Loblaw Companies Bundle

How Does Loblaw Companies Thrive in Canada's Retail Landscape?

Loblaw Companies Limited, the titan of Canadian retail, reported a strong start to 2025 with impressive revenue and earnings. Its diverse portfolio, spanning groceries to pharmacies, positions it as a central player for millions of Canadians. Understanding Loblaw's operational strategies is key to grasping the dynamics of the Canadian retail industry and its sustained profitability.

With a vast network of stores, including Loblaws and Shoppers Drug Mart, Loblaw caters to a wide range of consumer needs. Its strategic investments, such as a planned $2.2 billion in 2025, highlight a commitment to growth and innovation. To further analyze their strategic approach, consider the Loblaw Companies SWOT Analysis to understand their strengths, weaknesses, opportunities, and threats within the competitive retail industry.

What Are the Key Operations Driving Loblaw Companies’s Success?

Loblaw Companies Limited operates as a leading Canadian retailer, creating and delivering value through a multifaceted operational model. Its core business revolves around providing a wide range of products and services, including groceries, household essentials, health and beauty items, general merchandise, and pharmacy services. This extensive offering is delivered through a vast network of stores, encompassing brands such as Loblaws, No Frills, and Shoppers Drug Mart.

The company's operational processes are built on disciplined execution and strategic asset utilization. Loblaw's supply chain is a critical component, with ongoing investments in modernization and automation. For example, the initial opening of a 1.2 million square foot automated distribution center in East Gwillimbury, Ontario, in January 2025, and plans for a similar facility in Caledon, Ontario, are aimed at optimizing gross margins and reducing operating costs. These efforts support its coast-to-coast presence across Canada.

What sets Loblaw apart is its multi-format strategy, which allows it to cater to a broad spectrum of customer segments and budgets. The integration of the PC Optimum loyalty program across its businesses is a significant differentiator, offering personalized value and promotions that strengthen customer loyalty and increase share of wallet. Furthermore, the evolution of its Connected Healthcare strategy, with pharmacies playing an increasing role in healthcare service delivery and plans to open 100 new clinics in 2025, showcases a distinctive approach to customer value. This integrated approach, from sourcing and logistics to sales channels and customer service, translates into convenience, diverse product offerings, and personalized value for its customers.

Loblaw's core offerings include a wide variety of grocery items, fresh produce, and household essentials. It also provides health and beauty products, general merchandise, and pharmacy services. These products and services are available through a network of stores, including Loblaws and Shoppers Drug Mart.

The company focuses on disciplined execution and leveraging its scale and strategic assets. Investments in supply chain modernization and automation, such as the new distribution centers, are key. These initiatives aim to optimize gross margins and reduce operating costs.

Loblaw's multi-format strategy allows it to cater to various customer segments. The PC Optimum loyalty program offers personalized value, and the Connected Healthcare strategy enhances customer experience. This integrated approach provides convenience and diverse offerings.

Loblaw is investing in automated distribution centers to improve efficiency. Plans to open 100 new clinics in 2025 demonstrate a commitment to expanding healthcare services. These investments support long-term growth and customer satisfaction.

Loblaw's success is driven by its multi-format approach, which caters to different customer segments. The PC Optimum loyalty program and the Connected Healthcare strategy are key differentiators. These strategies enhance customer loyalty and provide personalized value.

- Multi-format strategy to serve diverse customer needs.

- PC Optimum loyalty program for personalized value.

- Connected Healthcare strategy with pharmacy services.

- Strategic investments in supply chain and healthcare.

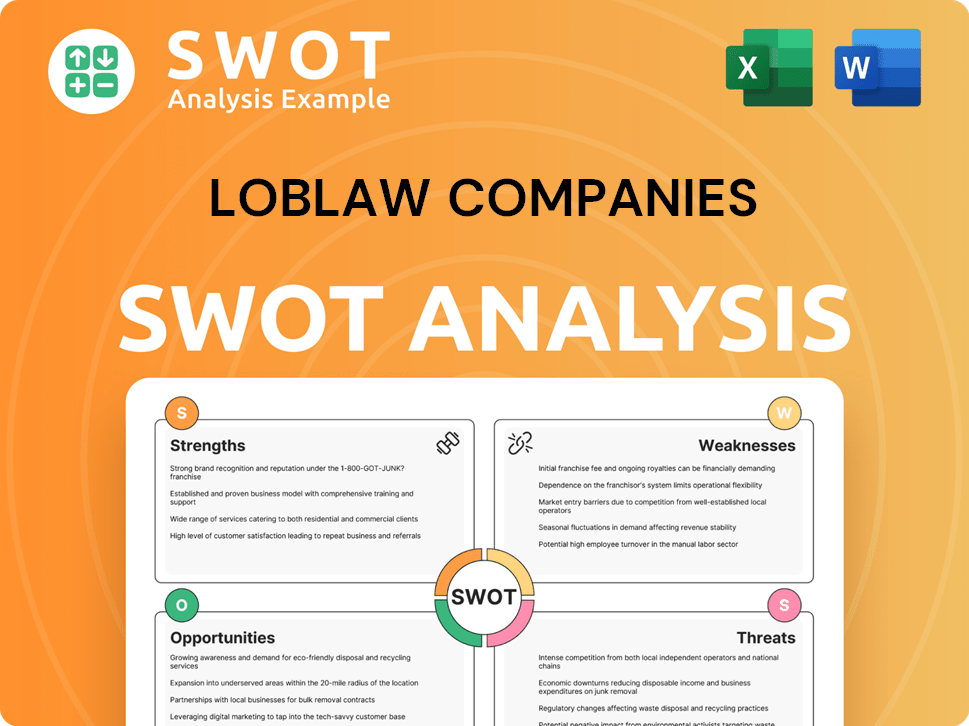

Loblaw Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Loblaw Companies Make Money?

The revenue streams and monetization strategies of Loblaw Companies are central to understanding its financial performance within the Canadian retail industry. As a leading Canadian retailer, Loblaw leverages a diverse portfolio of retail and service offerings to generate substantial revenue. This approach is designed to capture a wide customer base and adapt to evolving consumer preferences.

In the fiscal year ending December 28, 2024, Loblaw reported total revenue of $61.014 billion. The company's strategies focus on value, convenience, and customer loyalty to drive revenue growth and maintain a competitive edge. The company continues to evolve its business model to meet the changing demands of the market.

For the first quarter of 2025, revenue was $14.135 billion, reflecting the company's ongoing efforts to optimize its operations and enhance its market position. Loblaw's ability to adapt to market changes and maintain a strong financial performance is crucial for its long-term success. For more insights, you can explore the Competitors Landscape of Loblaw Companies.

Loblaw generates revenue primarily through food and drug retail sales, e-commerce, financial services, and other services. The company strategically manages these diverse revenue streams to maximize profitability and meet customer needs. Understanding these streams is essential for evaluating Loblaw's financial health and growth potential.

- Food Retail Sales: This includes sales from grocery banners such as Loblaws, No Frills, and Maxi. In Q4 2024, Food Retail sales were $10.138 billion, with same-store sales increasing by 2.5%. In Q1 2025, Food Retail sales were $9.787 billion, with same-store sales growing by 2.2%.

- Drug Retail Sales: Revenue from Shoppers Drug Mart and Pharmaprix, including pharmacy and front-store sales. In Q4 2024, Drug Retail same-store sales increased by 1.3%, with pharmacy and healthcare services growing by 6.3%. For Q1 2025, Drug Retail same-store sales increased by 3.8%, with pharmacy and healthcare services sales growing by 6.4%.

- E-commerce Sales: Online sales across various platforms, including PC Express. E-commerce sales increased by 18.4% in Q4 2024, reaching approximately $3.9 billion for the full fiscal year 2024. In Q1 2025, e-commerce sales surged by 17.4%.

- Financial Services: Revenue from President's Choice Bank. The Financial Services segment saw a decrease in earnings before income taxes in Q1 2025 by $14 million.

- Other Services: This includes revenue from apparel (Joe Fresh) and wireless mobile products.

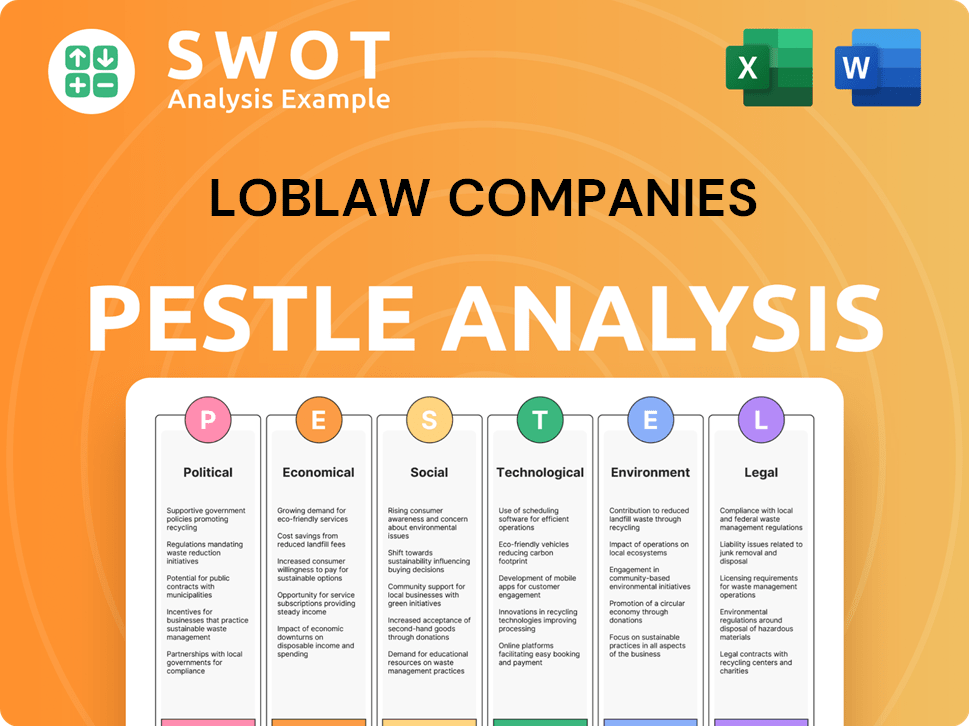

Loblaw Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Loblaw Companies’s Business Model?

Navigating the complexities of the retail landscape, Loblaw Companies has consistently adapted through strategic initiatives and significant milestones. The company's approach focuses on expanding its retail footprint, enhancing operational efficiency, and leveraging its strong brand presence to meet evolving consumer demands. This includes investments in both physical and digital infrastructure, alongside a commitment to customer loyalty and innovation.

A key strategic focus for Loblaw has been the expansion of its hard discount banners, with plans to open roughly 50 new hard discount stores in 2025. Alongside this, the company is also growing its food and drug retail locations and pharmacy care clinics, reflecting a multi-faceted approach to meet customer needs. This strategic expansion is supported by substantial investments in infrastructure and supply chain modernization, aiming to improve efficiency and logistical capabilities.

Loblaw's competitive edge is multifaceted, encompassing brand recognition, diverse product offerings, and a robust loyalty program. The company's commitment to innovation, including e-commerce expansion, and its strategic focus on healthcare services through Shoppers Drug Mart, further solidify its market position. These factors, combined with a strong emphasis on supporting Canadian companies, contribute to Loblaw's enduring success in the competitive retail industry.

In Q4 2024, Loblaw opened its first T&T Supermarket in the United States, marking an international expansion. The company also opened 52 new food and drug retail locations and added 78 new pharmacy care clinics across Canada in 2024. This expansion signifies Loblaw's commitment to growth and meeting consumer demands.

Loblaw has invested over $8 billion since 2020 in infrastructure improvements and supply chain modernization. The opening of a 1.2 million square foot automated distribution center in early 2025 is a key example. The company plans to open approximately 80 new food and drug stores and 100 new clinics in 2025.

Loblaw benefits from strong brand recognition and a diverse product range across over 1,000 corporate and franchise supermarkets. The PC Optimum loyalty program, with millions of members, boosts customer loyalty. E-commerce sales increased by 17.4% in Q1 2025, highlighting digital engagement.

Loblaw's focus on healthcare services and expansion of pharmacy clinics has proven successful. The company's commitment to Canadian companies and products also resonates with consumers. For more insights into the ownership structure, check out the details about Owners & Shareholders of Loblaw Companies.

Loblaw is strategically expanding its retail footprint and investing heavily in its infrastructure. This includes opening new stores and clinics, as well as modernizing its supply chain. These moves aim to improve operational efficiency and enhance customer experience.

- Focus on hard discount banners with new store openings.

- Expansion of food and drug retail locations and pharmacy clinics.

- Significant investment in automated distribution centers.

- Emphasis on e-commerce and digital engagement.

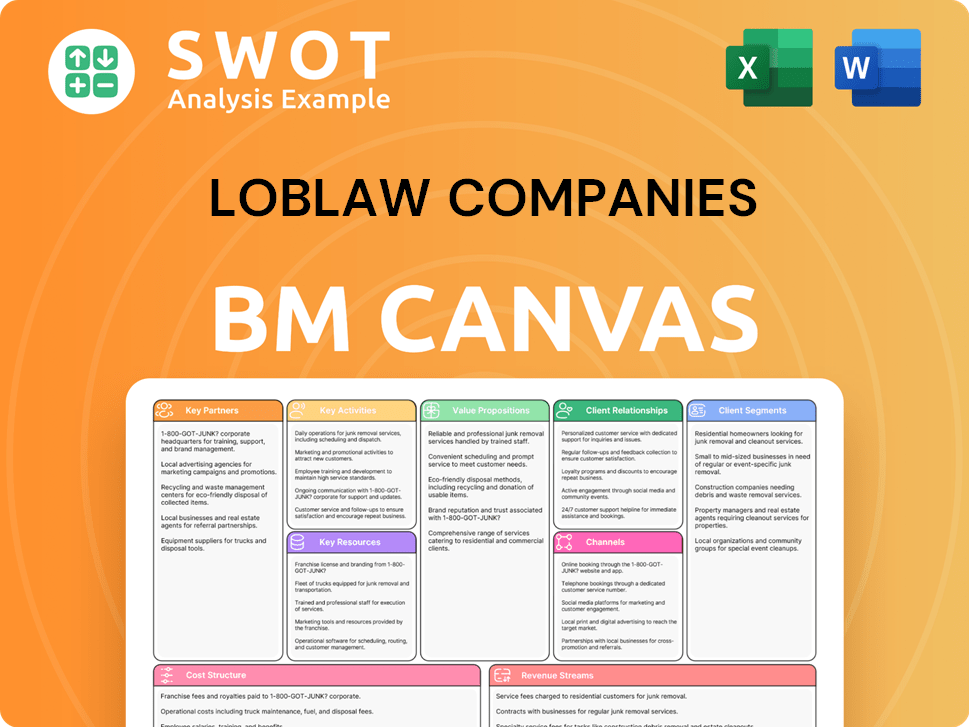

Loblaw Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Loblaw Companies Positioning Itself for Continued Success?

Loblaw Companies Limited, a prominent player in the Canadian retail industry, holds a strong market position as the largest food retailer in Canada. Its diverse portfolio, including banners such as Loblaws, No Frills, and Shoppers Drug Mart, caters to varied consumer segments, thereby securing a significant market share. Loblaw's focus on value, quality, service, and convenience, along with its PC Optimum loyalty program, reinforces customer loyalty and drives traffic in the food retail sector.

Despite its strong standing, Loblaw faces risks like intense competition, particularly from discount retailers, and economic uncertainties that could impact consumer spending. Supply chain disruptions and regulatory changes, especially in the pharmaceutical sector, pose additional challenges. The evolving consumer preferences, including the shift towards online shopping and health-conscious products, necessitate continuous adaptation. For more insights, consider exploring the Marketing Strategy of Loblaw Companies.

Loblaw is the leading Canadian retailer, with a significant presence in both the grocery store and pharmacy sectors. Its diverse brand portfolio allows it to serve a broad customer base. The company's focus on customer satisfaction and loyalty programs contributes to its strong market position.

Key risks include intense competition within the retail industry, particularly from discount retailers. Economic uncertainties and supply chain disruptions could also impact operations. Regulatory changes, especially in the pharmaceutical sector, present further challenges.

Loblaw plans to invest heavily in expanding its operations, including opening new food and drug stores and pharmacy care clinics. The company aims to improve access to affordable food and healthcare services. Digital engagement and retail excellence are key growth strategies.

Loblaw expects its retail business to grow earnings faster than sales in 2025. The company is investing heavily, planning to invest $2.2 billion in 2025 and over $10 billion by 2030, to drive sustained financial performance and expansion.

Loblaw's future strategy includes significant investments in expansion and modernization. This involves opening new stores and clinics, improving supply chain efficiency, and focusing on digital engagement.

- Investing $2.2 billion in 2025.

- Opening approximately 80 new food and drug stores by 2030.

- Expanding pharmacy care clinics.

- Modernizing supply chain with new automated distribution centers.

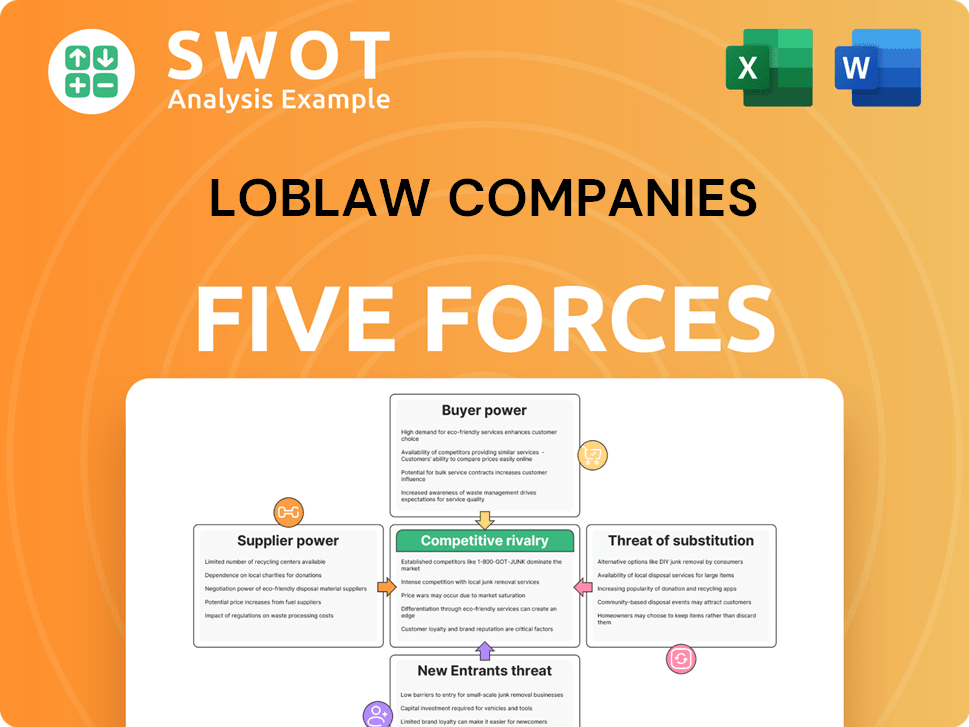

Loblaw Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Loblaw Companies Company?

- What is Competitive Landscape of Loblaw Companies Company?

- What is Growth Strategy and Future Prospects of Loblaw Companies Company?

- What is Sales and Marketing Strategy of Loblaw Companies Company?

- What is Brief History of Loblaw Companies Company?

- Who Owns Loblaw Companies Company?

- What is Customer Demographics and Target Market of Loblaw Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.