Light & Wonder Bundle

Decoding Light & Wonder: How Does This Gaming Giant Thrive?

Light & Wonder, a powerhouse in the global gaming industry, isn't just playing the game—it's redefining it. With record-breaking revenues and a diverse portfolio spanning casino games, interactive experiences, and social platforms, the Light & Wonder SWOT Analysis reveals the strategies driving its success. This deep dive explores how Light and Wonder, a leading gaming company, has achieved consistent growth and what the future holds for this innovative leader.

From its impressive Light & Wonder financial performance to its strategic market expansions, understanding Light & Wonder's operations is vital for anyone invested in the future of entertainment. This analysis will unravel the core elements of Light and Wonder's business model, examining its revenue streams, key acquisitions, and the technology that powers its slot machines and online gambling platforms. Explore the Light & Wonder games list and discover what makes this LNW company a leader.

What Are the Key Operations Driving Light & Wonder’s Success?

Light & Wonder (LNW company) operates by designing, developing, manufacturing, and distributing a wide range of gaming and entertainment solutions. Their core offerings include land-based gaming machines, game content, and digital platforms for interactive and social casino games. They serve casinos, iGaming operators, and lotteries.

The company's operational processes are extensive, including manufacturing gaming machines, providing gaming systems, and operating leased machines. They have a global distribution network, particularly strong in North America and Australia. Technology development is key, with significant investment in research and development to produce new games.

What sets Light & Wonder apart is its cross-platform strategy. This allows them to leverage content across land-based, iGaming, and social casino channels. This integrated approach lets them test concepts in social casinos before deploying them on physical machines and participate in the shift towards digital gambling.

Light & Wonder manufactures and sells a variety of slot machines. These machines are a core part of their revenue, providing entertainment in casinos worldwide. They constantly update their offerings to meet consumer demand.

They offer digital platforms for online casinos. This includes providing games and technology to iGaming operators, expanding their reach into the digital gambling market. The iGaming segment focuses on capturing omni-channel opportunities.

Light & Wonder develops social casino games. These games allow players to enjoy casino-style entertainment without real money wagering. They use social casinos to test new game concepts before they are released on physical machines.

The company also provides lottery solutions. This includes technology and services for lotteries, expanding their business beyond casinos and iGaming. The lottery segment is another revenue stream.

Light & Wonder provides a diverse and engaging portfolio of games across multiple platforms. They differentiate themselves by offering a seamless player experience. Their integrated ecosystem provides a wide range of gaming options.

- Diverse Game Portfolio: Offers a wide range of games for various player preferences.

- Cross-Platform Availability: Games are available on land-based, iGaming, and social casino platforms.

- Technological Innovation: Continuous investment in technology and game development.

- Global Presence: Operates in multiple regions, including North America and Australia.

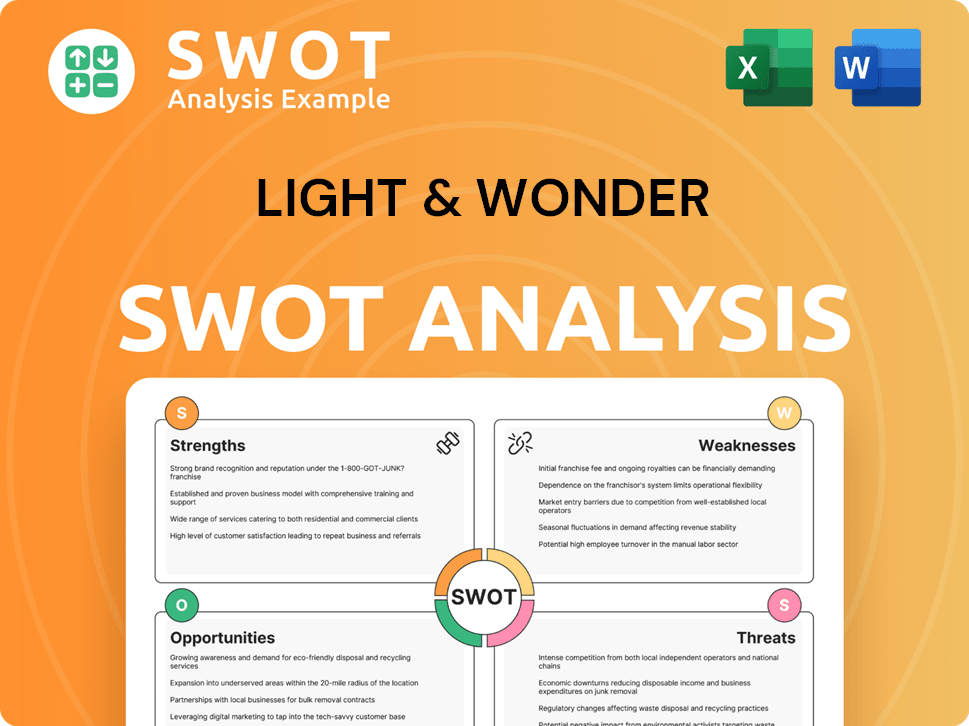

Light & Wonder SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Light & Wonder Make Money?

The revenue streams and monetization strategies of Light & Wonder (LNW company) are diverse, reflecting its presence in the gaming, social casino, and iGaming sectors. For the full year 2024, the company reported record consolidated revenue of $3.2 billion, demonstrating strong financial performance. This growth is fueled by strategic initiatives and market expansions across its various business segments.

The company leverages various monetization strategies, including direct-to-consumer channels in its social casino segment. Recent acquisitions, such as Grover Gaming's charitable gaming business, further enhance its recurring revenue base and expand its presence in regulated land-based markets. These strategies are designed to maximize revenue and achieve sustainable growth.

Understanding how Light & Wonder makes money involves examining its primary revenue streams and the strategies it employs to generate income. This includes sales of gaming machines, expansion of its installed base, and growth in its iGaming platforms. The company's focus on innovation and strategic acquisitions supports its financial goals.

Light & Wonder's revenue is primarily generated through three main segments: Gaming, SciPlay (Social Casino), and iGaming. Each segment contributes significantly to the company's overall financial performance. The company's strategic approach focuses on expanding its presence in key markets and developing innovative products to drive revenue growth.

- Gaming: This segment is a major revenue driver for Light & Wonder. In 2024, Gaming generated $2.1 billion, a 12% increase year-over-year. This growth was boosted by a 22% rise in gaming machine sales, particularly in North America and Australia. In Q1 2025, gaming revenue was $495 million, up 4% year-over-year.

- SciPlay (Social Casino): SciPlay revenue reached $821 million in 2024, up 6% year-over-year. This segment is focused on expanding its direct-to-consumer high-margin revenue channel. The company aims to have this channel account for 30% of SciPlay's total revenue by 2028. In Q1 2025, SciPlay generated $202 million in revenue.

- iGaming: The iGaming segment saw a 9% increase in revenue, reaching $299 million in 2024. This growth is driven by the expansion of platforms and content launches in the U.S. and international markets. In Q4 2024, iGaming revenue increased 11% to $78 million, and in Q1 2025, it grew 4% to $77 million.

Light & Wonder continues to implement various monetization strategies. The company's strategic acquisition of Grover Gaming's charitable gaming business for $850 million cash, with a potential additional four-year revenue-based earn-out of up to $200 million, is expected to boost its recurring revenue. For more insights into the company's growth trajectory, consider reading about the Growth Strategy of Light & Wonder.

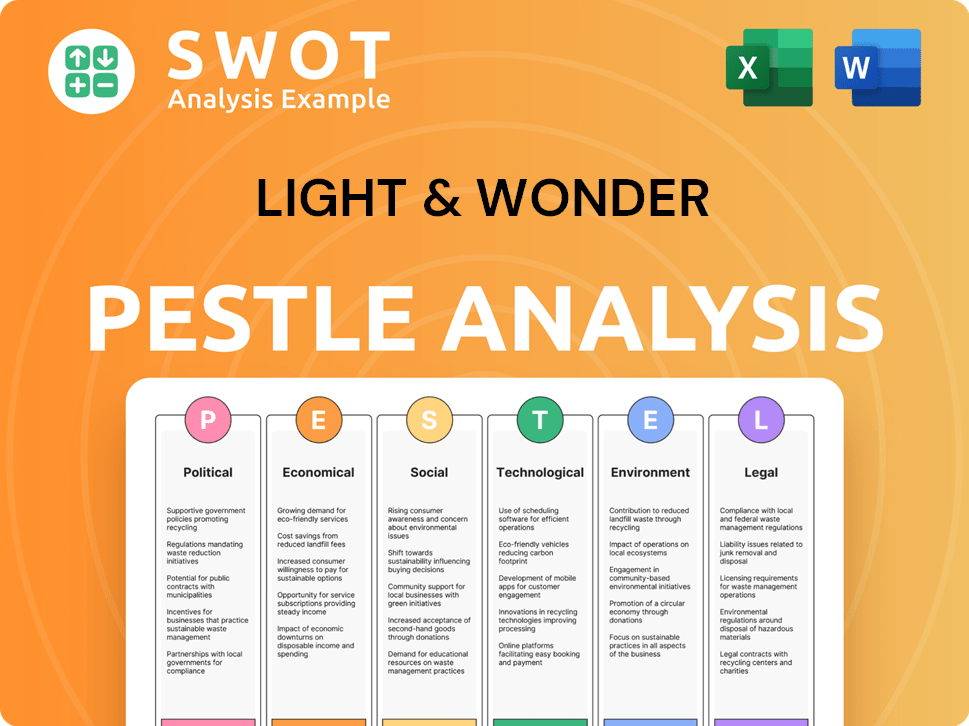

Light & Wonder PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Light & Wonder’s Business Model?

Light & Wonder (LNW) has undergone significant strategic shifts and achieved key milestones that have shaped its operations and financial performance. The company's strategic moves have focused on streamlining its business to concentrate on its core strengths in social casino, iGaming, and electronic gaming machines. This strategic direction has allowed Light & Wonder to optimize its resources and drive growth in key areas.

A major recent milestone for Light & Wonder is the acquisition of Grover Gaming's charitable gaming business, which closed on May 16, 2025. This acquisition is expected to enhance Light & Wonder's recurring revenue base and strengthen its cross-platform strategy. The company consistently launches new products and content, with successful game launches in Q1 2025, demonstrating its commitment to innovation and expansion.

Light & Wonder's commitment to research and development is crucial, with R&D expenditure expected to increase in line with sales, at around 9% of revenue. The company faces operational challenges, including ongoing litigation with Aristocrat regarding intellectual property. Despite these challenges, Light & Wonder's competitive advantages, including its brand strength and extensive game portfolio, position it well in the market.

The acquisition of Grover Gaming's charitable gaming business, finalized on May 16, 2025, for $850 million, is a significant milestone. This strategic move is expected to boost recurring revenue. The company continues to launch new games and content to drive growth.

Light & Wonder divested non-core assets to focus on social casino, iGaming, and electronic gaming machines. This simplification allows for better resource allocation. The company is also pursuing strategies to mitigate the impact of U.S. trade tariffs.

Light & Wonder benefits from brand strength, a strong game portfolio, and leading technology solutions. Its omni-channel experience, spanning land-based, iGaming, and social casino platforms, provides a distinct advantage. The company's financial discipline and operational excellence contribute to margin expansion.

R&D expenditure is expected to increase to about 9% of revenue. The company is focused on driving margin expansion and profitability. The acquisition of Grover Gaming is expected to positively impact the company's financial performance.

Light & Wonder has a strong brand and a large portfolio of popular games. The company's omni-channel approach allows it to offer content across various platforms. Its installed base of gaming units and financial discipline contribute to its success.

- Brand Strength: Strong brand recognition and reputation in the gaming industry.

- Extensive Game Portfolio: A wide array of popular and successful game franchises.

- Omni-Channel Experience: Content available across land-based, iGaming, and social casino platforms.

- Large Installed Base: Over 34,000 gaming units in North America by Q1 2025.

- Financial Discipline: Focus on operational excellence and margin expansion.

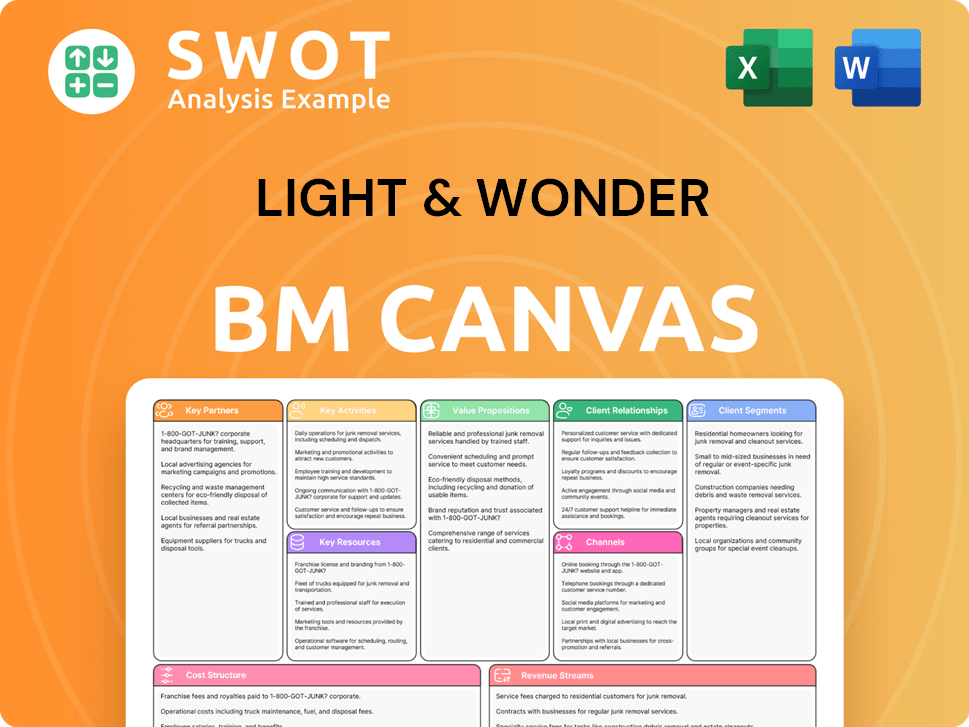

Light & Wonder Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Light & Wonder Positioning Itself for Continued Success?

Light & Wonder (LNW) stands as a prominent cross-platform global games company, demonstrating consistent growth in the competitive gaming industry. The company's strong industry position is supported by its financial performance and strategic initiatives. However, like any major player, Light & Wonder faces a variety of risks that could impact its future trajectory.

The future outlook for Light & Wonder is influenced by its ability to navigate challenges and capitalize on opportunities. The company's strategic plans and focus on innovation are key to sustaining its growth. Understanding the company's position, risks, and future outlook provides a comprehensive view of its operations and potential for investors and stakeholders.

Light & Wonder is a leading cross-platform global games company. It has achieved 16 consecutive quarters of year-on-year consolidated revenue growth as of Q1 2025. In 2024, the company reported record consolidated revenue of $3.2 billion, with the gaming segment leading with $2.1 billion.

LNW faces risks including ongoing litigation with Aristocrat regarding intellectual property. Macroeconomic factors such as potential interest rate increases and inflation could impact consumer spending. Regulatory changes and the rise of new competitors in the digital gaming space also pose challenges. The impact of U.S. trade tariffs on the supply chain is another consideration.

Light & Wonder is targeting a consolidated AEBITDA of $1.4 billion for 2025, excluding the contribution from the Grover Charitable Gaming acquisition. The company aims for a consolidated AEBITDA of $2.0 billion by 2028 and seeks to double its 2024 adjusted NPATA per share to over $10.55.

The company focuses on innovation, expanding its R&D engine and cross-platform strategy. Light & Wonder plans to increase its North American Premium footprint market share in the Gaming segment by 400 basis points and increase revenue per day by 2028. In iGaming, the goal is to increase global market share of first-party content by 300 basis points from 2024 to over 10% by 2028, and to enter new markets.

For SciPlay, Light & Wonder aims to increase Average Revenue per Daily Active User (ARPDAU) by over 30% from 2024 to 2028, and scale its Direct-to-Consumer revenue to 30% of total SciPlay revenue. The company's commitment to operational excellence and a strong product roadmap is expected to drive long-term growth. To learn more about the company's approach to the market, see Marketing Strategy of Light & Wonder.

- Expansion of R&D and cross-platform strategy.

- Increase in market share in North American Premium gaming.

- Growth in iGaming market share and entry into new markets.

- Focus on ARPDAU and Direct-to-Consumer revenue in SciPlay.

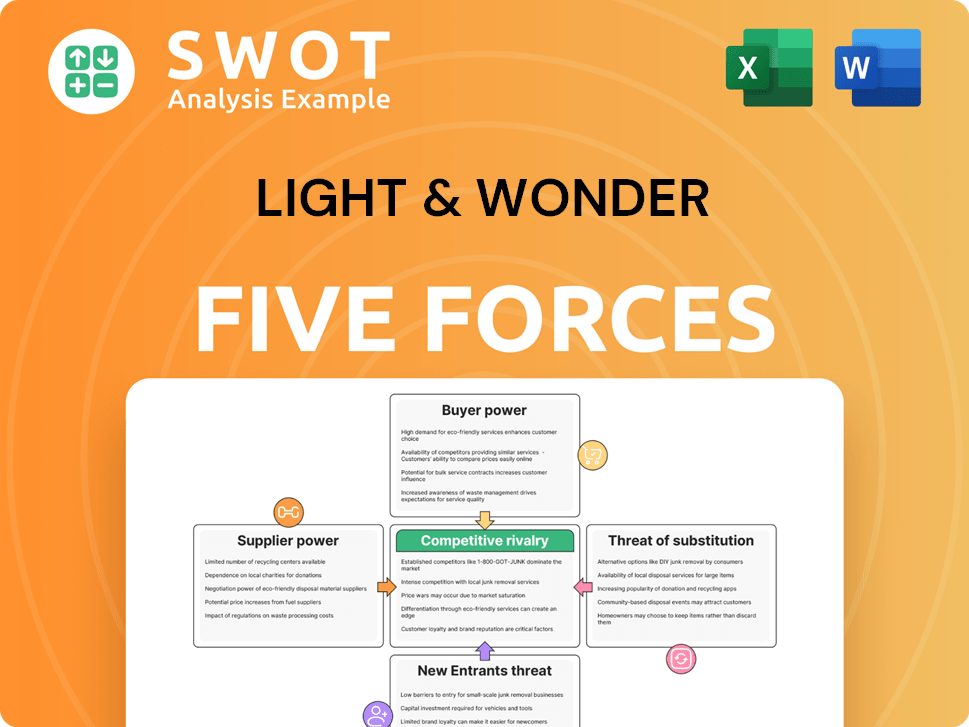

Light & Wonder Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Light & Wonder Company?

- What is Competitive Landscape of Light & Wonder Company?

- What is Growth Strategy and Future Prospects of Light & Wonder Company?

- What is Sales and Marketing Strategy of Light & Wonder Company?

- What is Brief History of Light & Wonder Company?

- Who Owns Light & Wonder Company?

- What is Customer Demographics and Target Market of Light & Wonder Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.