Lalique Group Bundle

How Does Lalique Group Thrive in the Luxury Market?

Dive into the captivating world of Lalique Group, a beacon of luxury with a rich history and a diverse portfolio. From exquisite crystal and perfumes to high-end furniture and lifestyle accessories, the Lalique brand has consistently captivated discerning consumers worldwide. But how does this prestigious Lalique company operate, and what strategies drive its continued success?

As Lalique Group transitions to a private entity, understanding its inner workings becomes even more critical. The company's recent delisting from the SIX Swiss Exchange signals a strategic shift towards long-term growth and a focus on its core business. Explore the Lalique Group SWOT Analysis to uncover the strengths, weaknesses, opportunities, and threats shaping the future of this iconic luxury brand and its diverse range of Lalique products.

What Are the Key Operations Driving Lalique Group’s Success?

The Lalique Group creates value by offering a diverse range of luxury products and services. This strategy caters to a clientele that appreciates fine craftsmanship, unique designs, and exclusive experiences. The Lalique company focuses on delivering high-end products and extending its presence into art, gastronomy, and hospitality, providing a comprehensive luxury lifestyle.

The Lalique business model is built on a foundation of exquisite crystalware, perfumes, cosmetics, jewelry, and lifestyle accessories. The company's value proposition is centered around its rich heritage in crystal artistry, unique designs, and collaborations with renowned artists. This approach makes each piece a work of art that embodies elegance and craftsmanship, enhancing the brand's appeal in the luxury market.

Operationally, Lalique Group manages most of its value chain. This includes sourcing raw materials and delivering products to the end consumer, which provides a high degree of autonomy and flexibility. The company operates state-of-the-art facilities in France for crystalware and perfumes. These facilities use extensive hand-craftsmanship and meticulous attention to detail to produce complex and sophisticated items.

Lalique products include crystalware, perfumes, cosmetics, jewelry, high-end furniture, and lifestyle accessories. The company also offers art, gastronomy, and hospitality services. This diversified portfolio allows the Lalique brand to cater to a wide range of luxury consumer preferences.

The crystal factory is located in Wingen-sur-Moder, Alsace, and a perfume filling and logistics center is in Ury, Seine-et-Marne. The company emphasizes hand-craftsmanship and meticulous attention to detail. The Lalique company controls its value chain, from sourcing to delivery, ensuring quality and flexibility.

Lalique Group has a distribution network that includes 28 boutiques worldwide. It also partners with renowned dealers and department stores. This multi-channel approach ensures broad market reach and accessibility for its luxury goods.

Lalique operates five hotels and restaurants, with three of them having earned Michelin stars. These exclusive settings reflect the Lalique ambiance. This integrated approach offers a comprehensive luxury lifestyle experience.

Lalique Group focuses on technology development, logistics, sales channels, and customer service. The group is increasingly leveraging digitalization to enhance brand awareness and improve the client experience. The company's integrated approach, from production to retail and hospitality, allows Lalique to offer a comprehensive luxury lifestyle experience.

- The company has expanded its digital marketing and e-commerce efforts.

- Lalique has a global presence with boutiques in major cities.

- The hospitality segment includes luxury hotels and fine dining restaurants.

- The group's strategy includes sustainable practices and initiatives.

Lalique Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lalique Group Make Money?

The Lalique Group generates revenue through a diverse set of streams, reflecting its multifaceted luxury business model. This approach encompasses product sales across various segments and ventures into hospitality and gastronomy.

The

For the full year ended December 31, 2023, the

The

- The Lalique segment recorded EUR 98.4 million in sales in 2023, a 3% improvement.

- The perfume business accounted for 36% of the Group's total revenues in the first half of 2023.

- The Ultrasun sunscreen brand achieved sales of EUR 16.4 million in 2023, a 10% year-on-year improvement.

- The hospitality and interior design businesses each contributed 4% to Group sales.

Lalique Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Lalique Group’s Business Model?

The Lalique Group has charted a course marked by strategic shifts and significant milestones, shaping its trajectory in the luxury goods sector. A pivotal move is the planned delisting from the SIX Swiss Exchange on September 4, 2024, following a public tender offer by the majority shareholder, Silvio Denz. This decision aims to allow the Lalique company to concentrate on long-term business development and diversification without the constraints of a public listing. Understanding how the Lalique Group operates requires a look at these key strategic actions.

Recent partnerships and acquisitions further define the Lalique business strategy. These include perfume licensing agreements with Superdry, with initial fragrances expected in late summer 2024, and an exclusive worldwide perfume licensing deal with Mikimoto, with the first Mikimoto crystal edition planned for 2025 and perfumes in spring 2026. The acquisition of a 71% stake in the Château Lafaurie-Peyraguey winery in the Bordeaux region in 2023 and the traditional silk label 'Fabric Frontline' further demonstrate the company's expansion efforts. The refurbishment of the Villa Florhof hotel and restaurant in Zurich, slated to reopen in May 2025, and the unveiling of a new flagship store, Maison d'Artiste, in New York City in March 2025, highlight the company's commitment to enhancing its brand presence and customer experience.

Operational challenges and strategic responses have also played a role. In 2023, the Lalique Group faced market and production challenges, particularly in the first half of the year, and supply-chain issues. However, the company responded with solid sales growth in the second half of the year. These strategic moves and operational adjustments are crucial to understanding the Lalique Group business model explained.

Delisting from SIX Swiss Exchange planned for September 4, 2024, following a public tender offer.

Acquisition of Château Lafaurie-Peyraguey winery in 2023, expanding into the wine sector.

Unveiling of Maison d'Artiste flagship store in New York City in March 2025.

Perfume licensing agreements with Superdry and Mikimoto, expanding fragrance offerings.

Acquisition of Fabric Frontline, adding to the luxury portfolio.

Ongoing refurbishment of Villa Florhof hotel and restaurant in Zurich.

Strong brand recognition and prestige, with a heritage dating back to 1888.

Diversified product range across multiple luxury sectors, including crystal, perfume, and hospitality.

Control over much of its value chain, enhancing autonomy and flexibility.

Market and production challenges in the first half of 2023.

Supply-chain shortages of production components in the perfume business.

Achieved solid sales growth in the second half of 2023 despite the challenges.

The Lalique brand benefits from a rich history, unique designs, and collaborations with renowned artists, providing a strong foundation in the luxury market. The company's diversified product range and presence across multiple luxury sectors, from crystal to hospitality, also provide a substantial competitive edge. To understand how Lalique products are marketed, read more in the Marketing Strategy of Lalique Group.

- Strong brand recognition and prestige.

- Diversified product offerings.

- Strategic partnerships and acquisitions.

- Investment in production capacities and digitalization.

Lalique Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Lalique Group Positioning Itself for Continued Success?

The Lalique Group occupies a solid position within the global luxury goods market, differentiating itself as a niche player amidst larger multinational corporations. Its diversified business model spans various luxury segments, including perfumes, crystal, jewelry, and hospitality, which allows it to spread risk and seize opportunities. The company’s brand heritage, distinctive designs, and commitment to luxury standards contribute to brand loyalty and sales differentiation.

Despite its strong foundation, the company faces several challenges, including inflationary pressures and supply chain disruptions. The global economic environment and intense competition in the luxury market also present uncertainties. However, the Group is actively pursuing strategic initiatives and innovations to sustain and expand its profitability.

The

The company faces risks from inflationary trends, which impacted operating expenses in 2023, and supply chain disruptions, particularly in the perfume business. The global economic environment and intense competition in the luxury market also present challenges. The company is also exposed to currency fluctuations due to its international presence.

The

The

The company is focused on strategic initiatives to maintain and expand its market position. These initiatives include new product launches, strengthening production capacities, and expanding its market presence. The delisting from the SIX Swiss Exchange will allow the company to focus on its long-term diversification strategy as a private entity.

- New product launches, including collaborations with Superdry and Mikimoto.

- Expansion of market presence with a new flagship store in New York.

- Refurbishment of the Villa Florhof hotel and restaurant with a reopening in May 2025.

- Relaunch of the Fabric Frontline silk label in spring 2025.

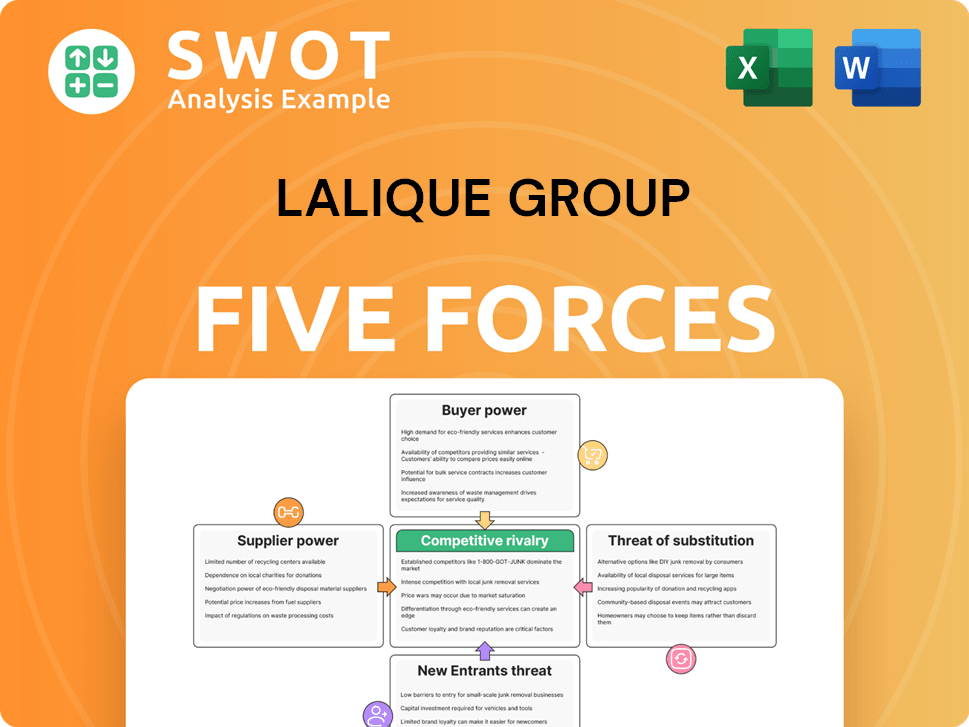

Lalique Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lalique Group Company?

- What is Competitive Landscape of Lalique Group Company?

- What is Growth Strategy and Future Prospects of Lalique Group Company?

- What is Sales and Marketing Strategy of Lalique Group Company?

- What is Brief History of Lalique Group Company?

- Who Owns Lalique Group Company?

- What is Customer Demographics and Target Market of Lalique Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.