Kobe Steel Bundle

Unveiling Kobe Steel: How Does This Industrial Giant Really Work?

Kobe Steel, a prominent Japanese steelmaker, is a critical player in the global materials and machinery sectors, yet its inner workings often remain a mystery to many. This industrial powerhouse influences numerous industries, from automotive and aerospace to infrastructure and energy, making it a fascinating subject for anyone interested in global markets. Understanding Kobe Steel's operations is crucial for investors, customers, and industry observers alike.

Kobe Steel's extensive reach and critical contributions to supply chains worldwide underscore its importance. Its Kobe Steel SWOT Analysis can provide valuable insights into its strengths and weaknesses. As global economies navigate shifts in demand, technological advancements, and supply chain resilience, a deep dive into how Kobe Steel operates and generates profit provides crucial insights into its adaptability and future trajectory. This examination will delve into Kobe Steel's core operational mechanics, its diverse revenue streams, and the strategic maneuvers that have shaped its competitive standing, including its Kobe Steel SWOT Analysis.

What Are the Key Operations Driving Kobe Steel’s Success?

The core operations of Kobe Steel Company (Kobe Steel) are centered around a multi-faceted approach to create and deliver value across several key business segments. As a leading Japanese steelmaker, Kobe Steel is a significant provider of steel, aluminum, and copper products. These products serve a diverse range of industries, including automotive, construction, infrastructure, and electronics.

Kobe Steel operations involve integrated production processes, from raw material sourcing to smelting, rolling, and finishing, utilizing advanced metallurgical technologies. Beyond materials, the company's machinery and engineering division designs and manufactures industrial machinery, such as compressors and crushing plants. The company also provides plant engineering services and operates power generation facilities.

A global supply chain supports Kobe Steel products, encompassing international raw material procurement and a sophisticated logistics network. Strategic partnerships enhance distribution and market reach. The synergy between its steelmaking expertise and machinery development creates a unique value proposition for customers seeking integrated solutions and high-quality, specialized products.

Kobe Steel is a major supplier of steel, aluminum, and copper products. These materials are essential for various industries, including automotive, construction, and electronics. High-performance steel sheets are critical for automotive body structures, enhancing vehicle safety and fuel efficiency.

The company designs and manufactures industrial machinery, such as compressors and crushing plants. This division also provides plant engineering services, offering comprehensive solutions from planning to maintenance. This segment supports infrastructure development and industrial processes.

Kobe Steel operates power generation facilities, contributing to a stable energy supply. This segment supports the company's broader operational needs and potentially provides energy solutions to external clients. The power business is a critical component of their infrastructure.

Kobe Steel has a global supply chain, sourcing raw materials from various international locations. A sophisticated logistics network ensures the efficient delivery of finished Kobe Steel products worldwide. Strategic partnerships also enhance its distribution capabilities.

Kobe Steel's value proposition lies in its integrated approach, combining materials expertise with machinery development. This synergy allows for specialized material development tailored to specific machinery requirements. This integration creates a unique advantage for customers seeking integrated solutions and high-quality, specialized products.

- Integrated Solutions: Offering both materials and machinery.

- Specialized Products: Tailored materials for specific machinery needs.

- Global Reach: Serving customers worldwide through a robust supply chain.

- Technological Advancement: Leveraging advanced metallurgical and manufacturing technologies.

Kobe Steel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kobe Steel Make Money?

The revenue streams and monetization strategies of the Kobe Steel Company are multifaceted, reflecting its diverse business operations. The company generates revenue primarily from its materials businesses, including steel products and aluminum and copper products. Additional revenue is derived from machinery and engineering, as well as its power business.

For the fiscal year ending March 31, 2024, Kobe Steel reported consolidated net sales of JPY 2,467.5 billion. This financial performance highlights the company's significant presence in the global market. The company employs various strategies to monetize its products and services, ensuring stable revenue streams.

Understanding how Kobe Steel operations generate revenue is crucial for investors and stakeholders. The company's approach to monetization involves long-term contracts, project-based sales, and tiered pricing, contributing to its financial stability and growth.

Steel products are a major revenue source for Kobe Steel, contributing significantly to its financial performance. The steel business segment generated JPY 1,377.9 billion in net sales for the fiscal year ending March 31, 2024. The company's steel products are essential in various industries, including automotive and construction.

Aluminum and copper products are another important revenue stream for Kobe Steel. This segment generated JPY 561.4 billion in net sales for the fiscal year ending March 31, 2024. These materials are used in various applications, including automotive and industrial sectors.

The machinery and engineering business provides a substantial revenue stream for Kobe Steel. This segment contributed JPY 421.5 billion in net sales for the fiscal year ending March 31, 2024. This includes industrial machinery, plant engineering services, and construction machinery.

The power business also contributes to Kobe Steel's revenue. This segment generated JPY 106.5 billion in net sales. The company's power generation activities support its overall business operations and provide a stable revenue source.

Monetization strategies include long-term supply contracts, project-based sales, and tiered pricing. These strategies help ensure stable demand and revenue. The company focuses on expanding higher-value-added products and increasing its global presence.

Kobe Steel is expanding its global footprint in key growth markets. This strategy helps diversify and strengthen its revenue mix. The company's international presence supports its long-term growth and market position.

The primary revenue drivers for Kobe Steel are its materials businesses, machinery and engineering, and power generation. The company employs various monetization strategies to ensure stable revenue streams and growth. For a broader understanding of the competitive landscape, consider reading about the Competitors Landscape of Kobe Steel.

- Long-term supply contracts with automotive and industrial sectors.

- Project-based sales for machinery, often with upfront payments.

- Tiered pricing for specialized materials based on grade and performance.

- Expansion of higher-value-added product lines.

- Increasing global footprint in key growth markets.

Kobe Steel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kobe Steel’s Business Model?

The operational and financial trajectory of the Kobe Steel Company has been significantly shaped by key milestones, strategic initiatives, and its ability to maintain a competitive edge in the global market. As a leading Japanese steelmaker, Kobe Steel's evolution reflects a commitment to innovation, sustainability, and adapting to the dynamic demands of various industries. The company's strategic focus on high-performance materials and decarbonization efforts highlights its forward-thinking approach.

Recent strategic moves by Kobe Steel, such as the emphasis on decarbonization, are pivotal. These initiatives are aligned with global environmental goals and position the company for future regulatory landscapes. For instance, the company is actively pursuing technologies to reduce CO2 emissions in its steelmaking processes, including the development of hydrogen ironmaking technologies and the use of electric arc furnaces. This strategic pivot addresses environmental concerns and supports a sustainable future. Additionally, Kobe Steel continues to invest in advanced materials to meet the evolving needs of industries like automotive and aerospace.

Kobe Steel has navigated operational challenges, including global supply chain disruptions and fluctuating raw material prices. Its response has involved optimizing production processes, enhancing supply chain resilience, and diversifying procurement sources. The company's deep technological expertise, particularly in metallurgy and materials science, has been a cornerstone of its competitive advantage. This expertise allows it to develop specialized products that meet stringent industry standards and customer specifications. Its diversified business portfolio also provides resilience against downturns in any single sector.

Kobe Steel's history includes significant advancements in steelmaking and materials science. The company has consistently adapted to technological shifts and market demands. These milestones have solidified its position as a key player in the industry.

Strategic moves include a focus on sustainability, with investments in technologies to reduce carbon emissions. The company is also investing in high-performance materials. These moves are designed to meet evolving industry demands and maintain a competitive edge.

Kobe Steel's competitive edge stems from its technological expertise and diversified business portfolio. Strong customer relationships and a global sales network also contribute to its success. The company continues to adapt to new trends, such as the increasing demand for sustainable materials.

Recent developments include a focus on decarbonization initiatives and investments in advanced materials. The company is also optimizing its production processes and enhancing supply chain resilience. These efforts are designed to ensure long-term sustainability and competitiveness.

Kobe Steel's competitive advantages are rooted in its technological prowess, diversified business model, and strong customer relationships. The company's ability to develop specialized products and adapt to market changes has been crucial to its success. The company's global presence and commitment to innovation further enhance its market position.

- Technological Expertise: Deep knowledge in metallurgy and materials science.

- Diversified Portfolio: Resilience against sector-specific downturns.

- Customer Relationships: Strong ties with key industrial clients.

- Global Network: Extensive sales and service infrastructure.

Kobe Steel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kobe Steel Positioning Itself for Continued Success?

The Kobe Steel Company holds a prominent position within the steel and materials sector, particularly in Japan. As a specialized supplier of steel, aluminum, copper products, and industrial machinery, it caters to diverse industries. Its global footprint extends across Asia, North America, and Europe, supporting a broad customer base.

However, Kobe Steel faces several challenges. These include fluctuating raw material costs, geopolitical risks, and the cyclical nature of its core industries. Environmental regulations, particularly concerning emissions, also present both hurdles and opportunities, necessitating strategic investments and innovations.

As a Japanese steelmaker, Kobe Steel is known for its high-quality, specialized offerings. It maintains strong customer loyalty, especially in sectors requiring precise material specifications. The company's global reach is significant, with operations and sales networks worldwide.

Key risks include fluctuating raw material prices and geopolitical tensions that could disrupt supply chains. The cyclical nature of industries like automotive and construction also poses challenges. Environmental regulations, particularly those related to emissions, require substantial investment.

Kobe Steel is focused on decarbonization through 'Kobelco Green Steel' and expanding into growth areas like semiconductors. It aims to enhance corporate value through high-value-added products. The company plans to expand its revenue generation through technology development and strategic market expansion.

Kobe Steel's strategic initiatives include expanding its presence in growth areas such as semiconductors and digital technologies. The company is committed to sustainable growth, innovation, and enhancing corporate value. It is focused on high-value-added products and solutions.

Kobe Steel's strategic focus includes decarbonization and expansion into new markets. The company emphasizes sustainability and innovation to enhance corporate value. These efforts are aimed at ensuring long-term growth and adapting to evolving market dynamics.

- Development of 'Kobelco Green Steel' to reduce environmental impact.

- Expansion into high-growth sectors like semiconductors and digital technologies.

- Focus on high-value-added products and solutions.

- Optimizing production processes for efficiency and cost-effectiveness.

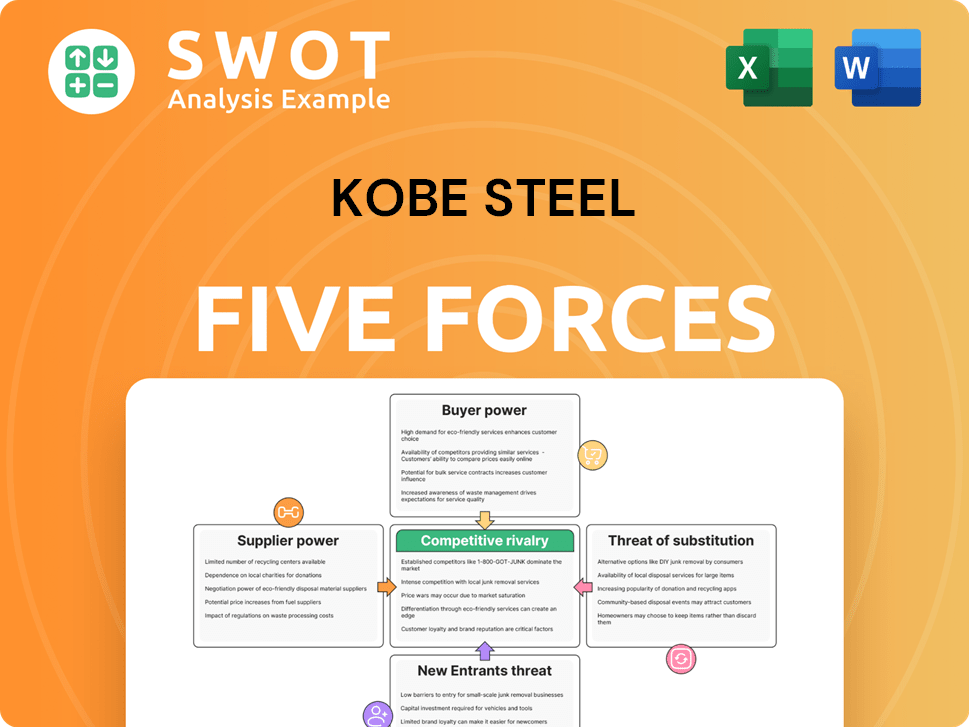

Kobe Steel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kobe Steel Company?

- What is Competitive Landscape of Kobe Steel Company?

- What is Growth Strategy and Future Prospects of Kobe Steel Company?

- What is Sales and Marketing Strategy of Kobe Steel Company?

- What is Brief History of Kobe Steel Company?

- Who Owns Kobe Steel Company?

- What is Customer Demographics and Target Market of Kobe Steel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.