.39 billion yen, with construction projects contributing significantly. The civil engineering segment, including both domestic and overseas projects, was a key driver of this growth. The company's focus on renewable energy facilities, distribution warehouses, and European property sales is expected to drive significant revenue in fiscal year 2025.

Kajima's monetization strategies are centered on construction contracts and real estate sales. The company aims to improve profitability through strategic project selection and efficient operations. For instance, the domestic building construction business achieved a gross profit margin of 9.6% in fiscal 2024 and is targeting over 10% by fiscal 2026. The company is also focused on large-scale projects, with a forecast of a gross profit margin exceeding 17% in fiscal 2025, aiming for a gross profit of 70.0 billion yen.

- Construction and Civil Engineering: Direct contracts for building and infrastructure projects.

- Real Estate Development: Sales of developed properties, including residential, commercial, and industrial projects.

- Renewable Energy and Warehouses: Sales and operations of renewable energy facilities and distribution warehouses.

- Focus on Profitability: Improve gross profit margins across all business segments. The Competitors Landscape of Kajima shows how these strategies compare to industry peers.

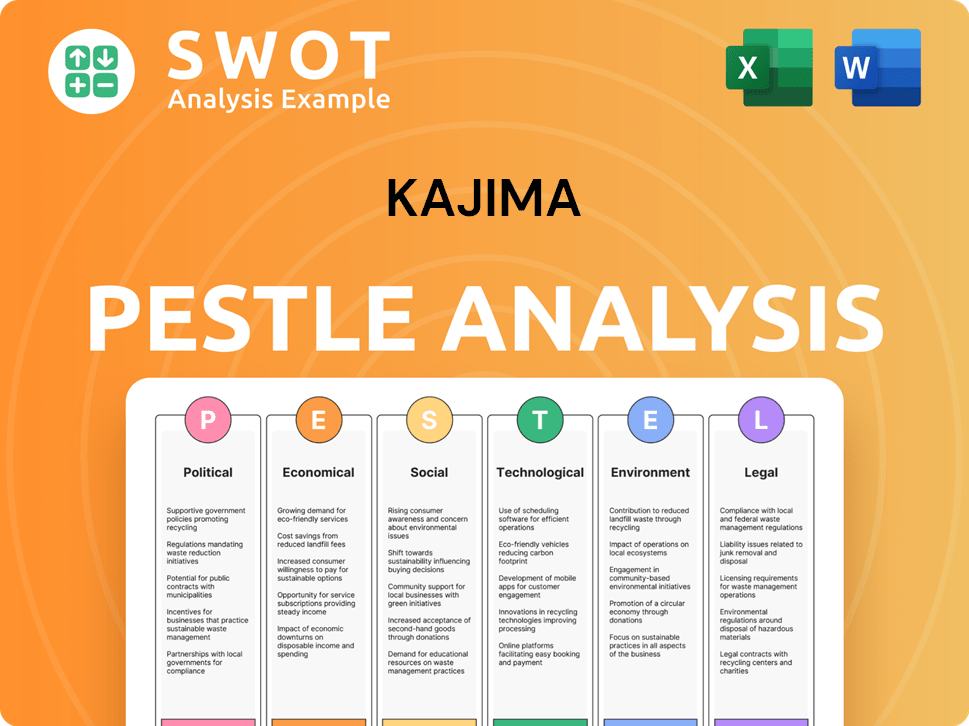

Kajima PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kajima’s Business Model?

The Growth Strategy of Kajima reflects a history of significant milestones and strategic decisions. The

Operational achievements include the smooth progress of large-scale construction projects, such as semiconductor factories. Strategic moves, like the acquisition of Rodgers Builders, Inc. in 2024, have boosted revenue in the construction sector. These actions highlight

Despite facing challenges like rising costs,

Continuous revenue and income growth for four consecutive years, with a fifth projected for fiscal 2025. The company anticipates a record-high consolidated net income of 130.0 billion yen in fiscal 2025. Successful construction of a large-scale semiconductor factory, with a pilot line start-up in April 2025.

Acquisition of Rodgers Builders, Inc. in 2024 to increase revenue. Aiming to push the gross profit margin of its domestic building construction business over 10% by fiscal 2026. Continuous investment in technology and innovation, with an annual investment of ¥100 billion by 2025.

A strong brand built over 175 years, fostering trust and attracting clients. Expertise in construction and engineering with a team of highly skilled professionals. Extensive global network with operations in over 20 countries, allowing access to diverse markets and resources.

Commitment to carbon neutrality by 2030, with targets to reduce emissions by 25% by 2025 and 50% by 2030. Focus on smart construction processes and digitalization. Continuous investment in research and development for efficient construction methods.

The company's financial performance is marked by consistent growth, with a projected record net income for fiscal 2025.

- Projected record-high consolidated net income of 130.0 billion yen in fiscal 2025.

- Aim to push gross profit margin of domestic building construction over 10% by fiscal 2026.

- Annual investment of ¥100 billion in technology and innovation by 2025.

- Targets to reduce emissions by 25% by 2025 and 50% by 2030.

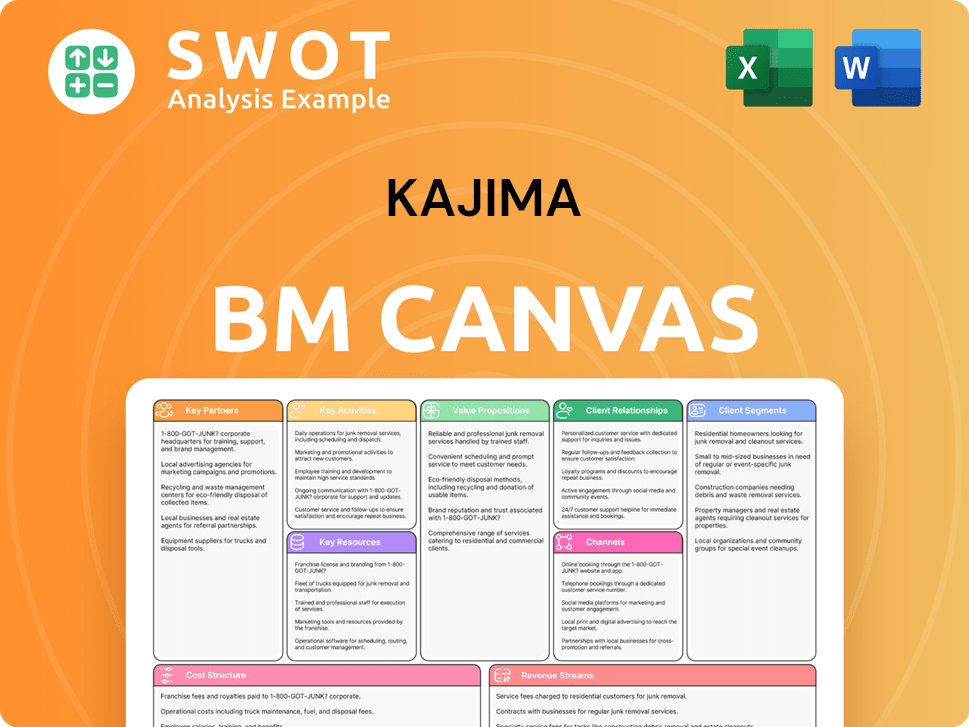

Kajima Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kajima Positioning Itself for Continued Success?

The Kajima Corporation holds a strong position in the construction and real estate development sectors. With a market capitalization of €10.68 billion as of June 2025, it is a major player globally. The company's consistent growth, with a projected fifth year of expansion in fiscal 2025, shows its solid market standing, supported by its diverse portfolio and brand reputation.

However, the Kajima business faces several challenges. These include potential impacts from rising construction costs and managing provisions for project losses. Furthermore, the overseas real estate development sector faces a conservative outlook due to high interest rates. The company also carries a significant debt, which could pose risks if not managed effectively. For more insights, you can explore the information available about Owners & Shareholders of Kajima.

The Kajima Company ranks among the top construction and real estate firms worldwide. Its diverse portfolio includes civil engineering, building construction, and real estate development. The company's strong brand reputation and global presence contribute to its industry leadership.

Key risks for Kajima construction include rising costs and managing project loss provisions. The overseas real estate sector faces challenges from high interest rates. A significant debt of JP¥931.4 billion as of December 2024 also presents financial risks if not managed carefully.

Kajima aims to achieve a consolidated net income target of 'more than 150.0 billion yen by fiscal 2030.' Productivity improvements and increasing international revenue to 40% by 2025 are key strategic goals. The company plans to invest ¥100 billion annually in technology and innovation by 2025.

The company is focused on boosting the gross profit margin of its domestic building construction business to over 10% by fiscal 2026. It is also committed to expanding its international revenue and investing heavily in technology and innovation to enhance its Kajima projects.

To ensure sustained growth, Kajima Corporation is implementing several strategic initiatives focused on productivity and global expansion. These initiatives aim to enhance profitability and maintain its competitive edge in the construction and real estate sectors.

- Enhancing productivity in domestic building construction to achieve a gross profit margin exceeding 10% by 2026.

- Increasing the international revenue contribution to 40% of total revenue by 2025, expanding its global footprint.

- Investing ¥100 billion annually in technology and innovation by 2025, focusing on smart construction and digitalization.

- Early achievement of a consolidated net income target of 'more than 150.0 billion yen by fiscal 2030.'

Kajima Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kajima Company?

- What is Competitive Landscape of Kajima Company?

- What is Growth Strategy and Future Prospects of Kajima Company?

- What is Sales and Marketing Strategy of Kajima Company?

- What is Brief History of Kajima Company?

- Who Owns Kajima Company?

- What is Customer Demographics and Target Market of Kajima Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.