Lincoln Tech Bundle

Unlocking the Potential: How Does Lincoln Tech Thrive?

In a rapidly evolving job market, understanding the dynamics of career-focused education is more critical than ever. Lincoln Tech, a leading Lincoln Tech SWOT Analysis, has been at the forefront of vocational training since 1946. With impressive financial growth and a commitment to addressing the skills gap, Lincoln Tech's operational model offers valuable insights for investors and industry watchers alike.

From its Lincoln Tech campus locations to its diverse Lincoln Tech program offerings, including Lincoln Tech automotive technology program, the company's strategic approach to career training is noteworthy. This analysis will explore how Lincoln Tech financial aid options, and how to apply to Lincoln Tech, contributes to its success, providing a comprehensive overview of this trade school and its impact on the future workforce.

What Are the Key Operations Driving Lincoln Tech’s Success?

The core of Lincoln Tech's operations centers around providing hands-on, career-focused training. They offer diploma, degree, and certificate programs across areas like automotive technology, health sciences, skilled trades, and culinary arts. These programs aim to equip students with the skills needed to enter the workforce or advance their careers quickly.

The value proposition of Lincoln Tech lies in its commitment to providing superior education and training for in-demand careers. They focus on creating a supportive and accessible learning environment. This approach transforms students' lives and adds value to their communities.

The company's operational processes emphasize experiential and interactive learning. This approach mimics real-world working environments in classrooms and labs. Instructors with industry experience provide students with practical skills. They employ a hybrid teaching model, 'Lincoln 10.0,' which combines online lectures with hands-on classroom training. This model is expected to serve 80% of students by mid-2026. This model offers flexibility and improves student retention.

Lincoln Tech operates strategically located campuses across 21 campuses in 12 states. They have strong partnerships with industry leaders to enhance their programs. These partnerships validate educational quality and create job opportunities for graduates.

Partnerships with companies like Hyundai and Genesis offer manufacturer-specific training. This training is provided at no extra cost to students. This collaborative approach ensures that the curriculum remains relevant to industry demands.

Lincoln Tech aims to produce highly qualified, job-ready graduates. Their focus on hands-on training and industry partnerships sets them apart. This approach translates core capabilities into direct customer benefits and market differentiation.

- Hands-on Training: Emphasizing practical skills in real-world settings.

- Industry Partnerships: Collaborations with leading companies for relevant training.

- Hybrid Learning Model: Combining online and in-person instruction for flexibility.

- Career-Focused Programs: Training in high-demand fields to improve job placement rates.

Lincoln Tech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lincoln Tech Make Money?

The primary revenue stream for Lincoln Tech stems from tuition and fees generated by its career-focused postsecondary education programs. These programs are offered through the Campus Operations segment, which encompasses all active campuses. The company's financial performance is heavily reliant on this segment, reflecting its core business activities.

In 2024, Lincoln Tech reported a total revenue of $440.1 million, demonstrating a strong 16.4% year-over-year growth. This growth trajectory continued into early 2025, with a 16% year-over-year increase in revenue for the first quarter, reaching $117.5 million. The company anticipates a full-year 2025 revenue range of $485 million to $495 million.

While specific revenue breakdowns by program area, such as automotive technology, health sciences, and skilled trades, are not consistently detailed in recent reports, the overall growth indicates robust demand across its diverse program offerings. Lincoln Technical Institute has expanded its revenue streams through innovative monetization strategies, including employer-funded training programs.

A significant example of diversification is the nearly $6.0 million, five-year agreement with Container Maintenance Corporation (CMC) for on-site employee training. This represents the largest program of its type to date, showcasing a shift towards corporate training services. The implementation of the 'Lincoln 10.0' hybrid teaching model is designed to enhance operational efficiencies.

- This model allows for increased capacity and program replication, potentially expanding student enrollment without a proportional increase in costs.

- Strategic expansions through new campus developments and program replications at existing campuses are designed to contribute significantly to future revenue growth.

- The East Point, Atlanta campus, which became profitable within seven months of opening in March 2024, exemplifies this rapid contribution to overall revenue.

- The company anticipates continued operating leverage as the transition to Lincoln 10.0 is completed, leading to future savings in instructional costs as a percentage of revenue.

Lincoln Tech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Lincoln Tech’s Business Model?

Established in 1946, has a rich history marked by significant milestones and strategic adaptations. Key historical developments include the addition of automotive courses in 1948 and being acquired by Ryder in 1969. A pivotal moment was its initial public stock offering in 2005, trading on NASDAQ under the symbol LINC. More recently, has focused on strategic growth initiatives, such as new campus development and program replication.

The East Point, Georgia campus, opened in March 2024, achieved profitability within seven months, exceeding expectations. The company also plans new campus openings in Nashville, Philadelphia, Houston, and Long Island by 2026. Strategic moves include expanding its 'Lincoln 10.0' hybrid teaching model, projected to serve 80% of students by mid-2026, enhancing operational efficiencies and student retention. The company has also navigated regulatory challenges through lobbying efforts.

In response to operational and market challenges, the company plans to divest the Euphoria Institute in Las Vegas, sharpening its focus on skilled trades and healthcare. The company's competitive advantages stem from strong industry partnerships and a focus on in-demand careers. Its commitment to hands-on training and career services further differentiates it. For insights into its marketing approaches, explore the Marketing Strategy of Lincoln Tech.

Founded in 1946, with automotive courses added in 1948. The company was acquired by Ryder in 1969. It went public in 2005, trading on NASDAQ under LINC.

Expansion of the 'Lincoln 10.0' hybrid teaching model, targeting 80% student participation by mid-2026. New campus openings are planned in multiple cities by 2026. Divestiture of the Euphoria Institute to focus on core programs.

Strong industry partnerships with companies like Hyundai and Tesla. It is the largest provider of automotive and skilled trade graduates in the eastern United States. Focus on in-demand careers, supported by substantial job opportunities.

The East Point, Georgia campus, opened in March 2024, achieved profitability within seven months. New campuses are slated to open in several locations by 2026. The company is adapting to new trends by investing in new programs and facilities.

The company's competitive advantages include strong industry partnerships, a focus on in-demand careers, and a commitment to hands-on training. These factors contribute to high job placement rates for graduates. The company's strategic moves, such as campus expansions and program replication, aim to capitalize on these strengths.

- Strong industry partnerships with companies like Hyundai, Tesla, and others.

- Focus on in-demand careers with substantial job opportunities.

- Commitment to hands-on training and career services, including job placement assistance.

- Adaptation to new trends by investing in new programs and facilities.

Lincoln Tech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Lincoln Tech Positioning Itself for Continued Success?

Within the postsecondary career education sector, specifically in the eastern United States, is a major player. It holds the top position for automotive and skilled trade graduates. In the western region, it ranks sixth. With an estimated market share of about 1.9% across its key programs, there's significant potential for expansion in this fragmented market. Strong ties with industry partners contribute to high employer loyalty.

However, the company faces risks such as potential market saturation, macroeconomic pressures, and regulatory changes. Competition from other educational providers and execution risks from campus openings and program expansions are also challenges. Compliance with federal regulations, including the 90/10 rule and cohort default rates, poses ongoing challenges. For more information about the company's mission, read Growth Strategy of Lincoln Tech.

The company is a leading provider of career-focused education, particularly in automotive and skilled trades. It has a considerable market share, indicating room for growth. It is known for its strong industry partnerships, enhancing job placement rates for graduates.

Key risks include market saturation, economic downturns, and regulatory changes. Competition from other educational institutions and execution risks associated with new campus openings are also concerns. It must comply with federal regulations, which adds to the complexity.

The company aims for revenue of $550 million and an adjusted EBITDA of $90 million by 2027. It plans to open three new campuses in 2025 and expand its hybrid teaching model. Significant capital expenditures are planned for new campuses and programs.

The company is focusing on expanding its Lincoln 10.0 hybrid teaching model to serve 80% of students by mid-2026. It is investing heavily in new campuses and program development. The company is positioned to capture a growing share of the skilled trades training market.

The company's strategy focuses on expanding its hybrid teaching model and opening new campuses. Financial targets for 2027 include significant revenue and EBITDA growth. It plans to invest heavily in new facilities and programs to support this growth.

- Expansion of hybrid learning model.

- Opening of new campuses in 2025.

- Capital expenditures of $70-75 million in 2025.

- Focus on industry partnerships and workforce demands.

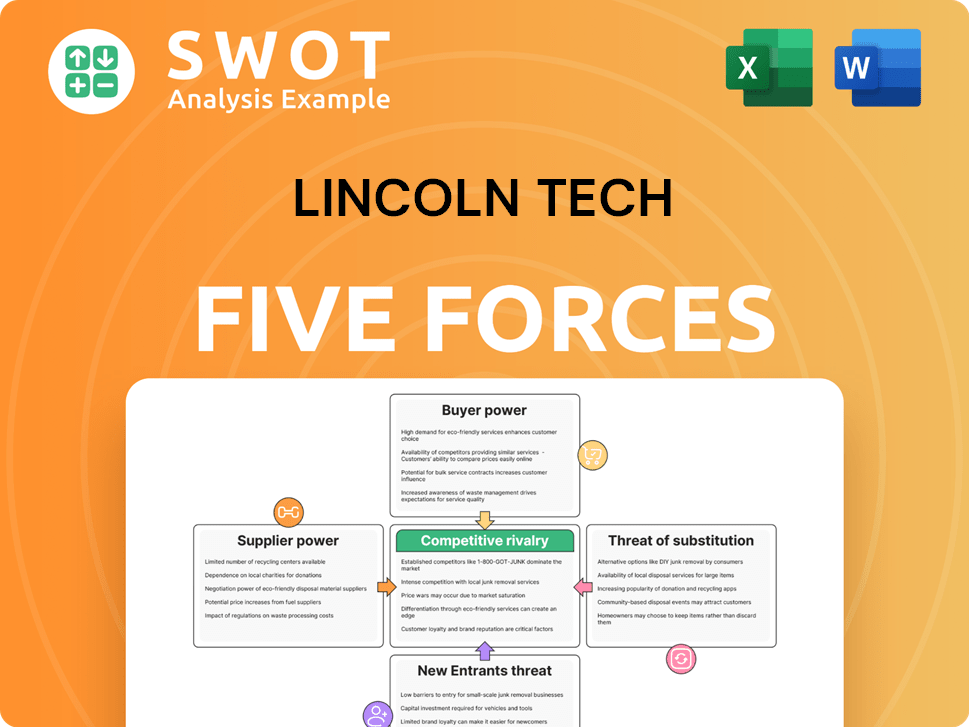

Lincoln Tech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lincoln Tech Company?

- What is Competitive Landscape of Lincoln Tech Company?

- What is Growth Strategy and Future Prospects of Lincoln Tech Company?

- What is Sales and Marketing Strategy of Lincoln Tech Company?

- What is Brief History of Lincoln Tech Company?

- Who Owns Lincoln Tech Company?

- What is Customer Demographics and Target Market of Lincoln Tech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.