Lincoln Tech Bundle

Who Really Controls Lincoln Tech?

Delving into Lincoln Tech SWOT Analysis is just the beginning. Understanding the intricate web of ownership is critical to grasping Lincoln Technical Institute's strategic moves and long-term prospects. From its inception in 1946, Lincoln Tech, now known as Lincoln Educational Services, has evolved significantly. This exploration uncovers the key players shaping its future.

This analysis of Lincoln Tech ownership will dissect the roles of its founders, key institutional investors, and the influence of the board of directors. Knowing the Lincoln Tech parent company and its ownership structure provides valuable insights into its governance and trajectory within the vocational education sector. We'll examine the company's history, financial information, and the impact of its current market value, answering questions like "Who owns Lincoln Tech?" and "Is Lincoln Tech publicly traded?"

Who Founded Lincoln Tech?

The story of Lincoln Tech ownership begins in 1946. J. Warren Davies, a decorated Army Captain, founded the Lincoln Technical Institute in Newark, New Jersey. This marked the start of what would become a significant player in vocational education.

Davies's vision was clear: to equip World War II veterans with practical skills to thrive in civilian life. Initially, the institute focused on training in air conditioning and refrigeration. Automotive courses were added later, expanding its offerings to meet evolving industry demands.

The early ownership structure of Lincoln Tech wasn't explicitly detailed in public records. However, the company's growth included traveling schools and a broader range of programs. Several changes in ownership and strategic acquisitions shaped its path to becoming a publicly traded company.

J. Warren Davies founded the Lincoln Technical Institute in 1946. The institute was established in Newark, New Jersey.

The primary goal was to provide vocational training for World War II veterans. Courses initially centered on air conditioning and refrigeration.

Automotive courses were introduced in 1948. The company expanded its reach through traveling schools.

Ryder acquired Lincoln Technical Institute along with two other technical schools. By 1977, the institute had expanded to ten campuses.

Stonington Partners and Hart Capital purchased Lincoln Technical Institute. This acquisition was a pivotal moment.

The company acquired Denver Automotive and Diesel College in 2001. Lincoln College of Technology in Nashville was acquired in 2003.

In 2000, Stonington Partners and Hart Capital acquired Lincoln Technical Institute, which was a key moment in its history. This acquisition paved the way for further expansion. The purchase of institutions like Denver Automotive and Diesel College in 2001 and Lincoln College of Technology in Nashville in 2003, were part of the company's growth strategy. These early acquisitions and private equity involvement set the stage for the company's eventual public listing. For more information about the company's financial performance, you can read about the Revenue Streams & Business Model of Lincoln Tech.

The early history of Lincoln Tech is marked by its founder's vision and strategic acquisitions.

- Founded in 1946 by J. Warren Davies.

- Focused initially on vocational training for veterans.

- Expansion through acquisitions, including Ryder in 1969 and Stonington Partners/Hart Capital in 2000.

- Acquisitions of Denver Automotive and Diesel College and Lincoln College of Technology further expanded the company's reach.

Lincoln Tech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Lincoln Tech’s Ownership Changed Over Time?

The initial public offering (IPO) of Lincoln Educational Services Corporation on June 23, 2005, marked a significant shift in its ownership structure. The company, trading under the ticker symbol LINC on the NASDAQ, offered shares at $20.00 each. Before the IPO, Stonington Partners, through its subsidiary Back to School Acquisition, L.L.C., held a substantial stake, owning 79.1% of the fully diluted equity as of May 31, 2005. This ownership was expected to decrease to 69.9% after the offering. Hart Capital, through Five Mile River Capital Partners LLC, and key investors like California Regent Richard C. Blum also held notable positions.

The IPO aimed to raise capital for repaying debts and general corporate purposes, which further reshaped the ownership landscape. The entrance of new investors and the dilution of existing shareholders' stakes were key outcomes of this event. The IPO transformed the company from a privately-held entity with concentrated ownership to a publicly-traded company with a more diverse shareholder base. This transition set the stage for future changes in ownership and corporate governance.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | June 23, 2005 | Reduced Stonington Partners' stake; introduced public shareholders. |

| Institutional Investment | Ongoing | Increased diversification of ownership; major institutional holders emerged. |

| Insider Ownership | Ongoing | CEO and other insiders maintain significant stakes, influencing company strategy. |

As of May 30, 2025, the ownership of Lincoln Educational Services Corporation is characterized by a mix of institutional and individual investors. There are 271 institutional owners and shareholders, holding a total of 29,048,719 shares. Key institutional holders include Juniper Investment Company, LLC, BlackRock, Inc., The Vanguard Group, Heartland Advisors Inc, and Dimensional Fund Advisors LP. Scott M. Shaw, the President and CEO, is the largest insider shareholder, with a direct ownership of 3.47% of the company's shares, which is valued at approximately $23.21 million. The company's market capitalization as of June 13, 2025, is approximately $683.35 million. This shift reflects the evolution from private equity control to a more diversified shareholder base, which influences company strategy and governance. For more information on the company's approach, you can check out the Marketing Strategy of Lincoln Tech.

The ownership of Lincoln Tech has evolved significantly since its IPO, with a shift from private equity to a mix of institutional and individual investors.

- Stonington Partners was a major stakeholder before the IPO.

- Institutional investors like BlackRock and Vanguard hold significant shares.

- The CEO remains a key insider shareholder.

- The company's market capitalization is approximately $683.35 million as of June 13, 2025.

Lincoln Tech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Lincoln Tech’s Board?

The current board of directors of Lincoln Educational Services Corporation, also known as Lincoln Technical Institute, plays a vital role in overseeing the company's strategic direction and governance. As of 2024, the board includes a mix of independent directors and representatives from major stakeholders. John A. Bartholdson, a co-founder and partner of Juniper Investment Company, LLC, a significant institutional shareholder, serves as the Non-Executive Chairman. Other independent directors include James J. Burke Jr., Kevin M. Carney, Sylvia Young, Anna Cabral, Michael Plater, Felecia J. Pryor, Carlton Rose, and Marta Newhart. Scott Shaw, the President and CEO, also holds a position on the board. The average tenure of the board members is about 4.8 years, indicating a good level of experience.

Understanding the board of directors is key to grasping the Lincoln Tech ownership structure. The presence of directors like John A. Bartholdson, affiliated with a major institutional investor, suggests that significant shareholders have a considerable influence on strategic decisions. Scott Shaw's ownership of approximately 3.47% of the company's shares also gives him substantial voting power. This structure helps shape the company's operations and financial strategies.

| Board Member | Title | Affiliation |

|---|---|---|

| John A. Bartholdson | Non-Executive Chairman | Juniper Investment Company, LLC |

| Scott Shaw | President and CEO | Lincoln Educational Services Corporation |

| James J. Burke Jr. | Independent Director | N/A |

| Kevin M. Carney | Independent Director | N/A |

| Sylvia Young | Independent Director | N/A |

| Anna Cabral | Independent Director | N/A |

| Michael Plater | Independent Director | N/A |

| Felecia J. Pryor | Independent Director | N/A |

| Carlton Rose | Independent Director | N/A |

| Marta Newhart | Independent Director | N/A |

The voting structure at Lincoln Educational Services generally follows a one-share-one-vote principle. This means that each share of common stock, which trades on the Nasdaq Global Market under the symbol 'LINC', carries equal voting rights. The major shareholders, such as Juniper Investment Company, LLC, have a significant say in the company's strategic direction.

- The board of directors includes independent directors and representatives of major shareholders.

- The CEO, Scott Shaw, also sits on the board and holds a notable percentage of shares.

- The company's governance is detailed in its investor relations materials and SEC filings.

- No recent proxy battles or governance controversies have significantly reshaped decision-making.

Lincoln Tech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Lincoln Tech’s Ownership Landscape?

Over the past few years, the ownership profile of Lincoln Educational Services Corporation has been influenced by its financial performance and strategic moves. For the full year 2024, the company reported a revenue of $440.1 million, marking a 16.4% increase. Net income reached $9.9 million. Student starts grew by 15.2% in 2024, and the quarter-end student population rose by 14.1%. Looking ahead to 2025, the company anticipates further growth, projecting revenue between $480 million and $490 million, and adjusted EBITDA between $55 million and $60 million.

Recent developments have included the strategic relocation and opening of new campuses. The Nashville campus transitioned to a new facility in early 2025, designed for operational efficiency using Lincoln's hybrid education model. The company also entered into a lease agreement for a new campus in Hicksville, New York, and completed the sale of its Summerlin, Las Vegas campus in early 2025. In February 2024, LCN Capital Partners purchased Lincoln Tech's Levittown, PA campus in a sale-leaseback agreement, providing capital for program replications and new campuses. These actions are part of a broader strategy, as discussed in Growth Strategy of Lincoln Tech.

| Metric | Value | Date |

|---|---|---|

| Institutional Ownership Increase | 106.42% | May 30, 2025 (over the past year) |

| Total Liquidity | Nearly $90 million | March 31, 2025 |

| Projected Revenue (2025) | $480 - $490 million | 2025 |

Ownership trends reveal a significant institutional presence. As of May 30, 2025, institutional ownership has increased by 106.42% over the past year. Top institutional holders include Juniper Investment Company, BlackRock, Inc., and The Vanguard Group. The company maintains a strong financial position with nearly $90 million in total liquidity and no outstanding debt as of March 31, 2025. The company's leadership has publicly stated objectives of reaching approximately $550 million in revenue and $90 million in adjusted EBITDA by 2027, which could further attract investors and potentially influence future ownership dynamics.

Juniper Investment Company, BlackRock, Inc., and The Vanguard Group are among the top institutional holders of Lincoln Educational Services Corporation.

The company has nearly $90 million in total liquidity and no outstanding debt as of March 31, 2025, indicating a strong financial position.

Lincoln Educational Services projects revenue between $480 million and $490 million for 2025 and aims for $550 million in revenue by 2027.

Recent developments include the opening of a new campus in Nashville and the sale of the Summerlin, Las Vegas campus.

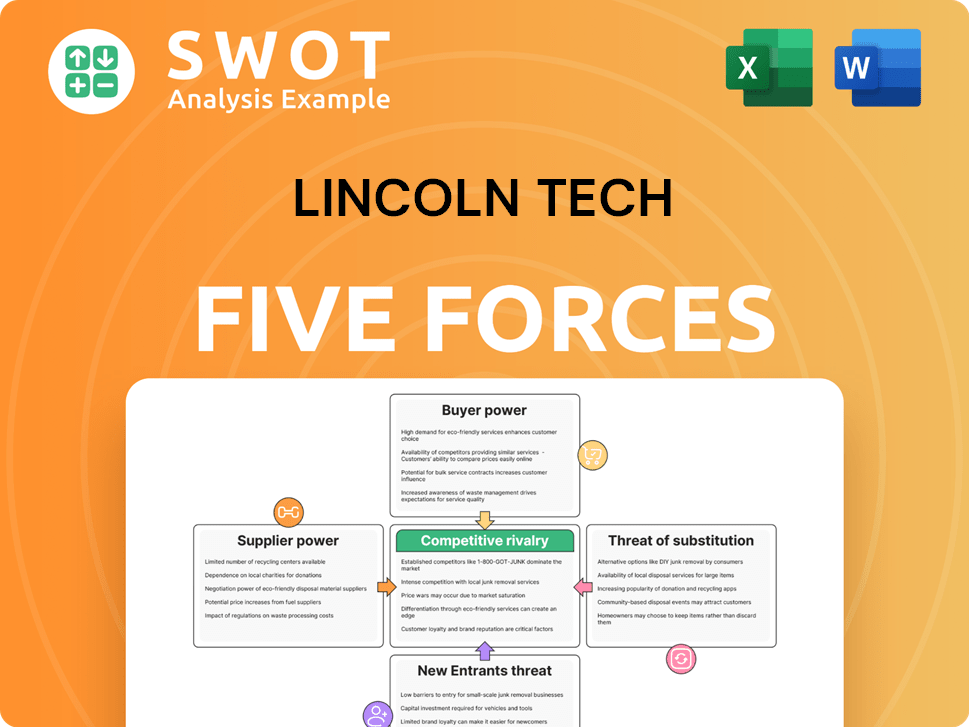

Lincoln Tech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lincoln Tech Company?

- What is Competitive Landscape of Lincoln Tech Company?

- What is Growth Strategy and Future Prospects of Lincoln Tech Company?

- How Does Lincoln Tech Company Work?

- What is Sales and Marketing Strategy of Lincoln Tech Company?

- What is Brief History of Lincoln Tech Company?

- What is Customer Demographics and Target Market of Lincoln Tech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.