Macromill Bundle

How Does Macromill Thrive Amidst Strategic Shifts?

Macromill, a key player in market research, is navigating a significant transformation as it transitions to a wholly-owned subsidiary. This strategic shift, driven by a tender offer from TJ1 Co., Ltd., impacts everything from its operational independence to its financial structure. Understanding the inner workings of the Macromill company is now more critical than ever.

As Macromill adapts to its new structure, its financial performance, including a 1.3% year-on-year revenue increase and a significant rise in profit before tax, provides valuable insights. To fully grasp Macromill's potential, it's essential to dissect its core business model, revenue streams, and strategic direction. A detailed Macromill SWOT Analysis can further illuminate its strengths and weaknesses, offering a comprehensive Macromill review.

What Are the Key Operations Driving Macromill’s Success?

The core operations of the Macromill company revolve around providing comprehensive market research and digital marketing solutions. They help businesses understand consumer behavior and optimize marketing strategies. Their services include custom research, data analytics, and digital advertising effectiveness measurement, among others. The company serves a wide range of clients, including advertising agencies and food and beverage companies.

Macromill's value proposition lies in its ability to deliver actionable insights through data-driven research. They offer a variety of services, including online marketing research, mobile marketing research, and global marketing research. The company's focus is on providing clients with the information they need to make informed decisions and improve their marketing performance. They have a solid customer base and a high rate of recurring business.

Macromill uses online panels and data technologies extensively in its operations. They have a significant network of consumer panels, including proprietary panels in Japan with 1.3 million individuals and an affiliated panel network representing 36 million people globally. Their ability to integrate questionnaire results with actual behavioral data sets them apart, providing deeper evaluation and analysis based on contact history and awareness. In April 2024, they expanded their nationwide consumer purchasing panel to 35,000 consumers, collecting daily purchase data.

Macromill specializes in providing market research solutions, including online surveys. These surveys help businesses gather valuable data on consumer preferences and behaviors. The data collected is crucial for making informed decisions.

The company uses advanced data collection methods to gather insights. They analyze the data to provide clients with actionable recommendations. This data-driven approach is key to their success.

Macromill offers digital marketing solutions to help businesses optimize their strategies. These solutions include measuring the effectiveness of digital advertising. They help clients improve their online presence.

They serve a broad scope of blue-chip clients across various sectors. Macromill maintains a solid customer base with a high percentage of recurring business transactions. This demonstrates client satisfaction and trust.

Macromill's operational strengths include its extensive consumer panels and advanced data analytics capabilities. They integrate questionnaire results with actual behavioral data for deeper insights. They also use rigorous quality control to ensure data accuracy.

- Extensive Consumer Panels: Proprietary panels in Japan with 1.3 million individuals and an affiliated network of 36 million globally.

- Data Integration: Combining questionnaire results with actual behavioral data.

- Quality Control: Employing various methods to ensure data accuracy and eliminate fraudulent responses.

- Strategic Partnerships: Collaborations, such as the one with Global Influencers Inc., enhance offerings.

Macromill SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Macromill Make Money?

The core revenue streams for the Macromill company stem from its extensive market research and digital marketing solutions. These services encompass a wide array of offerings, including custom research projects, data analytics, and advertising effectiveness measurement. The company's strategic focus on providing comprehensive insights and data-driven solutions drives its monetization strategies.

Macromill's revenue generation is diversified through various services, such as online and offline research, and marketing consulting. The company's ability to adapt and offer innovative solutions, particularly in the digital advertising space, is crucial for maintaining and growing its revenue streams. This approach allows the company to cater to a broad spectrum of client needs, ensuring a stable revenue base.

For the first six months ending December 31, 2024, Macromill reported a revenue increase of 2.5% to 22,638 million yen compared to the previous year. For the first nine-month period ending March 31, 2025, revenue rose 1.3% year-on-year, reaching 34,724 million yen, primarily driven by strong performance in its Japan business. The company's business profit for this nine-month period increased by 6.7% year-on-year to 5,881 million yen, with EBITDA increasing by 4.7% to 7,384 million yen.

Macromill's monetization strategies are evolving to meet market demands, especially in enhancing digital advertising effectiveness. The company's approach involves leveraging partnerships and certifications to provide advanced solutions. This includes a focus on privacy-compliant and integrated services to capture new revenue streams.

- In March 2024, Macromill was certified by Google as a third-party measurement partner for YouTube ads.

- This certification led to the development of 'AccessMill Connected' in June 2024, a service for cross-media measurement between YouTube ads and TV commercials.

- In October 2024, Macromill, as an Amazon Ads certified partner, launched advertising support and effectiveness measurement solutions using Amazon Marketing Cloud (AMC).

- These initiatives highlight the company's commitment to providing comprehensive and innovative market research and digital marketing services. To understand the specific audience, you can read about the Target Market of Macromill.

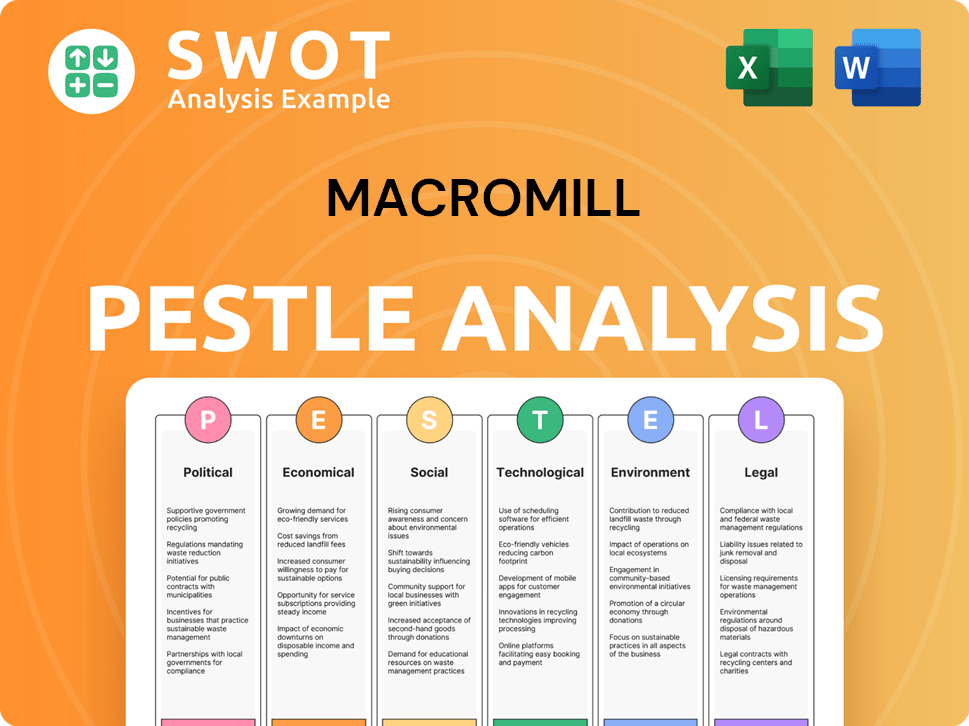

Macromill PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Macromill’s Business Model?

The strategic journey of the Macromill company has been marked by significant milestones and pivotal moves. A recent and impactful development is the tender offer initiated by TJ1 Co., Ltd. in November 2024. This offer, valued at approximately 45 billion yen, aims to transform Macromill into a wholly-owned subsidiary, which will lead to its delisting. This strategic maneuver is designed to facilitate business expansion and fortify the company's management structure, allowing it to focus on long-term growth without immediate pressures from short-term earnings.

Macromill's evolution also includes notable advancements in digital advertising measurement, showcasing its commitment to innovation and adapting to industry changes. The company has strategically positioned itself to meet the evolving demands of the market research sector. These moves highlight Macromill's proactive approach to enhancing its service offerings and maintaining a competitive edge in the market.

The company has made strides in digital advertising measurement. In March 2024, Macromill received certification from Google as a third-party measurement partner for YouTube ads. In June 2024, it launched 'AccessMill Connected,' a Google-certified solution for cross-media measurement of YouTube and TV ad effectiveness. Further expanding its capabilities, in October 2024, Macromill introduced solutions using Amazon Marketing Cloud as an Amazon Ads certified partner. These initiatives are crucial in addressing privacy regulations and ensuring effective advertising measurement.

Macromill's key milestones include becoming a Google-certified third-party measurement partner for YouTube ads in March 2024. Launching 'AccessMill Connected' in June 2024, and expanding digital advertising measurement capabilities with Amazon Marketing Cloud solutions in October 2024. These achievements underscore Macromill's commitment to innovation and its ability to adapt to the changing market landscape.

A significant strategic move is the tender offer by TJ1 Co., Ltd. in November 2024, aiming to make Macromill a wholly-owned subsidiary. The acquisition of M-Force Inc. in July 2024 to enhance its consulting business is another important strategic decision. These moves are designed to strengthen Macromill's market position and expand its service offerings.

Macromill's competitive advantage lies in its extensive consumer panel data and accumulated expertise. It holds a leading position in the Japanese market research industry. The integration of questionnaire data with behavioral data from its digital measurement panel further differentiates its offerings. Macromill is transforming into a 'Professional Marketing Services Company' to solve broader marketing challenges.

The tender offer from TJ1 Co., Ltd. is valued at approximately 45 billion yen. The company's focus on digital advertising measurement and expansion through acquisitions like M-Force Inc. demonstrates its commitment to growth and market leadership. For more insights, consider exploring the Competitors Landscape of Macromill.

Macromill's competitive edge is rooted in its robust consumer panel data and expertise in the Japanese market research sector. The company's proprietary panels in Japan, with 1.3 million members, and an affiliated network of 36 million members, provide a significant advantage. The ability to integrate questionnaire data with behavioral data sets Macromill apart.

- Extensive Consumer Panels: A large and active panel base for comprehensive data collection.

- Data Integration: Ability to combine survey data with actual behavioral data.

- Strategic Acquisitions: Expanding capabilities through acquisitions like M-Force Inc.

- Focus on Digital Measurement: Certified partner for Google and Amazon, enhancing advertising effectiveness measurement.

Macromill Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Macromill Positioning Itself for Continued Success?

The Macromill company holds a strong position in the market, especially as a major player in the Japanese marketing research industry. It serves a wide range of clients and maintains a solid customer base. Its global reach is supported by numerous international offices and a vast network for multinational surveys.

Despite its strengths, Macromill faces risks, including a potentially high debt level due to past transactions. The shift to private ownership might affect its social credibility and relationships. The market research industry also faces challenges like the need for sustainable advertising methods and addressing respondent authenticity in online panels.

Macromill is a leading online marketing research provider in Japan, serving a diverse clientele. It has a significant global presence, including proprietary panels in Southeast Asia. The company has a strong customer base with a high rate of recurring business.

A key risk is the high debt level from past delisting and M&A activities. The tender offer by TJ1 Co., Ltd., which was completed on March 18, 2025, could increase the debt. Shifts to private ownership may affect social credibility and partnerships.

Macromill plans to expand into consulting and solution provision. It is focused on innovation in digital advertising effectiveness measurement. The company aims for a revenue growth (three-year compound annual growth rate) of 9% and an increase in operating profit (three-year CAGR) of 19% by fiscal year June 30, 2026.

Macromill is partnering with Google and Amazon for privacy-compliant solutions. In November 2024, it integrated Meta's open-source MMM package 'Robyn' into its 'Brand Dynamics Modeling' service. It aims to achieve an ROE target of at least 10%.

Macromill's strategy includes expanding services and adapting to technological changes. The company's mid-term business plan targets substantial growth in revenue and operating profit. This demonstrates its commitment to sustained revenue generation and market leadership in the marketing and insights sector.

- Focus on digital advertising effectiveness measurement.

- Integration of advanced analytical tools like 'Robyn'.

- Achieving a revenue growth (three-year compound annual growth rate) of 9%.

- Targeting an operating profit increase (three-year CAGR) of 19%.

Macromill Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Macromill Company?

- What is Competitive Landscape of Macromill Company?

- What is Growth Strategy and Future Prospects of Macromill Company?

- What is Sales and Marketing Strategy of Macromill Company?

- What is Brief History of Macromill Company?

- Who Owns Macromill Company?

- What is Customer Demographics and Target Market of Macromill Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.